The Relevance of New Public Management

advertisement

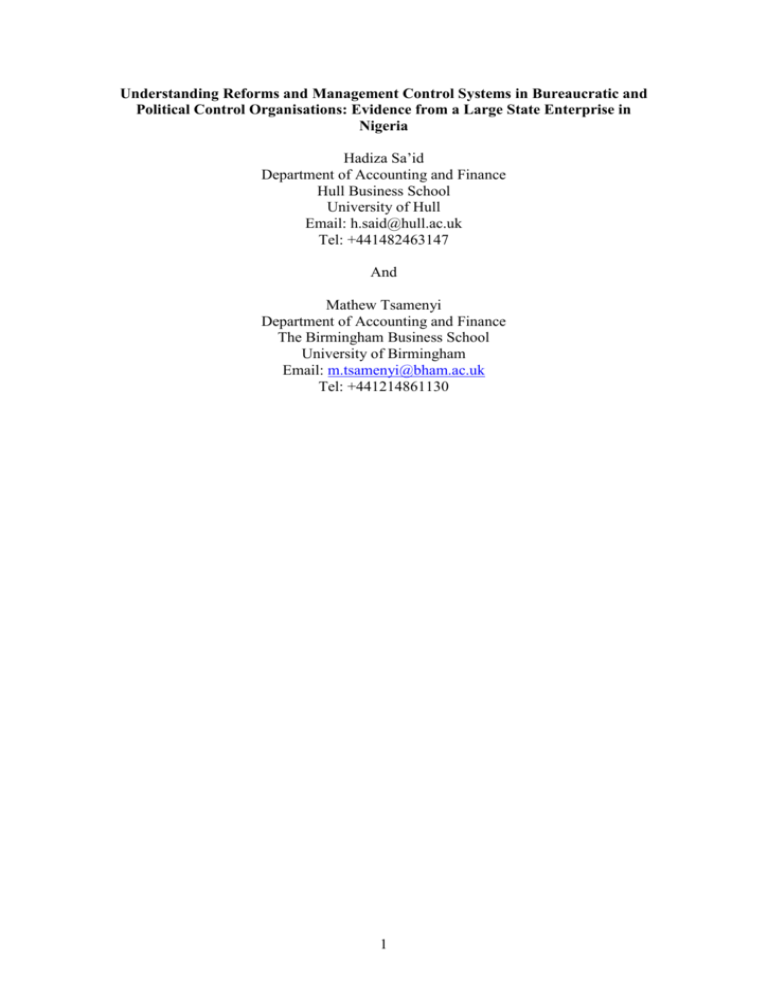

Understanding Reforms and Management Control Systems in Bureaucratic and Political Control Organisations: Evidence from a Large State Enterprise in Nigeria Hadiza Sa’id Department of Accounting and Finance Hull Business School University of Hull Email: h.said@hull.ac.uk Tel: +441482463147 And Mathew Tsamenyi Department of Accounting and Finance The Birmingham Business School University of Birmingham Email: m.tsamenyi@bham.ac.uk Tel: +441214861130 1 Understanding Reforms and Management Control Systems in Bureaucratic and Political Control Organisations in Developing Country: Evidence from a Large State Enterprise in Nigeria Abstract Over the past two decades most Less Developed Countries (LDCs) including Nigeria have been reforming their public enterprises as part of a wider international donor led economic reforms. The reforms involved among other things the adoption of private sector management practices, including management control systems (MCS) in public sector entities. Drawing on a processual approach, this paper reports on the results of a case study that explores the process of the reforms in a large commercial oriented state enterprise in Nigeria in an attempt to trace and understand the impacts of the reforms on the MCS in the organisation. Data for the analysis were gathered from multiple sources including semi-structured interviews with seventy-three managers, observations and the analysis of internal and external documents. The findings of the paper suggest that the various MCS innovations introduced as part of the reforms failed to play any meaningful role in the organisation as they were either not implemented or where they have been implemented were not used in day-to-day decision making. The organisation we examined is very complex and characterised by bureaucratic and political control which hindered the reform process. Furthermore, the MCS were designed by international consultants with little consideration for the complexity and the political context of the organisation. Keywords: Public sector reform; Management Control Systems; Processual Approach; Less Developed Countries, State-Owned Enterprises, Nigeria 2 1. Introduction The objective of this paper is to contribute to the ongoing debate on reforming state institutions especially in Less Developed Countries (LDCs). This debate is particularly important due to the increasing pressure on most LDCs (including Nigeria) to adopt wider international donor led neo-liberal economic reform programmes (Cook and Kirkpatrick, 1995; Uddin and Hopper, 2003; Hopper et al., 2009). The reforms are intended to among other things introduce more efficient private sector management practices into what is deemed an inefficient public sector (Hood, 1991; 1995; Hopper, et al., 2009). The State-Owned Enterprises (SOEs) which were set up to engage in commercial activities and have been the subject of a number of these reforms have particularly been singled out and criticised for being inefficient and a drain on the scarce national resources (Broadbent and Guthrie, 1992; Uddin and Hopper, 2001; Uddin and Tsamenyi, 2005). At one point, SOEs dominate every sector of the Nigeria economy but they have been poorly managed and blamed for contributing in part to the country’s underdevelopment (Nweki, 2007; TCPC, 1993). It is believed that reforming these SOEs will improve their efficiency and hence reduce the reliance they place on state subsidy and enhance their overall contribution to the national economy (Rees, 1985; Uddin and Tsamenyi, 2005; Uddin and Hopper, 2001; Rahaman and Lawrence, 2001). This is based on the assumption that private sector management practices introduced into these firms will actually work. For example, it is assumed that bureaucracy and cronyism which have characterised these organisations will be eliminated and proper systems of control and accountability will follow (World Bank, 2000; Prizzia 2001). 3 Empirical evidence from both developed countries (Broadbent and Guthrie 1992; Ogden, 1995; Lapsey and Pallot, 2000; Brignall and Modell, 2000; Modell, 2001) and LDCs (Uddin and Hopper, 2001; Rahaman and Lawrence, 2001; Wickramasinghe, et al., 2004; Uddin and Tsamenyi, 2005) has shown that very often these reforms are accompanied by the introduction of new management control systems (MCS). However the evidence on the outcomes of the adoption of these new management control innovations is mixed. Moreover, we believe the reasons for the success or failure and the lessons that can be learned from these reforms have not been well examined since a significant number of the studies identified above have focused on the outcome with minimal emphasis on the process of the reforms. This study is motivated by the need to understand why and how reforms implemented in public enterprises succeed or fail. This we argue will require focusing not only on the outcomes but also on the process of the reforms. We also argue that the views of the organisational actors are imperative in understanding the process and judging the outcomes of these reforms. To achieve the above, we conducted a case study on a large SOE in Nigeria. We focus on the process and outcomes of implementing new management control systems (MCS) in the organisation in order to understand how these MCS were implemented and subsequently used. We adopt a processual approach (Pettigrew, 1990 & 1997; Pettigrew et al. 2001; Dawson, 1994, 2003 & 2005) in order to understand the process and historical context of the reform. Processual approach emphasises the content, context and political factors influencing the change process over time (Dawson, 1997 & 2003; Greenwood and Hinings, 1996). It pays particular attention to political influence in the change process such as how individuals and groups struggle to promote 4 and protect their vested interests. These issues are important in understanding the reform in our case study organisation. The remainder of the paper is organised into five sections. The next section reviews relevant literature on public sector reform and MCS. After this we discuss processual approach followed by the research methods (including the background of our case organisation). This is then followed by a brief overview of the public sector reforms in Nigeria. The next section presents a discussion and analysis of the case results followed by concluding comments. 2. Review of Related Literature In the 1970s developed countries such as the US, UK, New Zealand and Australia embarked on reforming their public sector. These reforms were in an attempt to improve economic growth through reduction of operating costs, while maintaining or improving the efficiency and effectiveness of services provided to citizens (Dorsch and Yasin, 1998; Ogden, 1995). They involve changes in structures, culture, functions and processes of public organisations - changes such as reducing government funding to public organisations, corporatisation, commercialisation, privatisation, performance contracts, improved financial management, private-sector styles of management, contracting, and decentralisation (Boston et al., 1996; Parker and Gould, 1999; GreenPedersen, 2002; Larbi, 1999; Awio et al., 2007). Overall therefore, the reforms can be construed as solutions to the endemic problems affecting the public sector in these countries (Humphrey et al., 1993; Awio et al., 2007). 5 A number of studies such as Broadbent and Guthrie (1992), Ogden (1995), Lapsey and Pallot (2000) and Modell (2001) have investigated the implications of such reforms for MCS. The general conclusion was that MCS change is a major component of these reforms since by adopting appropriate accounting and reporting system public sector organisations can be made accountable and responsible for financial results similar to private sector enterprises (Broadbent and Guthrie, 1993, Humphrey et al., 1993; Olson et al., 1998; Nor-Aziah and Scapens, 2007). In the 1990s the public sector reform concept was imported into LDCs by the World Bank and its allies such as the International Monetary Fund (IMF) and other international aid agencies. These reforms were adopted in these countries as part of the wider Structural Adjustment Programme (SAP) which was introduced by way of loan conditionality (Toye, 1994; Cook and Kirkpatrick, 1995; Olowu, 2002; Uddin and Hopper, 2003; Uddin and Tsamenyi, 2005; Asaolu et al., 2005; Hopper et al., 2009). There is the assumption that better controls, improved efficiency and effectiveness, and economic development will emerge through the adoption of these reforms (Rees, 1985; Uddin et al., 2003; Wickramasinghe et al., 2004). Therefore, the reforms will result overall in increased investment, a rise in Gross Domestic Product (GDP), as well as an increase in productivity and employment (Uddin and Tsamenyi, 2005; Uddin and Hopper, 2001). A number of studies have investigated MCS changes in public sector organisations in LDCs following their adoption of reforms. However, the findings of these studies are inconclusive. While some studies reported successful reforms that resulted in changes in MCS that improved efficiency and decision making in these organisations, others 6 reported the opposite. For instance, the studies of Anderson and Lanen (1999) O’Connor et al. (2004) and Tsamenyi et al. (2010) reported that reforms resulted in improvement of MCS and overall decision making in the organisations they studied. Contrary to the above findings, Uddin and Tsamenyi (2005), in a case study of a large public organisation in Ghana that was reformed reported that there was no substantial change in MCS in the organisation. Budgeting remained directionless, politicised, delayed and ineffective. In effect the reform legitimised the poor performance of the SOE. A similar finding was reported by Uddin and Hopper (2003), Mserembo and Hopper (2004); Wickramasinghe et al. (2004), Davie (2004) and Sharma and Lawrence (2005). All these studies suggested that reforms failed to achieve their intended objectives. The mixed findings in the literature warrant further research. In particular, we argue that an approach that allows us to explore the process of the reforms will shed more light on why and how reforms may or may not achieve their intended objectives. In the next section we present processual approach as a method that can enable us understand the process of the reforms and the underlying socio-political contexts of the reform. 