Differentiation and insurance – Why actuaries still think that

advertisement

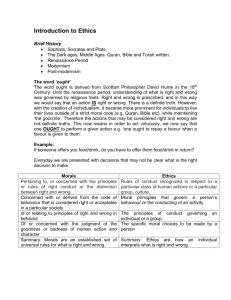

Differentiation and insurance – Why actuaries still think that sex is important? 1 Background The European Court of Justice ruled recently that it will no longer be possible to use gender as a risk factor in insurance for pricing purposes. The industry and also actuaries found this odd as it is so clear that using gender as a risk factor is actually good for everybody. In the discussions over the years it has been clear that what actuaries find self-evident is not at all self-evident generally. This article tries to give some understanding to the difficulty of communicating the case for gender differentiation. It starts by showing the trivial issue that differentiation as such makes economic sense. It continues with presenting two ethical standpoints, utilitarianism and Kantian ethics. Utilitarianism is one of the ethical theories saying that what is good can be decided by looking at the consequences – utilitarianism is thus a form of teleological ethics. Kantian ethics, on the other hand, is a deontological ethical theory: what is good can be decided a priori, without looking at the consequences. It seems that actuaries generally express their logic taking some form of utilitarianism as granted. It seems then that this logic is not easily acceptable to someone starting from a different ethical background. The meaning of the article is not to say that those who find using gender as a risk factor unacceptable are Kantian. Neither has it intended to say that all actuaries are utilitarian. It only tries to make it understandable that actuaries generally tend to use utilitarian argumentation which might not be easily welcomed by those who happen to subscribe to some non-utilitarian ethical theory. It does this by using Kantian ethics as an example. The article does not solve any problem or give guidance on how to formulate one’s argumentation to make it more widely accepted. It only tries to make it easier to understand why something one person finds self-evident is not at all evident to another person. It might also be interesting to note that actuaries are often quite conservative. We now think that gender differences are so evident that they must always have been used for pricing. It appears however that at least Finland has a very short history of using gender as a risk factor in life insurance. Different tables for men and women were introduced in Finland in 1973. This happened on the initiative of a certain actuary who had to spend many years to convince the industry and his fellow actuaries that this makes sense. 2 Logic of insurance Harper1 expressess the core of insurance principle as: “Insurance is based on the complementary principles of solidarity and equity in the face of uncertain risks. Solidarity implies the sharing by the population, as a whole or in broad groups, of the responsibility and the benefits in terms of costs, while equity means that the contribution of an individual should be roughly in line with his or her known level of risk.” It is usually understood that insurance has started when a community has decided to share risks among themselves. This has resulted in different kinds of organisations operating on the principle of mutuality. Usually the scope of mutuality has only gradually extended to larger spheres. There seems to have always been hesitancy over spreading risk sharing too wide in the fear that others might try to benefit from the arrangement in an inappropriate manner. Earlier mutual arrangements have gradually developed into more and more sophisticated structures and the operation has become increasingly business-like. Insurance is still today operated to a fairly large extent in the form of mutual companies even though limited companies have gained more and more share. Both types of companies operate to a large extent in a similar manner although certainly mutual companies have retained much more the idea of individuals agreeing internally to pool their risks. Both types of companies can also be thought as service providers that sell their products to the general public. Insurance talks always of pooling of risks, i.e. there exists always solidarity between the insured. This solidarity exists both in mutual insurance companies as well as in limited companies. There are different forms of solidarity. These can be expressed2 in the following way: “Risk solidarity is a consequence of risk sharing, and it implies that ex post the lucky support the unlucky. Subsidizing solidarity involves ex ante value transfers from one group to 1 2 Harper Peter S, Insurance and genetic testing, Lancet. 1993 Jan 23;341(8839):224-7 Franziska Tausch, Jan Potters,Arno Riedl, Preferences for Redistribution and Pensions: What Can We Learn from Experiments?, RM/10/044 another—as is the case, for example, when longevity risk is expected to be larger for one group (women) than for another (men). Income solidarity usually implies that income is redistributed from the rich to the poor” Insurance business can thus be thought of in two ways: - individuals subject to a certain risk agree to pool their risks by forming an organisation, an insurer, that carries the risk by collecting premiums (and sometimes doing retroactive collecting if premiums ex ante turn out to be insufficient), or - an insurance company, using the capital provided by its owners, offers pooling of risks to the general public by selling them insurance products. In both arrangements one needs to discuss the question whether the insurer should be able to use differentiation when covering the risks. In the first case one can ask whether a certain group of individuals should be allowed to exclude others from the population covered. In