ACCT 225 - Darla Moore School of Business

advertisement

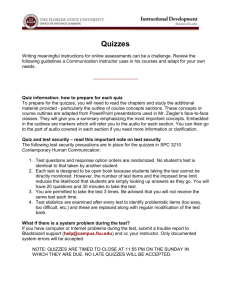

ACCT 226 Introduction to Managerial Accounting Fall 2013 – Section 001 Thursday 8:30AM – 9:45AM (Room 350) Video Instructor: Janice H. Fergusson, CPA, MACC Recitation Leader: Erin M. Hawkins, CPA Office: Room 301 Office Hours: Tuesday 10:00 – 11:00 Other times by appointment E-mail: Erin.Hawkins@grad.moore.sc.edu Required Materials: Managerial Accounting, 14th edition, by Garrison, Noreen, and Brewer, McGraw-Hill/Irwin, ISBN 9780077829308. This is a special edition looseleaf text with an online access code for Connect. This package is at a discounted price and is only available at the three local bookstores (Addams, SC Bookstore, and University Bookstore at Russell House). The online access code for Connect (with or without ebook) may be purchased separately from the publisher. A specific URL address has been created for your section and will be provided in a separate document with your Connect instructions. Lecture Outlines printed from Blackboard. You should print these outlines and use them as you view the lectures which are accessed through Blackboard. Prerequisite ACCT 225 – Introduction to Financial Accounting or equivalent with a Course(s): grade of “C” or better. Course Description: This course builds on the fundamental concepts introduced in financial accounting (ACCT 225) and examines a variety of tools and techniques used by managers for planning, control, and decision-making. Course Format: The format of this course will consist of a combination of recorded lectures and live problem-solving classes. You will be responsible for watching a 75-minute lecture video accessed through Blackboard prior to attending a weekly 75-minute class. Quizzes will be given on a regular basis to ensure that students are watching the recorded lecture videos and preparing before class. During the class, the recitation leader will work problems, cover supplemental material, and answer questions. Exams will be given during your regularly scheduled class. 2 Course Objective: The main objective of this course is to provide students with the skills for applying managerial accounting knowledge needed to effectively plan and control company operations and make good business decisions. To achieve this objective, the course specifically covers managerial accounting terminology, traditional and advanced product costing systems, cost behavior analysis, budgeting, performance evaluation, pricing, capital investment, and decision-making tools. Learning Outcomes/Course Competencies: (1) Students will demonstrate proficiency in the major accounting concepts underlying the production of data supporting the product pricing decision by: (a) identifying and giving examples of general cost classifications. (b) analyzing the use of cost information for product pricing purposes. (c) computing the three categories of inventories in the manufacturing process. (d) using various allocation methods to assign overhead to products/processes. (e) contrasting various cost accumulation models. (2) Students will demonstrate proficiency in the major accounting and organizational behavior concepts underlying operational control by: (a) preparing various components of a master (static) budget and explaining why organizations use static budgets as a planning and control device. (b) preparing a flexible budget and explaining the use of flexible budgeting for cost control purposes. (c) demonstrating how standards are set and used for the dual purpose of cost control and product pricing. (d) computing standard cost variances and explaining their significance. (3) Students will demonstrate proficiency in the major accounting concepts underlying the development of data to support analysis used by firms in the decision-making process by: (a) predicting and analyzing cost behavior patterns. (b) computing contribution margin and illustrating its use in the decision-making process. (c) performing break-even analysis and determining the level of sales needed to achieve a desired target profit. (d) computing the degree of operating leverage at a particular level of sales and explaining how it can be used to predict changes in net operating income. (e) differentiating the concepts of relevant costs, opportunity costs, and sunk costs in the decision making environment. (f) analyzing data in evaluating alternative project/product decisions (adding/dropping product