2) Program Description - San Diego Gas & Electric

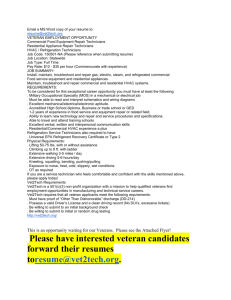

advertisement