the second case the question is whether a service provider is allowed to exclude certain individuals from its clients. The possibility of differentiation seems to depend also on the type of the product. We might have different rules when we are talking of products for the masses that are necessary for everyday life, compared to products that might be considered luxury. As an example it might be impossible to rent a home or get a mortgage without insurance cover. Then it might be thought that such insurance cover must be accessible to everybody with terms that are understood to be fair. If however we are dealing with a luxury product (e.g. a huge life insurance policy) there might be more possibilities of allowing differentiation. One criterion might also be whether the insured can by his or her own actions influence to which category he or she belongs to. Gender and health are in this sense independent of the actions of the insured whereas for example smoking or other things related to habits is chosen by the insured. Age might be thought differently from gender and health as each individual basically goes through all ages. In private insurance it is usually thought that only risk solidarity (or probabilistic solidarity, as it is sometimes called) is possible3: “That lucky policyholders pay for the damages caused by less fortunate insureds is the essence of insurance (probabilistic solidarity). But in private insurance, solidarity should not lead to 3 Rob Kaas, Marc Goovaerts, Jan Dhaene, Michel Denuit, Modern Actuarial Risk Theory, Springer 2008 inherently good risks paying for bad ones. An insurer trying to impose such subsidizing solidarity on its customers will see his good risks take their business elsewhere, leaving him with the bad risks. This may occur in the automobile insurance market when there are regionally operating insurers. Charging the same premiums nationwide will cause the regional risks, which for automobile insurance tend to be good risks because traffic is not so heavy there, to go to the regional insurer, who with mainly good risks in his portfolio can afford to charge lower premiums”. As noted above, the logic of differentiation of risks is at least in some areas more and more under criticism and even legal constraints are imposed. We need to ask why this is so. 3 Different justifications In sociology there are analyses on why different individuals can make different decisions when presented the same problem. The problem there is why people knowingly or unknowingly justify their decisions in different ways. This issue has been discussed under the theory of justification. Maybe the most widely known theory of justification is created by the French sociologists Luc Boltanski and Laurent Thévenot4. Boltanski and Thévenot argue that justifications fall into six main logics exemplified by six authors: - civic (Rousseau), - market (Adam Smith), - industrial (Saint-Simon), - domestic (Bossuet), - inspiration (Augustine), and - fame (Hobbes). Later research has added further logics but for our problem these logics are sufficient. Boltanski and Thévenot argue that the logics or justifications conflict as people compete to legitimize their views of a situation. Boltanski and Thévenot show that these justifications can easily point to different conclusions: “Each of the different worlds refers to a particular prudence that is expressed in particular in the economics of the business organization. In the inspired world it is creativity. In the domestic world it is the logic of good human relations. In the world of opinion it is fame, marketing and 4 Luc Boltanski, Laurent Thévenot, On Justification, Princeton University Press, 2006 (Luc Boltanski et Laurant Thévenot : De la justification. Les economies de la grandeur , Paris: Gallimard 1991) good public relations. In the civic world it is the logic of the social contracts and citizenship rights. In the market world it is the logic of money, management and business strategy that is important. In the industrial world it is the logic of productivity. In the modern enterprise that is the paradigmatic rationality”. It seems that the actuarial or the industry logic is based on the industrial world. I have however only used the theory of Boltanski and Thévenot to illustrate how easy it is to come to different conclusions on an issue. We are going to look at next at the economic case of differentiation and then look at the issues from an ethical point of view. 4 Economic case It is of course trivial issue to show that differentiation generally makes economic sense. But maybe it helps to look at this more carefully. Let’s look at two cases of groups A and B (number of insured in each group nA and nB, respectively) - in the first case compensation C is the same for both groups but the groups have different probabilities pA and pB for the payment (e.g. death benefit for two age groups). - in the second case different compensation CA and CB for the groups but probabilities (p) are the same (e.g. capital value of old age pension for men and women – omitting the fact that reaching the pensionable age has different probabilities). It is easier to think of this in a deterministic environment as, at least in the first approximation, stochastics probably does not change things materially. Also, the situation is easier to understand with a lighter mathematical back bag. 4.1 Same compensation – different probabilities As stochastics can be disregarded, we can look just at net premiums. Each insured would pay a premium of pAC (respectively pBC) that would cover the claim amount nApAC (respectively nBpBC). If we combine the groups, the expected claims will be (nApA+nBpB)C. If the requirement is that premiums cannot discriminate, then the individual premium will be (nApA+nBpB)C / (nA+nB). If pA<pB ,then clearly pAC = (nApA+nBpA)C / (nA+nB) < (nApA+nBpB)C / (nA+nB) < (nApB+nBpB)C / (nA+nB) = pBC. In principle all is well here – but we will return to this in the connection of adverse selection. 