Jarvi_and_Kuivalainen_-_Stream_2

advertisement

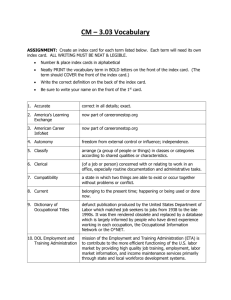

Does occupational welfare matter? Measurement and the importance of collectively negotiated sickness benefits in cross-national social policy analyses: Case of the Nordic countries By Laura Järvi and Susan Kuivalainen Laura Järvi University of Turku laura.jarvi@utu.fi Susan Kuivalainen National Institute for Health and Welfare susan.kuivalainen@thl.fi Paper to be presented at the annual ESPANET conference, 10 years of European Social Policy Analysis Network, September 6–8, 2012, Edinburgh. Please note this is a very first draft – comments and suggestions are welcomed. Introduction Comparative studies on welfare states measure social citizenship in order to understand their development, diversity, and change. Previous studies have primarily focused on statutory provisions while neglecting occupational welfare and collectively negotiated benefits even though welfare is channelled through several different routes, as pointed out by Titmuss (1958). The reason for this narrow focus is the perception that occupational welfare plays a relatively insignificant role in welfare delivering. Another reason for this neglect is the methodological challenges to measuring occupational welfare in crossnational comparisons, including the lack of any available systematic data. This paper aims to include occupational welfare in cross-national analyses on social policy. The central question in cross-national analyses on social policy – who gets what – is usually answered with stylised cases, which offer a common yardstick allowing systematic comparison. The social citizenship approach measures the extent of social rights via the coverage and level of protection provided. Calculations are based primarily on the average wage of the standard production worker, a gauge whose ability to reflect today’s reality is in many ways debatable due to changes in the labour market. Our analyses move away from the standard production worker and examine five different occupations representing both low- and high-skilled workers as well as public and private sector employees. We will generate analyses where the statutory provision can be compared to collectively negotiated benefits as one form of occupational welfare. Occupational welfare in this paper is understood as social benefits provided by employers to employees as a result from the employment. Here we focus on occupational welfare as agreed upon by labour market organisations, in particular on sickness benefits. Sickness benefits are one of the key aspects of social security. Many states have given legal obligation to employers to pay compensation during sickness, and, in addition, labour market organisations have agreed upon additional support. We have chosen four Nordic countries as case examples for several reasons. The Nordic countries are characterized not only by the strong role of the state and high levels of statutory benefits but also by 1 corporatist structures and their long tradition of collective bargaining (e.g. EspingAndersen 1990). Since the Nordic countries have similar systems of collective bargaining, it is useful to apply this method in analysing occupational welfare. The paper illustrates the potential of including collectively negotiated benefits into cross-national analyses covering select European countries. We discuss the strengths and weaknesses of the new approach, construct a more nuanced description of social benefits, and illustrate how a narrow focus on statutory benefits can be misleading. The paper starts by presenting the conventional method of studying social citizenship and then discusses occupational welfare and presents previous work. Much of the paper is devoted to presenting methodological choices. The section prior to the summary and discussion shows the preliminary results of inclusion of occupational welfare in analyses in year 2010. Social citizenship approach - conventional measures Comparative welfare state analyses have for long relied overwhelmingly on public spending as the indicator of welfare state commitment. In the late 1980s, an alternative approach emerged. While spending data revealed little about the level of social protection against risk, the social citizenship approach aimed to understand the impact of the welfare state on individual life-chances. The essence of this approach is the conditions stipulated in social insurance programs: under what circumstances are people eligible for social protection, for how long, and at what level of provision. The social citizenship approach better encompasses the extent of welfare state generosity. Moving away from the quantitative aspect toward the quality of social provision has also triggered a question of why countries with an equal level of public spending can have very different levels of social rights. If it was difficult to obtain data on public spending at a time when few international systems existed, it was even more difficult to access information on institutional rules 2 governing provision. Since institutional settings and rules are complex, researchers needed to ensure that like things were compared with like. A persistent question was how to find a common yardstick that could be applied internationally. Previous studies solved this problem by utilizing stylized cases (or model families). Research has verified that with stylized cases, cross-national social policy analyses are achievable. Comparisons with stylized cases created the possibility of studying how the system works at an individual level as the cases made otherwise disparate rules and circumstances more comparable and thus amenable to cross-national examination. One of the best-known research projects in this field is the Social Citizenship Indicator Program (SCIP) undertaken by Walter Korpi and Joakim Palme (2007) in the early 1980s to establish a theoretically relevant and empirically reliable set of institutional data for comparative research on welfare state development. Over the years, a dataset for five major social insurance programs was collected at five-year increments from the 1930s to 2002 in 18 OECD countries: old-age pensions, work accidents, sickness, unemployment, and family benefits. In order to have cross-nationally comparable data, SCIP utilized as a reference point a model of a typical production worker, labelled the ‘standard worker’. This worker was defined as an employee in manufacturing (the metal industry) and was assumed to have an average production worker’s wage. To ensure comparability, further assumptions were made regarding family composition, the age of family members, and work-career. Many published studies have used SCIP data (e.g. Esping-Andersen 