ACCOUNT 757 Issues in Financial Accounting

advertisement

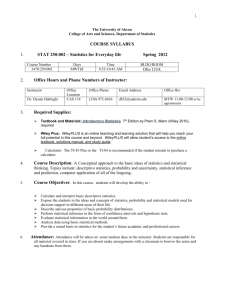

University of Wisconsin-Whitewater Curriculum Proposal Form #4A Change in an Existing Course Type of Action (check all that apply) Course Revision (include course description & former and new syllabus) Contact Hour Change and or Credit Change Diversity Option General Education Option area: Select one: * Grade Basis Repeatability Change Other: * Note: For the Gen Ed option, the proposal should address how this course relates to specific core courses, meets the goals of General Education in providing breadth, and incorporates scholarship in the appropriate field relating to women and gender. Effective Term: 2157 (Fall 2015) Current Course Number (subject area and 3-digit course number): ACCOUNT 757 Current Course Title: Issues in Financial Accounting Sponsor(s): Robert Gruber Department(s): Accounting College(s): Business and Economics List all programs that are affected by this change: Master of Professional Accountancy (MPA) If programs are listed above, will this change affect the Catalog and Advising Reports for those programs? If so, have Form 2's been submitted for each of those programs? (Form 2 is necessary to provide updates to the Catalog and Advising Reports) NA Yes Proposal Information: They will be submitted in the future (Procedures for form #4A) I. Detailed explanation of changes Course Description FROM: From: This course presents an in-depth examination of accounting theory in some of the more complex and contentious areas that have evolved into current accounting practice. Major areas include: 1) earnings per share (EPS), 2) partial operations and SEC reporting requirements, and 3) revenue recognition, including how theory is applied in cases as diverse as consignments, installment sales, and franchises. This course also covers recent pronouncements not covered in ACCOUNT 261 and ACCOUNT 343. PREREQ: ACCOUNT 343 To: This course examines some of the more complex and contentious areas that have evolved into accounting practice. Major areas include (1) statement of cash flows, (2) segment and interim reporting, (3) accounting for derivatives, (4) pensions and other postretirement benefits, (5) accounting changes and error corrections, and (6) assessing the quality of financial statements. This course also covers recent pronouncements not covered in ACCOUNT 261 and ACCOUNT 343. PREREQ: ACCOUNT 343 1 II. Justification for action: Several topics have been shifted to other courses or dropped from the accounting curriculum. Also several topics have been moved into ACCOUNT 757 and/or expanded to emphasize the problem-solving and critical thinking aspects of contemporary accounting issues. III. Syllabus/outline Old syllabus ISSUES IN FINANCIAL ACCOUNTING Dr. Clayton Sager Account 757 Fall 2008 Office: 5024 Carlson Phone: 472-1229 Common Exams: 1:00 Thursday on Oct. 2, Nov. 6 & Dec. 4. Final Exam on Thursday Dec. 18 at either 3:15 or 6:00 Scheduled Office Hours: Tuesday Wednesday online for email Thursday 1:45 to 4:00 and 8:35 to 8:50 3:00 to 6:00 1:45 to 4:00 and 8:35 to 8:50 During office hours Dr. Sager might be in the Department Office (5019) or in one of the other faculty offices. Also, unavoidable faculty meetings are sometimes scheduled during office hours. Email - Dr. Sager expects to respond within 24 hours to student email sent to SagerC@Uww.edu be- tween 6 pm Monday and 6 pm Thursday. The Wednesday hours listed should provide the fastest response, subject only to traffic from other students. To insure that your email is noticed and given the proper priority, please put the course number (757) and you name first on the subject line. For security reasons, Dr. Sager is not disposed to respond to questions about exam scores or grades via email. COURSE PREREQUISITES: Intermediate Accounting II (210-343) is the prerequisite to this course. The Financial Accounting sequence is cumulative, expertise in all Intermediate topics is assumed by the instructor. REQUIRED TEXTS: Intermediate Accounting, 10th, 11th, 12th or 12R edition, by Kieso and Weygandt (John Wiley and Sons). Designated as KW10, KW11 or KW12 in the schedule. The softcover Primis Custom Text for Issues In Financial Accounting (4 cr.), published by Primis, 2008 using chapter selected by the instructor, is available from the University Bookstore. ISBN 10:0- 39057387-6 = 13:978-0-39-057387-2. The softcover has material selected from 4 sources: Advanced Accounting, by Baker, Lembke, King and Jeffrey; Intermediate Accounting by Dyckman et al.; Managerial Accounting 12th ed. by Garrison, Noreen and Brewer and Harvard Business School Cases. This is NOT the same book used in prior years, most of the chapters have been updated. OTHER REQUIRED MATERIAL: Exams require: four-function calculator, pencils, erasers, and 8 1/2 x 11 paper for exam homework. Legal size and spiral bound paper are NOT acceptable for exam homework. SUPPLEMENTAL SOURCES: Access to current professional pronouncements will be required. Sources include the FARS system, or ACCOUNTING STANDARDS, or CURRENT TEXT, by the Financial Accounting Standards Board (Wiley), and ORIGINAL PRONOUNCEMENTS: FASB and APB versions. 