Philip Hancock, MBA, CPA 3001 VEAZEY TERRACE NW APT 1323

advertisement

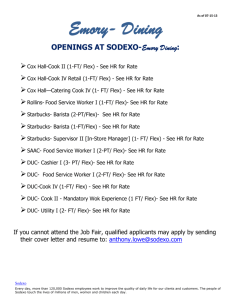

Philip Hancock, MBA, CPA 3001 VEAZEY TERRACE NW APT 1323 • WASHINGTON, DC 20008 PHONE: 202-445-5905 • EMAIL: PHILIP.HANCOCK@GMAIL.COM EXECUTIVE SUMMARY Highly accomplished, results driven senior accounting and financial management executive with 15 years of progressive experience in finance and accounting management within start-ups and global multi-billion dollar retail organizations. Demonstrated ability to streamline business operations that drive growth, increase efficiency, and bottom-line profit. Strong qualifications in developing and implementing financial controls and processes in addition to productivity improvements, technology improvements, and change management. Possess solid leadership, communication and interpersonal skills to establish rapport with all levels of staff and management. Open to relocation. Accounting & Financial Management Controllership & Decision Support Financial Analysis & Reporting Performance measurement Growth strategy development Strategic Planning Operations Efficiencies Supply Chain Management Inventory Control EXPERIENCE Vice President of Finance, North America World Duty Free Group, Bethesda, MD Jan 2014 – Present WDFG: $2.8B publicly traded leading specialty retail operator in the travel sector. Operating in 20 countries with a workforce of 8,500 managing more than 130 locations with over 550 retail stores worldwide. Recentlty a wholly owned subsidiary of Dufry AG. Manage all aspects of Finance and Accounting for the 280 store, $790m retail business in North America reporting to the global CFO (located in UK) and dotted-line reporting to the President, North America. Supervise a team of 35 finance and accounting associates. Joined as primary accounting officer following acquisition of HMS Host retail business establishing major WDFG presence in USA. Responsible for Accounting (AP/AR, GL), Forecasting, Budgeting, FP&A, Treasury, Risk Management, Capex, and Tax for USA business. Partner with Operations to identify cost drivers and savings opportunities against Plan. Established focused core KPI metrics for USA. Won / defended $40m of new business RFP’s in 2015 working as part of global team to assess new airport RFP opportunities. Implemented SOX 404 equivalent compliance framework (Italian Law 262) for USA business. Successful internal audit review - no major findings. Manage internal and external audit relationships (Big 4). SAP ERP system implementation as well as Operational system (POS terminals), and ancillary finance systems (Rent and Sales Tax). 28% YOY sales growth (3% LFL) through organic growth and subsequent acquisition of additional HMS Host locations. Significant role in successful negotiation for subsequent acquisition of remaining HMS Host locations in USA, including largest location. 3.4% reduction in store personnel costs leading to substantial store-level YOY EBTIDA growth. 18% head office cost savings through more efficient control over functional department costs vs. acquired business run rate. $3m savings resulting from early exit of post-acquisition transition services agreement vs. initial exit plan. $8m (30%) improvement in working capital through receivables initiative, accounts payable and inventory management. Division CFO (Vivabox USA, Benefits & Rewards USA) Sodexo, Gaithersburg, MD Feb 2008 – Dec 2013 Sodexo: $24B Euronext traded provider of integrated food & facilities management and prepaid incentive and recognition services worldwide. Sodexo Vivabox USA: $195M Integrated marketing services business serving the retail, manufacturing, and FMCG markets. Vivabox produces white label products for major US, Canadian, Mexican, and Brazilian retailers. Largest business in the worldwide division. Sodexo Benefits & Rewards USA: $35M Financial Services division of Sodexo. Sodexo B&R provides human capital and financial management consulting solutions to large US and international clients helping to measure and improve employee satisfaction metrics. Division CFO responsible for all aspects of Accounting and Finance for 2 subsidiary businesses in the USA (Sodexo Vivabox USA and Sodexo B&R USA) reporting directly to local CEO’s with dotted line reporting to global BU CFO (located in France). Managed the post-acquisition integration of Vivabox including all financial systems, reporting, Sodexo Group policies implementation achieving cultural alignment. Vivabox USA is now largest and most profitable business in the worldwide Business Unit. Built the finance department from the ground-up (B&R USA) including staffing, financial systems implementation and associated supporting infrastructure (data warehouse, operational & financial reporting system interfaces), policies & procedures, internal controls development, vendor negotiations, and developed key internal and external relationships to support the business (Sodexo USA). 