1990; Palme 1990; Kangas 1991; Wennemo 1994; Korpi and Palme 1998). The second generation’s studies have produced a number of different welfare state typologies, which have been classified according to their institutional features. These studies, in line with many others, placed the Nordic countries in one group characterized by a strong state role and broad statutory benefits with high coverage. A very similar approach was initiated by Lyle Scruggs (2004) at the University of Connecticut more than a decade later, partly to replicate Esping-Andersen’s decommodification index and partly because the SCIP data was out of the public domain until the late 2000s. The Comparative Welfare Entitlement Dataset (CWED) covered very 3 similar programme details (with the exception of work accidents) for the same 18 OECD countries, but did so annually and for a shorter period (1971–2002). Like the SCIP data, CWED data primarily analysed the level of provision for a six-month (26 weeks) spell of illness or unemployment. A key concept was the net replacement rate calculated at previous earnings at the level of the average production worker for two household situations (single person and couple with one earner). The data for wages was mostly derived from OECD. Many individual studies conducted since the 1980s have carried out cross-national comparisons on social insurance and assistance schemes with many collecting their own data on institutional characters and benefit levels (e.g. Day 1978; Bradshaw & Piachaud 1980). They have adopted the typical-case approach and followed the same principles. OECD publishes Benefits and Wages and Taxing Wages annually, providing stylized information on OECD tax and benefit rules. With a very few exceptions, these studies (and data sets) have been devoted to comparing benefits granted through legislation. The basic principle for programme inclusion is that the entitlement conditions are regulated by the state, that is, the benefits are statutory. This choice was justified since the primary interest was on the role of the state. Further, the choice was consistent with Marshall’s (1950) idea of social citizenship, where social rights referred to legislated social provisions. This research was subsequently criticized as being too one-dimensional as other forms of welfare were neglected (e.g. Adema 1999) as well as being based on average production worker wage calculations (see e.g. van Gerven 2008, 48; Kangas 2010, 404). Labour markets have changed profoundly during the past decades. While the ‘golden age of the welfare state’ in Western societies’ industrial era was characterized by stable labour markets, in post-industrial societies, irregularity and nonstandard work arrangements characterise increasingly segmented labour markets (Häusermann & Schwander 2012). Post-industrialization means that the majority of people are nowadays employed in the service sector, while fewer get their livelihood from industry. For example, in Norway and Denmark in 1970, around 50 percent of the workforce were in the service sector as 4 compared to almost 80 percent in 2010. Corresponding figures for people employed in industry were 37 percent and 19 percent (see Appendix table 1). For this reason, prior assessments of the level of social provision of the average production worker now appear to be rather a long way from the average case. At the time, the choice was arguable and presented the industrial blueprint of a wage earner for whom the welfare state was designed. The massive expansion of tertiary education has led to a broader and more heterogeneous middle class, which has displaced the lower-qualified manual worker as being the typical case. The growth of female employment, particularly in the Nordic countries, has further undermined previous assumptions: it is no longer sufficient to study the average worker simply by focusing on the average male worker. In 1970, just above one-third of the employed in the Nordic countries were females, while in 2010 almost half of employed people were females (see Appendix table 1). Due to the past changes in the labour market, fixed-term and part-time employment are more the rule than the exception, and therefore the ‘average production worker’ no longer reflects reality. From the viewpoint of occupational welfare, trends in labour markets towards atypical and precarious employment are meaningful, since these kinds of jobs are usually those with weak occupational social protection (McGovern et al. 2004; Rueda 2007). In order to be eligible for the perks and benefits offered by an employer, employees are often required to have some years in service and to be in full-time employment. Since 2005, OECD has used the pay for an average earned wage (AW) to calculate benefit levels. Prior to that, the average pay for an industrial worker was used. The broadened definition of the average worker includes both manual and non-manual workers, which are thought to better capture the average wage level in countries (See OECD 2005). For the Nordic countries, this has meant that the wage level with which the comparisons are made is lower in Denmark but higher in Finland, Norway, and Sweden (NOSOSCO 2009). 5 Adding occupational welfare to the examination Occupational welfare – definition and previous research The concept of ‘occupational welfare’ has been defined in many different ways. To put it simply, occupational welfare is the welfare that is distributed by employers to employees as a result from employment (see also Titmuss 1958). Broadly speaking, occupational welfare can be understood as not only covering the benefits and services related to social provision but also other non-wage benefits (‘fringe benefits’) that do not ordinarily link to social policy (Farnsworth 2004). In this work, occupational welfare is understood as a social protection, including benefits and services, with a functional role towards public welfare (see e.g. Shalev 1996; Cutler & Waine 2001; Greve 2008). This occupational social protection is approached via collective agreements that are negotiated by employer and employee organisations. There is relatively little theoretical and even less empirical research dealing with occupational social protection (but see, respectively, e.g. Farnsworth 2004; Greve 2007; Yerkes & Tijdens 2010), with most studies focusing on occupational pensions (e.g. Shalev 1996; Rein & Wadensjö 1997; Forssell et al 1999; Ebbinghaus 2011). It is no coincidence that only a few studies exist on the subject. Occupational welfare is less distinct than statutory provision, covering a range of statutory and non-statutory benefits. Hence, the line between the private and public sector can be fuzzy (Rein 1982; Shalev 1996; Greve 2008) and examination of occupational benefits difficult. This is especially the case when measuring occupational welfare in cross-national comparisons. Each country has its own systems, and information from different occupational schemes is not easily available and even when it is, it is scarcely comparable. As a result, comparative studies dealing with occupational welfare have primarily focused on a small number of countries (e.g. Forssell et al 1999). In a more detailed manner, occupational social provision has been examined only from a national perspective (see e.g. Farnsworth 2004, Sjögren Lindqvist & Wadensjö 2006; Yerkes & Tijdens 2010). 