2 Other Intermediate and Advanced texts such as INTERMEDIATE ACCOUNTING, by Dyckman et al or Chasteen et al, and ADVANCED ACCOUNTING, by Fischer, Taylor & Leer or Pahler & Mori. Some students might find these other sources easier to read. ATTENDANCE: Students are expected to attend each class session, and are responsible for all material presented in class including any material not found in the text which the instructor chooses to add in his lecture. This course relies on the lecture far more than the text. If missing a class is unavoidable the student is responsible for getting the material from another student. While attendance is not explicitly graded, any missed exam receives a grade of zero. See the item in the General Policy Statements. COURSE OBJECTIVE & DESCRIPTION: This course is a continuation of the basic Financial Accounting coverage started in Intermediate I, and parts of the course might well be characterized as Intermediate III. For students anticipating a professional career in accounting, this course provides a critical in-depth examination of accounting theory in some of the more complex and contentious areas that have evolved into current accounting practice. Professional-level coverage focuses on 5 major course modules: EPS: A comprehensive and in-depth consideration of both Theory and GAAP for EPS. Partial Operations and SEC: (3 short topics) Reports of Partial Operations relax certain fundamental accounting principles (entity and period concepts). The SEC section looks at the provisions of some national laws and the accounting concerns they raise. Revenue Recognition: By their nature, Intermediate Accounting courses do not provide a comprehensive overview of Revenue Recognition Theory. That is the subject of this module, which will be broken into 2 major segments. The first segment covers the basic models (installment, percentage of completion, etc.) while the second segment covers special cases that have arisen in practice (consignments, right of return, sale-leaseback, etc.). Comprehensive Topics: The study of the Cash Flow Statement and Accounting Changes touch on every line in the adjusted trial balance. These substantial topics have been moved to this course from Cost and Intermediate Accounting. New Topics and Capstone Review: Over the course of the semester we will also touch on aspects of accounting theory which were covered in previous courses. The last segment of the course will include a Capstone Project encompassing the entire financial accounting sequence. In addition, various changes in GAAP which have occurring since the students took their Intermediate Accounting courses will be covered during the last week(s) of the semester. EXAMS & GRADING: Course grades will reflect the total points earned on the exams, and the capstone project. Exam scores will be modified with a point reduction for the failure to properly complete all identification informa- tion on all items turned in for evaluation. Common exams are scheduled. Exams will each reflect the specific topics covered and will be weighted to reflect the relative scope and difficulty of the topic. In the past the exams have followed a multiplechoice or a fill-in-the-blank format. In some cases there is an out-of-class exam component, the set of Exam Prep Problems, incorporated into the exam. There will be three exams plus a final. After each exam the instructor will provide a tentative grade distribution. However, students are cautioned that such preliminary data is very tentative and therefore it will not be permanently recorded by the instructor. Note: with a “total point” grading system it may be misleading to “average” letter grades received on the individual exams. Letter grades are not as finely scaled as points earned. In addition, the 3 weight of each exam must be explicitly considered. The tentative grade distribution prepared by the instructor will be ‘curved’ by using the average score of the top 10% of the scores as a baseline. Initial grade cutoffs will be: A = 90% of the baseline; B = 75% of the baseline; C = 60% of the baseline; and D = 50% of the baseline. At least 30 of the exam questions used over the semester will be questions for which a significant statistical history is available. Final course grade distributions may be adjusted as needed to reflect performance relative to current and historical standards. COURSE OUTLINE AND EXAM SCHEDULE: This schedule is tentative and subject to revision. Additional items, if required, will be announced. Any quizzes given may be unannounced, and the listed Exam Weight will be adjusted for any quizzes given. If given, quizzes may be worth up to 10% of the course grade. In addition to the topics listed, the last week or two of the semester may be devoted to topics of current professional interest and/or pro- nouncements issued since the students took Intermediate. Three common midterm exams are scheduled from 1:00 to 3:40 on the dates listed when you registered for the class. There may be a second part for one or two of these exams, given during the regular class period on the same date. There will also be a final exam during the scheduled final exam period. The final exam will use the Capstone Project for some of the computations. EXAM: KW12 Chapters: Primis Chapters: Exam Date: Weight (±5%): EPS & SEC 16.2 22 & 14 Oct. 2 25% Revenue I, Interim & Segment 18 & 24 13 & 7 Nov. 6 30% Revenue II Cash Flow & Changes 22 & 23 15 & Case Dec. 18 20% HOMEWORK: The instructor employs two types of homework assignments. EXAM PREP PROBLEMS. The EPS and Capstone problems will be used by the students as data during the first and last exams. Students will be given a choice about the second exam. Experience suggests that these might take 5 to 10 hours each, so students should plan accordingly. In essence, Exam Prep Problems are take-home exams. Because they are part of the exams, the solutions will not be covered in class; discussion will be limited to questions about the facts and assumptions. Students are responsible for bringing these problems and their solutions to the exam. Everything brought to the exam must be turned in with the exam. Exam Prep Problems are intended to leverage the students time outside of the test setting, for those computations that are especially complex and time-consuming. The Exam Prep Problems also allow students to "bring something to the exam" to help their memory. Their solutions must be on point, but 17, 18 & 7 Dec. 4 25% 21 they can include hypotheticals and alternate assumptions to the computations. Text material and hand- 4 outs may not be brought to the exam in any form. ASSIGNED HOMEWORK. Check figures will be provided and portions of these assignments will be covered in class. Generally these will not be collected or graded. However, any quizzes will be based on Assigned Homework Problems, so the student should bring their solutions to each class. You will not have access to the text, so your homework solutions should be complete and well labeled. SPECIAL CONSIDERATIONS: ETHICAL ISSUES: The first day of class will touch on questions of truth, personal ethics, and the social value of information. Ethical concerns are an integral component of Financial Reporting Theory and they will be treated as such over the course of the semester. SPECIAL CONSIDERATIONS: COMPUTERS In learning and understanding accounting, the use of certain computer resources, notably spreadsheet programs, may be of considerable value. (Sager uses Mac OS computers.) Students, either individually or in groups, are absolutely encouraged to make use of such resources. Labs are located in both McGraw and Carlson. Students may choose to utilize such resources for any or all of the class assignments. However, computer skills per se will not be a direct component of the student’s grade. SPECIAL CONSIDERATIONS: INTERNATIONAL ISSUES International Issues are included in both the Partial Operations/SEC and the Revenue Recognition components of the course. SPECIAL CONSIDERATIONS: TEAMWORK In my experience, the greatest component of success in this course is the ability to work with other students. You must use your study time outside of class efficiently and effectively. Those sitting in class with you are the people most likely to help you work efficiently and effectively. SPECIAL CONSIDERATIONS: MPA Exam There has been some discussion among the faculty about using the Capstone material as a precursor to the MPA exam. Students should save a copy of their work on this project. Students should be aware that Section 2 of the MPA exam is composed of questions from each of the 4 required accounting graduate courses (Tax II, Issues, Theory, and Audit II). Passing