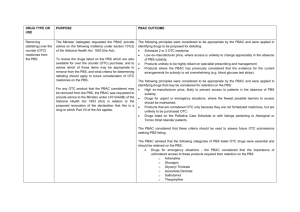

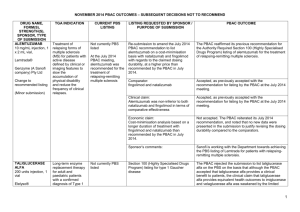

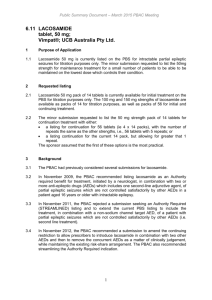

148 KB ppt - Private Healthcare Australia

advertisement

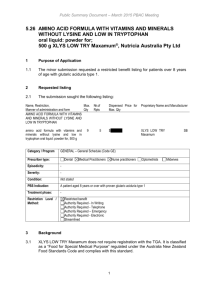

Can We Keep Pharmaceutical Costs Affordable and New Medicines Development Viable? A P.B.S. Perspective Andrew Wilson Chair, Economic Sub Committee PBAC Faculty of Health Sciences University of Qld PBS History Repatriation Scheme Commenced in 1919 Pharmaceutical Benefits Act Passed in 1944 History The 1944 Act was opposed by the Australian Branch of the BMA BMA saw the provisions of the Act as restricting doctors’ freedom of choice in the treatment of their patients History October 1945 ,as a result of a writ from the Medical Society of Victoria,the High Court ruled the PBA 1944 went beyond the powers of the constitution 1946 Constitution amended The Australian Policy Context NATIONAL MEDICINES POLICY Timely access to the medicines that Australians need ,at a cost individuals and the community can afford Medicines meeting appropriate standards of quality,safety and efficacy Quality use of medicines Maintenance of a responsible and viable medicines industry Access to Medicines Financing and supply arrangements for medicines optimise health outcomes and represent value for money All partners take adequate responsibility for achieving value for money Access to necessary medicines occurs at a cost the community as a whole can afford,particularly in the context of pressures such as the development of new high cost drugs and Australia’s ageing population Access to Medicines Access processes are made as simple and streamlined as possible,so that subsidisation of medicines is timely, mechanisms are understood and unnecessary administrative barriers and expenses avoided Financing arrangements for medicines avoid incentives for cost-shifting between levels of government or other funders,or other perverse incentives Current Coverage and Expenditure Background 1947: 139 life-saving drugs at cost A$300,000. 2005: >650 drugs at cost $5.8 billion. Australia spends 9.3% of its GDP on health. By 2042 the cost of the PBS is predicted to be 3.5%GDP. Australian Govt Health Expenditure ($29.7bn) 2002-2003 Other health PBS 16.1% 27.5% 29.5% 26.9% Public hospitals MBS GROWTH RATE IN PBS 6 5 4 3 $ BILLIONS 2 1 0 1991 1993 1995 1997 1999 Excludes co-payment 2001 2003 Relative Expenditure PBS and Patient CoPayment 02-03 14.2% Patient Contribution 4.5% Highly Specialised Drugs Other S100 PBS/PPBS 79% Total Expenditure $6.2 Billion Other S100 PHARMACEUTICAL EXPENDITURE 80% OF THE COST WAS DIRECTED TOWARDS CONCESSIONAL CARDHOLDERS PATIENT CONTRIBUTIONS AS A % OF TOTAL COSTS WAS: – 19.5% in 90/91, – 22.2% in 94/95 – 17.0% in 01/02 – 14.2 %in 02/02 What did the PBS cover? 602 generic drugs in 1,502 forms and strengths (items) marketed as 2,617 different drug products (brands) as general listings 10 generic drugs in 42 forms and strengths marketed as 48 products as palliative care listings 78 generic drugs in 209 forms and strengths marketed as 475 products as dental listings 27 generic drugs in 34 forms and strengths marketed as 51 products as Doctor’s bag listings 75 generic drugs in 257 forms and strengths marketed as 273 products as Section 100 listings. PBAC Processes Process leading to PBS Subsidy Drug approved for marketing by TGA Company submits to PBAC for subsidy – Sponsor intitiated – Submission assessed by evaluation group, considered by ESC, DUSC, RWG PBAC recommends or rejects subsidy Purchasing Authority negotiates price with company Listing in Yellow Book Registration vs Subsidy Listing Products registered on the basis of – Safety – Quality – Efficacy No requirement for comparative data. Once registered the product may be prescribed without government subsidy. PBAC PROCESSES PBAC considers – effectiveness – cost effectiveness – clinical place of the product Requires comparisons to other products (or standard medical care) already listed(or used) for the same or similar indications. PBAC PROCESSES Under the Act a new drug entity may be recommended for listing if: It is needed for the prevention or treatment of significant medical conditions not already,or