SUMMARY AND FURTHER ACTION POINTS DPG Main – 15th

advertisement

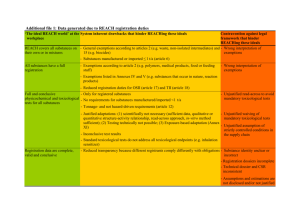

SUMMARY AND FURTHER ACTION POINTS DPG Main – 15th January 2013 1. Taxation reform in Tanzania and new DP exemption trends Positive trends observed in tax revenue management and collection are leading to an improved fiscal space together with a general decline in exceptions as a share of GDP. Exemptions on VAT constitute 2/3 of all exemptions so addressing VAT reform is key and receiving high-level GoT attention. VAT reform driven by GoT with IMF support aim at simplifying regimes and broadening tax base based through principles of equal and consumption-oriented taxation. Policy decision by Denmark to phase out the use of exemptions on ODA globally based on aidpolitical, administrative and legal grounds. Norway is expected to follow a similar path in the coming months, although through a pilot-approach. While much attention is given to taxation, exemptions and the role of ODA in UN, OECD and G20 fora, many views on exemptions do exist among DPs, particularly related to exemptions on ODA. A continuation of the discussion might be scheduled under the PER. 2. General Budget Support update The content of PAF 2013 is in place with a few outstanding issues on some KPAs, and 2013/14 GBS projections have been communicated to MoF. Following the release of the GBS Annual Review report, GBS commitments will be firmed up, potentially towards end March. GBS Evaluation is nearing completion. 3. Public Expenditure Review update PER Champion Group meeting on the 16/12. Status: 3 out of 4 PER study ToRs are ready and financing arrangements are being completed. Discussion on how to broaden the PER process to nonstate actors like CSOs, academia etc. together with the budget for Secretariat. 4. Medium Term Expenditure Framework Commitments Quality of MTEF Commitments has improved since December but is still much lower (USD 330 million) than the expected (app. USD 1.5 Bn) for 2013/14. MoF has extended deadline to 15/1. 5. AoB a) IMF Executive Board/PSI Review: the 5th PSI review/1st SCF completed on 9/1-13. Some incorrect media reports regarding threshold for non-concessional borrowing b) Big Results Now: 6 labs (Energy, Transport, Agriculture, Education, Revenue, Water) maybe with an additional area commencing soon under BoT Governor leadership. Expected that 25-30 key stakeholders per lab over a 6-week period will develop analysis and operational plans under McKinsey facilitation. Some DP participation might be requested by POPC and sector leads may be contacted. c) MCC: Tanzania has been selected to start preparations towards a new MCC-Tanzania Compact II by MCC Board of Directors. d) WB/Energy sector support: Draft energy sector support description is close to finalization with expected presentation to WB Board around April. e) New PMG Leads: Request from UNDP and WB for interested candidates in taking over the Poverty Monitoring Group lead positions. 6. Next DPG meeting: Tuesday, February 5th 2013 Minutes of DPG MAIN January 15th, 2013 SWEDEN/FINLAND EMBASSY CONFERENCE ROOM 1. Welcome and adoption of agenda and approval of DPG December minutes The meeting was opened by DPG Co-Chair, Mr. Gerard Considine. The agenda was adopted and minutes from the December 2012 meeting were approved. The DPG Co-Chair introduced and welcomed the new USAID Director, Ms. Sharon Cromer. During the meeting, the new UNHCR Representative, Ms Joyce Mends-Cole, was introduced. 2. Special Issue: Taxation reform in Tanzania and new DP exemption trends The Co-Chair noted that while revenue collection has increased from 10 to 15 percent of GDP over a five-year period, Tanzania’s recent performance is still considered below its potential. While broadening the tax base and strengthening systems are key components, addressing challenges of tax exemptions is also considered important for designing a tax system, which promotes inclusiveness and development. IMF presented tax collection and exemption trends in Tanzania as well as IMF’s support to VAT reform. Positive trends were noted in tax revenue management and collection which is leading to an improved fiscal space and a general decline in exceptions as a share of GDP. Most exemptions relate to VAT on imports and domestic transactions, and are estimated to account for almost 2/3 of all exemptions. It was therefore raised that addressing VAT exemptions should remain the key priority for GoT and development partners in relation to the national target of a gradual reduction in tax exemptions to 1 percent of GDP. To this end, IMF support GoT redrafting the VAT bill aiming to reform the application of VAT into a more simple and equitable tax. Similarly, a move towards emphasizing legislative exemptions and reducing the use of discretionary exemptions can be expected. Following the IMF presentation, the DPG Co-Chair noted that