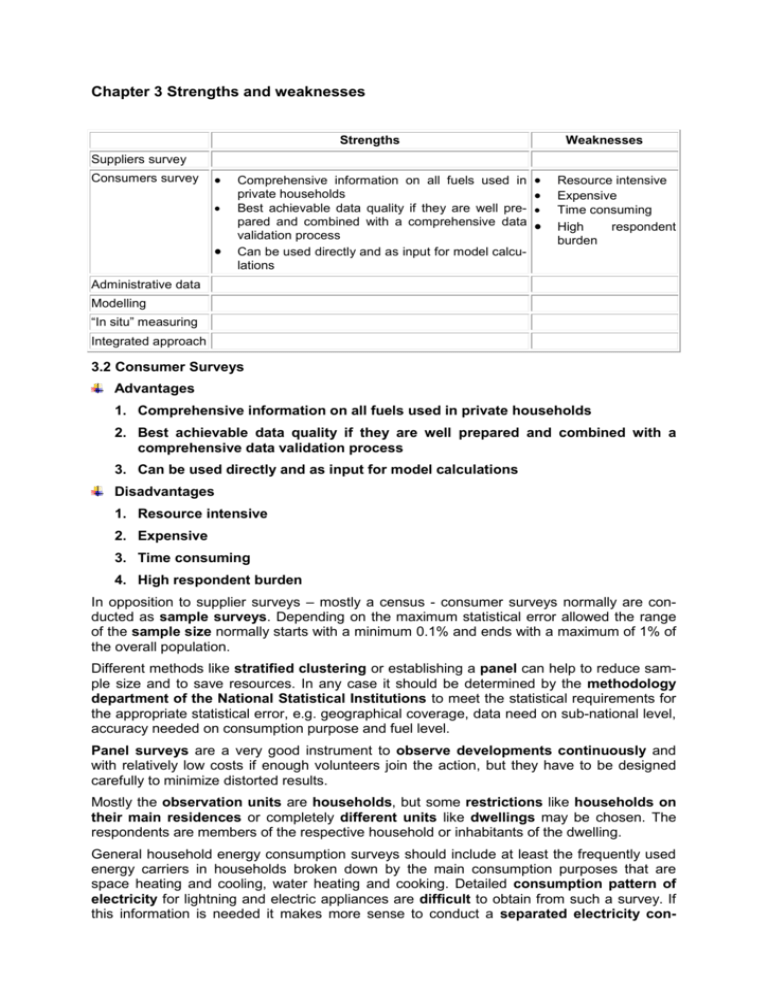

Chapter 3 Strengths and weaknesses Strengths Weaknesses

advertisement

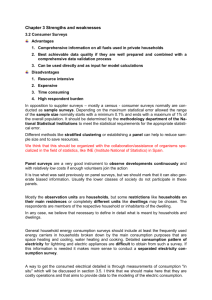

Chapter 3 Strengths and weaknesses Strengths Weaknesses Suppliers survey Consumers survey Comprehensive information on all fuels used in private households Best achievable data quality if they are well pre- pared and combined with a comprehensive data validation process Can be used directly and as input for model calculations Resource intensive Expensive Time consuming High respondent burden Administrative data Modelling “In situ” measuring Integrated approach 3.2 Consumer Surveys Advantages 1. Comprehensive information on all fuels used in private households 2. Best achievable data quality if they are well prepared and combined with a comprehensive data validation process 3. Can be used directly and as input for model calculations Disadvantages 1. Resource intensive 2. Expensive 3. Time consuming 4. High respondent burden In opposition to supplier surveys – mostly a census - consumer surveys normally are conducted as sample surveys. Depending on the maximum statistical error allowed the range of the sample size normally starts with a minimum 0.1% and ends with a maximum of 1% of the overall population. Different methods like stratified clustering or establishing a panel can help to reduce sample size and to save resources. In any case it should be determined by the methodology department of the National Statistical Institutions to meet the statistical requirements for the appropriate statistical error, e.g. geographical coverage, data need on sub-national level, accuracy needed on consumption purpose and fuel level. Panel surveys are a very good instrument to observe developments continuously and with relatively low costs if enough volunteers join the action, but they have to be designed carefully to minimize distorted results. Mostly the observation units are households, but some restrictions like households on their main residences or completely different units like dwellings may be chosen. The respondents are members of the respective household or inhabitants of the dwelling. General household energy consumption surveys should include at least the frequently used energy carriers in households broken down by the main consumption purposes that are space heating and cooling, water heating and cooking. Detailed consumption pattern of electricity for lightning and electric appliances are difficult to obtain from such a survey. If this information is needed it makes more sense to conduct a separated electricity con- sumption survey. Such surveys are extremely complex and rather expensive. Therefore it makes sense to keep their frequency low and to use them as input into modeling exercises. The survey can be conducted as simple postal survey, but due to the fact that energy consumption is complex to ask and the often missing knowledge of the respondents an interview either personally or by telephone is the more adequate survey form. Computer assistance in any case improves data quality. Therefore it should be applied if possible. In case the survey is conducted as interview on a voluntary base it makes sense to do it together with an obligatory interview survey (e.g. the labour force survey). This increases the response rate significantly. The questionnaire should be as simple and as short as possible, but it has to include all necessary questions. In case of complex facts it makes sense to prefer a more comprehensive but clear than a short and potentially misleading questionnaire. An appropriate questionnaire design influences the response rate positively. If using a questionnaire for the first time, or important changes are introduced to the existing questionnaire, it is useful to conduct a test survey on a small sample (100-200 households), a few months before the main survey. The test survey points out the questions which cause major problems to the respondents and allows adjusting these questions, thus improving the questionnaire for the main survey. It is recommended to send a