57th Day] Sunday, May 17, 2009 Journal of the House [57th Day

advertisement

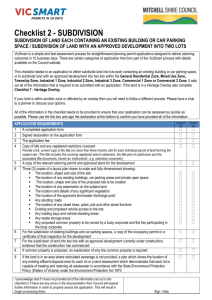

![57th Day] Sunday, May 17, 2009 Journal of the House [57th Day](http://s3.studylib.net/store/data/007098700_1-fb369aca20f57876eebb4b09569fec0d-768x994.png)