Ominous Clouds Darken Path

advertisement

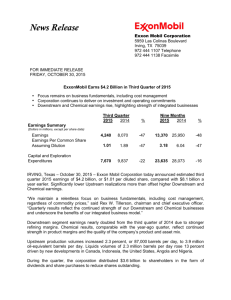

Ominous Clouds Darken Path Storm clouds continue to build over the economy, but astute observers must wonder how long the massaged numbers will hold up. Under scrutiny even the most benign numbers show economic weakness. Today we'll look at the unemployment, housing market and first quarter earnings reports to see where America is headed after three months in 2015. First time jobless benefit claims rose for a third straight week Thursday yet the news had a qualifying rider attached to it: "The underlying trend continued to point to solid improvement in the labor market." Is this because so many people have gotten discouraged and left the workforce or is it because of some actual shift in the winds of fortune? The report doesn't specify but happily reports claims of 295,000 are good news because that makes seven straight weeks the report has been under 300,000. (When I did a comparative unemployment study as part of a statistics class study in 1970 the unemployment number was considered poor when it reached 120,000. Now the fact it is not 250% more than that is cause for celebration.) But what is of concern is the jobs report blithely ignores the workforce dropouts and instead claims the lower moving average rate between March and April indicates "accelerated job growth." If so, in what sector(s) did jobs actually increase? Not construction or manufacturing-two cornerstones of long-term economic health. Construction was devastated on the report new home sales plunged 11.4% to a mere 481,000 sales annually. The Commerce Department report cheerfully highlights February home prices hit the highest level in seven years. With wages essentially flat, the drop in new home sales could be because the price is now out of the reach of most working people. Still Commerce remains upbeat about the housing outlook because "moves by the government to ease credit conditions for first-time buyers." Can you say "housing bubble" so soon after 2007? With new home sales languishing below half a million more than seven years after the bubble popped the first time, how can that be positive news? There is no solid, sustained increases in new home sales. Once again the GDP-increasing industry that went away in the recession has not returned to even half of its pre-recession level yet is counted as a positive. Finally look at the earnings report from Wall Street. The report starts out very positive: "Most U.S. companies (71%) so far this earnings season have managed to beat Wall Street profit forecasts despite weak sales." But what were those "expectations?" How did they compare to pre-Recession forecasts? Those two questions are key. W-e-l-l, those expectations aren't anywhere close to what they were in the first quarter of 2007. Indeed, in many cases the 2015 expectations as forecast by analysts were less than 10% of what those same companies were expected to do in the first quarter of '07. But the sorry numbers don't stop there. Most of the 71% that reportedly "beat expectations" did so through accounting tricks involving share buybacks and cost-cutting measures (usually lower payrolls numbers) rather than relying on healthy sales growth. So again any interpretation of the data has to factor in those parameters or they are not giving you a fair analysis. To their credit, most analysts did note the discrepancy somewhere in their reports but you could really see the discouragement in the new forecast numbers for the second and third quarters. Analysts are collectively trimming both profit and sales expectations for the second quarter right now. Dan Suzuki, senior U.S. equity strategist for BOA-Merrill Lynch, said, "The fact some companies beat the bottom line is not going to change the story. You are going to see some pretty ugly numbers over the next couple of quarters." How bad is it? First quarter earnings are expected to collectively be down 1.5% from 2014. Sales are expected to be 3.3% down year-over-year. Forty-four percent of the early reports for 1st quarter revenues show only 11 in 25 companies topped the lowered expectation level for revenues. Of those who topped revenues, less than half hit their expected sales targets. Even more troubling this trend affected almost every sector. The Street is quick to point a finger at the strong dollar and the weak energy prices for the failed expectations. But if gasoline prices are down, sales in other sectors--like restaurant or entertainment areas--should have seen a rise. They didn't. Also, a year ago analysts blamed extreme weather for first quarter sag, this time extreme weather was definitely less of a factor. The first quarter reports are showing a slowing economic engine. An engine that is definitely in idle mode. Is it preparing to once again go into reverse? Worse, is it preparing to turn off completely meaning the train sits, unable to move in any direction? Storm clouds are distinctly forming. Whether or not the storm becomes economically destructive is not as important as it once was because we no longer have a solid foundation to withstand any kind of a blast so the tent we are stuck in will suffer damage. Washington euphemistically called these developments "headwinds." Any more such headwinds and the engine will get blown clean off the track. "I have sworn on the altar of God eternal hostility to every form of tyranny over the mind of man."--Thomas Jefferson