HSBC_KEB_LoneStar_case - Duke University`s Fuqua School

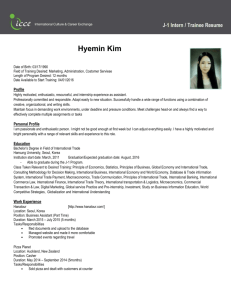

advertisement

HSBC’s Acquisition of KEB Finance 663: International Finance Professor Campbell R. Harvey February 9, 2016 Prepared by: Alok Chakraborty Chris Donghui Lee Arindam Mandal Harsh Singh Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 I. INTRODUCTION In September 2007, HSBC Holdings PLC, Europe's biggest bank, agrees to buy 51.02% of Korea Exchange Bank, South Korea's sixth-biggest bank, for $6.3B cash from US private equity fund Lone Star (KRW 18,045/per share)1, but the deal could face regulatory problems because of legal cases involving the current owner. HSBC chairman SK Green said the deal for South Korea's sixth-largest bank in terms of assets would "provide HSBC with a significant presence in Asia's third-largest economy and reinforce our position as Asia's No. 1 international bank." But in Seoul, South Korea's financial watchdog, the Financial Supervisory Commission (FSC), said it would not approve the sale until legal cases were settled involving the purchase of the bank by Lone Star. The purchase of the stake from U.S. private equity group Lone Star Funds would mark the exit of the Dallas, Texas-based Lone Star from a controversial investment. South Korean tax authorities last week raided Lone Star's office in Seoul, the latest development in a series of legal and tax disputes. London-based HSBC said on Monday that it does not intend to launch an offer for the remainder of KEB's shares and that the bank would remain listed on the Korea Exchange. HSBC has been trying for almost 10 years to build its presence in South Korea it currently has a small network of 11 retail branches where the economy has evolved dramatically over the past decade since the Asian economic crisis swept through the country. It previously mounted unsuccessful bids for three local banks: Seoul bank in 2002, Koram Bank in 2004 and Korea First Bank in 1998 and 2005. Acquiring KEB would catapult HSBC past foreign rivals Standard Chartered and Citigroup. Both have bested HSBC in the past in purchasing local banks during the post-Asian crisis turmoil. HSBC said it would finance the purchase from its own resources and the acquisition will be accretive to HSBC's earnings per share in its first full year of operations with the HSBC group. It added that it had identified "a number of areas of potential business growth." Alex Potter, an analyst at Collins Stewart, said the price paid is "reasonable." A local court in South Korea has been investigating allegations that Lone Star manipulated the stock price of KEB's credit card unit in 2003 so that the bank could take over the business at a lower price. The fund is also alleged to have played a part in deliberately underestimating KEB's financial strength to facilitate its purchase of a 65% controlling stake in the bank in 2003. Lone Star sold 13.6% of KEB in June to institutional investors, but retained the 51.02% it is selling to HSBC. HSBC shares dipped 0.1% to $18.07 in London. II. Hong Kong and Shanghai Banking Corporation Headquartered in London since 1993, HSBC is one of the largest banking and financial services organization across the world with a market capitalization of US$198B and risk-weighted assets of US$1,123,782M. Its international network comprises some 10,000 properties in 83 countries and territories in Europe; Hong Kong; Rest of Asia-Pacific, including the Middle East and Africa; North America and Latin America, where they provided a comprehensive range of financial services to 128 million customers through four customer groups and global businesses: Personal Financial Services; Commercial Banking; Global Banking and Markets; and Private Banking. 1 As of year-end 2007, US$ 1 = KRW 929.20. The exchange rate went up to KRW 1,102 by the end of 2008 2 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 Total operating income for HSBC worldwide was up 25% and EPS grew by 17.9% in 2007, with a return on common equity of 14.3%, much above the average returns of 11.7% of its US counterparts. HSBC’s strategic direction reflected its position as “The world’s local bank” combining the largest global emerging markets banking business and a uniquely cosmopolitan customer base with an extensive international network. As per SK Green, the Group Chairman, “2007 was a year when large parts of the international financial system came under extraordinary strain. For HSBC to achieve another new high in earnings, despite these conditions and the exceptionally weak performance of our US business, underscores the value of the strategic focus we announced early last year to drive sustainable growth by concentrating on the faster growing markets of