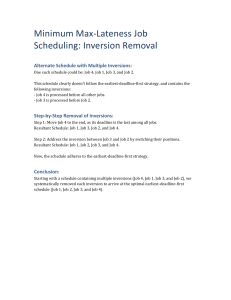

DEFINITION of `Corporate Inversion`

advertisement

DEFINITION of 'Corporate Inversion' Re-incorporating a company overseas in order to reduce the tax burden on income earned abroad. Corporate inversion as a strategy is used by companies that receive a significant portion of their income from foreign sources, since that income is taxed both abroad and in the country of incorporation. Companies undertaking this strategy are likely to select a country that has lower tax rates and less stringent corporate governance requirements. INVESTOPEDIA EXPLAINS 'Corporate Inversion' Corporate inversion is one of the many strategies companies employ to reduce their tax burden. One way that a company can re-incorporate abroad is by having a foreign company buy its current operations. Assets are then owned by the foreign company, and the old incorporation is dissolved. For example, take a manufacturing company that incorporated itself in the United States in the 1950s. For years the majority of its revenue came from U.S. sales, but recently the percentage of sales coming from abroad has grown. Income from abroad is taxed in the United States, and U.S. tax credits do not cover all taxes that the company has to pay abroad. As the percentage of sales coming from foreign operations grows relative to domestic operations, the company will find itself paying more U.S. taxes because of where it incorporated. If it incorporates abroad, it can bypass having to pay higher U.S. taxes on income that is not generated in the United States. This is a corporate inversion. Corporate inversion is not considered tax evasion as long as it doesn’t involve misrepresenting information on a tax return or undertaking illegal activities to hide profits. ADDITIONAL NOTES From TaxFoundation.org: A corporate inversion does not typically change the operational structure of a company. In most cases, an inversion simply means the addition of a small office in the company’s new foreign "home." Therefore, a re-incorporation rarely, if ever, leads to the loss of American jobs. In fact, to the extent that a corporate inversion leads to significant savings from a lower tax burden, employees may benefit through increased wages or more jobs. The practice of shopping around for a business-friendly environment in which to incorporate is nothing new. For decades, corporations (and non-profit organizations) have flocked to Delaware as the best place to incorporate because of that state’s well-established legal precedents, relatively open corporate governance regulations, and fully-developed insurance market. More than 308,000 companies are incorporated in Delaware, including 60 percent of Fortune 500 firms and 50 percent of the corporations listed on the New York Stock Exchange. Clearly, most of these companies do not have their headquarters or even a significant presence in Delaware. A company’s state (or country) of incorporation merely provides a point of presence by which the company can take advantage of certain laws and policies to better fulfill its mission of serving customers, employees, and shareowners. http://taxfoundation.org/article/corporate-inversions-introduction-issue-and-faq 10 Questions on Inversions: 1. Do you feel it is unethical for a firm primarily based in New Jersey to incorporate in Delaware in order to reduce its tax bill and/or be subject to Delaware business laws? 2. Do you feel it is unethical for a firm primarily based in the USA to incorporate in Ireland, the Bahamas, or another low-tax country? 3. Do corporate inversions cost the USA jobs? 4. Do corporations have a duty to pay more tax than laws mandate? 5. If not, why do politicians criticize them for perfectly legal inversions? 6. Can the USA pass laws preventing companies who invert from doing business in the USA? ________ Inversions completed in the past year included Chiquita Bananas and Burger King. How would voters react to shutting down these companies’ American operations? 7. A huge proposed inversion which did not go through was Pfizer, the big drug company. Can we risk removing their products from US consumers? 8. What type of law could the USA pass to prevent inversions? 9. Do you think we will continue to see corporate inversions? 10.What types of opportunities do inversions create for young professionals?