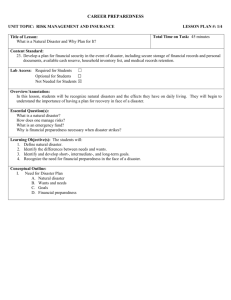

Disaster Recovery: Risk Management Lesson Plan

advertisement

CAREER PREPAREDNESS UNIT TOPIC: RISK MANAGEMENT AND INSURANCE Title of Lesson: Recovery from a Disaster LESSON PLAN #: 2/4 Total Time on Task: 45 minutes Content Standard: 23. Develop a plan for financial security in the event of disaster, including secure storage of financial records and personal documents, available cash reserve, household inventory list, and medical records retention. Lab Access: Required for Students ☐ Optional for Students ☐ Not Needed for Students ☒ Overview/Annotation: This lesson re-enforces competencies achieved under Standards 18 and 19 as students recognize financial records and personal documents that are essential to recover from a natural disaster. Essential Question(s): What would you need if there were an emergency? Are there personal items that you would take? How much money would you need? How would you access your money? What important documents would you need? Learning Objective(s): The students will: 1. Identify types of important documents. 2. Adopt strategies for managing important documents. 3. Explore the benefits of positive relationships with financial institutions. 4. Evaluate types of financial institutions. 5. Analyze various deposit accounts. 6. Demonstrate skill in basic financial tasks. 7. Compare and contrast various banking tools. Conceptual Outline: I. Important Records and Documents A. Important documents B. Strategies for managing important documents C. Financial institutions D. Benefits of different types of accounts E. Basic financial tasks F. Essential banking tools Materials, Equipment, and Technology Resources: Materials: 1. DVD #1: Katrina's Classroom: Financial Lessons from a Hurricane (order two weeks in advance) 2. Teacher Information #1: Katrina’s Classroom—Lesson 2: In the Aftermath a. OPTIONAL Handout #1: Learning More about Deposit Accounts (p. 27 of Teacher Information #1) b. OPTIONAL Handout #2: Blank Checks (p. 30 of Teacher Information #1) c. OPTIONAL Handout #3: Check Endorsements (p. 31 of Teacher Information #1) d. OPTIONAL Handout #4: Deposit Slips (p. 32 of Teacher Information #1) e. OPTIONAL Handout #5: Checking Account Register (p. 33 of Teacher Information #1) f. OPTIONAL Handout #6: Account Statement (p. 35 of Teacher Information #1) 3. Assignment #1: Pre-test Your Knowledge | In the Aftermath 4. Key #1 for Assignment #1: Pre-test Your Knowledge | In the Aftermath 5. PowerPoint #1: Test Your Knowledge | In the Aftermath 6. PowerPoint #2: In the Aftermath (narrated version http://www.frbatlanta.org/edresources/classroomeconomist/13Katrina_Lesson2/index.htm 7. Assignment #2: In the Aftermath 8. Key #2 for Assignment #2: In the Aftermath Equipment: 1. Computer with LCD projector or DVD player and television Technology Resources: 1. Internet access 2. Video #2: In the Aftermath (MP4 6:32) (http://www.frbatlanta.org/forms/katrina.cfm) a. Video Summary: “As Nick’s family fled New Orleans, his mother wisely took all their important financial records so she could access her bank account when the family stayed in Atlanta. Her Social Security payments were electronically deposited into her account so she received her payments without interruption. Today, Nick works for neighbors to make extra money and is opening a bank account to keep his money safe.” 3. http://www.frbatlanta.org/edresources/classroomeconomist/ 4. Narrated PowerPoint #2: Katrina’s Classroom: Financial Lessons from a Hurricane | Lesson 2: In the Aftermath (http://www.frbatlanta.org/edresources/classroomeconomist/13Katrina_Lesson2/index.htm) 5. Video #3: Back to School (MP4 6:05) (http://www.frbatlanta.org/forms/katrina.cfm) from Katrina’s Classroom— Lesson 4: Back to School. [Note: Katrina’s Classroom—Lesson 4: Back to School is an alternative and/or additional resource for Standards 4 and 5.] a. Video Summary: “After spending most of her senior year of high school in Houston, Texas, Jamie returned to New Orleans to attend college at Xavier University. Jamie has a bank account and lives on a tight budget so she can pay for the things she needs in college while building the basis for a good income in the future.” Procedures/Activities: 1. Teacher Preparation Two Weeks in Advance: Order a copy of the updated Katrina's Classroom: Financial Lessons from a Hurricane