6 Empirical analyses on occupational social protection have mostly focused on spending. In doing this, studies bear a resemblance to the first generation’s welfare state studies, which also focused on spending. The availability of cross-nationally comparable data on occupational social provision spending is far from adequate. Studies have mostly used data on non-wage costs, for example from the Labour Cost Survey (e.g. Rein 1996); researchers have also drawn their data from national statistics and studies in order to collect evidence on the extent of occupational welfare. Empirical analyses verify that there is more to welfare than what the state provides and the inclusion of occupational welfare in total spending leads to smaller variations between countries (Rein 1996; see also Adema 1999). The data on labour unit costs, however, appears to be inadequate for studying the importance of occupational welfare cross-nationally for different occupations and socioeconomic groups, since the studies are only from a national perspective. With stylised cases, one can study occupational welfare also from the viewpoint of different occupations and groups. Several studies provide analyses of coverage (e.g. Farnsworth 2004), which give important information on the extent of occupational welfare at the individual level. However, it is very rare for empirical research on occupational welfare to have adopted a social rights approach, involving an analysis of the importance of occupational welfare with the help of stylised cases. This type of analysis adds valuable information on the importance of occupational welfare not only for understanding its meaning for individuals but also to understand the logic of a public-private mix in providing welfare as well as to grasp potential stratifying effects. Occupational welfare through collective agreements One way to gain access to occupational benefits with at least somewhat comparable means is to approach them through collective agreements. Collective agreements are a justified approach in the Nordic countries in particular as they form the most common channel in which employment-related social benefits (sick pay benefits in particular) are agreed upon. However, there are several methodological challenges. The number of 7 complex collective agreements is large, and there is no systematic data available. There is also great variation between occupations and branches in their respective benefit conditions and levels. In addition, countries vary in their collective bargaining systems. In Nordic countries, collective bargaining is mainly industry-level, though much is also left to company negotiations and decentralization is becoming more common, especially in the private sector (see e.g. Elvander 2002). In some countries, such as the UK and most of the countries of Central and Eastern Europe, collective bargaining is mainly company-level (European trade union institute 2012). When it comes to data collection, sector-level agreements are easier to manage as their coverage extends beyond one workplace, and therefore the total amount of these kinds of agreements is more comprehensible. This is contrary to those countries where company-level agreements predominate: data collection is difficult not only because of the extent of the agreements but also because firm-based agreements are not usually publicly available. Thus, if we want to compare like things with like, different bargaining systems set serious difficulties to comparing countries. Nordic countries share the same kind of systems and therefore they are good countries to be compared. Another thing that affects comparability is the great differences between countries in their levels of collective bargaining coverage. In addition, the coverage may also vary within one country according to occupational status and sector (Scheuer 1997). The significance of collectively negotiated benefits is, of course, much lower in countries where few employees are covered by collective agreements. Nordic countries represent relative high coverage rates (from 91 percent in Finland to 70 percent in Norway). In the public sector, the coverage is 100 percent, which is significant as employment in this sector is high. At the other end, there is, for example, the UK, with only 30 percent of employees covered by collective agreements. (European trade union institute 2012.) Of course, this is not to say that there is not any occupational welfare available in the countries with low collective agreement coverage, merely that it is agreed on in a more individual manner without collective negotiations. In the Nordic countries, individually agreed perks and 8 benefits may also exist, but these are usually fringe benefits and do not concern benefits related to social protection. Choices regarding stylized cases In order to work, the applied method requires many specifications and assumptions to make cases comparable and situations identical across countries. Next, we present and discuss in more detail the specifications and assumptions of stylized cases. All information regarding statutory benefits, collective agreements and wages is collected from the year 2010. Occupations In order to analyze occupational welfare, we need to define occupations so we can choose the applicable collective agreements. We have selected occupations that are known and cross-nationally comparable. To keep things simple, five occupations are a good starting point. We have chosen the following occupations: cleaner, nurse, electrician, information technology (IT) engineer, and university teacher. The chosen occupations represent different industries, low- and high-skilled workers, and public and private sector employees. Incorporation of public sector employment is important because the public sector is a significant employer in the Nordic countries. Most public sector employees are nonmanual workers and are female. The inclusion of public sector employees is also important from a theoretical standpoint. Civil servants in many countries, particularly in corporatist countries, have enjoyed a relatively privileged position and had lavish welfare provisions. It is more likely that they are also offered better occupational benefits. In Esping-Andersen’s (1990, 70) etatism score, Finland was clearly above the mean value, whereas the other three Nordic countries were below. 