15-07-08 budget grid july 15

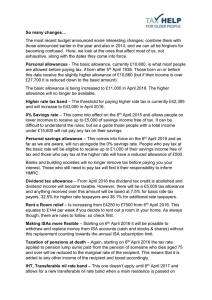

advertisement

BUDGET JULY 2015 SUBJECT BUSINESS TAXATION (INCLUDING BANK LEVY) ENERGY ENTERPRISE ENVIRONMENTAL TAXATION HOUSING INFRASTRUCTURE LABOUR MARKET AND SKILLS MEASURE / ANNOUNCEMENT Corporation tax main rate reduced from 20 per cent to 19 per cent from 1 April 2017 to 18 per cent from the 1 April 2020. The employer National Insurance contributions Employment Allowance will increase by £1,000 from April 2016, set at a limit of £3000. Dividend Tax Credit abolished from April 2016 and new Dividend Tax Allowance of £5,000 a year to be introduced. Set at 7.5% for basic rate taxpayers, 32.5% for higher rate taxpayers and 38.1% for additional rate taxpayers. 8% Corp Tax surcharge on bank profits - there will be an allowance covering the first £25 million of profits in each group. Controlled Foreign Companies, loss restriction: removes the ability of UK companies to reduce or eliminate a CFC charge by offsetting UK losses and surplus expenses against that CFC charge. Increase the permanent level of the Annual Investment Allowance (AIA) from £25,000 to £200,000 for all qualifying investment in plant and machinery made on or after 1 January 2016. Oil & Gas – Expand investment allowance to include certain discretionary operating expenditure and leasing of production vessels. Climate Change Levy - Removing the exemption for renewable source electricity (RSE) on or after 1st August. The government will hold a bidding round for a new programme of Enterprise Zones for this Parliament. Government to invest £23m in six Next Generation Digital Economy Centres over six sites (London, Swansea, Newcastle, Nottingham, York and Bath) Creates a new VED banding system for cars first registered on or after 1 April 2017. All other cars will remain in existing banding systems. ‘Help to Buy’ ISAs will be available for first time buyers to start saving into from 1 December 2015 First time buyers will be able to open their Help to Buy: ISA accounts with an additional one off deposit of £1000 Government to publish a second Road Investment Strategy by the end of this Parliament Government will cap regulated rail fares at RPI for the remainder of this Parliament. £14 million for local road maintenance improvements (see full budget statement for more details of projects by region) New round of the New Stations Fund to be launched with up to £20 million in total available for projects. From September 2017 free child care increases to 30hrs per week for working parents of 3 or 4 year olds. Introduction of a National Living Wage for over 25s of £7.20 in April 2016. The government’s ambition is for the NLW to increase to 60% of median earnings by 2020, and it will ask the Low Pay Commission to recommend the premium rate in light of this ambition going forward. This means an expected rise to £9 by 2017. Introduction of an apprenticeship levy for large employers to fund new apprenticeships. The levy will support all post-16 apprenticeships in England. The funding will be directly controlled by large employers via the digital apprenticeships voucher, and firms that are committed to training will be able to get back more than they put in. There will be formal engagement with business on the implementation of the levy. BUDGET JULY 2015 LOCAL GROWTH AND DEVOLUTION PENSIONS PERSONAL TAXATION New Youth Obligation for 18 to 21 year olds on Universal Credit. From April 2017, young people will participate in support regime from day 1 of their benefit claim and after 6 months they will be expected to apply for an apprenticeship or traineeship or go on a mandatory work placement. Government will allow institutions offering high-quality teaching to increase their tuition fees in line with inflation from 2017-18, and consult on the mechanisms to do this. From the 2016-17 academic year, maintenance grants will be replaced with maintenance loans for new students from England, paid back only when their earnings exceed £21,000 a year, saving £2.5 billion by 2020-21. Maintenance loan support will rise for students from low and middle income backgrounds up to £8,200 a year for those who are studying away from home, outside London. Transport for the North (TfN) will be established as a statutory body (i.e. with legally-mandated duties) for the long-term strategic planning of major transport projects in the north of England. It is to receive an additional £30m of funding in the next three years, with an executive team in place by Autumn 2015. It will be tasked with forming a priority list of schemes by Budget 2016. Government will consult on devolving powers on Sunday trading to city mayors and local authorities. This will look at allowing mayors or councils to extend Sunday trading for additional hours within parameters that they would determine. Coastal Communities Fund to be extended by at least £90 million until 2020-21 (subject to confirmation in Spending Review 2015). From April 2016 the government will introduce a taper to the Annual Allowance for those with adjusted annual incomes, including their own and employer’s pension contributions, over £150,000. For every £2 of adjusted income over £150,000, an individual’s Annual Allowance, the limit on the amount of tax relieved pension saving that can be made by an individual or their employer each year, will be reduced by £1, down to a minimum of £10,000. Consultation to be launched on the case for reforming pensions tax relief to strengthen incentives to save, offering savers greater simplicity and transparency, or whether it would be best to keep the current system. Income tax personal allowance will rise from £10,600 to £11,000 in 2016/17 and to £11,200 from April 2017. The 40p income tax threshold will increase to £43,000 from 2016, up from £42,385 - set to reach £50,000 by 2020. Non-domiciles: inherited and permanent status abolished. Removes access to non-UK domiciled tax status from longer-term residents who have been living in the UK for at least 15 out of the last 20 years, effective from April 2017. Inheritance Tax: additional transferable nil-rate inheritance tax band introduced for when a residence is passed on death to direct descendants. This will be £100,000 in 2017-18, £125,000 in 2018- 19, £150,000 in 2019-20, and £175,000 in 2020-21. It will then increase in line with CPI from 2021-22 onwards. The effective inheritance tax threshold will then be £1 million. Insurance Premium Tax: increased to 9.5% from 6% from 1 November 2015.