3. Processual Approach and Understanding the Reforms Reforming SOEs in LDCs is usually messy and complex because of the bureaucratic and political nature of these organisations (Uddin and Hopper, 2001; Wickramasinghe et al., 2004; Uddin and Tsamenyi, 2005). Processual approach presents a useful way of teasing out this complex and messy process (Dawson, 1997 & 2003; Greenwood and Hinings, 1996; Hinings, 1997; Pettigrew, 1997; Pettigrew et al., 2001; Siti Nabiha and 7 Scapens, 2005). Process research can generate sound knowledge of processes, outcomes and how and why outcomes are shaped by processes (Pettigrew, 1997). The approach viewed change as multi-level and a cross organisational process and emphasises on the examination of contexts, contents and processes of change and their interconnections overtime (Pettigrew, 1990 & 1997; Dawson, 1994, 2003 & 2005). Processual approach assumed that social reality is a dynamic process not a steady state (Pettigrew, 1997; Dawson, 2003). As argued by Pettigrew (1997 p.338) “Human conduct is perpetually in a process of becoming. The overriding aim of the process analyst therefore is to catch this reality in a flight”. This implies that change is a continuous process and it takes time to occur. Thus, the approach treat change as a complex and dynamic process that cannot be solidified (Pettigrew, 1997; Dawson, 1994). Processual researchers reject the account of studying change as a rational, linear event in which actions are presented as ordered and sequence and where actors behaved in a mechanistically and altruistically in their pursuit of organisational goals, to that of examining change as uncertain and emergent process that occurs overtime, and recognise conflicting rationalities, activities and behaviours (Pettigrew, 1985; 1990; Dawson, 1994, 2003). Furthermore, in order to understand change properly, an understanding of the social and political processes is vital (Pettigrew, 1985; 1997; Dawson, 1994). Dawson (1994) developed a framework for understanding the processes and context of change as it unfold in an organisation. He suggested that change process be studied over three timeframes presented as, the initial conception of need for change, the process of organisational change and the operations of new work practice and procedure. Dawson 8 argued that during each of the timeframes a series of tasks, activities and decisions are being made by individuals and groups and in the process of managing change an organisation may move backward and forward between various task and activities. The conception of need for change might come as a result of internal or external pressure or in order to enhance future competitiveness. The process of organisational transition refers to the commencement of the process of managing a non linear complex and ‘blackbox’ change transition. The operation of new work practices and procedure refers to the period following the implementation of change when new organisational arrangement and operations systems begin to emerge. Dawson (1994, p.40) argues that “It is during this timeframe, therefore that the ‘outcomes’ of change can be examined and contrasted with the operating system prior to change”. Dawson noted that although it is unrealistic to talk of the end point of change as change is continuous, he argued that it makes sense to discuss the effect of a particular change. Dawson’s framework also explains the ways in which change is shaped at a critical moments. He suggested classifying major determinants of change and locating them within the temporal timeframe. These determinants are the substance of change, the politics of change and the context of change. The substance of change refers to type and scale of organisational change while the politics of change refers to political activities of consultation, negotiations, resistance and conflicts that take place within and outside the organisation and at various levels during the management of change process. The context of change relates to how the operating environment shapes current practice. The operating environment can be both past and present, and internal and external. The internal factors include among other things the history and culture of the organisation, and administrative resources, while the external include factors such as 9 changes in government legislations, changes in competitors strategies, changing social expectations and technological innovations. Dawson (1994) argued that the co-existence of different histories can significantly shape process and outcome of change. As observes by Pettigrew (1997, p.339) “ What happens, how it happens, why it happens, what results it brings about is dependent on when it happens, the location in the processual sequence, the place in the rhythm of events characteristics for a given process”. We draw on the processual approach described above to collect, analyse and interpret our data. 4. Data Collection and Analysis Our research is based on a case study of a large SOE in Nigeria. For the purpose of confidentiality the company is hypothetically referred to as Nigeria State Enterprise (NSE). Case studies are powerful tools for studying issues that are not well understood, complex or contextually contingent, and sensitive (Ferreira and Merchant 1992; Yin, 1994; 2003). The organisation and the issues we studied can be considered as complex, sensitive and context determined hence the appropriateness of case studies. For example, NSE contributes significantly to GDP, government revenue, employment and foreign exchange, and is highly politicised with its board usually composed of politicians or political appointees, hence its sensitivity and complexity. The study was conducted between late 2007 and mid 2008 with a follow-up in 2012. The data was gathered by way of interviews, document analysis and observations. A total of seven months was spent in the case organisation by the researchers. During this 10 time, seventy-three open-ended semi structured interviews were conducted. The interviews were mainly with managers of diverse backgrounds and hierarchical positions at the Head Office and a number of subsidiaries, external consultants, external auditors, officials from the Bureau of Public Enterprise and politicians. Thirty-eight of the seventy-three interviews were tape recorded, while the remaining thirty-five were not as per the interviewees’ requests. In all cases notes were taken during these interviews. Informal discussions were also held with some employees, especially during lunch breaks. Evidence gathered from documents and observations was used to corroborate findings from the interviews (Stake, 1995; Yin, 2003). Documentary evidence was collected from the organisation’s quarterly magazine, monthly newsletter, the operations manual, monthly and quarterly performance reports, budget manuals, transformation documents and other internal documents in addition to external documentations such as copies of speeches, reports, and newspaper articles on the organisation. Privatisation and commercialisation documents of Nigeria were also obtained from the Bureau of Public Enterprises (BPE) in addition to World Bank and IMF reports. The observation was mainly non-participant though on few occasions the investigator was allowed to ask questions, for example, during a seminar organised for new recruits and at a management meeting. The observations were particularly useful as they provide knowledge of the context in which the events occur and enable the researcher to see things that the interviewees were not willing to discuss (Patton, 1990). Being in the organisation for seven months enabled the researchers to observe NSE’s daily activities; these include action such as opening time, the level of work done, MCS in 11 action and NSE’s general infrastructure. The study was conducted at a time when attempts were being made to implement two new accounting and information systems, namely, System Application and Products in Data Processing (SAP1) and Performance Measurement System (PMS). The investigators were permitted to observe the implementation process