inadequately covered by drugs in the existing list AND IS OF ACCEPTABLE COST EFFECTIVENESS RELEVANT FACTORS Readily Quantifiable Comparative Cost Effectiveness Comparative Health Gain Affordability Financial implications for PBS Financial implications for Gov health budget RELEVANT FACTORS Less Readily Quantifiable Severity of condition treated Presence of effective alternatives Ability to target therapy to those likely to benefit most Uncertainty Equity Development of resistance Government health priorities and other relevant factors ASSESSMENT OF EVIDENCE Sponsor asked to categorize clinical characteristics against the main comparator as: Having significant clinical advantages Being no worse in effectiveness and toxicity Being less effective and less toxic ECONOMIC EVALUATION COST-MINIMIZATION…. Used when drugs have the same outcome.Ensure that the new drug is no worse than comparator ie therapeutic equivalence COST EFFECTIVENESS….Clinical advantage measured in natural unit ,eg lifeyears gained,points of BP reduction ie cost per unit of effect ECONOMIC EVALUATION COST-UTILITY analysis-health outcomes rated by preference strength eg healthy years or quality adjusted life years (QALY).Output is cost per unit of preference state. MODELLED ECONOMIC EVALUATION…estimation of remote outcomes,final outcome,cost offsets PBAC RECOMMENDATIONS LIST AS COST-EFFECTIVE AT PRICE PREMIUM REQUESTED LIST AT A LOWER PRICE TO ACHIEVE ACCEPTABLE COST EFFECTIVENESS REJECT AS HAVING UNACCEPTABLE COSTEFFECTIVENESS RESTRICT TO PATIENT SUBGROUPS IN WHOM THE DRUG IS COST EFFECTIVE RESTRICTIONS A DRUG MAY BE ACCEPTABLY COST EFFECTIVE WHEN USED FOR ONE INDICATION OR PATIENT GROUP BUT NOT COST EFFECTIVE WHEN USED UNDER OTHER CIRCUMSTANCES. Initiation and continuing requirements Cholinesterase inhibitors in dementia – use of mini-mental scores Imatinib in chronic phase CML. – Continuing therapy will require evidence of continuance of cytogenic response annually TNF-alpha Inhibitors for RA – must have failed other treatment options and continuation depends on the attainment of a pre-defined response But Administratively complex, clinically intrusive, and difficult to define. Other Options Section 100 and High Cost Drug Scheme Life Saving Drugs Program Specific Purpose Allocation eg Herceptin PRICING AND COST CONTAINMENT BRAND PREMIUM POLICY AND GENERIC SUBSTITUTION THERAPEUTIC GROUP PREMIUM POLICY PRICE AVERAGING ACROSS INDICATIONS WEIGHTED AVERAGE MONTHLY TREATMENT COST PRICE VOLUME ARRANGEMENTS Future Trends Future Demand for health services,including pharmaceuticals will continue to increase…“The demand for health services is insatiable” Aging population-more demand and lesser capacity to pay Future New agents available as a result of the biotechnology including new delivery systems More agents for “prevention” More agents taken for life (long term), but only short term evidence of safety Incremental improvements in treatment of malignancies,neurological disorders etc Future High cost for drugs- many of them giving a relatively small incremental improvement resulting in what could be regarded as poor cost effectiveness Due to rapid expansion of knowledge it is unlikely that a patent life of 20+ years will be relevant Future Increasing pressure on the “globalization concept” of pharmaceuticals as illustrated by recent action in Africa and South America in regard to HIV drugs and in the US itself, Taiwanese threat re Tamiflu. Growing inability of the developing world to afford new drugs. Future Growing accountability to ensure government expenditure is”value for money” Difficult decisions by society as to whether prioritisation of medicines expenditure is appropriate for certain conditions Increased factionalism in clinical and general community … “my disease deserves more attention” TRANSPARENCY NEED FOR -fundamental right to know by ALL stakeholders HOW-issues of commercial-in-confidence IN WHAT FORM-different audiences have special needs LINKAGE WITH NPS-educational component in a timely manner NEW AGENTS WITH LIMITED DATA More new drugs receiving marketing approval with limited data Uncertainty in the model used to predict benefit eg prolongation of life based on unsubstantiated assumptions.Increasing