cost recovery implementation statement

advertisement

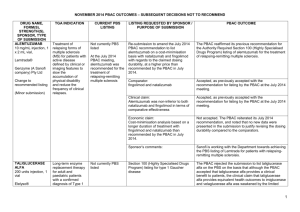

Australian Government Outcome 2 – Access to Pharmaceutical Services Department of Health COST RECOVERY IMPLEMENTATION STATEMENT LISTING OF MEDICINES ON THE PHARMACEUTICAL BENEFITS SCHEME AND DESIGNATED VACCINES ON THE NATIONAL IMMUNISATION PROGRAM 1 July 2015 – 30 June 2016 Cost recovery involves government entities charging individuals or non-government organisations some or all of the efficient costs of a specific government activity. This may include goods, services or regulation, or a combination of them. The Australian Government Cost Recovery Guidelines (the CRGs)1 set out the overarching framework under which government entities design, implement and review cost recovered activities. 1 The CRGs are available on the Department of Finance website (www.finance.gov.au). Page 1 of 18 1. INTRODUCTION 1.1 Purpose of the CRIS This CRIS provides information on how the Department of Health implements cost recovery for the applications for the listing of medicines on the Pharmaceutical Benefits Scheme (PBS) and designated vaccines on the National Immunisation Program (NIP). It also reports financial and non-financial performance information for Outcome 2 – Access to Pharmaceutical Services and contains financial forecasts for 1 July 2015 - 30 June 2016 and three forward years. The department of Health will maintain the CRIS until the activity has been discontinued. 1.2 Description of the activity What is the activity being cost recovered? The costs for the Pharmaceutical Benefits Advisory Committee (PBAC) and associated services related to evaluating, pricing and listing products on the Pharmaceutical Benefits Scheme (PBS) and the National Immunisation Program (NIP) are being recovered What policy outcomes will the activity achieve? The activity aims to provide access to clinically-effective, innovative, cost-effective, medicines to all Australians, and ensure the sustainability of the PBS. Why is cost recovery appropriate for the activity? Fees reflect the cost of processing submissions and arranging listing on the PBS. Cost recovery can provide an important means of improving the efficiency with which Australian Government services are provided and consumed. As well as giving an important message about the cost of resources involved, it can also improve equity by ensuring that those who use the services bear the costs. Under the National Medicines Policy, in 2014-15, the Government introduced a range of measures that ensure: timely access to the medicines Australians need; at a cost individuals and the community can afford; that those medicines meet appropriate standards of quality, safety and efficacy; and are underpinned by programmes that support quality use of medicines; and help maintain a responsible and viable medicines industry. Prior to passage of the legislation providing authority to impose a cost recovery charge for processes associated with the evaluation and listing of items of the PBS and NIP, two inquiries by the Senate Standing Committees on Community Affairs confirmed that the application of cost recovery principles to the PBS and NIP listing process was appropriate. Page 2 of 18 Section 99YBC of the National Health Act 1953 (the Act) requires that an Independent Review of the Impact of PBS Cost Recovery commence after the second anniversary of the amendments coming into force and be completed within four months of that date. The Act provides that the Review must be conducted by a panel (committee) of at least five people, four of whom are nominees of the Minister for Health and the other being a nominee of the Consumers Health Forum of Australia. The details of this Independent Review of the Impact of PBS Cost Recovery can be found: http://www.pbs.gov.au/info/news/2012/09/independent-review-impact-of-pbs-costrecovery The PBS cost recovery legislation required an independent review of the cost recovery arrangements to commence as soon as possible after the second anniversary of the Bill becoming law, that is, around July 2011. The Review was completed in November 2011 and the resultant report was tabled in Parliament. The activities and processes undertaken by the Department in connection with the listing of medicines on the PBS are classified below: Activities Process to gain PBS Listing Processes Receipt of a submission for listing Evaluation of a submission Committee reviews: Economics Sub Committee (ESC); Drug Utilisation Sub Committee (DUSC); and Pharmaceutical Benefits Advisory Committee (PBAC). Liaison with applicant Decision to recommend listing or reject Pricing negotiations Ministerial (or delegate) decision Cabinet decision (where relevant) Listing of medicine on the Schedule of Pharmaceutical Benefits and ongoing management and maintenance of the Schedule PBS Scheme Support Services to Government related to the PBS listing process* Monitor compliance of suppliers with restrictions Provision of information to sponsors Liaison with sponsors Tracking and monitoring of submissions Policy development Policy implementation Policy advice Drafting and answering ministerial correspondence Preparing ministerial briefings and handling ministerial queries Independent Review (PBS) Development of legislation Independent reviews of PBAC recommendations *these activities are not cost recovered Page 3 of 18 Who will pay cost recovery charges? PBAC considers submissions from industry sponsors of medicines, medical bodies, health professionals, private individuals and their representatives. However, for new products or new indications, it is normally the sponsor or manufacturer who holds the data required for such a submission. Applicants are charged fees for services provided in relation to their submission to have a medicine subsidised. When a submission is lodged the fee category is determined and a request for payment is sent to the applicant. The submission process continues and once payment has been received, the submission may be considered by the PBAC. Fees and payments The recovery of fees associated with the evaluation and listing of medicines, vaccines and other products or services on the PBS and NIP commenced on 1 January 2010. The prescribing regulations that underpin PBS and NIP cost recovery are the National Health (Pharmaceutical and Vaccines – Cost Recovery) Regulations 2009. Part 4.7 of the regulations provides for the annual indexation of fees based on increases in the Consumer Price Index. The fourth indexation of CPI increase is at 1.3 per cent, this will take place from 1 July 2015. The adjusted fees are detailed below: Fee Structure from 1 July 2015 Lodgment Pricing Independent Review Major $129,721 Complex $27,138 Minor $13,568 Simple $6,682 Secretariat $1,085 Secretariat $1,085 Generic $543 $129,721 2. POLICY AND STATUTORY AUTHORITY TO COST RECOVER 2.1 Government policy approval to cost recover the activity When did the government announce the decision to cost recover this activity? Cost recovery for PBS applications commenced on 1 January 2010 following passage of the PBS through Parliament on 16 June 2009. Further information can be found: https://www.comlaw.gov.au/Details/F2009L04013 Page 4 of 18 Page 5 of 18 Cost recovery is implemented according to the government decision as described in the table below: PBS Cost Recovery Fee Category Description Submission Category Description PBAC Evaluation In general, a major application seeks to list new drugs or medicinal preparations for PBS – Major subsidy or to make substantial changes to current listings. An application for a variation to an existing listing may also be major if it requires the PBAC to apply a health advantage test (as defined in reg. 2.4). (Regulations 2.3 2.6) Major evaluations are complex evaluations of drugs for which PBS listing may have significant financial implications. PBAC Evaluation In general, minor applications include those for new forms of an already listed drug or – Minor medicinal preparation or changes to the conditions of their prescription or supply. (Regulations 2.7 – These applications involve changes to existing items that do not have significant cost 2.11) implications but do require consideration by PBAC for clinical effectiveness and/or potential impact on the PBS. An otherwise major application may be deemed minor if it involves a resubmission (reg. 2.10) or a medicinal food (reg. 2.11). PBAC Secretariat Listing A secretariat listing is a minor application that is straightforward and not considered as a (Regulations 2.12, separate agenda item at a meeting of PBAC. PBAC still decides the merit of each application. 