of these systems and spent time with employees processing data with the Management Information System (MIS). In terms of data analysis, the contact summary sheet and coding recommended by Miles and Huberman (1994) was adopted to record and analyse the field data at the end of any visit. However the overall data was analysed by undertaking pattern matching and explanation building suggested by Yin (1994 & 2003). Pattern matching involves comparing an empirical pattern with the predicted one and explanation building involves analysing the case data by building an explanation about the case. However, because of the complexity of our case environment and the richness of the data collected, our analysis did not strictly follow Yin’s recommendation of looking for comparison between the case evidence with the pattern established in the literature or the theory. Rather the main themes that emerged from the data collected provided the foundation for the main pattern and explanation of the study. The data and the themes were studied over and over again with patterns identified from the themes and plausible explanations constructed from the regularities observed. For example, patterns were identified from themes such as power, mismanagement, political interferences, etc. Those themes occurred repeatedly across the data. 5.1 Overview of the Nigerian Public Sector In LDCs such as Nigeria, public enterprises are the dominant ventures and account for a significant share of national output and investments (Adhikari & Kirkpatrick, 1990). 12 The development of the Nigerian public sector began under colonial rule where the colonial government assumed responsibility for the provision of infrastructure such as railways, road, water, bridges, port facilities and electricity (Ugorji, 1995; Iheme, 1997). Similar to other post independent countries, Nigeria significantly expanded its public enterprises to drive socio-economic development and guard the economy from foreign domination and exploitation immediately after independence in the early 1960s (Adhikari and Kirkpatrick, 1990; Umoren, 2001; Adeyemo and Salami, 2008). A further expansion occurred in Nigeria’s public enterprises during the oil boom in the 1970s. In 1988, the total number of public enterprises in Nigeria was put as one thousand five hundred (1500), with about six hundred (600) operating at federal level and about nine hundred (900) smaller ones operating at state and local government level (TCPC, 1993; Anya, 2000). The government makes about 5,000 appointments annually to the boards and management of these enterprises, thus serving as an influential source of political patronage (Anya, 2000). Anya (2000, p. 1) described the Nigerian public sector as follows: These companies take a sizeable portion of the Federal Budget…Transfers to these enterprises ran into billions of naira. These transfers were in the form of subsidised foreign exchange, import duty waivers, tax exemptions and/or writeoff of arrears, unremitted revenues, loans and guarantees and grants/subventions. These companies were also infested with many problems which became an avoidable drag on the economy such as - abuse of monopoly power, defective capital structure, heavy dependence on treasury funding, rigid bureaucratic structures and bottlenecks, mismanagement, corruption and nepotism. It has been suggested that successive Nigerian administrations have invested about ngn13 trillion (about 53 Billion British Pounds) in these enterprises during the period 13 1978 to 1998 (Nweke, 2007)1. The combined employment of these enterprises was about 500,000 during the same period and when compared with the estimated population of Nigeria (about 148 million), the percentage of public sector employment stood at only 0.3 percent. 5.2 Public Sector Reforms and Management Control Systems in NSE In this section we examine the process of reforming NSE in an attempt to understand how this process shaped the MCS in the organisation. As identified earlier, NSE is a highly bureaucratic and politicised organisation and therefore power and politics are part and parcel of its existence and decision making. Using processual approach, we teased out the historical context of the reforms and the roles of power and politics in the process of the reforms. This is depicted in figure 1 below). The processual approach enabled us to tease out the historical context of the reforms and the roles power and politics played in the process of the reforms (see Figure 1 below). INSERT FIGURE 1 NEAR HERE We identify the substance of the change that is the rationale for introducing the change as the need to reform NSE into a viable commercial enterprise. Using the processual approach we were able to identify the substance of the change which refers to the rationale for introducing the change. This we identified as the need to reform NSE into a viable commercial enterprise. We were then able to examine the conception which relates to the reasons behind the change and in our case this is the economic crisis caused by the oil glut which necessitated the government’s adoption of 1 Nweke was a former Minister of Communication and Information in Nigeria. 14 IMF led SAP. Transition is about the process of change and we were able to explore the process of the changes that occurred in the structure, systems and operations of NSE. This process is shaped by the activities of various internal and external parties (this is the politics of change in Fig 1), for example top management, International Consultants, employees and the government. These groups were involved in series of non-linear process of consultations and negotiations which sometimes created conflicts and resistance. This transition was also shaped by NSE’s internal factors such as civil servant mentality of employees and the notion of job security, and external factors such as changes in government. The transition is likely to lead to changes in operations. Here we can examine whether new MCS have been introduced or not. However, the extent to which these new systems are actually implemented and used depends on the various contextual factors. Table 1 below summarises various reforms and their impact on our case firm. INSERT TABLE 1 NEAR HERE In order to understand the process of the reform and how this shapes the MCS, we divide the main attempts to reform the organisation into three periods – pre-Structural Adjustment Programme (SAP); SAP; and Debt relief. 5.2.1 Pre SAP Reforms (Before 1986) Though there have been earlier attempts at public sector reforms in Nigeria, these were largely peripheral as they were never implemented (Yahaya, 1993; TCPC, 1993; The Presidential Commission on Parastatals, 1981). One of the earliest attempt to reform was in 1981, when a presidential commission on public sector enterprises was appointed by the ruling civilian government of President Shagari to study the operations 15 of all public enterprises, with the aim of determining a new funding system, capital structure and incentive measures that would enhance productivity and efficiency (Yahaya, 1993). The commission submitted its report, which identified several endemic problems that these enterprises were facing. The main problems identified were high bureaucracy, misuse of monopoly powers, inappropriate capital structure, corruption, nepotism and mismanagement coupled with low returns, low profits, lack of cost consciousness and the absence of financial records (TCPC, 1993; The Presidential Commission on Parastatals, 1981). The commission recommended an increasing role for the private sector in managing and operating public enterprises (The Presidential Commission on Parastatals, 1981). However this recommendation was not implemented before the government was overthrown in a coup d’état in 1984 (TCPC, 1993). The second attempt was in 1984, when the Buhari administration also ordered a similar exercise to the first attempt. The study group confirmed the earlier finding; however, this recommendation was again not fully implemented before the administration was overthrown in another military coup in 1985 (TCPC, 1993; The Commission Report, 1984). These earlier attempts at reforms the Nigerian Public Enterprises failed to materialise. Although, above macro reforms failed to restructure the Nigerian public sector in general. However, in the case of NSE being a highly strategic and politicised public organisation as identified earlier, there were various attempts to reform the organisation. The earlier attempt was in 1981 during the administration of Shagari. This reform was in response to allegations published in a number of local newspapers about 16 substantial amount of money missing from NSE’s accounts. The President subsequently set up a Judiciary Commission of inquiry to investigate the matter. The Commission produced a report which revealed several irregularities in NSE’s purchase contracts awarded to third-parties, inefficient accounting procedures, and an organisational structure that is too large to run efficiently. The Commission recommended the decentralisation and reorganisation of NSE in order to make it commercially viable (Internal Documents). Consequent to the report, the government divided NSE into nine subsidiaries in 1981. This was in order to improve NSE’s efficiency, effectiveness, accountability