line or segment, make or buy decision, special orders). (g) recognizing the concept of decentralization and computing ROI and residual income to analyze performance of strategic business units. (h) evaluating capital investment opportunities using three methods (payback, simple rate of return, net present value) and identifying the strengths and weaknesses of each method. Embedded questions in quizzes, homework assignments, and periodic exams will be used to measure achievement of the learning outcomes. Class Attendance: 3 You are expected to attend every class. The University attendance policy specifics if you miss more than 10% of the scheduled classes, whether excused or unexcused, your course grade will be dropped one letter grade. You are also expected to arrive for class on time and stay for the entire class period. If you must miss class, you are responsible for all assigned material plus everything covered in class. It is your responsibility to get that information from a classmate or visit me during my office hours. Class Preparation and Attentiveness: You are expected to prepare for class in advance – that means watching the video, reading the chapter assignment, and preparing written solutions to the homework assignments before coming to class. You are expected to be attentive in class. Doing work for other classes, reading newspapers, working puzzles, text messaging, sleeping in classes, etc…will not be tolerated. You will be asked to leave the room for lack of attentiveness. Blackboard: I will provide information and course materials to you through Blackboard. It is your responsibility to check your e-mail address on Blackboard and change it if it is not your preferred e-mail address. To change your e-mail address, login to Blackboard and then go to personal information. Grading: Your grade for the course will be computed as follows: Exam One Exam Two Cumulative Final Exam Homework Quizzes Exams: 25% 25% 25% 15% 10% The three exams are scheduled as follows: Exam 1: Exam 2: Final Exam: Thursday, September 19 (Lectures 1-5) Thursday, October 31 (Lectures 6-9) Monday, December 16 (Lectures 1-14) The final exam will be comprehensive, covering all the material covered during the semester. Review sessions will be scheduled prior to each exam. No makeup exams will be given and a missed exam will generally result in a grade of zero. In the case of unforeseen emergencies, your final exam grade will be weighted for the missed test. This exception is at the discretion of the instructor (not the student) and will be granted only in the case of sincere emergencies, not for convenience. You are responsible for contacting me in advance of the scheduled exam time if an emergency 4 arises that will result in an absence from an exam. Appropriate documentation will be required to support emergencies. Calculators are permitted provided they are silent calculators with single-line display. Programmable or graphing calculators, cell phones, and other electronic devices are not allowed to be used on a quiz or exam under any circumstances. If your calculator does not meet the above standards, you will not be allowed to use it and a substitute calculator may not be available. Your instructor will not have extra calculators for quizzes, so you should invest in a simple four-function calculator and bring it to each class if you want to make sure that you have a calculator on quiz days. During exams, all personal belongings except for writing utensils and a calculator must be securely stored at the front of the room. We reserve the right to confiscate anything that is not secured in a closed bag during the exam, including cell phones and other electronic devices which must be powered off and stored during exams. Homework: There will be a total of 17 homework assignments submitted for grading in Connect. The total points earned on your highest 16 homework assignments will be averaged and used in computing your final course grade (in other words, your lowest homework score will be dropped). These assignments will include one or more exercises/problems from each lecture. The assignments are due no later than 11:30PM on the due date. You will have unlimited attempts to complete each assignment, but the assignment will not be available after 11:30PM on the due date, so schedule accordingly. Since you know at the beginning of the semester when these assignments are due, there are no provisions for making up a homework