9 Among the cited occupations, nurse and university teacher represent public sector1. In the Nordic countries, a nurse is a white-collar worker working in the service sector. According to our assumptions, a public sector nurse is a general nurse (all kinds of nurses being covered) who works in a hospital for the biggest public sector employer in the field. These definitions help us to collect reliable comparative wage data. A university teacher, on the other hand, is a high-skilled professional with a doctoral degree. The assumption regarding education has been made even though there are also university teachers who do not necessarily have a doctoral degree. The university teacher represents all fields of science, that is, there is not any specific discipline defined. This has been done in order to keep the number of teachers at a more comprehensive level, as there usually are only a few university teachers in each country per discipline. In Nordic countries, public sector nurses work at the local level, that is, in municipalities or counties, and most university teachers work at government-level universities. The local level plays an important role in the Nordic countries and, therefore, it is essential to make a distinction between local and government levels. Employees in the private sector usually work in the manual industry or in the service sector. The cleaner and electrician represent blue-collar workers, with the cleaner being a low-skilled service sector employee and the electrician a manual worker. One criterion for the selection of these two occupations has been that one is dominated by women and the other by men. Equality is one of the profound values of the Nordic welfare state and women have a long history of participation in the labour market. Many women work in the public sector where collectively negotiated benefits are relatively good and coverage is 100 percent. On the other hand, the welfare state was originally developed on a male breadwinner idea. Even today, women still earn less than men although women on average have a higher education. In Finland, for example, women’s wages are approximately 81 percent of men’s wages (Statistics Finland 2012). This supports the idea that male-dominated working sectors have better occupational benefits than female- 1 In all countries except in Finland, where university employees have not worked for government since 2010. 10 dominated ones. All in all, the gender aspect is interesting when examining occupational benefits. Our third private sector employee is an IT engineer who represents a high-skilled employee who has a university education. The IT engineer was chosen because this occupation is a comparatively new and modern occupation, which makes it interesting to compare with more traditional occupations. IT engineering is also relatively clear when the applicable collective agreement and wage data are concerned. A selection of highskilled white-collar occupations (university teacher and IT engineer) has not been simple, as employees at this level engage in various kinds of tasks and titles, which makes comparable data collection complicated. Collective agreements The collective agreements selected in this research are sector-level agreements (see Appendix table 2). Selected collective agreements are either the only ones applicable or one of the applicable ones to each occupation. In the private sector, the field of collective agreements is large, and there is usually no sole agreement that is applicable to each occupation. The applicable collective agreement is determined by the employer; however, as we have not defined a specific working place to our stylized cases in the private sector, we have chosen the most extensive agreement applied to each occupation, that is, the agreement that is applicable to the largest group of employees. We have made more presumptions regarding public sector employees; as a result, there is only one collective agreement that is applicable to each occupation. One assumption is that the nurse is working in a hospital for the biggest public sector employer and that the teacher is working in university. Without these assumptions, the applicable collective agreement might have been something else, for example, in the case of nurse, a government collective agreement. There exists no databank for collective agreements in any of the Nordic countries and, therefore, the agreements have been collected by using the websites of each occupation’s trade union. Most of the agreements are available on the Internet. In some of the cases, 11 the applicable collective agreement has been relatively easy to find, but in some cases, we have consulted the trade union in question to confirm the data. Denmark is an exception in that many white-collar workers (presuming that certain conditions are met) are covered by a ‘law on salaried employees’ that offers them full sick pay for an unlimited time. Regarding this, there are not any better conditions that collective agreements can offer. However, there is a ‘120-day rule’ in Denmark which means that different dismissal notices apply after 120 days of sickness absence; this is where collective agreements may stand out and state that the rule is not valid. All white-collar workers in our research are covered by the law on salaried employees, and, in addition, all occupations except IT engineer are covered by sector-level collective agreements. Wages All wage data are collected from national statistic offices and cover the average wage of each occupation in 2010. It can be assumed that there is a variation according to occupation on how well the average wage reflects the common wage: it is common that manual workers have more standardized salaries, whereas white-collar workers have more personalized and employer-attached wages. Furthermore, the private sector usually has a wider wage dispersion than the public sector does (see e.g. Statistics Finland 2012). Though we have an assumption that the employee has been working for the employer for a relatively long time, the wage data is not collected by seniority. We could assume that the average wage reflects relatively well the wage of an employee who is somewhere in the middle of his/her working career. When collecting wage data, we made the assumption that the employee is working full time and is in permanent employment.2 This choice has been made even though in some of our occupations, this does not necessary reflect the reality. For example, in Finland, only approximately half of the cleaners in the private sector work full time (Statistics Finland 2012). Fixed-term employment is usually more common in the public sector than the private. 