SECOND MINORITY REPORT ON PENSIONS

advertisement

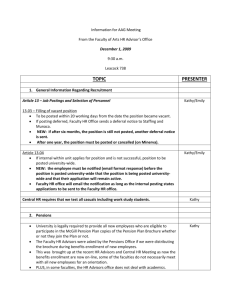

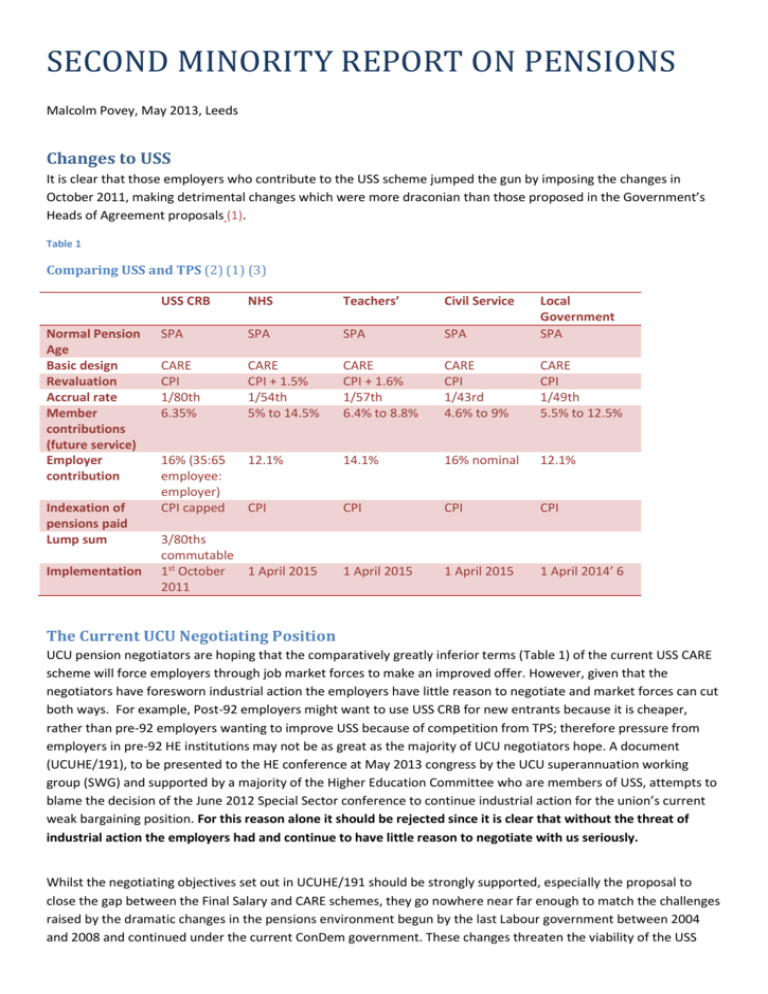

SECOND MINORITY REPORT ON PENSIONS Malcolm Povey, May 2013, Leeds Changes to USS It is clear that those employers who contribute to the USS scheme jumped the gun by imposing the changes in October 2011, making detrimental changes which were more draconian than those proposed in the Government’s Heads of Agreement proposals (1). Table 1 Comparing USS and TPS (2) (1) (3) Normal Pension Age Basic design Revaluation Accrual rate Member contributions (future service) Employer contribution Indexation of pensions paid Lump sum Implementation USS CRB NHS Teachers’ Civil Service SPA SPA SPA SPA Local Government SPA CARE CPI 1/80th 6.35% CARE CPI + 1.5% 1/54th 5% to 14.5% CARE CPI + 1.6% 1/57th 6.4% to 8.8% CARE CPI 1/43rd 4.6% to 9% CARE CPI 1/49th 5.5% to 12.5% 16% (35:65 employee: employer) CPI capped 12.1% 14.1% 16% nominal 12.1% CPI CPI CPI CPI 1 April 2015 1 April 2015 1 April 2014’ 6 3/80ths commutable 1st October 1 April 2015 2011 The Current UCU Negotiating Position UCU pension negotiators are hoping that the comparatively greatly inferior terms (Table 1) of the current USS CARE scheme will force employers through job market forces to make an improved offer. However, given that the negotiators have foresworn industrial action the employers have little reason to negotiate and market forces can cut both ways. For example, Post-92 employers might want to use USS CRB for new entrants because it is cheaper, rather than pre-92 employers wanting to improve USS because of competition from TPS; therefore pressure from employers in pre-92 HE institutions may not be as great as the majority of UCU negotiators hope. A document (UCUHE/191), to be presented to the HE conference at May 2013 congress by the UCU superannuation working group (SWG) and supported by a majority of the Higher Education Committee who are members of USS, attempts to blame the decision of the June 2012 Special Sector conference to continue industrial action for the union’s current weak bargaining position. For this reason alone it should be rejected since it is clear that without the threat of industrial action the employers had and continue to have little reason to negotiate with us seriously. Whilst the negotiating objectives set out in UCUHE/191 should be strongly supported, especially the proposal to close the gap between the Final Salary and CARE schemes, they go nowhere near far enough to match the challenges raised by the dramatic changes in the pensions environment begun by the last Labour government between 2004 and 2008 and continued under the current ConDem government. These changes threaten the viability of the USS scheme, even in its altered form whilst the viability of the TPS scheme depends very much on future actions of teachers and other public sector trade unions. In the next section an alternative strategy is outlined which addresses these issues. An alternative Trade Union strategy on pensions The UCU needs to make common cause with those trade unions still currently in dispute over pensions. These include the NUT, the FBU and the CWU. The UCU also missed an opportunity to work with Pension Professionals such as Con Keating (4) who put forward powerful arguments in favour of Defined Benefit schemes, undermining the current consensus on a move to Defined Contribution Schemes. Regardless of whether our members are in TPS, USS or another pension scheme we need to campaign hard for the regulatory changes needed to protect DB schemes from market