assignment. Specific instructions on completing these assignments will be given in a separate handout. Quizzes: There will be a total of 10 quizzes during the semester. The total points earned on your highest 8 quizzes will be averaged and used in computing your final course grade (in other words, your lowest two quiz scores will be dropped). The purpose for dropping the two lowest scores is to allow for illness, family emergencies, car trouble, etc. Please Note: You must be present the day a quiz is given to earn the points. There are no provisions for making up a quiz. If a quiz is given at the beginning of class and you are late, you will not be given extra time to complete the quiz. The grading scale will be: A B+ B C+ C D F 89.5-100 86.5-89.49 79.5-86.49 76.5-79.49 69.5-76.49 59.5-69.49 Below 59.5 5 The grading scale is set by the School of Accounting and your instructor will not be able to make any changes in it. There will be no deviations from the grading scale. For example, a student with a weighted average of 69.50 would receive a C, and a student with a weighted average score of 69.49 would receive a D. A grade of D+ is not awarded in this course. Any business major scoring a D or F must retake the course. Supplemental Instruction: Supplemental Instruction (SI) is offered for this course and provides you with the opportunity to attend study sessions per week. SI sessions for this course will be facilitated by an undergraduate student who has taken this course and excelled in the course material. During these weekly sessions, your SI leader will facilitate activities that encourage you to practice, discuss, and ask questions about the most recent lecture material. All SI sessions are held in the Student Success Center, Thomas Cooper Library. Dates/times of SI sessions can be found at http://www.sa.sc.edu/supplementalinstruction/. Students with Disabilities: If you have a documented disability for which you need special arrangements, please contact the Office of Student Disability Services, Phone 777-6142, TDD 777-6744, email sasds@mailbox.sc.edu, or visit their office located in LeConte College, Room 112A. Qualified students needing extra time during tests must provide their instructor with documentation at the beginning of the semester. To be given extra time, a student must take the test through disability services and must take it no later than the rest of the class. Extra time cannot be given to any student in the classroom with the other students. Please make your appointments with disability services following their rules. USC Honor Code: It is the responsibility of every student at the University of South Carolina Columbia to adhere steadfastly to truthfulness and to avoid dishonesty, fraud, or deceit of any type in connection with any academic program. Any student who violates this Honor Code or who knowingly assists another to violate this Honor Code shall be subject to discipline. This Honor Code is intended to prohibit all forms of academic dishonesty and should be interpreted broadly to carry out that purpose. The following examples illustrate conduct that violates this Honor Code, but this list is not intended to be an exhaustive compilation of conduct prohibited by the Honor Code: 1. Giving or receiving unauthorized assistance, or attempting to give or receive such assistance, in connection with the performance of any academic work. 2. Unauthorized use of materials or information of any type or the unauthorized use of any electronic or mechanical device in connection with the completion of any academic work. 3. Access to the contents of any test or examination or the purchase, sale, or theft of any test or examination prior to its administration. 4. Use of another person’s work or ideas without proper acknowledgment of source. 5. Intentional misrepresentation by word or action of any situation of fact, or intentional omission of material fact, so as to mislead any person in connection with any 6 academic work (including, without limitation, the scheduling, completion, performance, or submission of any such work). 6. Offering or giving any favor or thing of value for the purpose of influencing improperly a grade or other evaluation of a student in an academic program. 