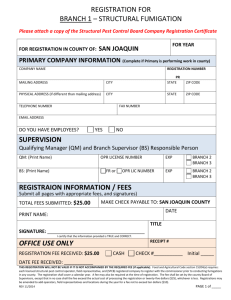

Charging Guidelines - Department of Agriculture

advertisement