and specialisation (Internal Documents). In terms of changes in MCS, our study revealed that minimal change occurred during this period. In fact, the reform was judged by interviewees as largely unsuccessful. Another attempt to restructure NSE took place in 1985. Like the first reform this second reform was an effort to streamline processes and enhance operational efficiency. According to the interviewees, the purpose of the reorganisation was to re-position NSE as an efficient organisation that will discharge the public responsibility vested in it. A manager explains this during the interview as follows: At that time, NSE could not understand what status it had, because we were always talking of how the government would give us subvention to fund our operations. But the government said to us that enough is enough and that we have to look inward and see how we can achieve better performance, at least breakeven. We [the government] do not charge you to make a profit, but at least you should breakeven. That means we should be able to finance our operations. Another manager reiterates the problem as: At that time, NSE was an arm of government without any definite structure. We are like an amoeba with no shape; everybody is reporting to a single Managing Director. As part of this second reform, NSE was divided into five (5) semi-autonomous sectors. Each sector was comprised of different companies. During this period, NSE’s top 17 management was very powerful largely because of the politicisation of appointments, decision making and control. Managers were rewarded on the basis of allegiance to the political machinery rather than achievement of any financial outcome. A manager comments that: When the sector head visited us we do go to the airport and lined up for him; he was very powerful. If the sector head likes you, you will be promoted; if not, you get nothing. Good performance was not rewarded, and that made staff care less about performance. The evidence we collected during the study shows that this second reform did not result in any changes in the MCS. In fact no new accounting practices were introduced; instead the focus was on changing the structure of the organisation without necessarily considering the accounting and reporting system. The interviewees believed that these two reforms have basically failed to improve processes and the mentality of employees in the organisation to make it a viable entity. One manager comments that: You know the act that set up NSE did not detail who should do this and that. It was as if there was no framework for working, so people were just doing whatever they can do and there was no strategic direction at all despite all the restructuring. Although there were departments and divisions, the functions were not clearly defined, the bottom line was not clearly defined, processes were not clearly defined and things were just haphazard. 5.2.2 SAP reforms (Post 1986) The third major public sector reform took place in 1986, as a result of the introduction of the World Bank and the IMF’s led structural adjustment programme (SAP). SAP with its associated public sector reform was adopted following the global oil price collapse in the 1980s which significantly affected the Nigerian economy due to its overreliance on oil exports2. The then Nigerian government invited the IMF to assess 2 The oil price collapse was due to oversupply of crude oil on the world market which drove oil prices down from US$35 per barrel in 1980 to below $10 in 1986. 18 the economy which culminated in the government applying for an Extended Fund Facility (EFF) (Bangura, 1987; Yahaya, 1993). The IMF made the adoption of SAP a condition for the loan (Olukoshi and Abdulraheem, 1985; Yahaya, 1993). Following several negotiations between the IMF, the World Bank and the Nigerian governments, SAP was adopted at the end 1986 though the government did not draw on the IMF loan facility (Callaghy, 1990; Jega, 2000; Olukoshi, 1993; Olukoshi, 1995; Zayyad, 1990). A commercialisation and privatisation decree was subsequently enacted in 1988 as part of the SAP. The decree established the Technical Committee on Privatisation and Commercialisation (TCPC) as the implementation agency with powers to supervise and monitor the programme (Commercialisation Decree no 25). TCPC completed the first phase of privatisation and commercialisation in 1993 with 88 enterprises privatised and 25 commercialised (TCPC; 1993)3. NSE, the case study firm was earmarked for commercialisation under the programme. The next part discusses NSE reforms under SAP. In line with reforms under SAP NSE was restructured in the late 1980s by the government to make it a more efficient, accountable and result oriented. As part of the reorganisation the five areas discussed above were broken down into many subsidiaries with each subsidiary effectively becoming a Strategic Business Unit (SBU). Other Cost Service Units were created with the head office as the holding company and a Group Chief Executive Officer (GCEO) appointed as the overall head. The SBUs were registered as limited liability companies and were allowed to operate independently 3 The main difference between privatisation and commercialisation is that whereas privatisation results in change of ownership from state to private, commercialisation retains ownership solely in the hands of the state. The commercialised enterprises are then mandated to operate as if they were private enterprises with profitability as the main objective. 19 with their own Chief Executive Officers and Board of Directors. The GCEO of NSE identified the main objectives of the reorganisation as the need to reduce central control and allow the subsidiaries the needed flexibility to optimise their business and operate commercially in the interest of the group (NSE Internal Document). 5.2.2.1 MSC Change during Commercialisation In preparation for commercialisation NSE adopted strategic planning (NSE Internal Document). The initial focus of the strategic planning was on efficiency, profitability and prudent management. A strategic plan was drawn for all SBUs, and a new mission was formulated as: “NSE is oriented towards efficiency, profitability and financial autonomy in its operations while seeking to maintain its leadership role in Nigeria’s long-term growth and economic development” (NSE Internal Document). One of the big 5 international accounting firms at the time was engaged as consultants to implement the strategic planning. The role of consultants as diffusers of new innovations has been discussed in the literature (Abrahamson, 1991, 1996; Malmi, 1999 and Jones and Dugdale, 2002). According to an NSE senior manager, “We employed consultants to help act as a third eye”. Some experienced staff were drawn from the NSE to work with the consultants as a team. Attempts were made to embed strategic planning into other organisational processes and in particular the budgeting process, thus to link the budget with some predetermined strategy (Crebert, 2001). The consultant and the staff went round the organisation and looked at jobs at the NSE; they received input from the staff who were doing the job and those who know the job, and established what the NSE was doing wrong, and how it could be corrected and improved. A thorough investigation and identification of the 20 root causes of some problems and the possible solutions were carried out. The team carried out workshops, consultation, seminars and training to educate staff on the strategic planning. Strategic planning was expected to become a facilitator of change in NSE as it is to enable management to identify the core areas and define the mission of the organisation. Staff that witnessed or were part of the strategic planning implementation noted how there was excitement among the managers that strategic planning was going to be the way forward and enhance decision making. Up to the point of the adoption of the strategic planning, there was nothing really like planning in the organisation hence the excitement about the strategic planning. Unfortunately, the high expectations that managers had about the strategic planning did not materialise and they began to question the promises made to them by senior management and the consultants about its value. For example, the budget was never linked to the strategic plan as neither strategic planning nor budgeting was rigorously followed. Budgeting in particular was politicised and driven by self interest. Budget targets were unrealistic and frequently manipulated. In effect strategic planning and the budget were decoupled from the day to day operations and decision making. As an example, it was required by law that NSE’s annual budget is approved by the government but very often this approval was several months behind schedule. Whenever this situation occurs (which was quite regular) the government directs NSE to operate on 25 percent of the previous year’s budget until the budget is approved. A manager comments on the problems of budgeting as: We manipulate the budget silently to allow us to carry out our operations because the process is not efficient. Look we are in October, and this year’s 21 capital budget has not been approved though the year ends in December. People have to devise means to survive. The general view from interviewees was that the reform of NSE under the SAP failed as reiterated by a manager as: “We did the reform but to implement it became a problem. The blueprint was done but implementation is another thing and this was never achieved”. The interviewees argued during the study that the fact that the government abandoned the idea of fully commercialising NSE contributed to the demise of the strategic planning innovation. The abandonment of the commercialisation can be attributed to the lack of overall success of the SAP initiatives in Nigeria (Lewis, 1999; Jega, 2000; Obadan and Edo, 2004). SAP was supposed to provide short-term measures that would last for two years (from June 1986 to June 1988). However, SAP lasted for more than seven years and was abandoned in 1994 (Umoren, 2001; BelloImam and Obadan, 2004; Obadan and Edo, 2004). Umoren (2001) argued further that the Nigerian SAP resulted in a dark secrecy in policy, processes and resources management, and aided corruption instead of creating transparency, to the extent that even the World Bank called for its review. 