since 2010, the OECD/DAC Task Force on Taxation and Development has been analyzing and promoting a more coherent OECD/DAC engagement in strengthening tax systems in developing countries under the chairmanship of South Africa and the Netherlands. Strong links have been developed between the OECD/DAC and the UN and the G20 on the role of taxation and exemptions for recipient country development and revenue collection. Denmark presented a recent decision to phase out the use of exemptions on ODA globally. Since November 2012 Danish embassies are no longer required to request exemptions of VAT on goods and services for development activities. The main arguments for Denmark’s decision were presented: a) Aid political: Based on trends in the aid effectiveness agenda in recent year with the increasing focus on the use of country systems, Denmark find that phasing out the use of exemptions will further support this process while also specifically minimizing opportunities for rent seeking and misuse of exemptions. b) Administrative: The management of tax exemptions is considered labor intense for both embassies and recipient Governments, and can therefore constitute an important cost saving. c) Legal: Denmark finds that there are at best unclear international agreements and legislation for the use of exemptions in ODA. Norway noted that it is expected to follow a similar path in the coming months based on similar considerations to those of Denmark. It was however emphasized that no official decision has been taken yet. It is expected that a gradual implementation might be sought, starting with all budget support countries. Both Denmark and Norway clarified that the rule of VAT exemptions however remain in place for humanitarian activities, mission costs and any co-financing arrangements with other parties which does not follow the new policy. Discussion While appreciation was noted on the Danish and potentially Norwegian decisions, it was raised that for some DPs a similar approach would not be possible given that budget support as an instrument is linked to a performance framework and ultimately with the option of discontinuing support. Indirect budget support through the phasing out of exemptions would thus not undergo any additional scrutiny beyond the established public financial management system of the recipient country. Similarly, some DPs noted that payment of tax using ODA is not possible according to national laws and Parliament oversight requirements. To this end, it was raised whether a corresponding increase in the ODA envelope was expected as the move would result in a net loss in programmable ODA budgets. It was noted by Denmark that while no additional financing would be available to cover the additional VAT expenditures, a pragmatic approach has been adopted where all existing engagements will be assessed on an individual basis in order to determine whether core activities will suffer. In such cases, exemptions could still be raised. Furthermore and related to the perceived loss of administrative control over the VAT paid, it was clarified that the headquarter decision deliberately seeks to reaffirm the need to fully use country systems. It was also noted by the EU that a flexible approach to covering exemptions which cannot be finalized with additional EU funds had become possible from 1 January 2013. Further clarify required whether future ACP agreements would need to be amended. Denmark and Norway echoed that decisions were yet to be taken whether new bilateral agreements would be needed. While the need to reduce the use of discretionary exemptions was supported, concern over loss of flexibility in project management was raised as many bilateral agreements remain unspecific when it comes to exemptions. It was clarified by IMF however, that the VAT reform was not expected to eliminate the use of discretionary exemptions but rather simplify and significantly enhance the legalistic approach. A reduction in the use of discretionary exemptions should therefore be expected. Recognizing that there are many diverting DP views on the matter, it was noted that international dialogue in OECD/DAC, the UN and G20 on ODA exemptions primarily relates to issues of transparency rather than phasing out the use. As the PER study on tax exemptions is finalized in the coming months, a discussion on the role of exemptions might therefore be tabled focusing on the wider implications for improving domestic public financing. Way forward The PER study on Managing Tax Exemptions scheduled for the coming months is expected to give further insights into the role, benefit and volume of exemptions. A general discussion might follow once the study is finalized. 