CP 4-2. (Continued)

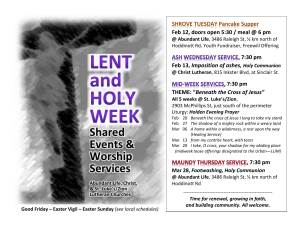

advertisement

CP 4-2. Solution: Marsh Corporation Forecasting with Seasonal Production Projected Unit Sales +Desired Ending Inventory (2 months supply) Beginning Inventory Units to be Produced Dec. 1,500,000 Jan. 1,700,000 Feb. 1,200,000 Mar. 1,400,000 2,900,000 2,600,000 3,400,000 4,500,000 2,600,000 2,900,000 2,600,000 3,400,000 1,800,000 1,400,000 2,000,000 2,500,000 4-1 CP 4-2. (Continued) Monthly Cash Payments Dec. Units to be produced Materials (from previous month) Labor ($20 per thousand units) Overhead ($10 per thousand units) Selling & adm. expense (20% of sales) Interest Taxes (40% tax rate) Dividends Total Payments 1,800,000 Jan. Feb. Mar. 1,400,000 2,000,000 2,500,000 $ 93,600 $ 84,000 $ 120,000 $ 28,000 $ 40,000 $ 50,000 $ 14,000 $ 20,000 $ 25,000 $ 52,700 $ 37,200 $ 43,400 $ 8,000 $64,560* $48,420* $188,300 $181,200 $359,380 *See the pro forma income statement, which follows this material later on, for the development of these values. 4-2 CP 4-2. (Continued) Marsh Corporation Monthly Cash Receipts Sales Collections (50% of Previous month) Collections (50% of 2 months earlier) Total Collections Nov. $175,000 Dec. $232,500 87,500 Jan. $263,500 116,250 Feb. $186,000 131,750 Mar. $217,000 93,000 87,500 116,250 131,750 $203,750 $248,000 $224,750 Monthly Cash Flow Cash Receipts Cash Payments Net Cash Flow January $203,750 188,300 15,450 February $248,000 181,200 66,800 4-3 March $224,750 359,380 (134,630) CP 4-2. (Continued) Marsh Corporation Cash Budget Net Cash Flow Beginning Cash Balance Cumulative Cash Balance Loans and (Repayments) Cumulative Loans Marketable Securities Cumulative Marketable Securities Ending Cash Balance January February $15,450 $66,800 30,000 25,000 $45,450 $91,800 -0-0-0-020,450 66,800 20,450 87,250 $25,000 $25,000 March $(134,630) 25,000 ($109,630) 47,380 47,380 (87,250) -0$25,000 Marsh Corporation Pro Forma Income Statement Sales Cost of Goods Sold Gross Profit Selling and Admin. Expense Interest Expense Net Profit Before Tax Taxes Net Profit After Tax Less: Common Dividends Increase in Retained Earnings Jan. Feb. Mar. Total $263,500 $186,000 $217,000 $666,500 139,400 98,400 126,000 363,800 124,100 87,600 91,000 302,700 52,700 37,200 43,400 133,300 2,667 $ 68,733 27,493 $ 41,240 2,667 $ 47,733 19,093 $ 28,640 2,666 $ 44,934 17,974 $ 26,960 8,000 $161,400 64,560 $ 96,840 48,420 $ 48,420 4-4 CP 4-2. (Continued) Marsh Corporation Cost of Goods Sold Unit Cost per thousand before January 1st $52 20 10 $82 Material ........... Labor................. Overhead .......... Unit cost per thousand after January 1st $60 20 10 $90 Ending inventory as of December 31 was 2,900,000; therefore, sales for January and February had a cost of goods sold per thousand units of $82, and March sales reflect the increased cost of $90 per thousand units using FIFO inventory methods. Pro Forma Balance Sheet (March) Assets Current Assets: Cash Accounts Receivable Inventory Plant & Equip: Net Plan Total Assets $ 25,000 310,000 405,000 800,000 $1,540,000 Liabilities & Stockholders' Equity Current Liabilities: Accounts Payable Notes Payable Long-Term Debt Stockholders' Equity: Common Stock Retained Earnings, Total Liabilities & Stockholders' Equity 4-5 $ 150,000 47,380 400,000 504,200 438,420 $1,540,000 CP 4-2. (Continued) Explanation of Changes in the Balance Sheet: Cash = ending cash balance from cash budget in March Accounts receivable = all of March sales plus 50% of Feb. sales $217,000 93,000 $310,000 Inventory = ending inventory in March of 4,500,000 units at $90 per thousand Plant and equipment did not change since we did not include depreciation. RE Old RE NI dividends $390,000 $96,840 $48,240 $438,420 4-6