General Findings - the United Nations

advertisement

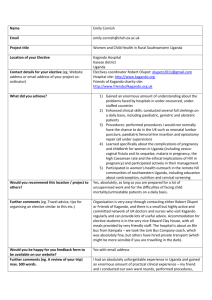

UN DESA Project on Capacity Building for Removing Institutional Constraints in Utilizing Trade Related International Support Measures For LDCs Mission Report – 22 to 30 May, 2014 1. Introduction The United Nations Department of Economic and Social Affairs (DESA) is implementing a project in Uganda to assist in identifying LDC-specific trade-related international support measures (ISMs) that can help exporters to remove institutional constraints in accessing those ISMs. With the assistance from an international and a national consultant, DESA undertook interviews with private sector stakeholders to assess the costs and benefits for accessing ISMs for each of the product/ISM combinations. Similarly, interviews were undertaken with representatives from the public sector involved in using ISMs to assess the cost and benefits for accessing the ISMs. The Consultants and DESA team also conducted site visits with a number of private sector exporters and producers to enable a better understanding of their export processes and therefore constraints faced. The data gathered from the interviews was used in the Cost-Benefit Analysis (CBA) accordingly prioritizing the particular institutional capacity constraints for accessing ISMs to be addressed. A two day workshop with the steering committee was organized to validate the survey findings and CBA results. 2. Surveys - private sector stakeholders The survey with private sector stakeholders was conducted for one major exporter or association selected for each product represented by the various respondents surveyed under Survey A (see Annex A). The exception was made for this fish sector for the reason that the sector is divided into two groups of stakeholders, the lower stream players consisting of processors / factories and exporters, and the upper stream players consisting of the fishermen, middlemen / suppliers to factories (also collectively referred to as the fishing communities). The focus of this survey was to collect data on possible targets of institutional capacity, gaps, costs and benefits of potential use of ISMs for each of the 8 products. This survey provided an opportunity to obtain critical information from all relevant private sector groups and allowed them to give input to defining parameters for the priority setting exercise of the CBA. General Findings The surveys revealed that challenges in meeting SPS requirements were still the highest and most costly for exporters. The cost of interventions in SPS related assistance is equally considered the highest of the five ISMs yet the benefits accruing in terms of increased trade was also highest if the SPS issues were addressed. TBT related challenges were rated least expensive, the survey however noted that the contact point for TBT related issues under the UNBS was active and visible to the biggest number of exporters. UNBS also worked closely with other government institutions like the Export Promotion Board, the line Ministry of Trade, Ministry of Agriculture and with the private sector players and associations. In fact, some of the exporters referred to UNBS for their SPS related enquiries and indicated that they were adequately assisted regardless of the fact that UNBS mandate is on issues related to TBT only. Regarding the market access support measure, DFQF, the survey revealed that exporters were not aware of the market access opportunities in emerging markets or how to access those markets. The lack of knowledge derived from the fact that there is no known contact office to give information on the available market access opportunities. Many exporters conduct their own research which proves to be expensive. There was also little knowledge of the EIF as an ISM and the EIF National Implementation Unit as the contact point. Moreover because of the little knowledge of the structure and value of the EIF, it was frequently ranked as the least important ISM. Furthermore, the UN Fish Stock Agreement was unknown to the respondents. List of Respondents: 1. UGACOF (Coffee) – Mr. James Njoroge 2. Uganda Tea Development Agency Limited – Ms Purity Mbae-Musyoke 3. Uganda Leather and Allied Industries Association – Mr. Mwebe Emmanuel 4. Uganda Flowers Exporters Association – Juliet Nekambi and Esther Nekambi 5. ESCO Uganda Limited (Cocoa and Vanilla) – Ms Winnie Nambehela 6. Uganda Fisheries and Fish Conservation Association – Mr. Seremos Kamuturaki 7. Uganda Fish Processors and Exporters Association – Ms Ovia Matovu and William Tibyasa 8. Horticultural Exporters Association of Uganda (HORTEXA) – Mr. David Lule 3. Site Visits: As part of research and consultation process of the project, the team of Consultants and DESA conducted four site visits: to a fish factory; a flower farm; a horticulture farm; and a tea plantation and factory. The rationale for conducting site visits was to witness the processes involved in the production, packaging and export of the products. The visits highlighted the various quality control processes that the exporters engage in, including SPS related measures to ensure that the final export product complied with the SPS standards set by the export market, as well as measures to ensure environmentally sustainable production. In addition the team learnt about the production structures of the 4 