2.13) Secretariat listings may be considered in or out of session by PBAC. Generic Generic applications occur where a new product is listed on the PBS because it is bioequivalent or biosimilar and the price is already determined by an existing item. Listing of a new brand medicine However, if the application is in respect of a product listed in Schedule 2 of the Regulations (currently somatropin and glucose indicators), it is deemed to be an exception under reg. 2.9 (Regulation 2.14) and 2.13 and is classified as minor or PBAC Secretariat Listing. Page 6 of 18 Independent Independent review is available for applicants where the PBAC has declined to recommend Review the listing of a new drug on the PBS or in certain circumstances where PBAC has not recommended the listing of an additional indication of an already listed drug – refer to (Regulation 4.3) Pricing www.independentreviewpbs.gov.au for additional information. Description Category Complex – Pricing Complex pricing negotiations are those that involve an increase in the cost to government or require calculation of dose relativity to be undertaken during the course of pricing (Regulation 3.3) negotiations, or where the Commonwealth and the applicant enter into a deed or deeds of agreement relating to the supply of the proposed or currently listed drug, special pharmaceutical product or designated vaccine subject to the application. Simple – Pricing Simple pricing negotiations are those that require consideration by the Department and will not involve an increase in the cost to the Commonwealth in relation to the supply of (Regulation 3.4) pharmaceutical benefits. Secretariat – An application is in the Pricing Secretariat pricing category if neither a complex pricing Pricing category nor a simple pricing category applies. (Regulation 3.5) 2.2 Statutory authority to charge The National Health Act 1953 - SECT 99YBA legislation provides authority for cost recovery charges. Legislative Instrument 2009 No. 372. Further information can be found at https://www.comlaw.gov.au/Details/F2009L04013 Payment of fees for certain services 1) The regulations may make provision in relation to services provided by the Commonwealth in relation to the exercise of a power by the Minister under any of the following: a) section 9B; b) a provision in Part VII (other than a provision in that Part prescribed by the (regulations). 2) Without limiting subsection (1), the regulations may make provision in relation to the following: (a) the making of applications for those services; (b) prescribing fees for those services; Page 7 of 18 (c) the time that prescribed fees are due and payable (including extending the time for payment of the fees); (d) the manner of payment of prescribed fees (including payment by instalments); (e) the payment of penalties in respect of late payment of prescribed fees; (f) exemptions from prescribed fees; (g) the waiver, remission or refund of prescribed fees; (h) the refusal to provide those services until a prescribed fee is paid; (i) the review of decisions made under the regulations. 3) A prescribed fee must not be such as to amount to taxation. 4) A prescribed fee is payable to the Commonwealth. 5) A prescribed fee that is due and payable may be recovered by the Commonwealth as a debt due to the Commonwealth. Source: http://www.austlii.edu.au/au/legis/cth/consol_act/nha1953147/s99yba.html 3. COST RECOVERY MODEL 3.1 Outputs and business processes of the activity What are the outputs of the activity? The ouputs of this activity are to list cost-effective, innovative, clinically effective medicines on the Pharmaceutical Benefits Scheme (PBS). The PBS is the primary means through which the Australian Government ensures Australians have timely and affordable access to pharmaceuticals. 2015-16 Estimated (indexed at 1.3 %) Unit Costs (based on the 2014-15 indexed 2007-08 model) Unit Cost ($) Total Cost ($ million) Major Assumed submission volume 93 129,998 12.089 Minor 76 13,645 1.037 Secretariat Subtotal for Submission & PBAC Evaluation Tier 1 (now Simple Pricing) 39 5 6,662 0.033 Tier 2/3 (now Complex Pricing) 75 27,978 2.098 Subtotal for Pricing for Listing Generics Total 100 - 15.257 Page 8 of 18 3.2 Costs of the activity 2015-16 Estimated (indexed at 1.3 %) Costs of Activities used to deliver the outputs (based on the 2014-15 indexed 2007-08 model) Activity Cost ($ million) 2015-16 2014-15 Cost ($ million) 2.9% 1.3 % Receipt and processing of application 0.717 0.726 Expert evaluation 8.358 8.467 Committee review 3.890 3.941 Price and risk sharing discussions 1.327 1.344 Restrictions related activities 0.513 0.520 Liaison with applicants 0.256 0.259 Total Cost of Listing Process 15.061 15.257 Costs to be included in Charges The costs included in the PBS fees comprise: Direct Staff Costs Staff costs include the base salary, superannuation and other direct employee costs of staff who are directly involved in the listing process. They are based on the Department’s Enterprise Agreement. Other Direct Costs Other direct costs