Private Equity players invest in Africa infrastructure boom

advertisement

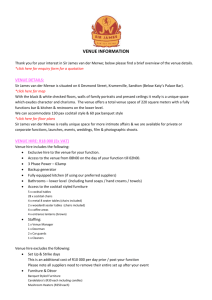

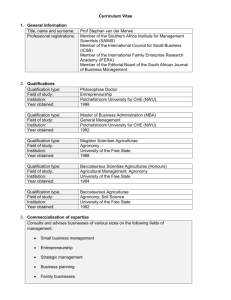

Private Equity players invest in Africa infrastructure boom Once best known for corporate investing, private equity firms are now ploughing money into African infrastructure. Erika van der Merwe, CEO of the South African Venture Capital and Private Equity Association (SAVCA) said: “Infrastructure gives private equity investors access to the strong African growth story, an exceptional theme in a structurally low-growth world.” Buying exposure to infrastructural assets through private equity provides investors exposure to an asset class that is not easily found elsewhere. “There are very few listed alternatives,” added van der Merwe. “There is limited capacity in the listed market and even in the bond market for gaining such exposure to infrastructure.” Big US private equity players like Blackstone, Apollo, KKR and Carlyle have recently invested in Africa with Blackstone taking a stake in a major dam construction project in Uganda. The bulk of foreign direct investment to be devoted to Africa over the next ten years is expected to be in infrastructure and related assets and industries. The most significant constraints to African growth are the lack of energy and transport & logistics infrastructure. Emile du Toit, SAVCA Chairman said: “None of the growth that is projected for the region will materialise without a major rollout of infrastructure, which private equity is now helping to fund. “The multiplier effects created by infrastructural investments are powerful tools for uplifting people and growing economies – and make infrastructure-focused private equity funds an ideal vehicle for fulfilling an impact investing mandate.” Van der Merwe added that all development finance institutions and many pension funds now are focused on responsible investing and are looking to modify their allocations to ensure that these mandates, which extend to environmental, social and governance criteria, are fulfilled. Because of the medium- to long-term nature of their investments, infrastructure funds – and private equity funds more generally – are ideally positioned to implement these mandates on behalf of the providers of capital. “The added attraction is that, compared with listed equity, private equity infrastructure funds offer lower-risk and more consistent returns. “This is due to the underlying revenues usually being contractual and backed by the local governments and related utility companies. And they often carry political risk guarantees on their revenue.” A growing number of SAVCA’s members are launching funds with a focused infrastructure mandate, a trend which Van der Merwe expects to continue. ENDS