the world.” The 2007 financial crisis shook the American banking system. Compared to its American counterparts, HSBC was able to fill its bleeding American arm through its strong performance in the emerging markets. In the like-for-like basis, risk weighted assets for HSBC, which in emerging markets grew by 42% compared with 16% for the Group as a whole. As the leading international bank in China, HSBC was among the first to incorporate locally in the mainland. They built the largest branch network of any international bank and had significant and profitable strategic investments in their Chinese associates. In mainland China, HSBC achieved for the first time a pre-tax profit of US$1B, in addition to over US$7B generated in Hong Kong. Elsewhere in Asia-Pacific, HSBC sought to further strengthen their position through a series of investments in faster-growing economies. In South Korea, HSBC agreed to acquire 51% of Korea Exchange Bank for US$6.5 billion, subject to regulatory approvals. In Taiwan, they acquired Chailease Credit Services, a factoring company serving commercial customers, and agreed to acquire the assets, liabilities and operations of The Chinese Bank, which would extend their network by 39 branches and bring them many new customers. They also increased their stake in Techcombank by 5% with the easing of investment rules in Vietnam. Similarly, they entered into an agreement to acquire a 26% interest in a new life insurance joint venture in India, in partnership with two of the larger state-owned banks, and to acquire just under 50% of Hana Life Insurance Company in South Korea. South Korea, being the third largest economy in Asia after Japan and China, was also one of the focus areas for HSBC. The South Korean GDP was projected to grow at 4.5% in the coming year, around 2% higher than the expected US growth rate. In addition, Korean loan markets were expanding fast with strong growth potential. In September 2009, HSBC, to tap the opportunities in the South Korean market, agreed to acquire 51% of Korea Exchange Bank (KEB) for US$6.5B. Loan Growth of Korean Banking Industry (KRW in billions) Source: FSS (Financial Supervisory Service, www.fss.or.kr), financial regulatory authority of S. Korea. Note: figures are year-ending balance of total loans made out in KRW. 3 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 III. SOUTH KOREA South Korea is an OECD nation2 with high gross domestic product per capita of US$ 21,632. Korea has an export based economy with exports accounting for roughly 65% of the GDP. After having a stable political environment and a sustainable democracy in the last two decades, the country successfully created a diversified economy by diversifying its industrial base; transforming home-grown companies into world-class electronic giants; increasing focus on R&D investment; increasing investment in China, Vietnam and India in the Asia-pacific region; forging trade agreements with major countries across the world; and creating a world class education infrastructure. Korea GNI (Gross National Income) per Capita (US$) Source: Bank of Korea (www.bok.or.kr) Political & geological risks In spite of these strengths, there are a few prominent threats to the economy, such as the serious competition from the Chinese industrial sector; over-indebtedness of households and small companies3; aging population; and heavy reliance on family-controlled conglomerates known as “Chaebols”. To top it all, the unpredictability of the North Korean4 regime and the perpetual tensions among the four super powers (US, China, Russia, and Japan) in the Korean peninsula amounts to significant country risks. The Korean stock market already reflects these risks: as a rule of thumb individual stocks trade at a 20% discount (also known as “Korea Discount”) to their fair values computed using fundamental prices. Although after mid 2000s the stock market did not fluctuate much after regional military skirmishes, the country risks were considered to be greater during early 2000s and late 1990s. Foreign exchange risk The graph below demonstrates the bumpy ride of the Korean Won against the US dollar in the past 35 years. The genesis of this volatility was around the Asian financial crisis in 1997, when the South Korean Won was decoupled from the US dollar as a condition to receive financial assistance from the IMF and global banks. This made the Korean Won one of the few free floating currencies in Asia. As a result the Korean Won was exposed to macroeconomic factors, with investors freely entering and exiting the country’s capital markets, a characteristic that encouraged industries to engage in currency hedging and made the economy open to wild fluctuations. Thus from a foreign investor’s standpoint, the volatile foreign exchange market has been both a huge risk and an opportunity. 