Partnership / Membership Protection

advertisement

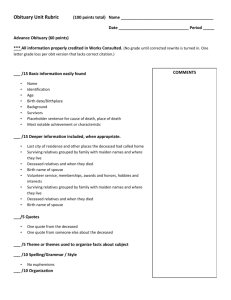

Partnership / Membership Protection INSTRUCTION TO USER – The following section has been designed for inclusion within a report generated by the PPOL suitability report writing solution. You will need to use the PPOL software to create a report containing an Introduction section and a standard Protection Recommendation for the underlying product you are recommending (e.g. level term assurance, whole of life etc) in the usual way. Once you have downloaded the report created via PPOL to Word, insert the protection recommendation within the text at the point indicated below and simply edit the resultant section to reflect your individual requirements. The text has been colour coded to aid with your understanding. Where the text is highlighted in blue this tends to suggest that the text may not be appropriate in all instances, and you may need to delete some or all of it. Where the text is highlighted in red, this will require your input. Most businesses will have implemented arrangements to cater for the retirement of their key individuals, and some may also have considered their business succession. Fewer will have considered the effects of the loss of a partner of the business (known as member if an LLP) through illness or death. A Partnership A partnership is defined in section 1 of the Partnership Act 1890 as ‘the relationship which exists between persons carrying on business in common with a view of profit, other than by way of membership of a body corporate.’ There is no longer any limit as to the number of partners a business can have. Within a partnership, each partner has an interest in the business rather than the ownership of ordinary shares, as would be the case in a limited company structure. A Limited Liability Partnership (LLP) An LLP is a form of legal entity, which is a corporate body formed in accordance with the Limited Liability Partnership Act 2000. Each member (as opposed to partner) has an interest in the business, rather than ownership of ordinary shares. The death of a business partner / member can have far-reaching consequences for the future of a business. The business would lose a valuable revenue generator but also, the remaining partners / members may end up having to work with the deceased partner’s / member’s beneficiaries who may not have the necessary skills experience or interest to continue in the business. Additionally, the partners’ / members’ interest may need to be turned into cash to pay death duties or provide for his or her dependents on death. For a partnership, in the worst case scenario the partnership can end up having to be automatically dissolved on death if there is no Partnership Agreement in place. Equally, if a partner became seriously ill, they might well want to leave the business. In this case, the remaining partners / members would need to have sufficient funds available to buy out their interest in the business. A surprisingly large number of partnerships and LLPs have no partnership or membership agreement in place. This is a crucial document that not only sets out how the profits and capital of the business should be shared, it also states what should happen in the event of dissolution of the partnership or LLP, retirement, death or ill health of any of the partners or members. Any existing partnership or membership agreement must be reviewed before recommending insurance solutions to ensure there is no conflict. Raising the finance to buy a partner’s / members’ interest may involve the sale of assets or finding someone who can afford to buy-in to the company. Finding a suitable replacement and raising the money can be difficult and time consuming. To this end, it is clear that the remaining partners / members need to retain continuity, stability and control of the business whatever the eventuality. This can be achieved by making adequate legal and financial provision. These steps are outlined below. Legal Solutions A Partner’s / Member’s Share Purchase Agreement is required to enable the surviving partners to purchase the interests of the business from the deceased partner’s estate and to provide the deceased partner’s / member’s dependents with a willing buyer and cash instead of an interest in a business. They are usually designed to ensure that funds are available in the right hands for the purchase of a partner’s / member’s interest on death. An effective Partner’s / Member’s Share Purchase Agreement should provide: 1. Flexibility. 2. Capital that is available in the right hands at the right time. 3. Tax efficiency. There are three ways in which the Partner’s / Member’s Share Purchase Agreement can be set up. These are: A Buy and Sell Agreement Double Option / Single Option Agreements Automatic Accrual Method It is important to consider the circumstances in which these agreements are to operate. For further information concerning each agreement, I refer you to the technical notes section in the Appendix of this report. For example, the partners / members may not wish them to take effect on a sale of an interest at any time, and may prefer instead to have the right of pre-emption i.e. a partner wishing to dispose of his interest must offer them for sale to the other partners first. Having considered the options, I have suggested that you proceed with a <INSERT> Share Purchase Agreement. Many life companies can provide specimen wording for this type of agreement. However, I do stress that it is beyond my scope to advise on the suitability of the agreement or its wording. To this end, I would strongly advise that you consult with your solicitor to ensure that the recommended agreement, and its wording, is suitable and sits comfortably with your Partnership / Membership Agreement. Financial Solutions Having decided which Share Purchase agreement to use, the next step involves the establishment of a suitable life insurance vehicle that can be used to fund the purchase of the deceased partner’s / members interest. An insurance policy aims to provide protection against the financial effects of death or earlier critical illness, and will provide the surviving partners / members of the business with a cash lump sum to purchase the deceased’s interest / interest of the individual who is critically ill, while ensuring that the partner / member who is critically ill is / deceased’s beneficiaries are compensated financially. Each partner / member should be insured to reflect their respective percentage interest of the partnership / LLP Partnership. It is difficult to value an unquoted company. As a rough guide, it is generally accepted that the value of a business can be calculated by multiplying its average annual net profit after tax for the last three years by a multiple of between three and six. However, if you are in doubt of the value of your business, I would suggest that you contact your accountant. Please note a shortfall in cover will mean the surviving partners / members will have to make up the difference out of their personal funds. But an excess of cover could call into question the “commerciality” of the arrangement. The partners / members and their interests are currently valued as follows: Name of Partner / Member % Interest Value (£) <INSERT> one of the following 3 options> 1. PARTNERSHIP / MEMBERSHIP PURCHASE IN TRUST A Trust Deed is designed for use where a partner / member of a partnership / LLP partnership intends to effect a policy or a cover on his/her own life in trust to provide funds on his/her death or a diagnosed critical illness, terminal illness or total and permanent disability for the other partners / members, on the basis that the other partners / members will likewise effect policies/covers on corresponding trusts. Who Can Benefit from this Trust? A Trust Deed can ensure your policy/cover is placed in trust from the outset. A Trust is created for the benefit of those people who are partners / members in your partnership / LLP partnership The Trustees should ensure that none of the policy/cover moneys are paid to anyone who ceases to be a partner / member or does not meet the conditions specified in the Trust Deed. Once the policy/cover is placed in Trust, it is not possible for you or the Trustees to change the Beneficiaries, unless you cease to be a partner / member of the partnership / LLP partnership (see below). Reverter to Settlor Provision It is important to note that the policy/cover will revert automatically to you if you cease to be a partner / member prior to a claim arising under the policy/cover. If this happens, this Trust will effectively come to an end. A simple assignment should then be made by the Trustees in favour of yourself. You could then place the policy/cover subject to a new trust. You may, for example, want to place the policy/cover in trust for the benefit of your children to assist with inheritance tax planning. The life company will be able to provide a specimen trust. However, I do stress that it is beyond the scope of <INSERT> to provide advice on the suitability of trusts and their wording. To this end, I would advise that you consult your solicitor on this matter. 2. PARTNERSHIP / MEMBERSHIP PURCHASE LIFE OF ANOTHER I have recommended that each partner / member effects a life insurance policy on the life of the other partner(s) / member(s). This should be for the amount that they would expect to have to contribute towards the purchase of a deceased or retiring colleague’s share. Should one of the partners / members die, the survivor will be paid the sum assured under the policy. Each owner is paying an equitable cost of the protection being provided and so equalisation of the premiums is not an issue. However I do stress that this is relatively inflexible if the business expands and new partners / members are brought into the business. If there are more than two business partners / members a number of contracts may be required leading to excessive cover levels and costs. Life Insurance Recommendation INSTRUCTION TO USER - INSERT APPROPRIATE PROTECTION PRODUCT RECOMMENDATION HERE I strongly recommend that we review your business protection on a regular basis to ensure your business protection marries your needs and objectives. Technical Notes – Share Purchase Agreements It is vitally important that the partners or members or shareholders of a business establish a formal agreement which deals with what may happen to their interest or share of the business on their death, and increasingly, in the event of them becoming terminally or critically ill. There are various Share Purchase Agreements available for consideration, a summary of which can be found below. Buy and Sell Agreement A Buy and Sell Agreement can be thought of as a prenuptial contract for businesses, specifying what happens if things go wrong. The buy/sell triggers are agreed and defined by shareholders or business partners or business members with legally binding clauses, declaring who may buy and at what price an interest in the business will be sold. If death is the trigger, the deceased’s estate then sells and the surviving shareholders or business partners or business members are obliged to buy the deceased’s share of the business, using a pre-agreed method of valuation. For example Bob and James are equal shareholders / partners / members in a business. If Bob dies, his share would form part of his estate. With a Buy and Sell agreement in place, the estate would be reimbursed for the agreed value of Bob’s shares or interest (avoiding the lengthy issues associated with probate), and the actual shares or interest would revert to James. HM Revenue & Customs treats this as a contract for sale. This means the loss of Business Property Relief (BPR) for IHT purposes, but this agreement can operate on retirement as well as death. The buy sell method is simple and easy to understand. However, it may increase Inheritance Tax liabilities because of the loss of business property relief. Double Option / Single Option Agreement Double Option Agreements are also known as ‘cross-option’ agreements. The surviving shareholders or partners or members have an option to purchase and the estate to sell shares or an interest within a pre-determined time, during which the estate is bound not to sell them to anyone else. For example, Vicky, Diane and Sarah are sisters – and equal shareholders or partners or members in a business. On Sarah’s demise, Vicky and Diane are in two minds as to whether they want the family business to continue. For six months – giving them time to make up their minds – Sarah’s estate (her husband and family), must keep the shares or business interest. If the surviving sisters choose to buy the shares or interest, Sarah's estate will have to sell the shares or business interest to the other two sisters, the value of the shares or business interest being calculated in accordance with the terms of the Double Option Agreement. Most Double Option Agreements provide only for death, not serious illness (although this agreement can operate on retirement). To provide cover against critical illness, a Single Option during a lifetime agreement may be preferable. This offers a shareholder or partner or member the freedom to decide whether to stay in the business or simply be reassured that the other shareholders or partners or members are bound to buy the shares / business interest. In both cases, Business Property Relief is not lost as HM Revenue & Customs do not view these agreements as contracts for sale. The double option agreement has the benefit of allowing the surviving shareholders partners or members an enforceable option to buy the deceased’s share, but with the added advantage that the agreement does not disqualify the value of that share for business property relief. Automatic Accrual Method This method is mainly used by partnerships / LLP partnerships. It does not involve the purchase or sale of shares or a business interest, instead, the deceased’s shares or interest pass automatically to the remaining shareholders or business partners / members. All shareholders or business partners or members take out life policies to compensate the estate, and these policies can be put into trust to ensure benefits go to chosen beneficiaries. For example, Peter, Nick and Wendy are all partners in an estate agents’ business. On Peter’s demise, Nick and Wendy automatically receive his share of the business and it is divided equally between them. Automatic accrual is flexible but relies upon each shareholder / partner / member maintaining their own policy for the current value of their company / partnership / LLP partnership interest. Taxation Implications Taxation of Premiums Premiums paid on policies taken out for the purposes of share or partnership or membership protection are usually paid for by each director partner or member, and therefore do not benefit from tax relief. As general rule if the company partnership LLP partnership pays the premium, they will not receive tax relief on the premium, as the purpose is share purchase rather than replacement of profits. However, the balancing premise is that the proceeds of any policy should then not be taxable. Please note that the tax treatment of the premiums cannot be assumed, and can vary depending upon individual circumstances. To this end, I strongly recommend that you contact your local Inspector of Taxes for further clarification on the tax treatment of this arrangement before the policy comes into force. Inheritance Tax (IHT) Provided the arrangement is classed as ‘commercial’ there will be no IHT consequences for the settlors of the life policies in trust. The deceased owner’s interest in the business will fall into their estate for IHT purposes. However, depending on the nature of the business, i.e. Company, Partnership, LLP Partnership, Business Property Relief would normally be available. Trusts effected on or after 22 March 2006 and earlier trusts brought under the new regime as a consequence of, for example, a change in beneficial interests could potentially incur a periodic charge at each 10 anniversary and exit charges on the basis applicable to discretionary trusts. However, provided the life assured is in reasonable health the term assurance will have little value. The event likely to cause greatest concern is a claim arising just before a 10-year anniversary leaving the trustee’s insufficient time to distribute the benefit before the anniversary date. Capital Gains Tax Life policies are usually exempt from Capital Gains Tax in the hands of the original owner. No CGT liability should arise unless the value of the deceased’s interest in the business increases between the dates of death and sale by more than the sellers’ available exemptions. Income Tax There should be no Income Tax on the proceeds of the term assurance policy as there are no investment gains. However, if a trust (existing or new) allows the settlor to benefit, it will fall within the scope of the pre-owned assets tax legislation, effective from 6 April 2005. Care should be taken on the use of non-term assurance policies. Wills All the shareholders involved in the shareholder protection arrangement should execute wills to ensure their intended beneficiaries receive the proceeds free of any intestacy delays.