20.509 - Public Transportation for NonUrbanized Areas

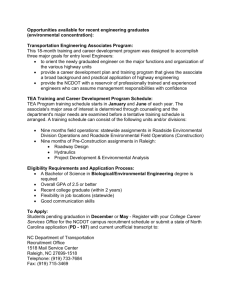

advertisement

APRIL 2015 20.516 JOB ACCESS REVERSE COMMUTE State Project/Program: JOB ACCESS AND REVERSE COMMUTE PROGRAM (JARC) U. S. DEPARTMENT OF TRANSPORTATION Federal Authorization: Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU) 49 U.S.C. 5316 State Authorization: N. C. Department of Transportation Public Transportation Division Agency Contact Person – Program Address Confirmation Letters To: Debra C. Collins, Director Public Transportation Division N.C. Department of Transportation 1550 Mail Service Center Raleigh, NC 27699-1550 (919) 707-4687 (919) 733-1391 dgcollins1@ncdot.gov Wayne Davenport, Lead Auditor, CICS, CFS Single Audit Compliance Unit N. C. Department of Transportation 1507 Mail Service Center Raleigh, N.C. 27699-1507 (919) 707-4581 Fax (919) 715-2710 wdavenport@ncdot.gov The auditor should not consider the Supplement to be “safe harbor” for identifying audit procedures to apply in a particular engagement, but the auditor should be prepared to justify departures from the suggested procedures. The auditor can consider the supplement a “safe harbor” for identification of compliance requirements to be tested if the auditor performs reasonable procedures to ensure that the requirements in the Supplement are current. The grantor agency may elect to review audit working papers to determine that audit tests are adequate. The Single Audit Compliance Unit of the NCDOT Office of Inspector General reviews all single audits, financial audits, and management letters of all “grantees.” We are looking at both the presentation (information as to program, pass-through and state funding, NCDOT identification numbers) and the dollar amounts presented versus our records. Any reports not received will be requested. Grants must be properly identified by program name (“Job Access and Reverse Commute”), CFDA number (“20.516”), and WBS number on the Schedule of Expenditures of Federal and State Awards. This information is available from the agreement in the upper left corner with NCDOT; program name is in the second/third paragraph while the WBS element is on the upper right hand corner of the first page. Grantor and/or pass-through grantor should also be included. Some of the capital funded under the Community Transportation Program is funded with state and local funds. If the capital is state funded, either the Facility Program or the State Capital Program is the sources of funds. Please do not combine like projects into one dollar amount since we would need to call you for the breakdown; please report award amount, Federal Pass-through, State share and local share. On NCDOT’s confirmation from the Grant Master List (GML), these moneys are shown as part of CFDA number 20.516. B-4 20.516 1 JOB ACCESS AND REVERSE COMMUTE PROGRAM (JARC) I. PROGRAM OBJECTIVES The objective of the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU) Job Access and Reverse Commute (JARC) grant program is to assist states and localities in developing new or expanded transportation services that connect welfare recipients and other low income persons, including persons with disabilities, to jobs and job related activities (e.g., child care and employment training). With the passage of SAFETEA-LU, the once discretionary JARC program became a formula program, with an allocation to each state for urban, small urban and rural areas. Job Access projects are targeted at developing new or expanded transportation services such as shuttles, vanpools, new bus routes, connector services to mass transit, and guaranteed ride home programs for welfare recipients and low income persons. Reverse Commute projects provide transportation services to transport the general public from urban, rural and other suburban locations to suburban employment locations. Although SAFETEA-LU repealed Section 3037 of Transportation Efficiency Act of the 21st Century (TEA-21), and substituted the new provisions of 49 U.S.C. 5316, those projects designated by Congress under Section 3037 and not yet obligated remain available to the project for obligation under the terms and conditions of Section 3037. II. PROGRAM PROCEDURES Eligible applicants may be state agencies, local governmental authorities, private nonprofit organizations, Indian tribes, and operators of public transportation services, including private operators of public transportation projects. Eligible activities for Job Access grants include capital and operating costs of equipment, facilities, and associated capital maintenance items related to providing access to jobs. However, NCDOT has determined that the JARC funds it directly administers that were appropriate prior to the passage of SAFETEA-LU will be used to support project operating costs. Also included are the costs of promoting the use of transit by workers with nontraditional work schedules, promoting the use of transit vouchers, creating mobility and coordination programs, and promoting the use of employer-provided transportation. For Reverse Commute grants, the following activities are eligible---operating costs, capital costs and other costs associated with reverse commute by bus, train, carpool, vans or other transit service. Agreements are executed upon approval for program eligibility. The agreement identifies all of the federal and state requirements for receipt of the funds. The agreements are updated as changes in federal, state and local regulations occur. Annual agreements, approved project budgets are transmitted