5.2.3 Reform under the Debt Forgiveness Initiative (The post 1998) Public sector reform were revived during the military regime of General Abdulsalami Abubakar in 1998; with the promulgation of public enterprises privatisation and commercialisation decree no 28. Prior to 1998, in 1993 the federal government established the Bureau of Public Enterprise (BPE) to replace TCPC. BPE was charged to monitor those enterprises already privatised and plan for future privatisation of others. However, from 1994 to 1997, little was achieved in public sector reforms. Though the military government of General Sani Abacha which ruled Nigeria during that period considered contract leasing of public enterprises, this policy was not 22 implemented. Odusola (2004) attributed the failure of public sector reforms during this period to the government’s lack of commitment to reforms, prolonged political crises, and the lack of technical and managerial skills needed for rejuvenating the public enterprises. The election of Olusegun Obasanjo in 1998 as a civilian president saw the strengthening of public sector reforms. The Obasanjo administration vigorously sought debt cancellations.4 The World Bank and IMF insisted on progress on reforms before offering any debt relief. Furthermore, a military decree promulgated by the former military administration was adopted and the National Council on Privatisation (NCP) was established as the policy body responsible for setting guidelines and policies for the privatisation and commercialisation programmes. The Bureau of Public Enterprise was established as its secretariat, responsible for implementing the NCP guidelines and policies. As part of this reform, NSE was mandated by the government to modernise and become efficient. This culminated in the introduction of a major reform termed ‘Project Alpha’ which was led by two international consultants. One manager summarised the role of the consultants as: “The consultants were engaged to help implement Project Alpha and help with the transformation and modernisation of NSE”. Like strategic planning Project Alpha was done by the consultants in collaboration with NSE staff. The project was done in two stages; the analytics and implementation stages. The analytics stage lasted for few months. During the stage, the project team carried 4 See http://allafrica.com/stories/200105170545.html and http://news.bbc.co.uk/1/hi/business/1345508.stm 23 out an exploratory assessment of the NSE situation, based on its mission, vision and best practices (NSE document). The NSE processes, people and technology were analysed; gaps were identified and ways of addressing the gaps were proposed (Internal document). The second stage was the implementation and was scheduled to last for about 2 years. This stage was designed to address the findings of the first stage, recommend solutions, designed and implements new systems, policies, processes and staff training required (Internal documents). The consultants and the staff working with them undertook assessment of NSE’s accounting and management information systems and found these systems to be generally weak and incapable of supporting the organisation in its drive to be efficient and competitive. For instance, they found that the mission, vision and strategies of the organisation are poorly defined. Though the organisation has a performance appraisal system they found that this was not linked to any strategic objective. Performance appraisal was based on subjective judgement and therefore not linked to the achievement of any tangible outcomes. It was revealed by the interviewees that during the performance appraisal which was normally conducted at the end every year, the staff basically picked up the appraisal forms and then started thinking about what they have done that year and wrote it down. The process was the same with the superiors who did the evaluation. A manager notes during the interview that: You will see towards the end of the year that some people will be nice to you, so that when the appraisal comes you will score them highly; after that they will change to their true selves. The performance appraisal process was therefore biased and highly politicised. For instance, though NSE was making huge losses, it was not uncommon to find that the performance of managers was still being judged as good with these managers being 24 paid bonuses and granted promotions. Even managers in charge of plants that were not functioning were still receiving favourable performance ratings and therefore bonuses and promotions. A manager observes the following: Performance is not linked to appraisal; we are making a loss here in our subsidiary. Our selling price is determined by the government, so the cost of our product is more than its selling price; still we are being promoted. As part of the implementation of Project Alpha, the consultants developed a Performance Measurement System (PMS) with Key Performance Indicators (KPIs), for the head office and its subsidiaries. The new PMS was expected to be driven from the top with KPIs, which were supposed to be drawn from the federal government to the last person on the shop floor. A manager comments that: KPIs come from the entire organisation’s objectives, and you know we are solely owned by the government. Our CEO cascades government objectives as they affect our sector; this is further cascaded down to the executives under him. Every department has its own KPIs and individual employee targets are to be linked to the departmental KPIs which are expected to be set at the beginning of each financial year. The agreed tasks and targets are to be signed by the staff, his/her supervisor and countersigned by the unit manager. The majority of the interviewees noted that the while the new appraisal system is more objective than the previous one it was too disparate as it does not bring the performance of the individual units or departments together. A manager was asked during the interview about how the KPIs affect his department, and he responded as: If the whole thing [Project Alpha] has gone to its conclusion then we will be in a position to see its benefits. I think you cannot have a situation where individuals in a department are doing excellently, whereas the department is not doing well. But this is the reality here. Furthermore, the way the tasks and targets are set is not clearly defined; a middle manager explains that: 25 At my level I wrote my own tasks and targets; I wrote my boss’ tasks and targets, I wrote his boss’ tasks and targets as well in relation to other departments that are under that boss; my boss was so impressed with what I did, because understanding the thing is the problem. I swear to God I am not joking; people don’t relate these kinds of things directly, you don’t have to put some bombastic things simply because the entire group gave it to you. It has to be something that you can achieve. At the same time, you don’t have to water it down to where you don’t have any targets to achieve, and you score yourself 90%, so there is this problem. Subsidiaries have targets that they have to achieve and if they fail to achieve these targets then appropriate action was to be taken by the head office. However, it was revealed during the study that this was not the case; both the subsidiary and the head office collected the information on performance, but this is never reviewed. A manager gave an example in which only three people were promoted to management level in his subsidiary. This subsidiary was the only subsidiary operating at that time, with overall performance of 65-70 percent on-time, but the other two that were not operating with 0 percent on-time have more people promoted, and the reasons given for their promotion was that the 0 percent production is not their fault. The manager comments that: You cannot punish the one that is performing that has not reached the targets you have set for him and reward the one that has not done anything at all fantastically. Does it make sense? So this is where we have a problem. Another innovation introduced by the consultants was the Balanced Scorecard (BSC) framework (Kaplan and Norton, 1996a, 1996b, 1996c). The consultant designed a BSC