volatility .We need to change the TUC’s current support for what Berry and Stanley call ‘the third consensus’ (5) and instead support the demands of the National Pensioners Convention campaign for a decent state pension (6). We need to strongly put the case for DB pensions (7), both to our members and the public in general. In the conclusion to their document written for the TUC entitled “Third Time Lucky” Berry and Stanley welcome the move to auto-enrolment and the restoration of the link between pensions and earnings proposed in the draft pensions bill, as recommended by the Pensions Commission (8). Unfortunately they ignore all the other aspects of pension reform, beginning with the changes in state pension age enacted by the last Labour Government in 2008, which dramatically undermine any benefits which might accrue. Even Berry and Stanley recognise serious problems with regard to the proposed low level of contributions and the dominance of employers and pension providers in pensions provision. They go on to say in their conclusion that “ … even the better structures in the third consensus run the risk of a race to the statutory bottom. Employers could discharge their obligations with relatively limited fuss, by handing over control of their workplace pension schemes to providers such as insurance companies, offering products with limited cost and administrative complexity to the employer, but higher costs and fewer safeguards for the actual savers and keeping contributions at the current minimum levels in perpetuity.” It is vital that the Labour Movement returns to the principle of socialising the risk to workers’ pensions. The move to Defined Contribution pensions is undermining the intergenerational covenant, threatening to leave entire generations without pensions and creating a division in society which threatens existing pensioners. Finally UCU pension negotiators must recognise that pensions are deferred wages and that the campaign for decent pensions is part of the fight for decent wages. This means that the general political struggle against the austerity consensus and a united fight in defence of pay levels with both public and private sector unions should be our priority. There are some encouraging signs that Trade Unionists are waking up to the disaster that the ConDems are preparing for working people in the United Kingdom. For example UNISON has recommended (May 23, 2013) that its members reject the most recent pay ‘offer’ in Higher Education. 1. HM Treasury. Government announces heads of agreement on public service pensions reform. [Online] 20 December 2011. [Cited: 21 April 2013.] http://www.hm-treasury.gov.uk/press_146_11.htm. 2. Pensions Policy Institute. Home Page. [Online] 2013. http://www.pensionspolicyinstitute.org.uk/. 3. Universities Superannuation Scheme. Summary of Scheme Changes. [Online] 9 June 2011. [Cited: 21 April 2013.] http://www.uss.co.uk/news/Documents/Important%20Info%20for%20USS%20members.pdf. 4. Keating, Con. [Online] 2013. www.futureofpensions.org/2.html. 5. Berry, Craig and Stanley, Nigel. Third Time Lucky. s.l. : TUC Touchstone Extras, 2013. 6. National Pensioners Convention. A state pension for the 21st Century. national Pensioners Convention Home Page. [Online] 2013. [Cited: 21 April 2013.] http://npcuk.org/wp-content/uploads/2011/09/A-state-pension-for-the21st-century-NPC-response.doc. 7. Povey, Malcolm J W. Pensions. [Online] 2011. http://www1.food.leeds.ac.uk/mp/Pensions/Pensions%20papers%20by%20Malcolm%20Povey.htm. 8. Institute for Government. Pensions Reform: the Pensions Commission (2002-2006). 2011.