Accounting Exam Review Questions

advertisement

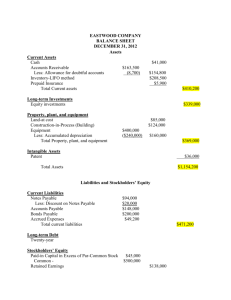

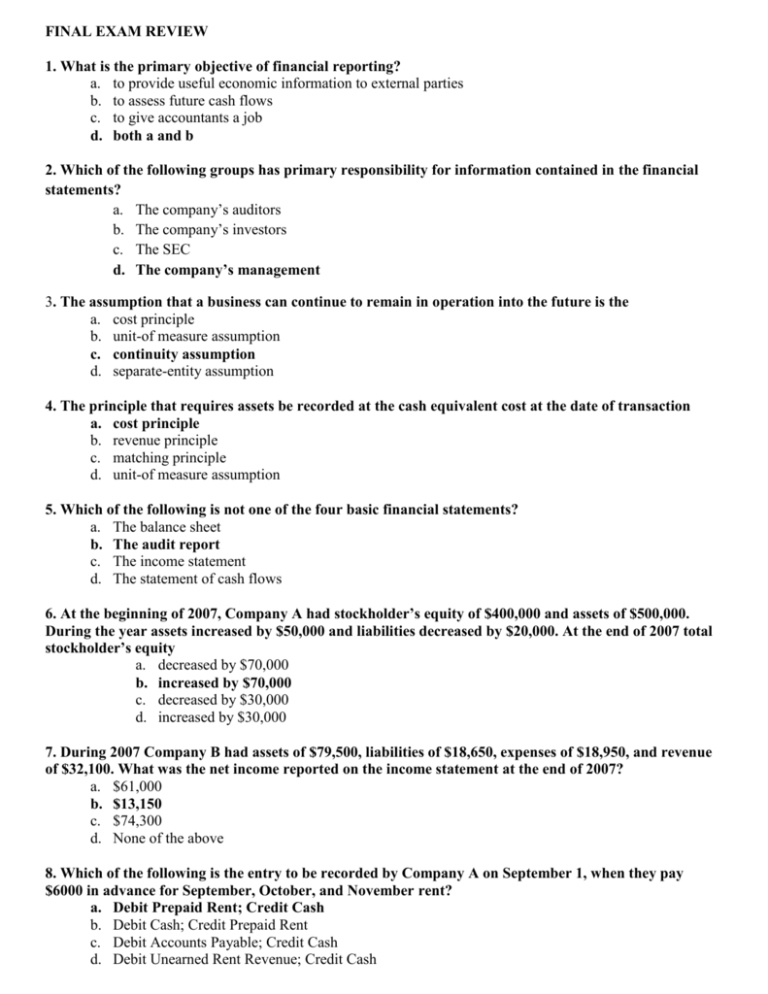

FINAL EXAM REVIEW 1. What is the primary objective of financial reporting? a. to provide useful economic information to external parties b. to assess future cash flows c. to give accountants a job d. both a and b 2. Which of the following groups has primary responsibility for information contained in the financial statements? a. The company’s auditors b. The company’s investors c. The SEC d. The company’s management 3. The assumption that a business can continue to remain in operation into the future is the a. cost principle b. unit-of measure assumption c. continuity assumption d. separate-entity assumption 4. The principle that requires assets be recorded at the cash equivalent cost at the date of transaction a. cost principle b. revenue principle c. matching principle d. unit-of measure assumption 5. Which of the following is not one of the four basic financial statements? a. The balance sheet b. The audit report c. The income statement d. The statement of cash flows 6. At the beginning of 2007, Company A had stockholder’s equity of $400,000 and assets of $500,000. During the year assets increased by $50,000 and liabilities decreased by $20,000. At the end of 2007 total stockholder’s equity a. decreased by $70,000 b. increased by $70,000 c. decreased by $30,000 d. increased by $30,000 7. During 2007 Company B had assets of $79,500, liabilities of $18,650, expenses of $18,950, and revenue of $32,100. What was the net income reported on the income statement at the end of 2007? a. $61,000 b. $13,150 c. $74,300 d. None of the above 8. Which of the following is the entry to be recorded by Company A on September 1, when they pay $6000 in advance for September, October, and November rent? a. Debit Prepaid Rent; Credit Cash b. Debit Cash; Credit Prepaid Rent c. Debit Accounts Payable; Credit Cash d. Debit Unearned Rent Revenue; Credit Cash 9. On May 1, Nike, Inc. purchased equipment costs $500,000, paying $200,000 cash and signing a formal promissory note to pay the balance in three years. What affect does this transaction have on the accounting equation? a. Assets decrease $500,000 b. Assets decrease $200,000 c. Assets increase $500,000 d. Assets increase $300,000 10. The asset account has a beginning balance of $10,000 and PacSun purchased a new truck for $26,000. If the ending balance of assets was $31,000 much of the truck did they pay in cash? a. $10,000 b. $5,000 c. $26,000 d. $36,000 11. Which group of accounts contains only those that normally have debit balance? a. Retained earnings, cost of sales, wages expense b. Prepaid expenses, wages payable, and contributed capital c. Cash, utilities expense, accounts receivable d. Utilities expense, unearned revenue, prepaid expenses 12. Failure to make an adjusting entry to recognize rent revenue receivable would cause a. an understatement of assets, net income, and stockholder’s equity b. an overstatement of assets stockholder’s equity and understatement of net income c. no effect on assets, liabilities, net income, nor stockholder’s equity d. an overstatement of assets, net income, and stockholder’s equity 13. Assume a company receives a bill for $10,000 for advertising done during the current year. If this bill is not yet recorded at the end of the year, what will the adjusting journal entry include? a. Debit to Advertising expense of $10,000 b. Credit to advertising expense of $10,000 c. Debit to accrued liabilities of $10,000 d. Need more information to determine 14. Assume the balance in prepaid insurance is $2,500 but it should be $1,500. The adjusting journal entry should include which of the following? a. Debit to Prepaid Insurance for $1,000 b. Credit to insurance expense for $1,000 c. Debit to Insurance expense for $1,000 d. Debit to insurance expense for $1,500 15. Which of the following does not enhance internal control? a. Assigning different duties to different employees b. Ensuring adequate documentation is maintained c. Allowing access only when required to complete assigned