incurred in connection with the PBS listing process include committee costs: Pharmaceutical Benefits Advisory Committee (PBAC); Economics Sub-Committee (ESC); Drug Utilisation Sub-Committee (DUSC); Pricing negotiations; other relevant ad-hoc committees and working groups; external evaluations; legal fees associated with the development of pricing agreements; IT systems supporting the PBS listing process; and administration costs. Overheads Overhead costs include: IT infrastructure maintenance; property operating expenses; business support group (finance, human resources etc); and executive costs. Page 9 of 18 Pharmaceutical Evaluation Section Pricing & High Cost Drugs Policy Implementation Section Publishing, Industry Liaison & Listing Branch Executive Branch Total PBS Listing Related Non-PBS Listing Related Total PBAC Secretariat Section 2007-08 Apportioning of staff costs for cost recovered (PBS listing) and Budget funded (non-PBS listing) activities The table below shows the Full Time Equivalent (FTE) staffing requirements used in the 2007-08 cost model. 13.4 14.25 11.63 0 9.05 4.9 53.23 0 0.86 2.9 10.14 2.55 2.1 18.55 13.4 15.11 14.53 10.14 11.6 7 71.78 An FTE in the Australian Public Service context refers to the number of hours worked. Fulltime staff members are defined as those who ordinarily work 35 hours or more per week. Staff working fewer than 35 hours per week are defined as working part-time. This definition is based on that used by the Australian Bureau of Statistics. Attribution of Costs to Activities The costing model developed in 2007-08 uses a two stage process to allocate overhead costs: 1) to each business unit; and then 2) to activities. This methodology enables resources to be allocated to activities based on their consumption at each stage of the process through to the final output. The cost data for the listing of medicines on the PBS were estimated on the following basis: the regulatory activities to be delivered on a cost recovery basis were identified in consultation with relevant staff (see section 2: Overview); an estimate of the resource cost base was developed, based on the internal budgets developed by the Department; staff costs and associated overheads were allocated to activities based on estimates of resource requirements advised by staff; direct costs were allocated to activities to which they relate; and overheads were attributed to activities in proportion to the staff numbers. Annual Cost Estimates The estimates provided below are based on the 2007-08 cost model. Estimated Costs of Activities based on the 2007-08 model Activity Receipt and processing of application Expert evaluation Committee review Price and risk sharing discussions Restrictions related activities Cost ($ million) 0.67 7.80 3.63 1.24 0.48 Page 10 of 18 Liaison with applicants 0.24 Total Cost of Listing Process 14.06 Estimated Unit Costs based on the 2007-08 model Major Minor Secretariat Subtotal for Submission & PBAC Evaluation Tier 1 (now Simple Pricing) Tier 2/3 (now Complex Pricing) Subtotal for Pricing for Listing Generics Assumed submission volume 93 76 39 Unit Cost ($) Total Cost ($ million) 119,757 12,570 - 11.137 0.955 - 5 75 6,139 25,775 0.031 1.933 100 14.057 The volume, cost and revenue estimates presented in the two previous tables were derived using the cost model developed in 2007-08. The model has not been updated since then and does not factor in any cost increases or changes in demand that occurred over this period. In accordance with the Government’s commitment to deregulation and to allow sufficient time for the finalisation of review of the PBS cost model, for this interim CRIS the Department has applied a Consumer Price Index (CPI) rate of 1.3 % to estimate the costs for 2015-16 (see the following two tables), which is less than the cumulative rise in costs incurred by the Department since 2007-08. The volume of submissions has also been left unchanged, but will be revisited as part of the cost model review. It is anticipated that the revised volume, costs and associated cost recovery revenue will be presented in the next CRIS scheduled for commencement on 1 July 2016. 