2 However, the wage data from Finland also includes employees with permanent and fixed-term employment. 12 Collected wage data has been defined as pay of regular working time, which means that it includes other pay, such as supplements, but excludes overtime. As with previous assumptions, this choice also relates differently for the selected occupations. Nursing is an occupation in which shift work is typical and therefore it is important that supplements related to this are also calculated. Overtime is excluded because sick pay according to collective agreements is usually calculated in a way that does not take overtime into account. Statutory sickness benefits, on the other hand, are calculated by the total annual wage, so the disadvantage that comes with this decision is that they are not calculated in an entirely truthful way. National average wage compared to wage of selected occupations When we compare the average wage of each country to the average wage of each occupation (see Table 1), we can see why it is important to move away from the traditional production worker to more specific calculations. The wage of the electrician and nurse is close to the national average in each country, but the cleaner, at one end, and university teacher, at the other, seem to be far from it. OECD defines low pay as less than two-thirds of median earnings for all full-time workers (AW). This threshold has gained wide acceptance in research and statistics. For example, NOSOSCO uses this 67 percent of AW. Thus, the cleaner clearly represents a low-wage earner. Different occupations help us to gain information in a more comprehensive and reliable way. In Table 1, we have compared the national average wage to the average wage of each occupation. It can be seen that one general average wage can be far from the reality as wage dispersion between occupations is wide. According to OECD (2011), income inequalities have increased in almost all OECD countries and Nordic countries stand out as places where the growth has been particularly significant. Finland is one of the top countries in this respect, as can also be seen from Table 1. 13 Table 1. National average wage compared to average wage of occupations Cleaner Electrician Nurse IT engineer University teacher Finland 60% 92% 94% 145% 161% Denmark 69% 90% 97% 157% 129% Norway 79% 95% 92% 129% 135% Sweden 70% 94% 95% 145% 145% General assumptions of stylized cases We have made an assumption that the employee has been working for the employer for more than five years. Assumption regarding the previous working time has to be made because in Finland, the length of the sick pay period depends on the duration of the uninterrupted employment. In the private sector in particular, the rule is that the longer the employment duration has been before the sickness, the longer the benefit period. Another thing that is important in all countries is the length of sickness. The longer the duration of sickness and absence from work, the greater the importance of sickness benefits becomes for the employee. Noteworthy is that all occupational groups do not become unable to work due to sickness the same way; for example, in Sweden, manual workers are on sick leave 2.4 times more often than salaried employees (Svenskt Näringsliv 2012). We will examine three different sickness periods in order to illustrate the significance of collectively negotiated benefits. Firstly, we have a relatively short sickness period of one week. This is because most of the sickness periods are short ones, caused by flu or other illnesses that do not require a long recovery time (see e.g. Svenskt Näringsliv 2010). Secondly, we will examine a somewhat mid-length sickness period, that is, one month. This mid-length period is important because this is when collective agreements most clearly offer better benefits, and therefore the significance of collectively negotiated sickness benefits usually lie within this period. Thirdly, we have a longer sickness period 14 of 26 weeks. This is the same sickness spell that was used by Scruggs (2004) in his CWED-data analyses. Calculations3 We are interested in the net replacement rate of statutory and collectively negotiated sickness benefits. From the claimant’s point of view, perhaps the most central aspect of the provision is the adequacy of income loss replacement. Income tax and social security contributions have been deducted from the average gross income of each occupation. The only exception is Sweden, where the social contributions are tax deductible; therefore, these deductions have been left out of calculations. Church tax has not been taken into account, as this is usually the procedure that is used, for example, by OECD. We have collected the taxation and social contribution rules regarding statutory and collectively negotiated sickness benefits from each of the investigated countries. Municipal tax is calculated in Sweden and Denmark according to the taxation in the capital cities; in Finland and Norway, we have used the national municipal tax average. Information on 2010 Finnish and Norwegian income taxes has been received by using the information in the OECD tax-benefit calculator. Information on Sweden and Denmark has been collected by using national tax calculators. We have used a case of a single adult with no children. Does occupational welfare matter? In this final section, we will shortly present differences between statutory and collectively negotiated sickness benefits. In this paper, we will not go further into the differences between occupations, working-sectors, or sexes. We will leave analysis regarding these to future investigations and concentrate in this paper on how the picture alters after bringing the occupational welfare into analyses. First, we carry out an analysis with conventional 3 We owe great thanks to our research assistant, Lauri Mäkinen M.Soc.Sc, for gathering the relevant information for calculations. 