Market Update Monday, December 09, 2013 1:45 p.m. Comments

advertisement

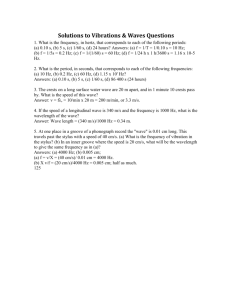

Market Update Monday, December 09, 2013 1:45 p.m. Comments: We've been waiting for the fundamental event that pushes the markets lower and confirms, at the least, that a bigger correction down has begun. The jobs numbers could have been just that catalyst but, markets have decided the news was good but just not good enough, so, the fed will not start tapering, yet! It is surprising that prices seem comfortable waiting for the exact announcement that the fed is going to start tapering. This is contrary to the way markets usually function because we all know that they forecast in advance by at least six months. Previous updates have mentioned that markets are stretching wave patterns as far as possible waiting for fundamentals to kick in. We are still in an historical bullish time frame for prices and the wave count seems to want to stretch out to the next degree which would allow the Santa Clause rally. The current move higher Friday and today created by this market sentiment brings the alternate wave pattern to a higher degree of probability that we will cover in today's update. Trades: Holding short with a 100% position as of Friday's move above 1805.00 with a cost average at 1804.50. Prices have rallied past our own rule that wave two shouldn't retrace more than 78.6% of wave one. We're still holding this trade now for two reasons...1) we're not risking much and...2) the Dow hasn't confirmed the same rally...yet!. Stops on 2/3 of the trade are at the previous highs of 1812.75 and we will hold 1/3 a little higher which was explained in an email this morning. We will explain better below. Summary: The rally from last Wednesday's low doesn't want to reverse and has risen higher than we would like in the S&P. We are waiting for prices to confirm the alternate by breaking above 1812.50 which does seem likely, eventually, whether today or not. The recent decline from the November 29 high into Wednesday last week counted as five waves but, can also count as three waves. More concerning with respect to the wave pattern was the failure by the S&P to break below the minimum targets that would have signaled a top in the market. We have labeled this chart of the S&P Index to show the alternate wave pattern where "minor" wave 5 is subdividing at one higher degree. This count doesn't actually work until prices break higher but there is good evidence that they will. The red horizontal line on the chart marks the previous wave (iv) low and also the top of where we show "minute" wave [i]. If a significant top was in place then prices shouldn't have held at that area unless the decline was all or part of a correction. If we draw a trend-line connecting the top of wave [i] and [iii], as shown on the chart, and then parallel that line at the bottom of wave [ii], we get the wave [iv] target which was hit almost exactly. Wave [ii] and [iv] are basically the same length. The five wave rally from the "minor" wave 4 low is sub-dividing at the "minute" degree with five sub-waves at the "minuette" degree within "minute" wave [i] and [iii]. We've had our eyes on this alternate pattern but with the market sentiment stretched at 25 year highs we were leaning toward a complete five wave pattern already in place. Another reason we put this wave scenario as the alternate was because this makes "minute" wave [i] of the impulse pattern the extended wave. The normal is for wave three to be the extended wave which is confirmed, as we've shown many times, by momentum. In this case the momentum is seen in wave [i] which would be correct because wave [i] is almost twice the size of wave [iii] under this wave count. Having this information will help, if this turns out to be correct, because wave [v] will have to be shorter than wave [iii]. We are in an Elliott limbo area now where prices have to make a new high to confirm the alternate or prices have to break the December 4 low to confirm a top. The current rally can also be wave (b) of wave [iv] as the alternate shown on the chart shows. A drop back to last week's low as wave (c) wouldn't be out of the question and would make the chart pattern more proportional. This is why we are only covering 2/3 of our position on a new high. If wave [iv] sub-divides with another push lower we will still be in the market. This would also buy more time for the yearend rally as wave [v] of 5 finally comes to an end. A push to new highs now, confirmed by the Dow, will indicate that wave [v] is already underway. And likewise a break below last week's low would confirm the market top. The way we've been counting the wave structure was showing today's rally as wave [ii]. Today's high makes wave (c) 1.618 x's (a) which is a normal calculation. Today's high has also come back to the underside of the recent trend-line that was broken during the decline. This is all perfect for a wave [ii] correction but, prices haven't given any sign of reversing lower, yet! Over the years we developed the rule that if we we're counting a wave two and it retraced more than 78.6% of wave one....we were probably wrong because the percentages that this happened were working against us. There have been times that this happened and now would be an instance because the Dow has failed, so far, to confirm this rally. A new high here could be wave (iii) of (v)....it could also create an "irregular" wave (b) unconfirmed by the Dow to be followed by a wave (c) drop to finish wave [iv]. Any move back to the low would confirm this chart as the correct wave scenario.