this section of the exam is a degree requirement. New syllabus Issues in Financial Accounting (ACCOUNT 757) Fall 2014 Professor Robert Gruber, PhD CPA CGMA CMA E-mail Address: Phone: Address: Office Hours: Class Schedule: gruberr@uww.edu 262.472.5463 Hyland 3539 UW-Whitewater 800 West Main Street Whitewater, WI 53190-1790 MW: 9:30 – 12:00, usually (check before showing up) By appointment, when necessary (T or R, but never F) E-mail, constantly (This is the best way to find me!) ACCOUNT 757: (MW: 08:00 – 09:15 pm) in HH2203 5 ACCOUNT 249: Online (09/03-12/17) BEINDP 293: Disney internships (no class meetings) COMM 110: Online for Disney interns Textbooks: A Course Readings book adapted Advanced Financial Accounting by Christensen, Cottrell, and Baker (2014), Intermediate Accounting by Spiceland, Sepe, and Nelson (2013), and Intermediate Accounting by Kieso, Weygandt, and Warfiled (15th edition, 2013). It is available in the University Bookstore and includes an access code to CONNECT. This is the course management system required for all homework assignments and several exams this semester. This Course Readings book is only be available via the University Bookstore (i.e., not Amazon or other used textbook markets) because it is customized and printed specifically for this course. Other materials: (1) Calculators that only include basic functions (i.e., cannot be statistical, financial, or alpha-programmable) and (2) pencils for examinations and quizzes. Course Description This course presents an in-depth examination of some of the more complex and contentious areas that have evolved into current financial accounting practice. Major areas include: 1. Partnerships: Formation, Operations, and Liquidation 2. Statement of Cash Flows 3. Segment, Interim, and SEC Reporting 4. Accounting for: a. Derivatives b. Pensions and Other Postretirement Benefits c. Accounting Changes and Error Corrections d. Financial Statement Quality e. Corporations in Financial Difficulty 5. Financial Reporting Framework for Small- to Medium-Sized Entities (FRF for SME) This course also can include recent FASB and IFRS pronouncements not covered in prior financial accounting courses; i.e., ACCT 244, ACCT 261, ACCT 343, ACCT 461, and ACCT 783. . Course Objectives The University of Wisconsin-Whitewater has adopted the LEAP initiative (Liberal Education, America’s Promise), which contains four targeted learning outcomes for postsecondary education. The ACCOUNT 757 course objectives will mainly focus on the second LEAP learning outcome: Intellectual and Practical Skills. The Four Essential LEAP Learning Outcomes 1. Knowledge of Human Cultures and the Physical and Natural World 2. Intellectual and Practical Skills, including: a. Inquiry and analysis b. Critical and creative thinking c. Written and oral communications d. Quantitative literacy e. Information literacy f. Teamwork and problem solving 3. Personal and Social Responsibility, including: a. Civic knowledge and engagement—local and global b. Intercultural knowledge and competence c. Ethical reasoning and action d. Foundations and skills for lifelong learning 4. Integrative Learning, including synthesis and advanced accomplishment across general and specialized studies In many ways, this course could be titled Intermediate III or Advanced II, because it is a continuation of the financial accounting topics begun or not covered in ACCT 261, ACCT 343, ACCT 461, and ACCT 6 783. In particular, this course emphasizes the application, interpretation, and analysis of accounting principles and procedures for complex accounting and financial reporting topics. After successfully completing this course, by analyzing and responding to exercises, problems, answering corresponding exam questions, and/or other similar assessment materials, students will be able to: 1. Apply the appropriate accounting conventions (i.e., rules, policies, and procedures) to each of the topics listed in the course description (e.g., accounting for partnerships and preparing a cash flow statement), and 2. Demonstrate an applied knowledge of the appropriate standards for high quality financial reporting in unusual situations, including accounting errors, changes in accounting policy, and troubled corporations. Attendance Daily attendance in an accounting class is very important. A large amount of new material is presented in each class session. Frequently, what is learned in one class session is used heavily in introducing new concepts in the next class session. It is the policy of this University and the Accounting Department that daily attendance is expected. I use a lecture/demonstration type