letter of approval to the chosen households before the survey starts. With this letter the respondents are informed about the purpose and the content of the survey, as well as the data they will be asked for. The respondents can also be asked to prepare the data on energy consumption (quantities and expenses), electrical appliances (energy classes), light bulbs and cars (fuel consumption, distance travelled). The notification letter could be accompanied by examples of energy bills, to assist the households providing the requested data. In case of interviews the interviewers should have a good knowledge on the different fuels. Furthermore, the interviewers should be well trained on consumption patterns of different types of fuel burning appliances and household purposes (e.g. space heating, water heating and cooking). Practical leaflets with region-specific examples about electricity, natural gas and district heat bills for private households, and training in reading the bills could enable the interviewers to assist the respondents. If it is manageable quantities and expenditures should be asked to calculate prices. These prices are valuable information for data validation by comparing them with average prices. If not known from other sources the floor area of the dwelling and the number and age of inhabitants or household members should be asked in any case. Additional information like insulation measures or the use of thermal setting points can improve the understanding of consumption pattern better. Therefore it is highly recommended to include such questions into the survey. If the results of the survey are planned to be used for reporting obligations of the RESdirective, a special focus has to be given on renewables. Detailed information how reliable data in this difficult field can be achieved are given in chapter 6.1. The best season to run such a survey is shortly after heating season e.g. April or May, depending on the geographical position and climate conditions. In no case the survey should be conducted during the heating season Although fuel consumption of privately owned cars is not attributed to households but to road transport, additional questions on fuel type, average consumption, annually driven km and age of the cars make sense. Normally households know this much better than dwelling bound energy consumption and this information is very useful for compiling energy accounts end energy efficiency indicators for transport. The survey frequency should not exceed 5 years to provide information on developments in time. The extrapolation of the results until the next surveys and the follow up revision of the period between the last two survey cycles can be done with heating and cooling degree days and trend analyses. Details how doing this will be given in chapter 3.4. Because of the high complexity of energy consumption survey, normally the data collected cannot be used directly, but have to be checked and validated very carefully. Generally this can be done with any information available from a wide variety of different sources, but official sources should be preferred. One very important aspect is the fact, that in case of storable fuels like fuel oil, gasoil, coal or fuel wood normally the purchased and not the consumed quantities are known and reported. Detailed description of possible data validation procedures which are mainly model based crosschecks one can find in chapter 3.4. Another aspect that can be improved with additional information is the grossing up procedure. Here e.g. the number of gas and electricity meters attributed to households - information that should be available from the suppliers – can be used to achieve more realistic figures. Conclusions and summery The 4 main elements to achieve good results are a careful preparation, a simple questionnaire, well trained interviewers and comprehensive data validation. Grossing up procedures can be improved by using supplier information, e.g. gas meters attributed to households. Model based extrapolation e.g. heating degree days help to decrease survey frequency.