to the local organization following approval of the statewide application by the grant entity, typically the Federal Transit Administration. II. COMPLIANCE REQUIREMENTS The federal granting agency has issued a compliance supplement that should be used in conjunction to this compliance supplement issued by the State Agency. Please refer to OMB Circular A-133 Compliance Supplement (Sect. A of the State Compliance supplement). In developing the audit procedures to test compliance with the requirements for a Federal program, the auditor should first look to OMB A-133 Compliance Supplement, Part 2, Matrix of Compliance Requirements, to identify which of the 14 types of compliance requirements described in Part 3 are applicable and then look to Parts 3 and 4 for the details of the requirements. The OMB A-133 Compliance Supplement may be found at www.whitehouse.gov/omb/circulars. OMB has issued an addendum to Circular A-133 on June 30, 2009. This addendum supplements the 2009 OMB Circular A-133 Compliance Supplement (Supplement) to provide B-4 20.516 2 JOB ACCESS AND REVERSE COMMUTE PROGRAM (JARC) additional guidance for programs (including clusters of programs) with expenditures of American Recovery and Reinvestment Act of 2009 (Pub. L. No. 111-5) (ARRA) awards that the auditor determines are major programs in audits performed under OMB Circular A-133. This addendum is effective for audits of fiscal years beginning after June 30, 2008. It should be used in conjunction with other Parts and Appendices of the Compliance Supplement in determining the appropriate audit procedures to support the auditor’s opinion on compliance for each major program with expenditures of ARRA awards. This addendum may be found at http://www.whitehouse.gov/omb/assets/a133_compliance/arra_addendum_1.pdf. A. ACTIVITIES ALLOWED OR UNALLOWED Compliance Requirement - Funds must be expended as specified in the grant award letter, the project budget and the grant agreement, which incorporates the grantee's and the Federal Transit Administration’s Master Agreement with NCDOT by reference. Urban areas are designated recipients of the funds and enter into agreement with the Federal Transit Administration. C. CASH MANAGEMENT Compliance Requirement – NCDOT and subrecipient project agreements specify that this is a cost reimbursement program. If the subrecipient receives payment of federal and state funds in advance of incurring the cost, the funds must be paid to the vendor within three (3) days of receipt from the department. NCDOT relies on the Federal Compliance Supplement, Part 3, Section C, Cash Management for guidance. Audit Objective – Determine if advanced funds were disbursed within three days and that remaining costs were reimbursed following grantee expenditure. Suggested Audit Procedure - Ascertain that funds received in advance of incurring the cost were disbursed within three (3) days of receipt from NCDOT. G. MATCHING, LEVEL OF EFFORT, EARMARKING Matching Compliance Requirement – The Federal share of eligible capital costs may not exceed 80 percent of the net cost of the activity. The Federal share of the eligible operating costs may not exceed 50 percent of the net operating cost of the activity. Depending on funds availability, the state will match one half of the local share of 20%. The source of matching funds is identified in the grant application. Several means of match are allowable: Funds from multiple federal programs other than those administered by NCDOT. These programs include, but are not limited to: a) b) c) d) e) B-4 Temporary Assistance for Needy Families (TANF) Community Services Block Grants (CSBG) Social Services Block Grants (SSBG) Workforce Investment Act (WIA) Community Development Block Grants (CDBG) NCDOT Employment Transportation Program and Rural General Public Funds. Local funds. These funds include, but are not limited to: 20.516 3 JOB ACCESS AND REVERSE COMMUTE PROGRAM (JARC) a) Employer contributions toward new or expanded services. b) Funds from for-profit organizations and non-profit organizations. c) Revenues from contractual agreements between human service agencies and transit systems in support of JARC funded projects. Audit Objective – Determine whether the minimum amount or percentage of contributions or matching funds was provided. Suggested Audit Procedure 1. Examine the agreement and any subsequent budget revisions and amendments. 2. Ascertain the total project costs, including those eligible for NCDOT or FTA participation. 3. Review financial records and determine the amount which can be claimed as the Federal and State share. 4. Verify that the match is from the allowable source. 5. Verify that the values placed on in-kind contributions are in accordance with program regulations. Level of Effort – No testing is required at the local level. Earmarking – No testing is required at the local level. I. PROCUREMENT AND SUSPENSION AND DEBARMENT Compliance Requirement – Subrecipients must comply with the federal and state procurement guidelines. Procurement guidelines are developed by the NCDOT based on the requirements. Nonprofit agencies must develop a written procurement policy and guidelines as required by FTA Circular 4220.I.F. The guidelines must be approved by NCDOT. Compliance Requirement - American Recovery and Reinvestment Act Reporting (ARRA). In addition to those statutes listed in the A-102 Common Rule and OMB Circular A-110, Section 1605 of ARRA prohibits the use of ARRA funds for a project for the construction, alteration, maintenance, or repair of a public