for the entire NSE. The BSC was to be implemented initially at the group level and later cascaded down the organisation. The BSC was also to be linked to the annual budget. As part of the development of the BSC the consultants also recommended the adoption of an Enterprise Resource Planning System (ERP). The consultants sold both systems as tools that will enhance the efficiency, transparency and information integrity leading to overall superior financial performance and competitive position of the organisation (see for instance, Curran et al., 1998; Hayes et al., 2001 for similar arguments on the 26 benefits of ERP systems). Management proclaimed in the Reforms Document (2004) that the adoption of the BSC will aid the organisation in achieving its new mission and vision. The ERP was expected to generate information that will feed into the BSC system. While the adoption of an integrated MCS that will have a BSC and ERP sound laudable, the implementation ran into a number of problems and as a result these systems were never implemented. One of the major problems was not renewing the consultant contract. Many of our interviewee noted that the consultant designed these MCS without consulting and involving those that are going to work with them. Thus, when the consultants were paid and had left the country, there was no real ownership of the systems they implemented. When we visited the company again in early 2010 we were informed that the earlier reforms have been abandoned and another reform is now being initiated. One senior official of the company we spoke to states that “Since the last time you have been around here we have started another reform, but almost everything is confusing now as in the last 3 years we have had five Chief Executive Directors”. Thus, the integrated MCS never made it to the implementation stage. 5.3 Why the Context Matters Peocessual researchers argue that context is important in understanding organisational action (Pettigrew, 1985 & 2001; Dawson, 1994). The context of NSE provides explanations for why the various reforms and the associated MCS we described above were not successfully implemented despite the huge financial commitment. As argued elsewhere NSE is a highly politicised organisation and because of this politics dominate decision making in the organisation. For example, the various reforms in the 27 organisation have all been mandated by the political authorities. Perhaps the statement by NSE’s Group CEO explains this: Project Alpha was in response to the federal government’s mandate for NSE to achieve an aggressive sustainable growth agenda (NSE Internal Document). Because of the politicisation management was not given a free hand to introduce the necessary reforms that will create the environment for the implementation of the various MCS innovations. Thus, though on paper NSE was to reform and operate as an independent commercial oriented enterprise, this did not materialise in practice. It has been argued in the literature that SOEs especially in LDCs cannot operate freely without political interference (Uddin and Hopper, 2001; Uddin and Tsamenyi, 2005). In the case of NSE, political interference is visible in every aspect of the organisation from the appointments of executives to operational decision making. For, instance, approval is needed from the government for any expenditure exceeding a particular limit. Even the raw materials needed for daily operations have to be approved by the government if the amount exceeds a certain limit and this applies to the head office and the subsidiaries. A manager explains: Subsidiaries have no autonomy, the autonomy is not there. For example when I was working in subsidiary A, the CEO of the subsidiary has no power to purchase common raw materials needed for operation without going through approval processes, there is a lot of bureaucracy. Government wants to make almost all decisions. The CEO cannot approve anything above Ngn50millon [£223,000]. The government gives us impression that we are serving the nation, if you did not do what the government wants you end up being sacked. This problem of limit of authority will not allow us to move on. Majority of the managers interviewed voiced their dissatisfaction with this interference. They argue that the financial limit was set in the 1980s when the Nigerian currency was strong, thus the limit in today’s circumstance is very minimum and unrealistic. Various 28 competitive advantages are lost as a result of going through the bureaucracy of getting those approvals. The interviewees also complained that employees were not fully engaged in the process of designing the new MCS. Managers therefore find it difficult to accept and claim ownership of these innovations. Thus according to them the consultants introduced ‘ideal’ systems without necessarily adapting them to suit the local organisational context. One manager comments on the ERP as: “Employees have not been involved in the development of SAP1, and therefore do not have an understanding of how the system is to work”. A senior manager further elaborates on the problems of the ERP as: In my previous organisation which was a private bank when they introduced SAP1, detailed guidelines on the system and its implementation were provided to employees. For example, it was a requirement that you have a computer on your desk and they provided that, except for lower cadres of staff. Everybody was involved, unlike here; nobody comes to me and ask me about my job, and see how it will fit with the new system. There the system was customised for the bank’s needs, but here it is not so. In terms of the MIS for example, except for the Information Technology staff responsible for it, there is no real utilisation of it by other staff. Moreover it is not updated regularly, nor is it used in report generation or for decision making. In addition, many of the staff were not given access to the system; hence they were not exposed to its benefits. Furthermore, there were various technical glitches especially as infrastructure such as computers and electricity was not readily available, and training was not provided to the employees on how to use the MIS. One manager summarises the problem as: We started using the system for appraisals, but because of the non-availability of computers we stopped that; appraisals are now done manually. 29 Some interviewees also believed that top management had a hidden agenda for not implementing the new MCS since this will encourage information sharing and transparency and therefore expose corrupt practices. ERP in particular would allow for data to be captured, edited, processed and shared (McCausland, 2004). It would allow for comprehensive audit trails and top management with their private agenda would not want this to happen. Thus the political patronage that had become the norm in NSE could be exposed hence the concerns of interviewees that these new systems will never be fully implemented. This is consistent with arguments under processual approach that individuals and groups struggle to promote and protect their vested interests (Pettigrew, 1985 & 2001; Dawson, 1994). Given the extended level of politics and bureaucracy that permeates organisational life in NSE, it is impossible for any new innovations that call for proper control and accountability to be implemented in the organisation. Changes in NSE though were sometimes presented as if they were for efficiency purposes, are very often politically driven and merely serve legitimacy purposes (Lapsley and Pallot, 2000). Any innovation that is likely to de-politicise decision making in the organisation will never be fully implemented. Reforms recorded limited success in NSE, and this in turn affected the various MCS introduced. We observe that because of the dominance of politics in the organisation, accounting data plays minimal role in decision making. For example, accounting information does not feature in setting prices. Moreover, performance measurements are not clear, nor are they based on defined and agreed targets. As discussed above, even the new PMS introduced failed to link individual staff performance with that of 30 their units, departments and the group. Rather performance is still judged on the basis of political patronage (see also Hoque and Hopper, 1994; Wickramasinghe and Hopper 2004; Tsamenyi et al. 2010). For instance, in the past three years NSE’s Group CEO has been changed five times and in each of these occasions the lack of meeting performance targets has never been given as a reason for the change. Rather, these changes are politically motivated. Politics is thus the main means of control in the organisation, from top management to the shop floor. A manager notes that: “A lot of policies are conceived based on self interest and politics and not national interest.” Politicians influence all aspects of decision making in the organisation, for example where to purchase assets, source materials and sell products. A manager observes: The government will tell us to buy material to improve our product; it may be from Japan; meanwhile, this same material can be sourced from our own subsidiary inward…. Furthermore, the government determines who we sell our product to and at what price the product is sold. If the government has dealing with another country and wants to please them they will direct us to sell the product to them at favourable terms though we can obtain a better price by selling elsewhere. Another manger comments that “How NSE is run is all political. For example, we are asked by the government to sponsor or purchase things that are not in our budget and that have no value to our business”. Formal structures though exist do not serve any rational decision purposes. Instead these structures exist in theory but when it comes to practice political patronage is the dominant factor in how the organisation functions. All board and top management appointments are made by the ruling government and political changes result in changes in the board and top management. The technocrats who have been hired to run the organisation set goals in line with the ruling government’s goals. A manager explains that: In terms of goals and policies our own [meaning NSE’s] depends on the government’s goals and policies. The government controls our decisions; we cannot be commercialised. 