2015-16 Estimated (indexed at 1.3 %) Costs of Activities (based on the 2014-15 indexed 2007-08 model) Activity Cost ($ million) 2014-15 2.9% Receipt and processing of application 0.717 2015-16 Cost ($ million) 1.3 % % 0.726 Expert evaluation 8.358 8.467 Committee review 3.890 3.941 Price and risk sharing discussions 1.327 1.344 Restrictions related activities 0.513 0.520 Liaison with applicants 0.256 0.259 Total Cost of Listing Process 15.061 15.257 Page 11 of 18 2015-16 Estimated (indexed at 1.3 %) Unit Costs (based on the 2014-15 indexed 2007-08 model) Unit Cost ($) Total Cost ($ million) Major Assumed submission volume 93 129,998 12.089 Minor 76 13,645 1.037 Secretariat Subtotal for Submission & PBAC Evaluation Tier 1 (now Simple Pricing) 39 5 6,662 0.033 Tier 2/3 (now Complex Pricing) 75 27,978 2.098 Subtotal for Pricing for Listing Generics Total 100 - 15.257 Charging Structure The charging structure presented in this CRIS was developed in 2007-08 to reflect the services provided at that time to industry, the milestones within the process and the levels of complexity associated with different submissions. The Department intends to complete a comprehensive review and update of its costing model, which will have an impact on the charging structure. It is anticipated that the revised volume, costs and associated cost recovery revenue will be presented in the next CRIS scheduled for commencement on 1 July 2016. Note: The Department publishes information about fees and their indexation under this regulation on its website at http://www.pbs.gov.au. 3.3 Design of cost recovery charges Which cost recovery charges (fees and/or levies) are used? The cost recovery charges (fees and/or levies) which are defined by submission categories as described in the National Health (Pharmaceuticals and Vaccines – Cost Recovery) Regulations 2009. The fee category descriptions are as follows; PBS Cost Recovery Fee Category Description Submission Category PBAC Evaluation Description In general, a major application seeks to list new drugs or medicinal preparations Page 12 of 18 – Major for PBS subsidy or to make substantial changes to current listings. (Regulations 2.3 2.6) An application for a variation to an existing listing may also be major if it requires the PBAC to apply a health advantage test (as defined in reg. 2.4). Major evaluations are complex evaluations of drugs for which PBS listing may have significant financial implications. PBAC Evaluation – Minor In general, minor applications include those for new forms of an already listed drug or medicinal preparation or changes to the conditions of their prescription or supply. (Regulations 2.7 – 2.11) These applications involve changes to existing items that do not have significant cost implications but do require consideration by PBAC for clinical effectiveness and/or potential impact on the PBS. An otherwise major application may be deemed minor if it involves a resubmission (reg. 2.10) or a medicinal food (reg. 2.11). PBAC Secretariat Listing (Regulations 2.12, 2.13) A secretariat listing is a minor application that is straightforward and not considered as a separate agenda item at a meeting of PBAC. PBAC still decides the merit of each application. Secretariat listings may be considered in or out of session by PBAC. Generic Generic applications occur where a new product is listed on the PBS because it is bioequivalent or biosimilar and the price is already determined by an existing item. Listing of a new brand medicine (Regulation 2.14) Independent Review (Regulation 4.3) However, if the application is in respect of a product listed in Schedule 2 of the Regulations (currently somatropin and glucose indicators), it is deemed to be an exception under reg. 2.9 and 2.13 and is classified as minor or PBAC Secretariat Listing. Independent review is available for applicants where the PBAC has declined to recommend the listing of a new drug on the PBS or in certain circumstances where PBAC has not recommended the listing of an additional indication of an already listed drug – refer to www.independentreviewpbs.gov.au for additional information. Source: http://www.pbs.gov.au/info/industry/listing/elements/fees-and-charges Page 13 of 18 The recovery of fees associated with the evaluation and listing of medicines, vaccines and other products or services on the PBS and NIP commenced on 1 January 2010. The prescribing regulations that underpin PBS and NIP cost recovery are the National Health (Pharmaceutical and Vaccines – Cost Recovery) Regulations 2009. Part 4.7 of the regulations provides for the annual indexation of fees based on increases in the Consumer Price Index. The fourth indexation of these fees, in line with the annual CPI increase of 1.3 per cent, will take place on 1 July 2015. The adjusted fees are detailed below. Fee Structure from 1 July 2015 Lodgment Pricing Independent Review Major $129,721 Complex $27,138 Minor $13,568 Simple $6,682 Secretariat $1,085 Secretariat $1,085 