2 OECD (Organization for Economic Co-operation and Development) is an international economic organization of 34 countries founded in 1961 to stimulate economic progress and world trade. The key criteria for membership are: like-minded, a significant player, mutual benefits, and global considerations. 3 Household debt/disposable income (2007): 136%, SME debt to equity ratio (2007): 200% (Source) Korea Herald Economics (April 24, 2013). http://finance.daum.net/rich/news/finance/main/ MD20130424112409059.daum 4 Stand-off between North and South Korea lasted more than sixty years. 4 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 Volatility of Korean Won against USD The Korean banking industry Although the subprime mortgage crisis started hitting the US in early 2007, and as a result, distorting capital flows from developed to emerging markets, the fundamentals of Korean banks stood quite solid. The banking industry saw growth opportunities especially in the small and medium enterprises loan market, interest margins remained resilient, and asset quality, indicated by delinquency and non-performing loan ratios, were at historic low levels. Bank capital ratios (BIS ratios) also stayed well above the international hurdle rate of 8%. The average banking industry PBR (Price to Book) ratio remained at 1.1x, 15.3% discount off the historical average of 1.3x. This was mainly attributable to the capital outflows carried out by foreign investors (mostly from the US and the UK) worried about the unravelling in the US subprime market, rather than to the deterioration of fundamentals in Korean banks. Most Korean banking analysts held the view that the imbalance of capital flows and subprime crisis would not hit the Korean market severely5 and they assigned overweight ratings on the industry, believing that banks were heavily undervalued. Key Financials of Korean Banking Industry (U$M, %) 2004 2005 2006 2007.1Q Net Income ROA 8,800 0.85 13,600 1.27 13,600 1.12 6,600 2.05 Net Interest Margin NPL Ratio BIS Ratio 2.82 1.9 12.1 3.08 1.22 13.0 2.85 0.84 12.8 2.73 0.85 13.0 Source: Industry Credit Outlook (Korea Ratings) 5 Source: Daewoo Securities Research, Korean Banking Industry Report (April 15, 2008) 5 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 On July 3, 2007, the Capital Markets Consolidation Act was passed in Korea. This new law allowed financial companies to diversify. Currently, there were only brokerage houses, asset management companies, futures companies, investment trust companies, and it is impossible for an entity of one type, such as a brokerage house, to perform another type of financial service, such as asset management. Under the new law, these categories will disappear, and there will only be multi-service institutions, called financial investment companies. “After the new law, Korea will be changed from a manufacturing and bank-led economy to a market oriented economy. Securities companies will no longer depend on brokerage fees for survival. They can market diverse products to find new sources of profits, but those that fail will become scapegoats of larger financial investment companies” said Choi Jong-won, an analyst at TongYang investment bank. “Mergers and acquisitions will sweep the financial industry,” said Roh Hee-jin, a researcher at Korea Securities Research Institute. “Only the best and biggest bank will survive.” The Korean banking industry, after a series of consolidation post the 1997 Asian Financial crisis, was left with seven major players, each having their own expertise and domination over a certain market segment: KB (Kookmin Bank), for example, dominated the mortgage lending market, IBK (Industrial Bank of Korea) led the SME market, and KEB was well-positioned in the foreign exchange and trade finance markets. Between 2004 and 2007, the industry was in the midst of an aggressive expansion of bank lending. Small and medium enterprises (SMEs) and households were heavily indebted. Bank loans to SMEs stood at KRW 398.9T (US$394.1B) in May 2007, while the delinquency ratio was 1.3% in March 2007. Household debt was growing even faster than in the US. The total grew by 210% from 2001-2006, compared with 190% in the US for the same period. Total home mortgages reached KRW 229T (US$226.25B) in June, up 35.5% from KRW 169T (US$166.9B) at the end of 2004. IV. KOREA EXCHANGE BANK History of KEB Korea Exchange Bank (KEB) was carved out of the Bank of Korea with a capital of KRW 100B in January 1967 and is headquartered in Seoul, South Korea. Over the next 10 years, the bank became the market leader in foreign exchange and trade finance, providing financial