4.2 Same probabilities – different compensation Again we can just look at net premiums. The premium would be pCA (respectively pCB) and the claim amount would be nApCA (respectively nBpCB). If we combine the groups, the expected claims will be p(nACA+ nBCB). If we cannot discriminate in premiums, the premium would be p(nACA+ nBCB)./ (nA+ nB). If CA<CB then, as in 1.1, clearly pCA < p(nACA+ nBCB)./ (nA+ nB). < pCB. Again, in principle all is well here – but there is a need to return to this in the connection of adverse selection. 5 Adverse selection It is evident that individuals in group A will feel deceived, the more so if the combined tariff is much higher than the actual tariff for group A would have been. It is somewhat difficult to judge how high the difference needs to be before individuals start to react. Anyway, if we start from the economists’ hypothesis of complete markets, this should happen immediately as the price differs between the groups. This would, when we talk of voluntary insurance, result into a situation where some individuals think they are better off by not taking insurance. This leads to a phenomenon actuaries call adverse selection. When adverse selection occurs, the premiums are insufficient. Therefore, anticipating adverse selection, premiums need to be loaded. This will result in more individuals not insuring which would again result in a higher loading. Ultimately the premium would be set at pBC or pCB. In this situation only those belonging to group B would buy insurance. Clearly this would be suboptimal when you look at the whole. Actuarial logic says that to cover as efficiently as possible the largest amount of insureds one would need to differentiate between groups A and B. Referring to theory of justification this would clearly apply the industrial logic. One can easily see that differentiation based on industrial logic would run into difficulties when trying to make decision makers applying another logic to accept this. As the issue is extensively analysed elsewhere5,6 I am not going to spend more time on this here but look at the ethical case. Jyri Liukko, Solidaarisuuskone – elämän vakuuttaminen ja vastuuajattelun muutos, Gaudeamus Helsinki University Press, 2013 5 Traditional insurance has tried to apply easily verified and objective criteria for differentiation. Additionally a desirable characteristic of a criterion is that the insured cannot have direct influence on it. Criteria like gender and age are thus easily applicable and observed. Some insurers use criteria like smoking which is much more difficult as the insured can tell he is nonsmoker and still continue smoking. With the choice of criteria modern technology is increasingly offering new methods of differentiation. Genetic testing has given rise to much discussion on differentiation although currently this testing has delivered fairly limited actual techniques for insurance (and using genetic testing in underwriting is forbidden in many jurisdictions). It is however evident that medical technology in different forms, i.e. not only in genetic testing, will create more and more sophisticated methods to differentiate between different risks. 6 Moral case It is clear from the analysis above that actuaries can easily say that all differentiation in premiums is beneficial for the society from an economical point of view. On the other hand this would in many cases mean discrimination that would not be morally acceptable. For example, in most cultures people would hardly be content if insurance would be allowed to discriminate according to ethnic background. Gender has however been an issue where differentiation has not been thought to mean discrimination. Now its use has been prohibited in the European Union. We will look at two ethical theories and show that based on these one can make different conclusions of the acceptability of gender differentiation. These ethical theories are presented here only very briefly but there are good texts available elsewhere. For a good condensed treatment the reader 6 Jyri Liukko, Genetic discrimination, insurance, and solidarity: an analysis of the argumentation for fair risk classification, New Genetics and Society Volume 29, Issue 4, 2010 Special Issue: SOLIDARITY MATTERS: EMBEDDING GENETIC TECHNOLOGIES IN PRIVATE AND SOCIAL INSURANCE ARRANGEMENTS could consult a basic textbook7. Utilitarism has good separate treatments8,9 and also Kantian ethics is treated extensively elsewhere10,11. 6.1 Utilitarianism Utilitarianism is a form of consequential ethics. The general definition of consequentialism is “Of all the things a person might do at any given moment, the morally right action is the one with the best overall consequences”12. Consequentialism is based on two principles: - Whether an act is right or wrong depends only on the results of that act - The more good consequences an act produces, the better or more right that act. There are different forms of consequential ethics. The one that seems to correspond actuarial thinking is utilitarianism. Utilitarianism states that people should maximize human welfare or well-being. There are utilitarian thoughts also earlier but utilitarianism as a clearly identified logic is thought to start with Jeremy Bentham (1748 – 1832) after whom it was elaborated by John Stuart Mill (1806-1873). In its classical form utilitarianism says that no act is inherently wrong as everything depends on the consequences of the act. For example lying or even murder can be accepted if the result can be thought to be beneficial. There are other problems with utilitarianism that have resulted in other theories for example by John Rawls (1921-2002). 