uncertainty in magnitude of benefit and thus in CE Need to develop risk sharing arrangements and regular review(not just of utilisation) of new listings eg at 1,2 and 5 years in order to make new agents available earlier TRIAL OUTCOMES v’s INPRACTICE OUTCOMES Essential to ensure that successful outcomes in trials can be replicated in practice eg Bupropion-in the listing it is stated”For use within a comprehensive treatment program”,but no requirement for the patient to participate or even enrol in a suitable program. Need for better post-marketing surveillance for safety and real effectiveness Risk Sharing Regular review of new listings eg at 1,2 and 5 years Issues to be considered: – Continuation of benefits where trials were short term – Size of benefit (both clinical and savings) in practice – Use outside of approval – Evidence of variable effectiveness – Actual clinical practice Making New Medicine Development Viable The Pharmaceutical Industry It is a commercial industry – they have to make profit and have competitors. – Shouldn’t be surprised that they behave like any other industry most of the time – Benevolent Its big – any country would like to be part of the economic action They have been successful in developing many important drugs (although less clear on discovery). New Medicines There are plenty of diseases and conditions where new medicines are needed or need to be improved – Some are not likely to be commercially interesting or viable eg too small a population or diseases of poor populations – Commercial interest is greatest for diseases that are common in wealthy nations eg CVD, cancer New Medicines Must be prepared to pay for real innovation – Clinically meaningful improvements in survival or quality of life – Demonstrable resource saving that is realizable Many so called innovations are minor improvements – May give significant marketing advantage but little improvement in cost-effectiveness Consequences of the FTA Impact of US-Australian Free Trade Agreement Additional opportunity for companies to comment on advice to PBAC Opportunity to present to PBAC at time decision is being considered. Fuller reporting of decisions. Review (not appeal) mechanism for decision Post US-Australia FTA Review Process Independent of current process Limited to rejections by PBAC Any aspect of rejection Review of technical aspects of decisions One or more experts relevant to the area of technical dispute. TRANSPARENCY PBAC decision making criticized for being non-transparent BUT Industry maintains information that informs decision can not be released because commercial-in-confidence US-Australia FTA Transparency US-PHARMA interpretation – that the processes and decisions of the PBAC-PBPA processes are more open to applicant Australian govt – PBAC interpretation – all processes and decisions are more open to clinical and general community. Post US-Australia FTA Transparency Public Disclosure Document on all approvals and on 2nd rejections Summary of the PBAC deliberations including considerations on the evidence presented by company. Some details will not be disclosed where it is commercially sensitive (exact price, market share etc) Is the FTA a threat to the PBS? Political will to defend the Australian benefits Slow death by legal strangulation Bigger threats – Loss of community and professional confidence – Providing escape clauses when PBAC advise is unpalatable – Paper Overload Implications for Private Health Insurance Why?? If a drug is not cost-effective for public subsidy through the PBS, how can it be cost-effective through publicly subsidized private health insurance? Conclusions Do we get value for money for pharmaceuticals? – Yes if they selected for their cost-effectiveness and used according to those criteria. Is the growth in cost of pharmaceuticals sustainable? – It depends on what the benefits are. Conclusions Are the PBAC processes adequate to slow PBS growth? – This is not the sole function of the processes and while demand grows it will not cape expenditure alone. Does Australia pay its fair share through its pricing of pharmaceuticals to support new medicine development? – Yes noting that more is spent on marketing medicines then development.