View Extended Abstract - United States Association for Energy

advertisement

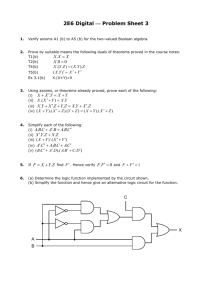

ADJUSTMENT COST, UNCERTAINTY, AND PROVED RESERVES OF CRUDE OIL [Xiaoli Zheng, University of Calgary, 4036185183, corresponding author email: xzhen@ucalgary.ca] [John Boyce University of Calgary, email: boyce@ucalgary.ca] Overview U.S. and Canada's proved reserves of crude oil share the similar trend with crude oil production for the past century. The ratio of proved reserves to production, which measures how many years at current production before current proved reserves are exhausted, is around 8-10 years in U.S. and 8-15 years in Canada. These numbers also prevail within firm-level data. From 1999 to 2013, 20 major U.S. and Canadian firms hold 9-16 times more proved reserves than current production. Moreover, these numbers have declined very slowly since the 1940's in U.S. and the 1970's in Canada .This leads to the research questions of this paper; What are the forces that drive a firm’s decisions on proved reserve accumulation; Why do they accumulate large amounts of proved reserves; Why does the ratio of proved reserves to productions remains relatively stable over time. These issues are important because they help to understand a firm’s market behaviors. For example, Shell recently spent $70 billion to buy BG group in order to boost its declining oil and gas reserves. This paper is interested in examining how economic factors, such as crude oil prices, price volatility and exploration costs, affect a firms' optimal proved reserve accumulation. Methods To answer these questions, we first clarify the definition of proved reserves and then build a simple deterministic and a stochastic model. The deterministic model uses the concept of adjustment cost and delayed response in which a representative firm has constant marginal costs of production and discovery. Therefore, unlike previous studies, we do not rely upon reserve-dependent costs of extraction (e.g., [9] and [10]). Due to the delay between resource discovery and production, a firm makes decisions on how fast the resources are to be transferred to the proved and then production stage when it finds a new discovery from the oil-in-place stock. We assume there are adjustment costs associated with the fact that moving discoveries quickly to the proved and then production stage is more costly than doing it slowly ([8]). The second model attempts to explain how demand and exploration uncertainties affects the the crude oil production and the accumulation of proved reserves. This model follows Pindyck's ([7]) and Mason's ([4] and [5]) framework that considers stochastic models of exhaustible resource extractions. The model allows for a stochastic world in which demand and exploration uncertainties are added to the deterministic model. Although the stochastic model follows Pindyck and Mason's framework, it differs in two aspects: the stochastic model is based on the specification of deterministic model, thus the feature of delayed responses and adjustment costs is still kept; Additionally, the stochastic model explicitly solves the analytical solutions of expected productions and proved reserves. Results In the deterministic model, we find a delayed response is necessary for the firm to hold proved reserves while adjustment costs govern the periods of delay. In the stochastic model, this result still holds. However, the deterministic model solely relies on the periods of delay to explain the holding of large amounts of proved reserves relative to production. Moreover, it fails to account for why the ratio of proved reserves to productions declines slowly or even remains stable. In stochastic model we find uncertainties from demand and exploration lower the firm's optimal productions and thus resources would be exhausted within a longer period. The stochastic model predicts that a firm would hold larger proved reserves than productions if the demand volatility is much smaller than the interest rate, or if the exploration volatility is not noticeably larger than the interest rate. By using U.S. data, we verify that this prediction is empirically relevant. The existence of these volatilities also explains why the ratio of proved reserves to productions declines slowly or even remains stable. Conclusions This paper answers important questions in the oil industry: what are the forces that drive firms' decisions on proved reserve accumulations and why do they accumulate large amounts of proved reserves? We consider a representative firm that maximizes the lifetime profits by choosing an optimal plan of oil discoveries and production over time. We recognize that there are important delays and adjustment costs in transferring resources from the oil-in-place stock to the production stage. We found the larger is the delayed periods, the more likely the firm will reach production quickly. This relationship is still true in a stochastic model in which we allow the random shocks from demand and exploration to play a role in determining the resource transfers. The deterministic model explains why firms hold proved reserves by the delayed responses and adjustment costs, but does not account for why the ratio of proved reserves to productions declines very slowly or even remains stable. In the stochastic model, we found both demand and exploration volatilities reduce current rate of productions and thus the stock of oil in place exhausts over a longer period. The results of the stochastic model suggest that firms would hold larger proved reserves than current production if demand volatility is much less than interest rate, or if the exploration volatility is not noticeably larger than the interest rate. We examines this prediction using the U.S. data and find it is consistent with empirical evidences. The intuition behind the stochastic model suggests that proved reserves refer to expected future productions within the delayed periods and they differ from the concept of oil in place left underground. Therefore, although demand and exploration volatilities lower current rate of productions and leave more resources as oil in place, proved reserves may not necessarily increase. Proved reserves are proven to be economically and technically recoverable under current conditions so that they are ready for expected productions in the near future ([1]). Since uncertainties lower the rate of current productions, the expected productions in the near future would also be lowered ([3]). In this sense, large uncertainties may discourage the incentives to accumulate proved reserves. Thus, in order to induce a firm to accumulate greater proved reserves than the productions, these volatilities cannot be very large. Specifically, we show that the demand volatility is much smaller than interest rate, and exploration volatility is slightly larger than the interest rate. The existence of these volatilities also yields the ratio of reserves to productions to decline slowly or even remains relatively stable. References [1] EIA. U.S. “Crude Oil http://www.eia.gov/naturalgas/crudeoilreserves/. and Natural Gas Proved Reserves". 2014. [2] Kamien, M., Schwartz, N. “Dynamic Optimization: The Calculus of Variations and Optimal Control in Economics and Management". North Holland, Amsterdam, 2 edition, 1991. [3] Kellogg, R. “The Effect of Uncertainty on Investment: Evidence from Texas Oil Drilling". American Economic Review, 106(6):1698-1734, 2014. [4] Mason, C. “On Stockpiling Natural Resources". Resource and Energy Economy, 33(2):398-409, 2011. [5] Mason, C. “On Equilibrium in Resource Markets with Scale Economies and Stochastic Prices". Journal of Environmental Economics and Management, 64(3):288-300, 2012. [6] Oksendal,B. “Stochastic Differential Equations: An Introduction with Application". Springer, U.S.A, 6 edition, 2003. [7] Pindyck, R. “Uncertainty and Exhaustible Resource Markets". Journal of Political Economy, 88(6):12031225, 1980. [8] Pindyck, R. “Adjustment Costs, Uncertainty, and the Behavior of the Firm". The American Economic Review, 72(3):415-427, 1982. [9] Solow, R., Wan, F. “Extraction Costs in the Theory of Exhaustible Resources". Bell Journal of Economics, 7(2):359-370,1976. [10] Swierzbinski, J., Mendelsohn. R. “Exploration and exhaustible resources: The microfoundations of aggregate models". Bell Journal of Economics, 30(1):175-186, 1989.