6.2 Kantian ethics Kantian ethics is the result of the work of Immanuel Kant (1724-1804). It is one form of dutybased or deontological ethics. In deontological ethics some actions are wrong or right in themselves, regardless of the consequences. Deontological ethics is sometimes called nonconsequentialist ethics just because you cannot justify an action by showing that it produces good consequences. 7 Julia Driver, Ethics, the Fundamentals, Blackwell Publishing, 2007 Alexander, Larry and Moore, Michael, "Deontological Ethics", The Stanford Encyclopedia of Philosophy (Winter 2012 Edition), Edward N. Zalta (ed.), URL = <http://plato.stanford.edu/archives/win2012/entries/ethics-deontological/> 9 http://www.bbc.co.uk/ethics/introduction/consequentialism_1.shtml 10 Johnson, Robert, "Kant's Moral Philosophy", The Stanford Encyclopedia of Philosophy (Winter 2013 Edition), Edward N. Zalta (ed.), URL = <http://plato.stanford.edu/archives/win2013/entries/kant-moral/> 11 http://www.bbc.co.uk/ethics/introduction/duty_1.shtml#top 12 Internet Encyclopedia of Philosophy, http://www.iep.utm.edu/conseque/ 8 Kant thought that it is possible to develop a consistent moral system by using reason. Kant created the so-called categorical imperative that is the core of Kantian ethics and can be expressed in two formulations (Kant stressed that these versions are different ways of expressing the same rule): - always act in such a way that you can also will that the maxim of your action should become a universal law, and - act so that you treat humanity, both in your own person and that of the another, always as an end and never merely as a means. The first formulation can be simplified to say that always act in such a way that you would be willing for it to become a general law that everyone else should do the same in the same situation. Like utilitarianism also Kantian ethics creates paradoxes but these are not essential to what follows. 6.3 What can happen when a utilitarian discusses with a person who subscribes to Kantian ethics One can reach different judgments based on moral assumptions. Two examples of this are in the following. If we start from utilitarianism (or Bentham) then our goal is the maximum of total benefit. Of a smaller concern here is who gets the benefit. We could easily say that full differentiation in insurance always increases the overall (financial) utility and should thus be allowed. This is so because the maximum amount of those needing insurance cover could be actually covered with the lowest cost. This would certainly mean that quite a few people actually needing cover (maybe in fact those most in need) would either be excluded from the insurance pool or they would have to pay premiums they cannot afford. If however we start from Kantian ethics we might reach another conclusion. From Kantian ethics we would say that all actions should be proposed as universal laws (categorical imperative). If we can choose with our individual choices to which group, A or B, we belong, we could conclude that discrimination is fair. If, however (as is usually the case with gender), we would not be able to belong to both groups, our view would be different. We could not, generally and in Kantian ethics, say to an individual in group A that he/she should accept a higher premium because this individual could never belong to group B. Of course we could think that educated people should accept this but it seems that already this is something we cannot generally require. It seems actuaries have the tendency of motivating things knowingly or unknowingly using utilitarian ethics as the starting point (and this might not only apply to actuaries but to the whole insurance industry motivating its existence through utilitarianism or, using the thoughts of Boltanski and Thévenot, the industrial logic as the mode of justification). What we have seen above is that there are other ways of looking at a single situation. Actuaries often find it hard to understand why their logic is not accepted. Why for example such a trivial fact is not understood that differentiation of risks is always to the benefit of everybody. Maybe actuaries should however learn to think that utilitarianism is not the only way of looking at things and there are valid ways of looking at things from another viewpoint. Probably that would not make it easier for actuaries to win support to their arguments but it would at least make the world more easily understandable. Not all risk factors are the same. In the European Union there is now under discussion a directive on age and disability. One can say that age is an interesting risk factor in Kantian ethics. We can say that everyone goes through all ages so according to Kantian ethics differentiation might still be possible. Another way of looking at this is to say that actually using age as a risk factor is not differentiation or discrimination. This conclusion can be reached by starting from the fact that, at least in principle, everybody as an individual goes through all states, all ages. In this sense one can say that using age does not mean a decision of dividing individuals to different categories. Instead, using age is just stating the fact. We see from statistics that longevity is strongly correlated with gender. We see however also that longevity is strongly dependent on socioeconomic factors. Socioeconomic factors have in themselves a factor that very strongly increases mortality. This risk factor is smoking. Maybe actuaries could find it easier to say that they think sex is important but smoking is more important than sex. But in any case actuaries do these both things knowingly or unknowingly subscribing to the ideas of utilitarianism.