services to aspiring local companies like Samsung and Hyundai as they started to expand overseas. In 1977-1988, KEB became a full-fledged commercial bank6 and pushed for global expansion: in March 1978, they established a subsidiary in Brussels, Belgium; KEB Chicago branch joined FDIC in March 1980; KEB Singapore branch issued US$20M of floating-rate CD in 1981; KEB was designated as the official Korean bank for the Los Angeles Olympic Games in 1983. In 1994, the bank was privatized and its stock was listed on Korea Stock Exchange. In July 1998 Commerzbank became a major shareholder. But in 2003, as South Korea’s banking industry was reeling from losses caused by issuing too many credit cards, KEB reported its biggest net loss since the Asian financial crisis in the late 1990s. Lone Star, founded by John Grayken to buy distressed assets, purchased Korea Exchange Bank in October 2003 in one of the largest M&A transactions in the Korean market in the aftermath of the 1997 crisis. Aftermath of the Credit Card crisis in 2003 6 In April 1978 KEB launched Visa branded credit cards for the first time in Korea. 6 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 Coming out of the credit card crisis, KEB delivered one of the best fundamentals within the banking industry. The management focused on margin improvement and lowering credit costs (Loan loss ratio) along with a modest loan growth. In addition, KEB started deleveraging by reducing bad assets and strengthening its capital base. The bank’s net interest margin stood at 3.42%, delinquency rate was 0.75%; sustainable loan growth rate of early 10% as of September 20067. Given the fact that all other Korean banks were racing into fierce loan growth with YOY increase rate of 15% to 30%, KEB’s loan growth plan was considered as very prudent and sustainable. Its total assets as of year-end 2006 was KRW 69T, net income KRW 1,006B, EPS was KRW 1,560. ROA and ROE stood at 1.49% and 16.7% respectively. Price to book trading band was at the range of 1.2x-1.5x. KEB put much of its effort to normalize its operation and improve fundamentals, thus making itself an attractive acquisition target in the eyes of potential buyers such as HSBC (in 2007) and KB (in 2005). Another important factor that set KEB apart from the rest of its competitors—and a good target for HSBC—was the foreign origin of its major shareholder—Lone Star. After Lone Star’s takeover in 2003, KEB focused on restructuring its balance sheet and improving margins rather than growing their assets. Having a foreign investor helped the bank sidestep much of the regulatory and political pressure that forced its peer-banks to take on more risk and keep making new loans in a bid to spur up a slowing economy. Lone Star Funds Lone Star was a Dallas, Texas based private equity firm that invests in distressed assets both in the United States and in global markets. John Grayken, the founder and chairman, set up the first fund in 1995 (called Brazos) and had since organized six private equity funds with a total capital of U$13.5B by the end of 2005. The realized annual rate of return of funds was between 9% and 28%. Funding of Lone Star was through sovereign wealth funds, university endowments, high net worth individuals, and corporate and public pension funds. Lone Star entered Asia amidst the Asian Financial Crisis in 1998. Before the acquisition of KEB, the fund was an active acquirer of nonperforming loans, real estates, and distressed banks. In Korea, it made sizable real estate investments (Star Tower, Star Lease, and Kukdong Construction Co.) and realized capital gains of total KRW 1,172B through the resale of those assets. However, such transactions created huge controversies within the country since Lone Star did not pay any capital gain taxes. This was because all the investments were made via a SPV (special purpose vehicle, or a paper company) founded by Lone Star in Belgium, which had a tax treaty with Korea that exempted Belgian companies from paying corporate taxes on their capital gains in Korea. In 2003, Lone Star acquired a 51% stake in KEB at a price of KRW 2,155B. Legal disputes of Lone Star Lone Star was involved in series of legal disputes on various counts. During its investment in Korea from 2003 to 2012, approximately 200 lawsuits were filed against the fund. Moreover, over 100 prosecutors and more than 600 inspectors were mobilized in order to deal with those cases. Key legal disputes involving Lone Star were: 7 Collusion with the Korean government officials in the acquisition of KEB – KEB, it was alleged, filed a much worse BIS ratio of 6.16% than it actually had in order to be sold to Lone Star at a deep bargain. Regulators approved the filing as legitimate, which