7. Conduct intended to interfere with an instructor’s ability to evaluate accurately a student’s competency or performance in an academic program. Whenever a student is uncertain as to whether conduct would violate this Honor Code, it is the responsibility of the student to seek clarification from the appropriate faculty member or instructor of record prior to engaging in such conduct. Suspected violations of the honor code will be reported to the Office of Academic Integrity. Violations of the honor code will result in disciplinary measures. Sanctions will be imposed to the fullest extent possible for any student who participates in any act of academic dishonesty. General Comments and Tips for Success: It is extremely important that you keep up in this course. If you fall behind, it is very difficult to catch up! So plan now to work hard. Come to class, participate, and ask questions. At a minimum, proper preparation for class consists of watching the video, reading the assignment, and working the homework assignments. WORK the homework exercises/problems as many times as you need so you UNDERSTAND the material. The exams are challenging and will differentiate between those students who understand the material and those who do not. If you find you are having trouble with the material, please recognize this fact and do something about it as soon as possible. Experience has shown that those students who seek help early and regularly attend SI sessions tend to be more successful in this course. There are no opportunities for extra credit in this class, so please do not ask for extra credit at the end of the semester when you haven’t earned the grade that you want. Begin working hard now for the grade that you want! The skills that you learn in this course will help you tremendously in other business courses and in the real world. You will be able to understand why something is done instead of taking it for granted. You will be surprised at how much this course will benefit you in the real world and in your other business courses. 7 Course Outline – Fall 2013 Dates 8/22 (Th) Lecture Topic/ Event Lecture 1: Introduction to Managerial Accounting Textbook pages p. 2 pp. 24-30 pp. 43-46 Homework Assignments E2-1, E2-2, P2-24 Due 8/28 (W) General Cost Classifications 8/28 (W) 8/29 (Th) Last Day to Drop/Add Class Lecture 2: Job-Order Costing – Part 1 Lecture 3: Job-Order Costing – Part 2 Schedules of Cost of Goods Manufactured/Cost of Goods Sold 9/5 (Th) Graded Homework Assignments GHA-1 (P2-22) Lecture 4: Process Costing pp. 83-101 E3-1, E3-2, E3-3, E3-4, E3-11 GHA-2 (P3-19) pp. 102-111 E3-6, E3-7 P3-23, 3-25 GHA-3 (P3-24) E4-7, E4-11 P4-14 Due 9/4 (W) GHA-4 (P4-13) pp. 141-155 Due 9/11 (W) 9/12 (Th) Lecture 5: ABC Costing pp. 272-300 E7-1, E7-3, E7-4 GHA-5 (E7-12) Due 9/18 (W) 9/19 (Th) 9/26 (Th) Exam 1 (Lectures 1-5) Lecture 6: Cost Behavior Variable vs. Absorption Costing pp. 29-43 pp. 229-252 E2-3, E2-4, E2-5, E2-8 P2-15 GHA-6A (P2-18) E6-1, E6-2, E6-7 P6-18 GHA-6B (P6-21) Due 10/2 (W) 10/3 (Th) 10/10 (Th) Lecture 7: Cost-Volume-Profit Analysis pp. 183-210 Lecture 8: Basic Framework of Budgeting Master Budget – Part 1 pp. 335-350 E5-4, E5-5, E5-6, E5-16 P5-20, P5-21 E8-3, E8-4, E8-5, E8-12 GHA-7 (P5-29) Due 10/9 (W) GHA-8 (P8-19) Due 10/16 (W) 8 Course Outline, continued: Dates 10/11 (F) 10/17 (Th) 10/24 (Th) Lecture Topic/ Event Textbook pages Homework Assignments Graded Homework Assignments Last Day to receive a grade of “W” Fall Break – No Classes Lecture 9: Master Budget – Part 2 pp. 350-361 E8-6, E8-7, E8-8, E8-9 P8-21, P8-26 GHA-9 (P8-16) Due 10/23 (W) 10/31 (Th) 11/7 (Th) Exam 2 (Lectures 6-9) Lecture 10: Flexible Budgets and Performance Analysis pp. 383-399 E9-9, E9-10, E9-11, E9-12, E9-13 GHA-10 (E9-19) Due 11/6 (W) 11/14 (Th) 11/21 (Th) 11/28 (Th) 12/5 (Th) Lecture 11: Standard Costing pp. 418-443 pp. 454-460 Lecture 12: Performance Measurement in Decentralized Organizations pp. 472-482 Lecture 13: Differential Analysis: The Key to Decision Making pp. 527-543 E10-1, E10-2, E10-3 P10-11 E10A-6 E11-1, E11-2, E11-6, E11-7, E11-9 P11-14 E12-2, E12-3, E12-4, E12-10 GHA-11 (P10A-8) Due 11/13 (W) GHA-12 (P11-18) GHA-13A (E12-12) GHA-13B (E12-14) Due 11/20 (W) Thanksgiving Holiday No Classes Lecture 14: Capital Budgeting pp. 579-587 pp. 590-605 E13-1, E13-7, E13-14 P13-20, P13-21 GHA-14A (P13-22) GHA-14B (E13-12) Due 11/27 (W) 12/16 (Monday) 9:00AM Final Exam (Lectures 1-14) Please Note: Your instructor reserves the right to adjust this schedule at any time. If you are not in class on a day that a change may be made, it is your responsibility to find out the changes from a classmate or visit me during my office hours.