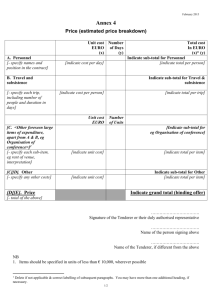

IDRAS_IFB_TRC - Tanzania Revenue Authority

advertisement