Caribbean Offshore Banking Legislation

advertisement

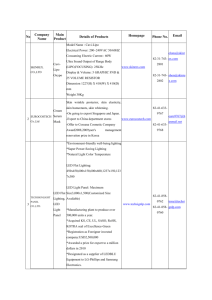

Some Aspects of Caribbean Offshore Banking Legislation Physical Banking OFC Description Tax Benefit Reserve Capital Banking Presence/ Requirement Requirement Restriction License Fee International NO income tax, A Banking Class 1- General May engage in Class 1- Banking is the capital gains tax, corporation is Banking License. No generally US$25,000 carrying on from or other direct tax not subject to less than US$3 accepted banking within Antigua and may be levied any reserve million, of which activity but shall Class 2 Barbuda banking in upon profits or requirement US$500,000 is not knowingly US$15,000. any currency that is capital gains. (239) deposited with accept deposits foreign in every (272) Antigua Financial in legal tender of International bank Services Regulatory any CARICOM must own a Commission (FSGC). country. (240) separate office, country of the Antigua CARICOM region. Tax exemption (4-2) shall continue for open every day a period of at least Class 2-Has a Monday to Friday, 50 years from the restricted list of with at least one date of customers approved full-time incorporation. by FSGC. Holds no employee. (276) less than US$500,000, of which US$100,000 is deposited with FSGC (238) Non-Resident $25,000 Renewal- $25,000 Non-resident Banks- can Banks should operate freely in have have an Capital adequacy foreign currency, office with requirements do not but need electronic apply to foreign permission from correspondence banks. the central bank and file keeping to conduct capabilities. Some business on foreign branches Bahamian dollar. are given Banking activity in currencies other than The Bahamas the currency of the country in which the bank accounts are No direct tax on NO reserve capital gains, requirement for sales, or profits. foreign banks. held exemption to continue business without a physical presence. Barbados Off-shore Banking is No income tax, receiving or using capital Licensee must Capital of the maintain a company must be foreign funds for gains tax or other reserve fund and banking activity (4) direct tax or must contribute The licensee No specific shall not amount quoted US$500,000 if knowingly within the act. controlled by local accept any A fee is impoed impost shall be 25% of net residents, levied in profits to $2million if controlled Barbados upon reserves if by foreign residents. reserves are less (22.1, 22.2) the profits or gains of a licensee. (102.1) than paid-up deposits from, or for the issuance of accept as a license or customer of any registration of its services, (109.2) residents of capital. Barbados. (16.c) (23.1) Regressive tax rate starting at 2.5% on profits up to B$10 million, down to 1% on profit in excess of B$30 million. (106.1) Must have a physical Place of Business with at License B banks The Banking Business No income, Cayman conducted with non- capital gains, or Islands residents corporation tax. No reserve requirement. Capital adequacy ratio of no less than 10% (10.1) shall not undertake banking business with residents. (6) least two residents to act as agents. (6.2) Category B License Application fee of $70,000. Annual Renewal fee of $57,000 Must transfer to Dominica St. Kitts and Nevis Offshore banking No income tax , business is capital gains tax, exclusively in the or other direct tax currencies other than may be levied East Caribbean upon profits or Dollar. (2) gains. (57.1) Offshore bank reserve fund not Total paid up capital written approval, must have a less than 25% of together with is offshore banks representative profit in cases reserves of shall not accept a office (6a) where the accumulated net resident of reserve fund is profits amount to no Dominica as a Annual License less than the less than US$1 customer for any renewal of issued paid up million. 14 (2) offshore banking US$8,000 capital. 15(1) services. (20.1d) No income tax, or Must keep a Offshore banks Must have a will not registered office knowingly and agent present, accept deposits and one director or keep as a who is resident. customer of any (5.2) capital gains or reserve fund not “Offshore Banking” other direct taxes , less than 25% of is receiving foreign no dividends tax profit in cases funds through (88.1) where the normal banking activity. 