duties d. None of the above- all enhance internal control 16. A deposit in transit on a bank reconciliation should be a. added to the depositors book cash balance b. subtracted from the depositors book cash balance c. added to the bank statement balance d. subtracted from the bank statement balance 17. When using the allowance method, as Bad debt expense is recorded, a. Total assets remain the same and stockholder’s equity remains the same b. Total assets decrease and stockholder’s equity decreases c. Total assets increase and stockholder’s equity decreases d. Total liabilities increase and stockholder’s equity decreases 18. Company A determines on Feb. 1, 2009, that a $1000 account receivable will be uncollectible. What affect does this write off have on the financial statements? a. Increases bad debt expense b. Increases the Allowance for Doubtful Accounts c. Decreases bad debt expense d. Has no affect 19. Item A B C D Quantity 1500 750 3500 2500 Cost Per Unit $3 $4 $2 $5 Market Unit Cost $4 $2 $1 $3 What is the amount that should be reported for the ending inventory using the LCM rule applied to each item? a. $27,000 b. $18,500 c. $17000 d. $15000 (Use the following information for Questions 20-21) Turnwell Corporation uses the periodic inventory system. The following information about their inventory is available: Date Transaction Number of Units Cost per Unit 1/1 Beg Inventory 60 $200 4/12 Purchase 100 $230 7/8 Purchase 50 $210 9/22 Purchase 70 $205 During the year, 130 units were sold at a price of $225 per unit. Other operating costs equaled $200 and their tax rate is 10%. Round final answers to the nearest dollar 20. What was the ending inventory and cost of goods sold on 12/31 under the LIFO cost flow assumption? a. $27,150 and $32,700 b. $28,100 and $31750 c. $32,700 and $27,150 d. $31750 and $28100 21. What was the ending inventory and cost of goods sold on 12/31 under the FIFO cost flow assumption? a. $27,150 and $32,700 b. $28,100 and $31750 c. $32,700 and $27,150 d. $31750 and $28100 22. On January 1, 2008, Company ABC purchased equipment for $70,000. The estimated salvage value is $10,000. The estimated useful life is 12 years. Using STRAIGHT LINE depreciation, how much is the depreciation expense per year? a. $10,000 b. $1,200 c. $5,000 d. $80,000 23. On January 1, 2009, Company C purchases equipment for $100,000. The estimated useful life in units is 200,000 units. The estimated salvage value is $20,000. During 2009, the equipment’s output is 15,000 units. In the next year (2010), the output is $25,000 units. What is the accumulated depreciation at the end of 2010 (after 2 years)? a. $6,000 b. $10,000 c. $16,000 d. $12,000 24. Company C uses double declining balance depreciation method. On January 1, 2010, they purchase a piece of equipment for $120,000. The estimated salvage value is $10,000. Useful life is estimated to be 10 years. What is the depreciation expense for 2011 (the second year)? a. $24,000 b. $43,200 c. 19,200 d. $11,000 25. Company C borrowed 1,000,000 on November 1, 2007. The note carried a 6% interest rate with the principal and interest payable on June 1, 2008. What is the amount of interest expense recorded on December 31, 2007? a. $10,000 b. $60,000 c. $15,000 d. None of the above 26. If a bond is sold (issues) below its face value(par), the stated rate of interest was a. higher than market rate b. lower than market rate c. equal to market rate d. not related to market rate 27. Newton Corporation sold its $1,000,000, 7%, ten-year bonds to public on January 1, 2006. The bonds pay interest annually, beginning on December 31, 2006. Newton received $1,153,420 in cash at the issuance of the bonds. The market rate of interest when the bonds were sold was 5%. Compute the amount of the premium that Newton Corporation should amortize on December 31, 2006, assuming the “effective-interest” method is used. a. $15,342 b. $14,865 c. $12,329 d. $10,276 28. When treasury stock is purchased with cash, what is the impact on the balance sheet equation? a. No change- the reduction of asset Cash is offset with the addition of the asset Treasury Stock