of class structure and anticipate, because of the nature of the material, about 40% of what we do in class will not be in the book. This includes solutions to textbook problems, class demonstration exercises, answers to student questions, handouts, etc. You will be held responsible for any material presented and/or discussed in class, but please do not come to me for class notes. Get them from a fellow student because they were there when the notes were generated. With that said, I understand that professional obligations and commitments might periodically, but very infrequently, shift your priorities towards attending another event or activity instead of attending class. You will incur no penalty if you inform me via email (1) of your absence prior to its occurrence and (2) the exact nature of your absence, including the sponsoring organization. Other Course Policies (a) I will try to respond to your email messages within 6-hours during the week (Sunday through Thursday) and within 12-hours on the weekend (Friday and Saturday). However, there may be situations where this is not be possible. But I will do my best! Please remember to use proper, professional email etiquette (see the D2L Course Information folder for email etiquette considerations). (b) Please be sure that all cell phones, pagers, and other electronic devices are turned off during all class sessions. The reason is simple: basic respect and consideration for others, including me. Please note that if an electronic device does go off during an exam or quiz, you must forfeit the exam or quiz to me immediately. Your score will be based on what you did prior to the interruption caused by your electronic device. (c) As developing professionals and good citizens, it is important that you treat your co-workers and fellow citizens with civility, which includes respect for others, good manners, courteous behavior, and politeness. Specific examples include being on time for class, no texting during class, and no talking during lectures. Mastery When you were much smaller, your report card may have included grades for such things as effort, paying attention in class, attendance, and the neatness of your locker. I am not going to debate the educational purpose of reporting these items, except to observe that they presented another option for all concerned to feel good about the student. As the years progressed, some students and teachers (it is a fact that all teachers were once students) clung to these as "feel good" things, perhaps something to supplant a demonstrated deficiency as to the topic of study. But there are, and must be, distinctions made. Where effort and intentions may be of use in some realms (such as set dressing in theater) they are irrelevant in others (I understand that the IRS does not care if a professional tax preparer meant well, that is more a sentencing consideration). 7 According to WINS, the great majority of you are seeking a graduate degree (MPA). This degree is not a K-12 program mandated by state law. This degree is not an undergraduate degree (BBA), where there are so many expectations involved. This is a graduate degree, which is granted only IF and WHEN you have demonstrated a high degree of mastery and independent knowledge in a specific subject area (e.g., accounting) At this level, I appropriately assign zero weight to effort, intentions, participation, etc. My primary concern is stated simply: is it correct? You will each have an equal and fair chance to demonstrate your level of understanding for me on various exams and homework assignments. You will all be held to the same standard, whether you work for pay 40 hours a week, or if you have to do 40 hours of homework a week just to keep up. University Statement The University of Wisconsin-Whitewater is dedicated to a safe, supportive and nondiscriminatory learning environment. It is the responsibility of all undergraduate and graduate students to familiarize themselves with University policies regarding Special Accommodations, Academic Misconduct, Religious Beliefs Accommodation, Discrimination and Absence for University Sponsored Events. For details please refer to the Undergraduate and Graduate Timetables; the Rights and Responsibilities section of the Undergraduate Catalog; the Academic Requirements and Policies and the Facilities and Services sections of the Graduate Catalog; and the Student Academic Disciplinary Procedures (UWS Chapter 14); and the Student Nonacademic Disciplinary Procedures (UWS Chapter 17). College of Business & Economics’ Student Code of Ethics As members of the University of Wisconsin-Whitewater College of