DVD from Federal Reserve Bank of Atlanta at http://www.frbatlanta.org/forms/katrina_order.cfm. Allow two weeks for delivery. Video clips are provided with this resource, but it is wise to verify these are the latest versions. Video #2 is imbedded in PowerPoint #2. Video clips can be downloaded and/or viewed from website http://www.frbatlanta.org/forms/katrina.cfm. 2. Teacher Preparation: Review Teacher Information #1 to be able to lead class discussions. Determine how much of the basic financial tasks needs to be covered beyond showing on PowerPoint #2. Copy and distribute as appropriate Optional Handouts #1-#6 found on pages 27-35 of Teacher Information #1. 3. Pre-Assessment: Distribute copies of Assignment #1. Give students a few minutes to circle answers to the 10 questions. Show PowerPoint #1 to use in scoring and reinforcing knowledge about basic financial tasks that are essential “in the aftermath” of a disaster. Use pre-test results to affirm decision made in teacher preparation as to the amount of time and focus needed for basic financial tasks. 4. Class Discussion: Show PowerPoint #2 with Video #2 imbedded on slide 4 OR show narrated version available at http://www.frbatlanta.org/edresources/classroomeconomist/13Katrina_Lesson1/index.htm. Discuss. Video #2 Discussion Questions: How did Nick and his family manage during Hurricane Katrina and when they were in Atlanta? What was the first thing that Nick’s mother took as the family fled? (Important papers to establish their identity and prove ownership of their home, plus insurance documents.) What kinds of papers are import to protect? (Passport, birth certificate, mortgage, insurance information, checkbook, bank statement.) What was Nick’s family’s source of income? (Dad’s income and mom’s disability payments.) How did money get into their bank account when they were in Atlanta? (Electronically deposited payments.) How did they access the money once it was deposited? (ATM machines, writing checks) What would they have done if they hadn’t had a bank account? (They would have had to carry large amounts of cash, which is not always safe, to buy food or gas or stay in a hotel.) What would have happened if they had not taken their important documents? (They could not have proved they owned their house; they could not have written checks.) How are they managing financially now that they are back? How did the preparations Nick’s family made help them when they returned to New Orleans? (They were able to prove their identity and show they owned the home.) Why did Nick open a bank account? (To keep his money safe.) 5. Class Discussion: Introduce Video #3 by explaining to the class that they are going to watch the story of Jamie, a college student who left New Orleans during Hurricane Katrina and lived in Texas with relatives. Ask them to pay close attention to what Jamie brought with her as she left and how she is managing her money today. (Play Video #3.) Video #3 Discussion Questions: How did Jamie and her family manage financially when she was in Houston? When Katrina struck, Jamie had just bought clothes for school. Where did she get the money for the clothes? (She had saved the money from her summer job.) What else did she do with the money she had saved? (She had money to spend while in Houston.) How did Jamie and her family manage financially while they were living in Houston? (Her parents used debit cards to get money and pay for things.) What did Jamie’s friends recommend in order to save money? (Having an emergency fund; don’t live paycheck to paycheck.) What did they think you should do in order to save money? (Examine lifestyle; save as much as you can; live comfortably but not too comfortably.) What are ways to reduce spending? (Packing your lunch instead of buying it; finding cheaper entertainment like free concerts; reducing the number of take-out coffees and sodas; avoid impulse buying.) What spending habits cause people to live above their means? (Impulsively buying things, having expensive cell phone contracts, managing cell phone minutes and text messaging carelessly.) 6. Class Activity: Distribute copies of Assignment #2 if you wish to give the post-test as a summative assessment for Lesson 2. Alternative is to re-use PowerPoint #1 to reinforce key points. Assessment: 1. Assignment #1 (Pre-test) 2. Assignment #2 3. Class participation