b. Assets decrease and stockholder’s equity increases c. Assets increase and stockholder’s equity decreases d. Assets decrease and stockholder’s equity decreases 29. The effect of a stock dividend is to a. reduce the amount of retained earnings and increase total contributed capital b. reduce the amount of retained earnings and reduce the amount of total assets c. reduce the amount of retained earnings and reduce total contributed capital d. none of the above is correct 30. Company B sold 5,000 shares for $50 per share in the current year. The year after that the company purchased 2,000 shares of its own stock for $45 per share and then resold the stock for $47 per share. What would be the journal entry for the resale of the treasury stock? a. Debit Cash $94,000; credit treasury stock 90,000; credit Additional PIC $4000 b. Debit Cash $100,000; credit treasury stock 90,000; credit additional PIC $10,000 c. Debit Cash $90,000, credit treasury stock 94,000; debit additional PIC $4000 d. None of the above 31. Which of the following is not an advantage of preferred stock? a. Right to vote b. Current dividend preferences c. Preference on asset distributions in the event of the corporation is liquidated d. All of the above are advantages of preferred stock 32. Which of the following is not added when computing cash flows from operations using the indirect method? a. the net increase in accounts payable b. the net decrease in accounts receivable c. the net decrease in inventory d. all of the above should be added 33. Which of the following would not appear in the investing section of the statement of cash flows? a. purchase of inventory b. sale of investments c. purchase of land d. all of the above would appear in the investing section 34. Which of the following items is not subtracted when computing cash flows from operations using the indirect method? a. Increase in accounts receivable b. Increase in prepaid expenses c. Increase in accrued liabilities d. Decrease in accounts payable 35. An example of an investing transaction would be a. purchasing equipment for cash b. buying inventory from a supplier on credit c. selling stock to investors for cash d. all of the above are investing transactions 36. Company C had COGS for the year of $ 60,000. The inventory at the beginning of the year totaled $40,000 and $35,000 was left at the end of the year. How much did the company purchase during the period? a. $55,000 b. $75,000 c. $20,000 d. $100,000 THE GAP, INC. CONSOLIDATED BALANCE SHEETS January 31, 2009 ($ and shares in millions except par value) ASSETS Current assets: Cash and cash equivalents Short-term investments Restricted cash Merchandise inventory Other current assets Total current assets Property and equipment, net Other long-term assets Total assets $ $ LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Current maturities of long-term debt Accounts payable Accrued expenses and other current liabilities Income taxes payable Total current liabilities Long-term liabilities: Long-term debt Lease incentives and other long-term liabilities Total long-term liabilities Commitments and contingencies (see Notes 11 and 15) Stockholders’ equity: Common stock $0.05 par value Authorized 2,300 shares; Issued 1,105 and 1,100 shares; Outstanding 694 and 734 shares Additional paid-in capital Retained earnings Accumulated other comprehensive earnings Treasury stock, at cost (411 and 366 shares) Total stockholders’ equity Total liabilities and stockholders’ equity $ $ February 2, 2008 1,715 — 41 1,506 743 4,005 2,933 626 7,564 $ 50 975 1,076 57 2,158 $ 1,724 177 38 1,575 572 4,086 3,267 485 7,838 $ 138 1,006 1,259 30 2,433 — 1,019 1,019 50 1,081 1,131 55 2,895 9,947 123 (8,633) 4,387 7,564 55 2,783 9,223 125 (7,912) 4,274 7,838 $ THE GAP, INC. CONSOLIDATED STATEMENTS OF EARNINGS ($ and shares in millions except per share amounts) Net sales Cost of goods sold and occupancy expenses Gross profit Operating expenses Operating income Interest expense Interest income Earnings from continuing operations before income taxes Income taxes Earnings from continuing operations, net of income taxes Loss