building or work unless all of the iron, steel, and manufactured goods used in the project are produced in the United States. ARRA provides for waiver of these requirements under specified circumstances. An award term is required in all awards for construction, alteration, maintenance, or repair of a public building or public work (2 CFR section 176.140). Further information about this requirement, including applicable definitions, is found in 2 CFR part 176, Subpart B located at http://edocket.access.gpo.gov/2009/pdf/E9-9073.pdf. Audit Objective – Determine whether an award using ARRA funding includes a Buy-American award term and, if so, whether the recipient is complying with the Buy-American provisions of ARRA or if any waivers have been granted. Suggested Audit Procedure – Select a sample of ARRA-funded procurements, if any, for activities subject to Section 1605 of ARRA and test whether the non-Federal entities requested and received any exceptions to Buy-American requirements; and test the sample of procurements to ascertain if entities are otherwise in compliance with the ARRA requirements. B-4 20.516 4 JOB ACCESS AND REVERSE COMMUTE PROGRAM (JARC) L. REPORTING Project Reports Compliance Requirement – Progress reports must be submitted to NCDOT on a monthly or quarterly basis with any claims for reimbursement. Audit Objective – Determine that reports were submitted accurately and are adequately supported. Suggested Audit Procedure - Trace operating statistics reflected in the reports to underlying accounting records. Nongovernmental Reports Compliance Requirement – North Carolina General Statute 143C-6-23 “Use of State Funds by Non-State Entities,” and North Carolina Administrative Code Chapter 9, Subchapter 03M “Uniform Administration of State Grants” addresses reporting requirements for nongovernmental entities. These regulations along with reporting forms may be accessed at: https://www.ncgrants.gov/NCGrants/Regulations.jsp https://www.ncgrants.gov/NCGrants/PublicReportsRegulations.jsp Audit Objective – Determine applicable reporting requirements. Suggested Audit Procedure 1. Determine if the organization is subject to G.S. 143C-6-23. 2. Determine what type of filing/report should be made with the NCDOT. DBE Reports Compliance Requirement - Grantees must submit quarterly DBE Report of Awards and Report of Payments (DBE-IS form) documenting actual utilization (CFR Parts 23 and 26, and the U.S. DOT DBE Final Rule, Federal Register dated February 2, 1999 - Participation by Disadvantaged Business Enterprises in Department of Transportation Programs). Additional required reports include Project Progress Reports and reports of significant events (FTA Circular 5010.1C). Based on the level of FTA funding, exclusive of transit vehicle purchases, recipients are required to implement a DBE program. To monitor the progress of the DBE program, recipients are required to submit quarterly reports based on a record keeping system (49 CFR Section 23.49, 23.11). Audit Objective - Determine DBE reports are supported by adequate documentation. Suggested Audit Procedure 1. Review grantee’s DBE contract expenditures (as opposed to contract awards) as outlined in 49 CFR Part 26. B-4 20.516 5 JOB ACCESS AND REVERSE COMMUTE PROGRAM (JARC) 2. Review the reports and trace the information to underlying data to determine completeness and accuracy. 3. Determine that for all participation amounts reported, the firms have been certified and that the certification is current. M. SUBRECIPIENT MONITORING NCDOT passes this grant to its subrecipients who can pass the funds down further to another subrecipient. If this situation occurs, NCDOT relies on the Federal Compliance Supplement, Part 3, Section M. Subrecipient Monitoring, for guidance. If this situation does not occur, no testing is required at the local level. Compliance Requirement - American Recovery and Reinvestment Act: A pass through entity is responsible for identifying to the first-tier subrecipients the requirement to register in the Central Contractor Registration (CRC), including obtaining a Dun and Bradstreet Data Universal Numbering System (DUNS) number, and maintain the currency of that information (Section 1512(h), ARRA, and 2 CFR 176.50(c)). Audit Objective – Determine whether the pass-through entity determined that subrecipients have current CCR registrations prior to making subawards and performed periodic checks to ensure that subrecipients are updating information as necessary. Suggested Audit Procedure – Test the pass-through entity’s subaward review and approval documents to determine whether, before award, the pass-through entity checked CCR to determine whether subrecipients were registered. N. SPECIAL TESTS AND PROVISIONS NOTE: Title 2, Subtitle A, Chapter II, Part 200.104 This guidance supersedes requirements from various prior OMB Circulars and provides reforms in three main areas: Reform Area Guidance Previously Located In Administrative Requirements Circulars A-102 (the Common Rule), Circular A-110 and Circular A-89 Cost Principles Circulars A-21, A-87 and A-122 Audit Requirements Circulars A-133 and A-50 These regulations became effective for new awards and/or new funding increments made on or after Dec. 26, 2014, exactly one year after the publication date of these reforms. However, standards set forth related to the audit requirements will be effective for audits of fiscal years beginning ON or AFTER Jan. 1, 2015; i.e., the first single audits affected by this rule will be for the year ending Dec. 31, 2015. B-4 20.516 6