Business & Economics’ community, we commit ourselves to act honestly, responsibly, and above all, with honor and integrity in all areas of campus life. We are accountable for all that we say and write. We are responsible for the academic integrity of our work. We pledge that we will not misrepresent our work nor give or receive unauthorized aid. We commit ourselves to behave in a manner, which demonstrates concern for the personal dignity, rights and freedoms of all members of the community. We are respectful of college property and the property of others. We will not tolerate a lack of respect for these values and fully accept responsibility to maintain the honor code at all times. AICPA Code of Professional Conduct Students should be familiar with Rule 203 (ET: Accounting Principles) of the AICPA’s Code of Professional Conduct, which specifies when a violation of GAAP is, and is not, an ethical concern. Only a fool asserts that they are acting ethically without knowledge of the relevant rules and considerations. Grading Policies Course grades will be based upon your performance on (1) homework assignments and (2) four chapter exams. 1. Examinations Four exams will be administered in this course as indicated on the course schedule. The format will be approximately 65-70% objective-type questions (e.g., true/false statements and multiplechoice questions) and 30-35% free-response questions (e.g., essays, exercises, and problems). Please arrange your schedule on exam dates so we can begin the exams at 07:30. Exam 4 will be administered during final exams week in HH2203. (It is possible that the exams (some or all) will be computerized; i.e., you will need to bring a laptop with you to the exam. If you don’t have a laptop, please let me know one week in advance and one will be provided on the exam date.) 2. Homework There will be homework activities assigned throughout the course. All assignments will be completed and submitted in CONNECT, except chapter 18 and SCF, which will be submitted in the appropriate D2L Dropbox folder. In general, homework assignments are due by 23:59 on the due dates posted in CONNECT. Late homework cannot be accepted under any circumstances in fairness to students who manage their time and other commitments so as to get their homework 8 assignments done by the due date. Homework assignments will be assigned a point value based on the (1) estimated amount of time required to complete the assignment and (2) degree of difficulty in regards to each problem’s intended solution. Chapter/Topic Point Value 15 (Partnerships) 16 (Partnerships) 21 (Statement of Cash Flows) 13 (Segments and Interim Reporting) A (Derivatives) 17 (Pensions and Other Benefits) 20 Accounting for Changes and Errors 18 (Financial Statement Quality) 20 (Corporations in Financial Trouble) Total (24% of course grade) 14 13 20 14 13 17 14 10 10 125 Due at 23:59, except as noted 09/15/14 09/22/14 10/13/14 10/19/14 (16:30) 11/03/14 11/10/14 11/16/14 (16:30) 12/01/14 12/14/14 (16:30) 3. Other Credit and Extra-Credit Opportunities a. Register in McGraw/Hill’s CONNECT by 23:59 on 09/08/14, including spending 10-15 minutes exploring its features and folders. (Required 3-points) b. Completely fill in ALL information in your D2L Profile by 23:59 on 09/08/14, including a clear picture of yourself (Do not fill in personal contact information like email address, phone numbers, and mailing address). (Required 4-points) c. Join the WICPA as a student member; WICPA cost is $30. This must be done within the first two weeks of the semester; i.e., 23:59 on 09/17/14. (Extra-credit 3-points) d. Complete the syllabus quiz and turn it in on time (08:00 on 09/08/14). (Required 5-points) e. Attend the Accounting Department’s annual Accounting Career Fair on 09/10/14 between 15:30 and 19:00. (Extra-credit 2-points) f. Participate in the course and instructor evaluations at the end of the semester. (Required 3-pts) g. Other extra-credit opportunities may arise and be announced during the semester, including attending lectures on campus, attending a WICPA-sponsored conference, etc. 4. Grade Components (Slight shifts between categories is possible, but not very probable.) Item Homework Exam 1 Exam 2 Exam 3 Exam 4 Other Total 5. Date See above 09/24 10/20 11/17 12/15 ----- Maximum Points 125 (25%) 100 (20%) 95 (19%) 85 (17%) 80 (116%) 15 ( 3%) 500 (100%) Your Points Grading Scale (Curving is possible, but not probable, and should not be relied upon.) Grade A AB+ B BC+ C CD Point Range 450-500 438-449 425-437 375-424 363-374 350-362 300-349 288-299 250-287 9 Percent 90.0% 87.5% 85.0% 75.0% 72.5% 70.0% 60.0% 57.5% 50.0%