15 measures where only the statutory sickness benefit is included. Contrary to most previous studies, we use in addition to the average wage earner’s wage varying income levels to illustrate how the net replacement rates differ with income level and how the single case indicator (100 AW) actually provides a partial picture of cross-national differences. Income levels are those of our selected occupations. Table 2. Net replacement rates according to statutory sickness benefits, case of one week Denmark Finland Norway Sweden 100 AW 100% 100% 100% 80% Cleaner 100% 100% 100% 80% Electrician 100% 100% 100% 80% Nurse 100% 100% 100% 80% IT engineer 100% 100% 100% 80% University teacher 100% 100% 100% 80% Table 2 displays the statutory net replacement rates for the one-week sickness period. In the case of a short sickness period, only statutory benefits are relevant since in all Nordic countries, the employer has a statutory obligation to pay compensation during this time. Employers are obligated to pay full salary in Denmark, Finland, and Norway, whereas in Sweden the compensation is a bit lower, with 80 percent compensation rate. It is clear that statutory net replacement rates (Table 2) are good in all four countries, and occupational welfare does not play any importance. In all four Nordic countries, the first 10-21 days (depending on the country) are paid by the employer; after this, the responsibility is passed to national insurance companies. Next, we focus on mid-length sickness of one month. In Table 3, we present the net replacement rates according to statutory sickness benefits (Table 3a) and according to collectively negotiated benefits (Table 3b). 16 Table 3a. Net replacement rates according to statutory sickness benefits, case of one month Denmark Finland Norway Sweden 100 AW 47.9% 66.3% 100% 72.4% Cleaner 69.7% 67.6% 100% 77.6% Electrician 53.5% 71% 100% 77.0% Nurse 49.2% 71% 100% 75.9% IT engineer 30.5% 58.4% 80% 50% University teacher 37.1% 56.4% 76.5% 50% Table 3 b. Net replacement rates according to collectively negotiated sickness benefits, case of one month Denmark4 Finland Norway Sweden5 Cleaner 100% 100% - 87.3% Electrician 100% 100% - 86.6% Nurse 100% 100% 100% 78.5% IT engineer 100% 100% 100% 88% University teacher 100% 100% 100% 88% It can be seen that the net replacement rates of statutory benefits are reduced from that of the short sickness period. The replacement rates decreases mainly with the wage. The only exception is Finland where the taxation on sickness allowance causes the net replacement rate of cleaner to be lower than the replacement rates of the electrician and nurse. The significance of collectively negotiated benefits is obvious as most collective agreements offer full sick pay. The importance of occupational benefits can especially be seen in Denmark. Only in Norway is the relevance of occupational benefits minor since 4 In Denmark, IT engineers are not paid compensation according to collective agreements but according to a special law on salaried employees. Here, we refer to them as collectively negotiated benefits. 5 In Sweden, collectively negotiated benefits are not distinguished in a simple way from statutory benefits as occupational top-up sickness benefits from the Swedish Social Insurance Agency. Here, the replacement rate of collectively negotiated benefits is calculated together with statutory benefits, as this is the true compensation that the employee receives. 17 the level of statutory benefits is high. Norway differs from other Nordic countries in that it offers one year of full salary paid by the national insurance company (NAV). Full salary is paid up to a certain wage level (approximately 61,449 euro in year 2010), after which the compensation rate is gradually reduced. Low-income occupations do not receive any collectively negotiated sickness benefits in Norway; nonetheless, these occupations receive full compensation from NAV. In all countries, the importance of collectively negotiated benefits can most clearly be seen in high-income occupations; the net compensation rate of the IT engineer and university teacher is most often many times higher when we move on from statutory to occupational benefits. In Sweden, the IT engineer and university teacher have the same compensation rate since they happen to have the same average wage. Table 4a. Net replacement rates according to statutory sickness benefits, case of 26 weeks Denmark Finland Norway Sweden 100 AW 47.9% 66.3% 100% 72.4% Cleaner 69.7% 67.6% 100% 77.6% Electrician 53.5% 71% 100% 77.0% Nurse 49.2% 71% 100% 75.9% IT engineer 30.5% 58.4% 80% 50% University teacher 37.1% 56.4% 76.5% 50% Table 4b. Net replacement rates according to collectively negotiated sickness benefits, case of 26 weeks Denmark Finland Norway Sweden Cleaner - - - 87.3% Electrician - - - 86.6% Nurse 100% 66.6% 100% 77.6% IT engineer 100% - - 79.1% University teacher 100% 75% 100% 78% 18 In Table 4a and b, we present the results of 26 weeks of sickness in line with previous studies. Compared with the one-month sickness period, there are no changes in statutory benefits. This is because statutory benefits are usually paid the same way up to the point where the employee is no longer eligible for the sickness allowance. The maximum length of sickness benefit is usually approximately one year depending on the country. When looking at the Table 4b, we can see that the importance of collectively negotiated benefits is now less than it was in the case of one month. Occupations representing bluecollar workers are no longer eligible for occupational benefits, except in Sweden. Sweden differs from other countries as it usually has comparatively the lowest compensation rates (see Table 3) but on the other hand, the benefit period is longer. High-wage occupations and the public sector employee nurse continue receiving occupational benefits after 26 weeks of illness. The only exceptions are the IT engineer in Finland and Norway. It seems that public sector agreements offer benefits for a longer time than private sector ones. All in all, it is evident that the level of protection is significantly different with occupational welfare. Summary and discussion In this paper, we aimed to bring occupational welfare into cross-national social policy analyses. Although comparative welfare state research has flourished for the past decades, studies have predominantly focused on statutory provisions, while ignoring occupational welfare. Those studies that have analyzed occupational welfare are mainly theoretical; the few empirical studies are for the most part single-country studies. Titmuss (1958) brought occupational welfare into the scientific discussion when he pointed out there are different routes to welfare and these alternative routes should not be underestimated when evaluating the total provision of welfare. Our paper sheds light upon the theoretical understanding of the complex public-private mix. Our first-hand interest was, however, methodological—whether and how the commonly used stylized case approach could be applied to study occupational welfare in cross-national analyses. The stylized case method is widely utilized in prominent academic work on welfare states 19 (e.g. Esping-Andersen 1990; Korpi & Palme 1998). We aimed to overcome one of the great weaknesses of previous studies, which have been