31 6. Concluding comments Reforming public sector institutions in LDCs has generated a considerable debate during the past two decades (Cook and Kirkpatrick, 1995; Uddin and Hopper, 2003; Awio, 2007; Nor-Aziah and Scapen, 2007). This is particularly important as these reforms are often not adopted voluntarily but instead imposed on governments by the World Bank and its allies. The evidence we presented in this paper questions the process of implementing some of these reforms by engaging international consultants who have little understanding of the reality of these types of organisations. In an attempt to gain international legitimacy for the reforms, usually western consultants (mainly from the big 4) are engaged. The consultants believe that bringing ‘ideal Western systems’ into these types of organisations will work. Ideas that seem laudable on paper cannot just simply be transferred into these types of organisations and assume that they will work. Fyson (2009) argues about how the role of these consultants in shaping the reform process is not well understood. In the case of NSE these consultants were paid huge sums of money and implemented systems that were never used. As we have illustrated the users of these systems were not properly engaged in the process of development. There was thus no local ownership of the various MCS introduced in the organisation. The innovations are seen as imported without adaption to the specific local context. Hence, the MCS are viewed as too technical as they are not well understood by the majority of staff who are supposed to use these systems to support their-day-to-day decision making. 32 Clearly the reforms and the associated MCS did not work. Even the current Head of NSE acknowledged that: If we had genuinely embarked on the reforms, which were started with the strategic planning programme in 1986, NSE would have by now been in the league of successful companies in the world (NSE Internal Document). The employees are not committed to the new MCS innovations being implemented as they believe these systems will disappear with the appointment of a new management team which is a frequent occurrence in the organisation. For example, the MIS was perceived as a Project Alpha initiative, which would disappear with the project hence the system has not been updated nor used. SOEs are usually characterised by political and bureaucratic controls that dominate decision making (Hoque and Hopper, 1994; Uddin and Hopper, 2001; Uddin and Tsamenyi, 2005). Reforms in these organisations require political support and the government’s commitment to minimise interference. In the case we have examined, the government’s decision not to grant full autonomy to NSE and constant changes of top management derailed the reform. Top managers tended to align the interest of the organisation to that of the ruling government, thus affecting the continuity of reforms. 33 References Abrahamson, E. (1991) Managerial Fads and Fashions: The Diffusion and Reflection of Innovations. Academy of Management Review, 16(3): 586-612 Abrahamson, E. (1996) Management fashion. Academy of Management Review, 21(1): 254-285 Adeyemo, D. O. and Salami, A. (2008) A review of privatisation and public enterprises reforms in Nigeria. Contemporary Management Research, 4 (4): 401-418 Adhikari, R. and Kirkpatrick, C., (Ed.) (1990). Public enterprise in less developed countries: an empirical review. Public enterprise at a cross road. London, Routledge. Anderson, S. W. and Lanen, W. N. (1999) Economic transition, strategy and the evolution and of management accounting practices: the case of India. Accounting Oganisations and Society, 24(5/6): 379-412 Anya, Anya O. (2000) Privatisation in Nigeria, paper presented at the Nigerian Economic Summit at the Netherlands Congress Centre, The Hague, undated, www.nigerianembassy.nl/Prof.%20Anya.htm Asaolu, T. O., Oyesanmi, O., Oladele, P. O. and Oladoyin, A. M. (2005) Privatisation and commercialisation in Nigeria: implications and prospects for good governance. South African Journal of Business Management, 36(65-74) Awio, G., Lawrence, S. and Northcott., D. (2007) Community-led initiatives: reforms for better accountability? Journal of Accounting Organisational Change, 3(3): 209-226 Bangura, Y. (1987) IMF/World Bank conditionality and Nigeria’s structural adjustment programme. Uppsala, Nordiska Afrikainstitutet. Bello-Imam, I. B. and Obadan, M. I., (Ed.) (2004). Democratic governance and development management in Nigeria's 4th Republic, 1999-2003: the prologue. Ibadan, Jodad Publishers. Boston, J., Martins, J., Pallots, J. and Walsh, P. (1996) Public management: the New Zealand model Oxford: Oxford University Press. Brignall T.J.S. and Modell S. (2000). An institutional perspective on performance measurement and management in the New Public Sector, Management Accounting Research, Vol. 11, No.3, pp.281-306. Broadbent, J. and Guthrie, J. (1992) Changes in the public sector: a review of recent "alternative" accounting research. Accounting Auditing and Accountability Journal, 1992(2): 3-31 Callaghy, T. M. (1990) "Lost between state and the market: the politics of economic adjustment in Ghana, Zambia and Nigeria." In Nelson, J. M. (ed.). Economic crisis and 34 policy choice: the politics of adjustment in the Third World. New Jersey: Princeton University Press: 257-230 Cook, P. and Kirkpatrick, C. (1995) Privatisation policy and performance: international perspectives. NJ: Prentice-Hall. Crebert, G. (2001) Links between the purpose and outcomes of planning: perceptions of heads of school at Griffith University. Journal of Higher Education Policy and Management, 22: 173-183 Curran, T., Keller, G. and Ladd, A. (1988) SAP R/3 business blueprint: understanding the business process. Englewood Cliffs, NJ: Prentice-Hall. Davie, S. S. K. (2004) "Accounting and reforms initiatives: Making sense of situationspecific resistance to accounting." In Hopper, T. and Hoque, Z. (ed.). Research in Accounting in Emerging Economies. Elsevier Ltd. Supplement 2 Dawson, Patrick (1994), Organizational Change: A Processual Approach, London: Paul Chapman. Dawson, Patrick (1997), “In at The Deep End: Conducting Processual Research on Organisational Change”, Scandinavian Journal of Management, Vol. 13 (4), 389 – 405. Dawson, Patrick (2005), Changing Manufacturing Practices: An appraisal of the processual approach. Human Factors and Ergonomics in Manufacturing, Vol 15 (4), pp. 385-402. Dorsch, J. J. and Yasin, M. (1998) A framework for benchmarking in the public sector literature review and directions for future research. The International Journal of Public Sector Management, 11(2/3): 91-115. Ferreira, L. D. and Merchant, K. A. (1992) Field research in management accounting and control: a review and evaluation. Accounting Auditing and Accountability Journal, 5(4): 3-34 Fyson, S. (2009). Sending in the consultants: development agencies, the private sector and the reform of public finance in low-income countries. International Journal of Public Policy, 4(3-4), p.314-343 Green-Pedersen, C. ( 2002) New public management reforms of the Danish and Swedish states: The role of different social democratic responses. Governance: An International Journal of Policy, Administration, and Institutions, 15(2, April): 271-294 Greenwood, R., & Hinings, C. R. (1996). Understanding radical organizational change: Bringing together the old and the new institutionalism. Academy of Management Review, 21: 1022–1054. Hayes, D. C., Hunton, J. E. and Reck, J. L. (2001) Market reactions to ERP implementation announcements. Journal of Information Systems, 15(1): 3-18 35 Hood, C. (1991) A public management for all seasons? Public Administration. 