4(1) Except with reserve fund is Tax on profits and less than the gains up to twenty issued paid up million, 1% on capital. 23(1) Capital of at least US$2 million and paid up capital must be deposited and maintained at the ECCB. (22.1) of its services a resident of St. Offshore banks Kitts and Nevis must have at least profits exceed $30 (16.1) million (91.1) one who is a citizen of St. Kitts and Nevis Banking license fee Class 1 $25,000, Class 2 US$15,000 A physical place of business with at least two management International banking is banking St. Lucia business that does not involve accepting deposits or holding claims on May choose to be exempt from taxes No stated or be subject to a requirement 1% tax rate. Class A- not less than International US$1million. banks cannot Class B US$250,000 accept deposits in paid-up capital. or issue loans to 11(b) residents (2) residents. (2) employees. (8.1) International Bank License Annual Fee Class A US$25,000 Class B US$15,000 Cannot accept Banking business St. Vincent that does now involve residents 2(1) No income , capital, or other direct taxes (20.1) Class A- paid up deposits from capital of not less than residents or No stated US$500,000 invest in any requirement Class B- paid up asset that capital of not less than represents a US$100,000 (10.a) claim on any resident. 2(b) Class A- Annual Fee US$10,000 Class B- Annual Fee US$5,000 List of Local Commercial Banks (2009) Barbados The Bahamas (2005) Jamaica Trinidad & Tobago Bank of Baroda (Trinidad and BNS Barbados National Bank Bank of The Bahamas Citibank BNS Ja ltd Tobago) Limited First Caribbean International Citibank (Trinidad and Tobago) (Jamaica) Limited First Caribbean International Butterfield Bank (Barbados) Ltd. Bank (Trinidad and Tobago) Commonwealth Bank Ltd. Citibank Limited (Barbados) ltd. Fidelity Bank Bahamas Ltd. National Commercial Banks First Citizens Bank Limited First Caribbean International Finance Corporation of The ltd. (Regional Head Office) Bahamas Ltd. First Global Bank Intercommercial Bank Limited First Caribbean International First Caribbean International RBTT Bank Jamaica RBTT Bank (Barbados) Ltd. Bank (Bahamas) Limited Limited RBC Royal Bank of Canada BNS Republic Bank Limited Pan Caribbean Bank Limited RBTT Bank Limited BNS of Trinidad and Tobago Royal Bank of Canada Dominican Republic Haiti (2006) Limited Antigua & Barbuda Dominica ABI Bank Ltd BNS Banco de Reservas de la Banque Nationale de Cr´edit Republica Dominicana (BNC) Banco Popular Dominicano (BPH) Banco Dominicano del Banque de l’Union Ha¨ıtienne Progreso (BUH) Bank of Antigua Ltd. Ltd. Banco Multiple Leon Capital Bank BNS Royal Bank of Canada Banco Multiple Caribe et Commerciale S.A. Internacional (Promobank) Caribbean Union Bank Ltd. Soci´et´e Cara´’ib´eenne de First Caribbean International Banco BHD Banque S.A. (SOCABANK) Bank (Barbados) Ltd. Banco Multiple BDI Socabel RBTT Bank Caribbean Ltd. Banque Populaire Ha¨ıtienne First Caribbean International Antigua Commercial Bank Bank (Barbados) Ltd. National Bank of Dominica Banque de Promotion Industrielle Soci´et´e G´en´erale Ha¨ıtienne de Banco Multiple VIMENCA Banque S.A. (SOGEBANK) Banco Multiple Santa Cruz Sogebel Royal Bank of Canada Banco Multiple Lopez de Haro Unibank Citibank Citibank BNS BNS Grenada St. Kitts & Nevis BNS Bank of Nevis Ltd. St. Lucia St. Vincent & the Grenadines 1st National Bank St. Lucia Ltd. BNS First Caribbean International First Caribbean International Bank (Barbados) Ltd. BNS Grenada Co-orperative Bank First Caribbean International BNS Ltd. Bank (Barbados) Ltd. Bank (Barbados) Ltd. National Commercial Bank Bank of St. Lucia Ltd. Republic Bank (Grenada) (SVG) Ltd. First Caribbean International Ltd. RBTT ( St. Kitts) Bank Bank (Barbados) Ltd. RBTT Bank (Grenada) Royal Bank of Canada RBTT Bank Caribbean Ltd. RBTT Bank Caribbean Ltd. St. Kitts- Nevis-Anguilla National Bank Ltd. Royal Bank of Canada Number of Offshore Business (2003) Jurisdiction Offshore Banks International Business Companies Anguilla 2 3,041 Antigua & Barbuda 15 13,500 Aruba 2 4,320 Bahamas 301 47,040 Barbados 56 4,673 Bermuda N 13,337 British Virgin Islands 13 360,000 Cayman Islands 580 30,000 Dominica 1 8,601 Grenada 2 2,293 Montserrat 11 22 Netherland Antilles 39 18,750 St. Kitts and Nevis 1 13,800 St. Lucia 2 1,052 St. Vincent & the Grenadines 10 6,342 Turks and Caicos 8 13,952