3. Matters Arising a. GBS update The GBS Chair presented the outcome of a troika meeting with GoT on 21st December 2012. The troika meeting agreed on the content of PAF 2013 with a few outstanding technical issues on some key policy actions. GBS commitments were confirmed 3 weeks after the 19/11 GBS Annual Review in accordance with the GBS MoU. Levels are similar to 2012 but with an increasing weight on performance related tranches. Potential WB contributions currently under preparation might ultimately see an overall increase in the 2013/14 budget support. Following the release of the GBS 2011/12 Annual Review report, GBS commitments will be firmed up and communicated to GoT towards the end of March. EU informed that the draft final GBS Evaluation Report is expected towards the end of January. This will trigger a range of consultations and possibly a seminar in March with the larger DPG group. b. PER update The World Bank informed that the 3rd meeting of the PER Champion Group took place on 13 December 2012. The following three PER study ToRs are ready: (i) Agricultural Input Subsidy (ii) Managing Tax Exemptions (iii) Public-Private Partnerships (PPPs) and other PPP activities/Public Investment Management (PIM) Financing arrangements for these three studies are being completed. For the 4th PER study on Public Expenditure Tracking a Concept Note is in place. Discussion is ongoing on how to broaden the PER process to non-state actors like CSOs, academia etc. The budget for Secretariat also being discussed. c. Medium Term Expenditure Framework (MTEF) Commitments The DPG Secretariat informed that the deadline for MTEF commitments was 31 December 2012, but due to low compliance of DPs, MoF had decided to extend the deadline till 15 January 2013. Although the quality of MTEF Commitments has improved since December, it is still much lower (USD 330 million) than the expected (app. USD 1.5 Bn) for 2013/14. It was noted that GoT will use the figures submitted as the basis for the 2013/14 budget preparations. As such and in line with MoF’s requests during the DPG December meeting, timely submission of MTEFs for GBS, Basket and Project support is important for the strengthening of the national budget process If not yet completed, DPs were requested to enter MTEF commitments by CoB Tuesday 15/1 and communicate any issues directly to Ministry of Finance with copy to the DPG Secretariat. 4. AoB a) IMF Executive Board meeting IMF informed that the Executive Board had completed the 5 th review on Tanzania’s economic performance under the Policy Support Instrument (PSI) and the 1 st review on the precautionary Standby Credit Facility (SCF) arrangement. Macro-economic achievements of Tanzania were considered favorable and the budget for 2012/13 well balanced with room for inclusion of additional spending on social sectors, and at the same time aiming for debt-stabilization. IMF further explained that media reports regarding an increase in the ceiling for nonconcessional borrowing had not been reflective of the discussion and decisions made. The IMF Board did not endorse a higher ceiling for new non-concessional borrowing but rather accommodated the part of the financing for the Mtwara-DSM gas pipeline that was intended by the government to be concessional but subsequently turned out to fall marginally short of the concessionality threshold. b) Big Results Now DFID informed that the Steering Committee for the BRN has been established under the chairmanship of the BoT Governor Ndulu and with a direct reporting line to the President. Six labs on Energy, Transport, Agriculture, Education, Revenue, Water are commencing soon under BoT Governor leadership. A seventh lap focusing on gas is under discussion. The time line consists of three phases: (i) Dec – Feb: research/finalizing scope on the 6 labs. (ii) Feb – April: lab meetings with GoT, DPs, Private Sector and CSOs (iii) April – May: alignment to budget process 25-30 key stakeholders per lab will develop analysis and operational plans under McKinsey facilitation. Some DP participation might be requested by POPC. It was agreed that the DPG Co-Chairs will seek further clarification from POPC regarding DP involvement and support to the process. c) MCC update: Tanzania eligible for 2nd compact In December, the MCC Board of Directors selected Tanzania to develop a second compact proposal. Against this backdrop, Tanzania is starting the development of a new proposal for the second compact, which however is contingent on successful implementation of the first compact. d) WB/Energy Sector support Documentation for the new WB energy sector support is close to finalization. It is expected that the program support will be presented to the WB Board in April. e) New Lead for DPG Poverty Monitoring Group (PMG) Request from UNDP and WB for candidates interested in taking over the Poverty Monitoring Group Lead and Deputy Lead positions to contact the current Lead: Amarakoon Bandara: amarakoon.bandara@undp.org. 5. Next DPG meeting: Tuesday, February 5th 2013 The next DPG Main meeting will be on 5th February 2013.