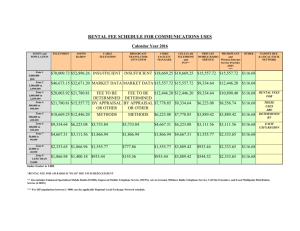

Medical fee schedule

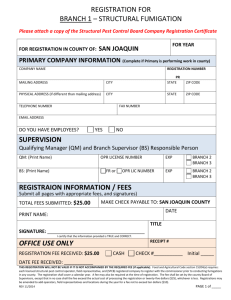

advertisement