criticized for being too onedimensional as they build their analyses solely on average production worker wage. The average production worker concept is no longer seen as representing the typical worker in a postmodern society where segmentation and irregularity characterize the labour markets. When studying collectively negotiated benefits, we were able to a certain extent to tackle this question by choosing different occupations to reflect low-skill as well as high-skilled workers. Existing wage dispersion allowed us not only to analyze the impact of different earning levels on the level of social protection but also to analyze the importance of collectively negotiated occupational benefits in the case of sickness. Five different occupations were chosen for which the level of total provision was stipulated and calculated. Occupations were chosen to present not only the typical lowand high-skills occupations but also female- and male-dominated occupations and occupations in both the public and private sector. However, in this paper, the interest was not to analyze the differences between occupations, working-sectors or sexes but instead leave this to future theoretically driven investigations. Visibly selected occupations are vulnerable to critique. Our goal was to present thorough arguments for the choices. The number of occupations could have been higher, but the more the cases you have, the more complex and blurry are the analyses. Five occupations were regarded as a good starting point, with a number large enough to have information from several cases and to avoid conclusions drawn solely on one or two occupations. A decisive choice in cross-national comparisons is the sample of countries. Here we followed a common road in the field of welfare state studies and chose the ‘most similar’ research strategy. Four Nordic countries were included in analyses. Cross-national comparisons on occupational welfare are rare, partly because countries vary in their schemes and the field of collective agreements is complex. The Nordic countries bear resemblances in their collective bargaining systems, and therefore it served well that our methodological exercise focused on cases of illness negotiated in collectively bargained agreements. Our analyses brought evidence to show the not-so-equal aspects of the 20 model, that is, different occupational groups have varying levels of support with occupational welfare having stratifying rather than redistributive effects (cf. EspingAndersen 1990, Bradley et al. 2003). Future work should be elaborated to cover more countries; only in this way can better understanding of the role of occupational welfare be gained and the total welfare consisting of private and public parts revealed. One way forward in comparing countries with entirely different systems is that instead of focusing on sector-wide collective agreements, one could concentrate on company-level agreements representing different occupations. We have tried to proceed this way in our investigation, but so far it has proved challenging to collect these kinds of agreements that are often treated as company secrets. In the paper, we focused only on income maintenance. We followed earlier work where analyses excluded benefits ‘in-kind’. Hence, free or subsidized health care provided by employers was not included. For example, in Finland, occupational health services have a very important role, since it is statutory for the employers to organize free-of-charge health services for employees. The choice to have only a single adult as the family type is also vulnerable to critique. It is customary to have at least two family types, single, and a couple with children. In the case of collectively negotiated benefits in case of illness, the rules do not make any difference whether a person is single or has a family. In none of our studied countries do spouse earnings or situations alter the level of provision, nor do they consider any extra benefit for children. In the case of including a couple with children as our second family type, the analyses would have become more complicated and would not have revealed the role of occupational welfare any more than the single adult case does. However, the family type is not wholly irrelevant. For example, in Finland many collective agreements state that in case a parent is absent from work due to his/her minor age child’s illness, he/she is entitled to pay during that time. This kind of question, however, requires another study. 21 Since the focus of this paper was on occupational welfare, analyses covered only employees. Hence, self-employed workers, students, and the unemployed were not included. Preliminary results show occupational welfare to have great importance on the level of overall welfare. Further, they demonstrated occupational welfare to have a stratifying nature. These differences between groups would be even larger if unemployed people were included in analyses. This is indeed a question that reserves attention in future work. This was one of the first attempts to study occupational welfare cross-nationally via the stylized case method. As the method proved to be suitable for its purpose, it is essential to extend the work to cover more cross-sectional points. This way, research can bring better understanding to the complex public-private mix. Occupational welfare can be seen as related to the general debate over the welfare state’s condition and possible retrenchment policies. In some countries, collective agreements may have a role in compensating the declining welfare state (Yerkes & Tijdens 2010). It has even been argued that social policy that is based on collective agreements influences and supports welfare state retrenchment policies (Trampusch 2006). To gain a more complete picture of welfare delivering, further investigations are required and methodology work elaborated. 