Generic $543 $129,721 Why was this type of charge chosen? The charging structure presented in this CRIS was developed in 2007-08 to reflect the services provided at that time to industry, the milestones within the process and the levels of complexity associated with different submissions. The Department intends to complete a comprehensive review and update of its costing model, which will have an impact on the charging structure. It is anticipated that the revised volume, costs and associated cost recovery revenue will be presented in the next CRIS scheduled for commencement on 1 July 2016. The volume, cost and revenue estimates were derived using an indexed version of the cost model developed in 2007-08. The model has not been updated since then, and hence cost recovery fees calculated using the model do not factor in any cost increases or changes in demand that occurred over this period. To allow sufficient time for the proper review of the PBS cost model and for administrative simplicity purposes in this interim period, the Department applied a CPI rate of 1.3 % to estimate the fees and fee revenue for 2015-16 (see the table above), which is less than the cumulative rise in costs incurred by the Department since 2007-08. The volume of Page 14 of 18 submissions has also been left unchanged, but will be revisited as part of the cost model review. The revised volume, costs and associated cost recovery revenue will be presented in the next CRIS. The first application of CPI (at the rate of 1.6%) was applied to fees from 1 July 2012.The second and third application of CPI was 2.5% for 2013 and 2.9% for 2014. The fourth application of CPI (at the rate of 1.3%) will be applied to fees from 1 July 2015. The CPI figure is annually derived from the Australian Bureau of Statistics website for the last quarter of the financial year. Further information can be found: http://www.abs.gov.au/ausstats/abs@.nsf/mf/6401.0/ How do the charges relate to costs of outputs/business processes of the activity? The charging structure presented in this CRIS was developed in 2007-08 to reflect the services provided at that time to industry, the milestones within the process and the levels of complexity associated with different submissions. The Department intends to complete a comprehensive review and update of its costing model, which will have an impact on the charging structure. It is anticipated that the revised volume, costs and associated cost recovery revenue will be presented in the next CRIS scheduled for commencement on 1 July 2016. Where is the current schedule of charges published? http://www.pbs.gov.au/info/industry/listing/elements/fees-and-charges 2015-2016 charge rates and revenue estimates for the current budget year Cost Recovery Type 2015-2016 Estimated Estimated Fee Structure indexed Fee volume total revenue ($)(Rate) ($ million) Lodgement Major Lodgement Minor Lodgement - PBAC Secretariat Lodgement Generic Pricing Complex Pricing Simple Pricing Secretariat Independent Review TOTAL Fee $129,721 93 Fee $13,568 76 Fee $1,085 39 Fee $543 100 Fee $27,138 72 Fee $6,682 10 Fee $1,085 43 Fee $129,721 - Output Business process = $129,721 × 93 = $12.064 million = $13,568× 76 = $1.031 million = $1,085 × 39 = $0.042 million Output 2 Business process 2.2 Output 2 Business process 2.2 Output 2 Business process 2.2 =$536 x 100 =$0.054 million =$27,138 x 72 =$1.954 million =$6,682 x 10 =$0.067 million =$1,085 x 43 =$0.047 million - Output 2 Business process 2.2 Output 2 Business process 2.2 Output 2 Business process 2.2 Output 2 Business process 2.2 Output 2 Business process 2.2 $15.259 million Output 2 Business process 2.2 *No revenue has been projected as Independent Review events are rare and only occur on ‘as need be’ basis. Page 15 of 18 Cost recovery fees are charged on a per submission basis. Actual revenue may vary in line with the fluctuations in the actual number and type of submissions, and the number of waivers or exemptions applicable. For example, for 2013-14, approximately 20% of revenue was waived or exempted . 4. RISK ASSESSMENT The Department of Health considers the proposed 2015-16 Cost Recovery Implementation Statement for listing of medicines on the PBS and designated vaccines on the National Immunisation Program arrangements as having medium to low risk. Cost Recovery is not new for PBS items. It has been in place since 1 January 2010 and the fees have increased by CPI annual since introduction. The proportion of submission that are eligible for fee waivers and exemptions presents a risk of revenue not meeting expenses. During 2015-16, the Department will complete a comprehensive review of the original costing model. It is anticipated that the revised volume, costs and associated cost recovery revenue, which require further consultation will be presented in the next CRIS scheduled for commencement on 1 July 2016. 