eventually lowered KEB’s valuation by KRW 340B ~ KRW 825B. 2006 KEB fundamentals were quoted from CLSA report (August 31, 2006): “Attractive Risk Return” 7 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 Breach on principle of “separation of industrial capital and financial capital”− this count is directly related to the first count of intentionally lowering the BIS ratio. If Lone Star had been classified as industrial capital (which was highly likely), it could not have been eligible to own a bank in the first place. Nonetheless, since KEB was named as an insolvent financial institution with a BIS ratio lower than 8%, Lone Star was able to become an owner of a bank benefiting from the exception clause stating that a bank can be sold to even an industrial capital if the target bank becomes insolvent. Tax evasions on real estate investment and KEB transaction. Stock price manipulation over KEB Credit Services (KEBCS)—a publicly traded subsidiary of KEB—by Lone Star Korea’s CEO, Paul Yoo (KEB owned 49% of KEB Credit Card and wanted to increase its stake to over 50% so as to become a major holder of the company). Lone Star, the major shareholder of KEB in 2003, spread a rumor about its plan to decrease KEBCS’s capital. As a result, the stock price of KEBCS plummeted, and KEB acquired KEBCS at a price that was much lower than its estimated fair market value. Among the many other accusations, the court issued its final ruling over a single count: Lone Star was found guilty of the stock price manipulation of KEBCS. All other charges, except for the tax evasion, were dropped. Regulators’ standpoint The banking industry was quite different from that in the US in the sense that the financial market was run by several large commercial banks. Although there were investment banks, their profit sizes did not match up to those of commercial banks. Therefore, each commercial bank played a major role in the Korean economy. In addition, the banking system was heavily regulated by government entities, such as the FSC (Financial Services Commission) and the FSS (Financial Supervisory Service). These regulators were entitled to massive amount of authority and power, heavily intervening with operations of financial companies or setting up more or less market-unfriendly (or shareholder unfriendly) rules and regulations over banks in the name of preventative measures. Most banks and financial companies complied with these regulations without much of a protest in order to be on the right side of the regulators. In 2007, the FSC, which has the authority to approve M&A transactions, was under severe political pressure in the wake of the HSBC-KEB deal. HSBC’s proposal to acquire KEB from Lone Star was conditional upon the completion of the transaction by April 30, 2008. However, FSC deferred the approval due to the on-going legal disputes involving Lone Star. In February 2008, Seoul District Court held Lone Star guilty of stock price manipulation over KEBCS, which occurred in November 2003. This court rule was quite critical from the regulator’s perspective because Lone Star would lose its status as the major shareholder of KEB and would have to divest most of its stakes through an open market sale if the fund received any legal punishment or got indicted according to Korean Banking Law. Meanwhile, Lone Star appealed the court ruling taking it to the high court, which made FSC to hold out its decision until the court case was resolved. 8 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 HSBC feeling the pressure of the financial crisis: Meanwhile in 2008, HSBC’s total operating income is up by only 1% compared to 25% in 2007; Group pre-tax profit down by 62%; average share holder equity return is 4.7% against 15.9% in 2007; EPS is down 72%; total equity down 26%. Cost efficiency ratio, resources used to generate revenue, deteriorated by 10.7%. Loan impairment charges rose at a faster rate than income; the credit performance, measured by risk adjusted margin declines by 1.2% to 4.8% in 2008. For North America, HSBC reports a loss of US$15.5B including goodwill impairment charge of US$10.6B in Personal Financial Services. HSBC misses their profitability targets; still HSBC continued its acquisition of The Chinese Bank in Taiwan and IL&FS Investsmart in India along with Bank Ekonomi in Indonesia. They sell their regional bank network in France. After 15 years of double digit dividend growth, under the impact of volatile financial world and constraints of capital, they decide to lower the dividend, which was a 29% decrease from prior levels. They decide to raise $17.7 billion of equity in the hope of strengthening their capital ratios by 150 basis points. The chairman of the board takes no cash