from discontinued operation, net of income tax benefit Net earnings $ $ Weighted-average number of shares—basic Weighted-average number of shares—diluted Basic earnings per share: Earnings from continuing operations, net of income taxes Loss from discontinued operation, net of income tax benefit Net earnings per share Diluted earnings per share: Earnings from continuing operations, net of income taxes Loss from discontinued operation, net of income tax benefit Net earnings per share Cash dividends declared and paid per share Fiscal Year 2007 2008 14,526 9,079 5,447 3,899 1,548 1 (37) 1,584 617 967 — 967 $ 15,763 10,071 5,692 4,377 1,315 26 (117) 1,406 539 867 (34) $ 833 716 719 $ 791 794 1.35 — 1.35 $ $ $ 1.34 — 1.34 $ 0.34 $ $ 2006 $ 15,923 10,266 5,657 4,432 1,225 41 (131) 1,315 506 809 (31) $ 778 831 836 1.10 (0.05) 1.05 $ $ $ 1.09 (0.04) 1.05 $ 0.97 (0.04) 0.93 $ 0.32 $ 0.32 $ $ 0.97 (0.03) 0.94 THE GAP, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS ($ in millions) Cash flows from operating activities: Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation and amortization (a) Share-based compensation Tax benefit from exercise of stock options and vesting of stock units Excess tax benefit from exercise of stock options and vesting of stock units Non-cash and other items Deferred income taxes Changes in operating assets and liabilities: Merchandise inventory Other current assets and other long-term assets Accounts payable Accrued expenses and other current liabilities Income taxes payable, net of prepaid and other tax-related items Lease incentives and other long-term liabilities Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Proceeds from sale of property and equipment Purchases of short-term investments Maturities of short-term investments Acquisition of business, net of cash acquired Change in restricted cash Change in other long-term assets Net cash used for investing activities Cash flows from financing activities: Payments of long-term debt Proceeds from share-based compensation, net Repurchases of common stock Excess tax benefit from exercise of stock options and vesting of stock units Cash dividends paid Net cash used for financing activities Effect of exchange rate fluctuations on cash Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental disclosure of cash flow information: Cash paid for interest during the period Cash paid for income taxes during the period 37. What is the % change in total assets from 2007 to 2008? -3.5% 38. What was the amount of depreciation and amortization in 2007? $457 39. What is the par value of the common stock? $0.05 40. What was the 2008 earnings per share? $1.35 41. What was Gap’s tax rate in 2007 and 2008? 2007: 39% 2008: 38.3% 42. How many shares of treasury stock did GAP have at the end of 2008? 411 Fiscal Year 2007 2008 $ 967 $ 833 2006 $ 778 568 55 5 (6) 61 10 547 52 8 (7) 54 (51) 530 54 25 (23) 11 (41) 51 34 (4) (284) (94) 49 1,412 252 18 199 32 (4) 148 2,081 (97) 12 (6) 56 (102) 53 1,250 (431) 1 (75) 251 (142) (1) (1) (398) (682) 11 (894) 1,287 — 7 (3) (274) (572) 22 (1,460) 1,841 — 11 8 (150) (138) 75 (705) 6 (243) (1,005) (18) (9) 1,724 $ 1,715 $ (326) 125 (1,700) 7 (252) (2,146) 33 (306) 2,030 1,724 — 190 (1,050) 23 (265) (1,102) (3) (5) 2,035 2,030 $ $ $ $ 17 674 39 535 $ $ $ 40 575 43. If Gap had accumulated depreciation of $4312 in 2008, what was PPE, gross? $7245 44. Compute the following ratios for 2008 a. Net Profit Margin: Net Income/Net Sales Revenue b. Gross Profit Margin: (Net Sales Revenue-COGS)/Net Sales Revenue c. Asset Turnover Ratio: Net Sales Revenue/Average Total Assets d. Fixed Asset Turnover Ratio: Net Sales Revenue/Average Net fixed assets e. Return on Equity: Net Income/Average Stockholder’s equity f. Quality of Income: Cash flow from operating activities/Net Income g. Receivable Turnover: Net sales revenue/Average Net Receivables h. Days to Collect: 365/Receivables Turnover Ratio i. Inventory Turnover: COGS/Average Inventory j. Days to Sell: 365/ Inventory Turnover Ratio k. Current Ratio: Current Assets/Current Liabilities l. Debt-to-Assets Ratio: Total Liabilities/Total assets