5. STAKEHOLDER ENGAGEMENT In accordance with relevant provisions of the National Health Act 1953, an independent review of PBS cost recovery was undertaken in 2012. The Committee that undertook the Review extended the opportunity to Medicines Australia, Generic Medicines Industry Association of Australia (GMiA), AusBiotech and the Consumers Health Forum of Australia (CHF) to provide a submission. Each of these four organisations presented matters for the Committee’s consideration. In accordance with the requirements of the Australian Government Cost Recovery Guidelines, periodic reviews of cost recovery arrangements are to be undertaken no less frequently than every five years. PBS Cost Recovery commenced 1 January 2010. During 2015-16, the Department will complete a comprehensive review of the original costing model. It is anticipated that the revised volume, costs and associated cost recovery revenue, which require further consultation, will be presented in the next CRIS scheduled for commencement on 1 July 2016. 6. FINANCIAL ESTIMATES Financial estimates for the activity for the budget and three forward years Expenses = X A 2015-2016 ($ million) $15.26 B 2016-2017 ($ million) $15.46 C 2017-2018 ($ million) $15.66 D 2018-2019 ($ million) $15.86 Revenue = Y $12.21* $12.37* $12.53* $12.69* Balance = Y – X -$3.05 -$3.09 -$3.13 -$3.17 Cumulative balance -$16.01 -$19.10 -$22.23 -$25.40 Explain material variance Approximately 20% of all PBAC submissions each year are eligible and granted Fee Waivers and Exemptions which exempts the sponsor from paying cost recovery fees. Page 16 of 18 Explain balance management strategy A review of the current cost model is expected to be completed in time for the following CRIS on 1 July 2016. *Cost recovery fees are charged on a per submission basis. Actual revenue may vary in line with the fluctuations in the actual number and type of submissions, and the number of waivers or exemptions applicable. For example, for 2013-14, approximately 20% of revenue was waived or exempted. 7A. FINANCIAL PERFORMANCE Activity performance during the previous financial years 2010-2012* ($ million) 2012-2013 ($ million) 2013-2014 ($ million) 2014-2015 ($ million) Expenses = X 14.06 14.28 14.64 15.06 Revenue = Y 14.53** 9.22** 9.87** 11.46** Balance = Y – X 0.47 -5.06 -4.77 -3.60 Cumulative balance 0.47 -4.59 -9.36 -12.96 Explain material variance The number of submissions per meeting and per year is variable. In addition to this approximately 20% of all PBAC submissions each year are eligible and granted Fee Waivers and Exemptions which exempts the sponsor from paying cost recovery fees. This trend accounts towards the overall negative cumulative balance. Explain impact on balance management strategy A review of the current cost model is expected to be completed in time for the following CRIS on 1 July 2016. *1 January 2010-30 June 2012 this period was the first period for which the 2007-2008 Cost Recovery model was implemented. **Cost recovery fees are charged on a per submission basis. Actual revenue may vary in line with the fluctuations in the actual number and type of submissions, and the number of waivers or exemptions applicable. For example, for 2013-14, approximately 20% of revenue was waived or exempted. 7B. NON-FINANCIAL PERFORMANCE The charging structure presented in this CRIS was developed in 2007-08 to reflect the services provided at that time to industry, the milestones within the process and the levels of complexity associated with different submissions. The Department intends to complete a comprehensive review and update of its costing model, which will have an impact on the charging structure. It is anticipated that the revised volume, costs and associated cost recovery revenue will be presented in the next CRIS scheduled for commencement on 1 July 2016. 8. KEY FORWARD DATES AND EVENTS October 2015: Review of current Cost Recovery cost model. May 2016: Secretary and Minister approval of new CRIS. July 2016: Publication and Implementation of new CRIS 2016-17. Page 17 of 18 9. CRIS APPROVAL AND CHANGE REGISTER Date of CRIS change CRIS change Approver Basis for change July 2015 Certification of CRIS Secretary Compliance with new Cost Recovery Guidelines Page 18 of 18