30% profit improvement in both divisions in 3 years by implementing improvements that accelerated cash flow and by developing a financial dashboard highlighting key financial measures, ROI-focused metrics, and improvement opportunities. Dashboard system was implemented and standardized for both divisions improving financial and operational insight into the business. Dashboard is supplemented with detailed monthly reporting and analysis package. 10% reduction in operating costs for both divisions in 3 years by improving supply chain efficiency and through vendor pricing negotiations. Manufacturing fully off-shored to China offering enhanced pricing options, greater product quality for our clients, improved profit margins, and increased scalability. Final product assembly remains in North America (VBUSA). Page 1 of 2 Senior Controller Library Systems & Services, Germantown, MD Nov 2006 – Feb 2008 LSSI: $65m private equity backed provider of library consulting and management services to government agencies and the private sector. Selected by new company private equity firm ownership to take financial reins upon acquisition of LSSI. Managed and directed all finance and accounting functions supervising a staff of 11 reporting to the PE appointed President. Immediately upon being hired developed the company’s first monthly forecasting process and implemented internal controls to drive margin improvement and cost savings opportunities. EBITDA strengthened from a quarterly loss position to significant quarterly profit. Business was previously profitable on an annual basis but fell short on a quarterly basis due to seasonality. Restored confidence in the finance function and positioned company for success under new PE firm ownership (Islington Capital). Significant involvement in modeling and negotiating renewal of the largest contract (60% of revenue) for a 10-year term. Region Director of Finance First Transit, Alexandria, VA Aug 2005 – Nov 2006 FT: Subsidiary of First Group Ltd. LSE traded provider of transportation management services to the federal government and private sector. Finance and accounting responsibility for 15 location $32m region overseeing team of 19 finance employees region-wide (AP, AR, GL accounting, payroll, FP&A) reporting to the region President and business US CFO. Responsible for all forecasting, budgeting, reporting, monthly close, internal control and audit activities for the region. Review KPI’s identifying performance improvement opportunities with location General Managers and regional operations team. Successfully launched 5 new locations, all profitable within the first year, and renewed/defended 4 profitable contracts with competing bids. Controller Aggregate Industries, Rockville, MD Mar 2004 – Jul 2005 AI: Subsidiary of Holcim Group Ltd. Global supplier of construction materials - cement, aggregates, concrete and construction services. Accountable for all aspects of $1.4b fixed assets ledger and $100m/yr yearly capital expenditures across all divisions. Planning, analysis, budgeting, forecasting, reporting, reconciliation, and audit of all capital expenditures working with region teams. Participated in shared services center implementation transitioning from a decentralized fixed assets approval & purchase process to centralized procedures including approvals, purchases, reporting, and controls. Revealed $8m in misappropriated funds and accounting adjustments that contributed approximately $2m to EBIT. Senior Financial Analyst Starbucks Coffee Company, Syosset, NY Jun 2002 – Feb 2004 Starbucks: Nasdaq traded international specialty coffee retailer operating in over 60 countries worldwide. Responsible for budgeting, forecasting, and tracking for new stores including construction, renovation, and closure planning across the East region. Provided variance analysis on new store performance vs. forecast and budget. Perform region-wide KPI reporting and variance analysis (actual, budget, and forecast) for new, existing, and pipeline stores. Developed an Excel based financial reporting tool that generated automated reports disseminated automatically to region management reducing reporting time from 3+ days to less than 1 hour. Process was adopted throughout the US for all regions as the standard reporting tool. SOFTWARE SKILLS SAP FICO, IBM Cognos, Hyperion (HFM), ADP, SAP Retail, MS Dynamics Great Plains, FRX, MS Office, Advanced Excel EDUCATION Hofstra University – Zarb School of Business – Hempstead, NY MBA Finance, 2003 Hofstra University – Hempstead, NY BS Economics, 2001 Certified Public Accountant (CPA) VA license no. 39940 MEMBERSHIPS & ASSOCIATIONS National Retail Federation (NRF) - Financial Executives Council (active member) Page 2 of 2