69: 319. Hood, C. (1995) The "new public management" in the 1980s: variations on a theme. Accounting, Organisations and Society, 20(2-3): 93-109 Hopper, T., Tsamenyi, M., Uddin, S. and Wickramasinghe, D. (2009) Management accounting in less developed countries: what is known and needs knowing. Accounting Auditing and Accountability Journal, 22(3): 469-514 Hopper, T., Wickramasinghe, D., Tsamenyi, M. and Uddin, S. (2003) Finance accounting in developing countries: the state there in. Financial Management: 14-19. Hoque, Z. and Hopper, T. (1994) Rationality, accounting and politics: a case study of management control in a Bangladeshi jute mill. Management Accounting Research, 5: 5-30 Humphrey, C., Miller, P. and Scapens, R. W. (1993) Accountability and accountable management in the UK public sector. Accounting Auditing and Accountability Journal, 6(3): 7-29 Iheme, E. (1997) The incubus: the story of public enterprise in Nigeria. Lagos: The Helmsman Association. Jega, A. (2000) "General introduction: identity and transformation and politics of identity under crisis and adjustment." In Jega, A. (ed.). Identity transformation and iIdentity politics under structural adjustment in Nigeria. Stockholm: Elanders Gotab: 11-23 Jones, T. C. and Dugdale, D. (2002) The ABC bandwagon and the juggernaut of modernity. Accounting Organisations and Society, 27: 121-163 Kaplan, R. S. and Norton, D. P. (1996a) Balanced scorecard as a strategic management accounting system. Harvard Business Review, Jan-Feb,75-85 Kaplan, R. S. and Norton, D. P. (1996b) The Balanced scorecard: translating strategy into action. Boston: Harvard Business School Press. Kaplan, R. S. and Norton, D. P. (1996c) Linking the balanced scorecard to strategy. California Management Review, Fall (4): 53-79 Lapsley, I. and Pallot, J. (2000) Accounting, management and organisational change: a comparative study of local government. Management Accounting Research, 11: 213229 Larbi, G. A. (1999) The new public management approach and crisis states Geneva, United Nations Research Institute for Social Development 1-60. Lewis, P. (1999) Transition in Nigeria? Journal of Opinion, 27(1): 50-53 36 Malmi, T. (1999) Activity-based costing diffusion across organisations: an exploratory empirical analysis of Finish firms. Accounting Organisations and Society, 24: 649-672 McCausland, R. (2004) ERP for the masses. Accounting Technology, May: 14-20 Miles, M. B. and Huberman, A. M. (1994) Qualitative data analysis: a source book of new methods. CA: Thousand Oaks, SAGE. Miles, M.B., Huberman, A.M. (1994) Qualitative Data Analysis: An expanded sourcebook (2nd edn.), Sage: London & Thousand Oaks, California. Modell, S. (2001) Performance measurement and institutional processes: a study of managerial response to public sector reform. Management Accounting Research, 12: 437-464 Mserembo, P. K. and Hopper, T. (2004) "Public sector financial reform in Malawi." In Hopper, T. and Hoque, Z. (ed.). Research in Accounting in Emerging Economies. Elsevier Ltd. Supplement 2 Nor-Aziah, A. K. and Scapens, R. W. (2007) Corporatisation and accounting change:the role of accounting and accountants in a Malaysian public utility. Management Accounting Research, 18: 209-247 Nweke, F. J. (2007) FG wasted N13trn to state own enterprises. Daily Trust, 05 April. Obadan, M. I. and Edo, S. E. (2004) Overall economic direction strategy and performance. In Bello-Imam, I. B. and Obadan, M. I. (ed.). Democratic Governance and Development Management in Nigeria's Fourth Republic 1999-2003. Ibadan: Jodad Publishers: 15-34 O'connor, N. G., Chow, C. W. and Wu, A. (2004) The increased adoption of formal/explicit management controls in Chinese enterprises in transitional economy. Accounting Organisations and Society, 29(3): 349-375 Odusola, A. F. (2004) Privatisation of public enterprises in Nigeria: the journey so far. In Bello-Imam, I. B. and Obadan, M. I. (ed.). Democratic governance and development management in Nigeria's forth republic 1999-2003. Ibadan: Jodad publishers Ogden, S. G. (1995) Transforming of accountability: the case of water privatisation. Accounting Organisations and Society, 20(2/3): 193-218. Olowu, D. (2002) New public management: an African reform paradigm. Africa Development, XXVII(3 and 4): 1-16 Olson, O., Guthrie, J. and Humphrey, C. (1998) Global warning: debating international developments in new public financial management. Oslo: Cappelen Akademisk Forlag. Olukoshi, A. O. (1993) "Structural adjustment and Nigerian industry." In Olukoshi, A. O. (ed.). The politics of structural adjustment in Nigeria. London: James Currey: 54-74 37 Olukoshi, A. O. (1995) "The political economy of the structural adjustment programme." In Adejumobi, S. and Momoh, A. (ed.). The political economy of Nigeria under military rule: 1984-1993. Harare: Sapes Books: 138-162 Parker, L. and Gould, G. (1999) Changing public sector accountability: critiquing new directions. Accounting Forum, 23(2): 110-135 Patton, M.Q.(1990). Qualitative evaluation and research methods. SAGE Publications. Newbury Park London New Delhi Pettigrew, AM, (1985), The Awakening Giant, Oxford, Blackwell Pettigrew, Andrew M. (1990), Longitudinal Research on Change: Theory and Practice. Organization Science, Vol. 1 No. 3, 267 – 292. Pettigrew, Andrew M. (1997), What is a Processual Analysis?, Scandinavian Journal of Management, Vol. 13 No. 4, 337 – 348 Pettigrew, A. M., Woodman, R. W. and Cameron, K. S. (2001) Studying Organizational Change and Development: Challenges for Future Research, Academy of Management Journal 44(4): 697–713. Prizzia, R (2001), 'Privatization and Social Responsibility: A Critical Evaluation of Economic Performance. The International Journal of Public Sector Management, 14(6), pp.450-464 Rahaman, A. S., & Lawrence, S. (2001), “A negotiated order perspective on public sector accounting and financial control”, Accounting, Auditing and Accountability Journal, Vol.14, No. 2, pp.147-165 Rees, R. (1985) The theory of principal and agent. The Bulletin of Economic Research, 37(1): 3-26 Sharma, U. and Lawrence, S. (2005) Public sector reforms, globalisation, vs. local needs: the case of a state rental organisation in Fiji. Journal of Accounting and Organisational Change, 1(2): 141-164 Siti-Nabiha, A. K. and Scapens, R. W. (2005) Stability and change: an institutionalist study of management accounting change. Accounting Auditing and Accountability Journal, 18: 44-73 Stake, R. E. (1995) The art of case study. Thousand Oaks: Sage Publications. TCPC (1993) The Presidency: Technical Committee on Privatisation and Commercialisation, Final Report. 1. Toye, J. (1994) Dilemmas of development. Oxford: Blackwell. 38 Tsamenyi, M, Onumah, J, and Tetteh-Kumah, E, (2010), Post Privatization Performance and Organizational Changes. Critical Perspectives on Accounting, Vol.21 p.428-442 Uddin, S. and Hopper, T. (2001) A Bangladesh soap opera: privatisation, accounting, and regimes of controls in a less developed country. Accounting, Organisation and Society, 26: 643-672 Uddin, S. and Hopper, T. (2003). Accounting for privatisation in Bangladeshi: testing the World Bank claims. Critical perspectives on accounting, 14: 739-774 Uddin, S. and Tsamenyi, M. (2005) Public sector reforms and the public interest. Accounting, Auditing and Accountability Journal, 18(5): 648-674 Ugorji, E. C. (1995) Privatisation/commercialisation of state-owned enterprises in Nigeria: strategies for improving the performance of the economy. Comparative Political Studies, 27: 537-560 Umoren, R. (2001) Economic reforms and Nigeria's political crisis. Ibadan, Nigeria: Spectrum Books Limited. Wickramasinghe, D., Hopper, T. and Chandana, R. (2004) Japanese cost Management meets Sri Lankan politics: disappearance and reappearance of bureaucratic management controls in a privatised utility. Accounting Auditing and Accountability Journal, 17(1): 85-120 Wickramasinghe, D. and Hopper, T. (2005) A cultural political economy of management accounting controls: a case a study of textile mill in a traditional Sinhalese village. Critical perspectives on accounting, 16: 473-503 World Bank (2000). The quality of growth. New York, NY: Oxford University Press Yahaya, S. (1993) State versus market: the privatisation programme of the Nigeria state. London: James Currey. Yin, R. K. (1994) Case study design and methods. London: Sage. Yin, R. K. (2003) Case study research. London: SAGE Publications. Zayyad, H. R. (1990). Economic democratisation. International Conference on the Implementation of Privatisation and Commercialisation Programme in Nigeria: An African Experience Technical Committee on Privatisation and Commercialisation. 39 TABLES Table below summarises various reforms 1981 Reforms Key agents Presidential commission on public sector enterprises Shagari governments 1985 Buhari administratio n 1986 Structural Adjustment Programme/PSR reforms 2004 Debt forgiveness/Proj ect PACE Babangida government, World Bank, IMF, SAP, general public, NSE staff, Consultants NNPC top management, middle management, lower staff, consultants, NPM doctrine, IMF, World Bank, general public 40 Changes in NSE structure Restructure into nine subsidiaries Change MCS Sideline s in NSE MCS None None Creation of None None five semiautonomou s sectors None Strategic NSE staff and Planning the government NSE staff, frequent changes of NSE top management, and consultant FIGURES Substance of change Reform NSE into a commercial enterprise and new MCS introduced Conception Economic crisis and the Nigerian Government adoption of SAP Politics of change NSE top Mgt, middle Mgt, lower staff, consultant and the government influences Transition: The process of changing NSE’s structure, systems and operations to become a commercial organisation Context of change Entire NSE and different government Operations New structure and various MCS Figure 1: Processual framework and the process of NSE’s reforms. 41