22 References Adema, Willem (1999) Net social expenditure. OECD labour market and social policy occasional papers, No. 39, OECD publishing. Bradley, David & Huber, Evelyne & Moller, Stephanie & Nielsen, François & Stephens, John D. (2003) Distribution and Redistribution in Postindustrial Democracies. World Politics 55(2), 193–228. Bradshaw, Jonathan & Piachaud, David (1980) Child support in the European Community. London: Bedford Square Press. Cutler, Tony & Waine, Barbara (2001) Social insecurity and the retreat from social democracy: occupational welfare in the long boom and financialization. Review of International Political Economy 8 (1), 96–118. Day, Lincoln (1978) Government pensions for aged in 19 industrial countries: demonstration of a method for cross-national evaluation. Comparative Studies in Sociology 1978; (1): 217–233. Ebbinghaus, Bernand (2011) (ed) The Varieties of Pension Governance Pension Privatization in Europe. Oxford: University Press. Elvander, Nils (2002) The labour market regimes in the Nordic countries: A comparative analysis. Scandinavian Political Studies 25 (2), 117–137. Esping-Andersen, Gøsta (1990) Three worlds of welfare capitalism. Cambridge: Polity Press. European trade union institute (2012) Collective bargaining. [online] http://www.workerparticipation.eu/National-Industrial-Relations/Across-Europe/Collective-Bargaining2. (Accessed on 02.07.2012). Forssell, Asa & Medelberg, Magnus & Stahlberg, Ann-Charlotte (1999) Unequal Public Transfers to the Elderly in Different Countries - Equal Disposable Incomes. European Journal of Social Security 1(1), 63– 89. Farnsworth, Kevin (2004) Welfare through Work: An Audit of Occupational Social Provision at the Turn of the New Century. Social Policy & Administration 38 (5), 437–455. Greve, Bent (2007) Occupational welfare. Cheltenham; Northampton: Edward Elgar. Greve, Bent (2008) What is welfare? Central European Journal of Public Policy 2 (1), 50–73. Häusermann, Silja & Schwander, Hanna (2012) Varieties of Dualization? Labour Market Segmentation and Inside-Outsider Divides Across Regimes. In Patrick Emmenegger, Silja Häusermann, Bruno Palier and Martin Seeleib-Kaiser (eds.) The Age of Dualization. The Changing Face of Inequality in Deindustrializing Societies. University Press: Oxford, 27–51. Kangas, Olli (1991) The Politics of Social Rights. Studies on the Dimensions of Sickness Insurance in OECD Countries. Stockholm: Swedish Institute for Social Research. Kangas, Olli (2010) Work accident and sickness benefits. In Castles, Francis; Leibfried, Stephan; Lewis, Jane; Obinger, Herbert; Pierson, Christopher (ed.) The Oxford handbook the welfare state. Oxford: Oxford university press, 391–405 Korpi, Walter & Palme, Joakim (1998) The paradox of redistribution and strategies of equality. American Sociological Review 63:5, 661–687. Korpi, Walter and Palme, Joakim (2007) The Social Citizenship Indicator Program (SCIP), Swedish Institute for Social Research, Stockholm University. Kvist, Jon (1997) Retrenchment or restructuring? The emergence of a multitiered welfare state in Denmark. In Clasen, Jochen (ed.) Social insurance in Europe. Bristol: The Policy Press, 14–39. Marshall, Thomas (1950) Citizenship and Social Class and Other Essays. Cambridge: Cambridge University Press. 23 NOSOSCO (2009) Social Protection in the Nordic countries 2008/2009. Scope, Expenditure and Financing. Copenhagen: Nordic Social Statistical Committee. OECD (2011) Divided we stand: Why inequality keeps rising. OECD publishing. Palme, Joakim (1990) Pension rights in Welfare Capitalism. The Development of Old-Age Pensions in 18 OECD Countries 1930 to 1985. Stockholm: Swedish Institute for Social Research. Rein, Martin (1996) Is America Exceptional? The Role of Occupational Welfare in the United States and the European Community. In Michael Shalev (ed.), The privatization of social policy? Occupational welfare and the welfare state in America, Scandinavia and Japan. Basingstoke; New York: Palgrave Macmillan, 27–43. Rein, Martin & Wadensjö, Eskil (1997) (eds) Enterprise and the welfare state. Cheltenham: Edward Elgar. Rueda, David (2005) Social democracy inside out: partisanship and labor market policy in industrialized democracies. Oxford; New York: Oxford University Press. Scheuer, Steen (1997) Collective Bargaining and the Status Divide: Denmark, Norway and the United Kingdom Compared. European Journal of Industrial Relations 39 (3), 39–57. Scruggs, Lyle (2004) Welfare State Entitlement Data Set: A Comparative Institutional Analysis of Eighteen Welfare States. Shalev, Michael (ed) (1996) The privatization of social policy? Occupational welfare and the welfare state in America, Scandinavia and Japan. Basingstoke; New York: Palgrave Macmillan. Sjögren Lindquist, Gabriella & Wadensjö, Eskil (2007) National Social Insurance – not the whole picture. Report for ESS 2006:5. Statistics Finland (2012) Structure of Earnings [e-publication]. Access method: http://www.stat.fi/til/pra/2010/pra_2010_2012-04-05_tie_001_en.html. (Accessed on 6.7.2012). Svenskt Näringsliv (2010) Tidsanvändning 1a kvartalet 2010. Svenskt Näringsliv (2012) [online] http://www.svensktnaringsliv.se/fragor/fakta_om_loner_och_arbetstid/fola2012/9-tidsanvandning-ochfranvaro_163253.html. (Accessed on 04.07.2012). Titmuss, Richard (1958) Essays on ‘the welfare state’. London: Allen & Unwin. Trampusch, Christine (2007) Industrial relations as a source of social policy: A typology of institutional conditions for industrial agreements on social benefits. Social Policy & Administration 41 (3), 251–270. Trampusch, Christine (2006) Industrial relations and welfare states: the different dynamics of retrenchment in Germany and the Netherlands. Journal of European Social Policy 16 (2), 121–133. Van Gerven, Minna (2008) The broad tracks of path dependent benefit reforms. Helsinki: Kela. Wennemo, Irene (1994) Sharing the Costs of Children. Studies on the Development of Family Support in the OECD Countries. Stockholm: Swedish Institute for Social Research. Yerkes, Mara & Tijdens, Kea (2010) Social risk protection in collective agreements: Evidence from Netherlands. European Journal of Industrial Relations 16 (4), 369–383. 24 Appendix table 1. Employment by sector and gender in 1970 and 2010 Denmark Finland Norway Sweden Civilian employment in industry as % of civilian employment 1970 37.8 34.6 37.2 38.4 2010 18.2 23.2 19.7 20 Civilian employment in service as % of civilian employment 1970 50.7 42.8 48.9 53.5 2010 79.4 72.3 77.7 77.9 Civilian employment females as % of civilian employment 1970 39.4 44.9 30.8 39.4 2010 48.1 48.7 47.5 47.2 Source: OECD, Labour Force Statistics (online) Appendix table 2. Selected collective agreements University teacher Cleaner Electrician Nurse IT engineer Finland Kiinteistöpalvelualan TES 2010–2012 Sähköistysalan TES 2010– 2013 Serviceoverenskomst 2010–2012 Elektriker overenskomst 2007–2010 Teknologiateollisuuden TES 2009– 2012 Law on salaried employees Yliopistojen yleinen TES 2010–2012 Denmark Norway Overenskomst for renholdsbedrifter 2010– 2012 Landsoverens komst for elektrofagene 2010–2012 Kunnallinen yleinen virka- ja työehtosopimus 2010-2011 Overenskomst for ikke-ledende personale på Sundhedskartell ets område 2008 Overenskomst mellon Spekter og NSF 2008–2010 Hovedtariffavta len i staten 2010–2012 Sweden Kollektivavtal Serviceentreprenad 2010–2012 Installitionsavtalet 2012–2012 Overenskomst Norges Ingenior- og teknologorgan insasjon HSH og NITO Anställningsvillkor IT-företag 2010–2012 Allmännä bestämmelser Overenskomst for akademikere i staten 2008–2011 Allmänt löneoch förmånsavtal 25 26