compensation and links his pay to performance bonus linked to performance targets in terms of capital ratios etc. CEO and CFO elected to opt out of the bonus awards in 2008. The Board decides that no cash bonus would be made to any Executive Directors in 2008. For its part, HBSC certainly suffers economic losses as a result of the global financial crisis; nor was the bank immune from sub-prime mortgage lending and other practices that came under fire in light of the financial crisis. Notwithstanding this fact, CEO Stephen Green indicates that HBSC was the first bank to publicly say "there was an issue" with its consumer lending business. HSBC management makes such statements in 2006 and 2007, leading to the closing of its consumer lending division in the United States in early 2008. Additionally, Green indicates that HSBC was "reining back" that business in 2007-2008, even as competitor banks continue to issue loans. "I am pleased and can be proud of our approach," Green said. "We were honest about the issues early and took the measures to deal with it early on." By contrast, Green points out, "It is surprising and interesting that in '07 and '08 people [other banks] continued to write significant volumes of mortgages in the U.S. market that subsequently started to show impairment." Even though HSBC seemed to be well positioned compared to the US banks and continued acquisition of The Chinese Bank, IL&FS, and Bank Ekonomi, it was time to reconsider HSBC’s bid to acquire KEB. Hence, HSBC’s management thought of looking into the bid again and re-analyze the valuation. Valuation of KEB: The major issue in the valuation in KEB was discount rate. Korea market was amongst the developed markets and the risks imposed were quite similar to that of these economies. However, the financial analysts at HSBC were not very comfortable with the traditional CAPM model, as they wanted to use a framework which can help them segregate the major country, industry, and firm specific risks in different buckets especially sovereign, operating, and financial. They identified a widely used framework prepared by Duke University’s Professor Campbell Harvey (Exhibit 5), which could suffice their requirement. Once the analysts used it to find out the correct discount rate, they wanted to stick with basic bank valuation methodologies, i.e. Equity Method of valuations – Abnormal Earnings method and Price to Book Value (relative valuation). The analysts were also aware of the fact that Korean stocks generally trade at a ~20 discount of their implied valuations. A year ago, in August 2007, the markets worldwide were at a high and the future looked good. KEB was trading on the day before deal was announced (Aug 31, 2007) was 14,600 won. The agreed offer price (agreed between 9 Finance 663.301 International Finance Alok Chakraborty, Chris Donghui Lee, Arindam Mandal, Harsh Singh Locker # 188 Lone Star and HSBC) was 18,045 won per share and the deal should be executed by April 2008, subject to regulatory approval. Whereas analyst’s fair value assessment was 15,500 won (with 16.4% control premium). HSBC analysts also did their own analysis assuming that KEB will continue performing well and will maintain a stable dividend payout ratio and return on equity. However, a year later, the world was changing. With Morgan Stanley shares down 37% over last year, Bear Stearns failing and Lehman Brothers on the verge of breakdown, it is quite evident that a crisis is about to hit all the markets worldwide. But, Asian markets, especially Korean, was still holding up well. KEB was trading at 13,700 won. However, the chances of escaping this crisis seemed low. Hence, it is time to re-evaluate the bid, adjusting for the imminent financial crisis. Conclusion: As HSBC management sat down to decide on the acquisition of Lone Star stakes in KEB, they discussed on the new valuation prepared by the analysts. Paying a 50-60% premium does not seem to be humongous, given that it would give them access to the growing Korean market. As the management decided to go through the valuation and check for different scenarios, they also thought of looking into the possibilities of the deal finally going through due to the ongoing legal issues involving Lone Star’s stake in KEB. Given the uncertainty of the deal, as suggested by one of the leading Korean market sell side analysts (Exhibit 12), the management was also poised to discuss about the liquidity situation within HSBC and global market. Considering the changing landscape in world economy and the deal date continuously extending due to the litigation issues, it was time to decide whether HSBC should go for the deal or drop the bid. *********************END OF CASE*************************** 10