products visited, challenges and success stories. General findings: The Fish factory is foreign owned, but leased out to a Ugandan corporation who is operating the export of fish. The main export is Nile-perch fish to Belgium. The factory has registered fish suppliers from whom they acquire their fish. The factory maintains a relatively high level of hygiene for both the fish and the workers in processing the fish for export. At the Fiduga flower farm, the only produced and exported products are the cuttings which are then replanted at the destination and sold as a finished product. Fiduga is amongst the few flower farms that export new varieties of flowers (other than roses) to Europe. The farm was also foreign owned and operated as a production point for the Dutch based Fides Company. Similar establishments are in neighboring Kenya and Ethiopia. COSEDA exports horticultural products / fruits and vegetables grown on its own farms as well as sourced from other local farmers. The production and export is mainly demand based, i.e. the client in Europe requests for a specific number of shipment which is grown, harvested and exported. Horticultural production is heavily dependent on the climate patterns which with climate change negatively affect production. The Namayiba Tea Estate produces various brands of tea for bulk export / wholesale. The main market for their tea is the Mombasa auction in Nairobi. The factory expressed desire to package and exports their tea directly to the international market, however the challenge faced is the high competition from tea exporters who already have niche products and large market share internationally. Institutions visited: 1. Site Visit to Fish Factory: Greenfields – Mr. Shekar 2. Site Visit to Flower Farm: Fiduga – Ms. Gertrude Obita 3. Site Visit to Horticultural Farm: COSEDA – Mr. David Lule 4. Site Visit to Tea Farm and Factory: Namayiba Tea Estate – Mr. Lawrence Ssegujja 4. Survey - public sector stakeholders: The survey for the public sector was organised in the form of a workshop. Key public sector stakeholders were interviewed with the focus of collecting data on possible targets of institutional capacity, gaps, costs and benefits of potential use of ISMs as perceived by the public sector. General Findings: The majority of the government officials had some knowledge on all the ISMs under consideration with the exception of the UN Fish Stock Agreement. Many had attended the WTO trainings on SPS and TBT and had worked with the EIF as well. The respondents also expressed the need for additional training especially for the District Commercial Officers (DCOs) who had not attended these topic related trainings. The capacity of the DCOs was still lacking in the districts. Many of the DCOs were ill equipped with only the 25 EIF Tier II funded DCOs owning laptops, access to internet and an office notice board for their activities. They are however strategically located to disseminate trade related information to the local producers at the district level. List of Respondents: 1. Elizabeth Tamale - Ministry of Trade Industry and Cooperatives 2. Alex Mukuluma – EIF - NIU 3. Irene Musiime – District Commercial Officer Mukono 4. James Muganza – District Commercial Officer Jinja 5. Robert Mpakibi Waiswa – District Commercial Officer Wakiso 6. William Wepukhulu – District Commercial Officer Mbale 7. Christine Nsubuga – District Commercial Officer Luwero 8. Samuel K. Mukasa – District Commercial Officer Kayunga 9. Benjamin Ogunia – District Commercial Officer Soroti 10. Robinson Lufafa – Ministry of Agriculture Animal Industry and Fisheries 11. Francis Chesang - Uganda Coffee Development Authority 12. Damalie Lubwama - Cotton Development Organization 13. Daisy Eresu - Department / Unit responsible for tea 14. Dr Rukuunya Edward - Department of Fisheries 15. Muwanga Musisi John - Department responsible for Cocoa and Vanilla 16. Mwebe Emmanuel Zoya - Department responsible for Leather / Hides and Skins 17. Henry G.K. Nyakojo – EIF Advisor 18. Jin Lee – Embassy of the Republic of Korea 19. Embassy of Republic of China 20. Charles – United Nations Food and Agriculture Organisation 5. Cost-benefit analysis preparation (27-28 May): Based on the data obtained from the interviews, DESA prepared the CBA and a report containing a summary of the survey results, including institutional constraints, indicators to measure the constraint, targets, gaps and total costs and benefits for selected product/ISM matches. The consultants used the CBA report to come up with preliminary recommendations for intervention by DESA. The first was to build capacity of the enquiry and contact points of the various ISMs listed. Following the capacity building of the contact points, the second recommendation was for a toolkit that would provide information on the ISMs for Uganda as well as a system of alerts to the exporters on changes in the regulations relating to their products and from their export destinations. These preliminary recommendations were presented to the Steering committee for comments and applicability in the context of Uganda. 6. Workshop (28-29 May): The workshop started off with presentations on the background of the project, phase 1 also known as the pilot phase of the project and the progress of the project activities in Uganda and preliminary findings of the surveys conducted. The methodology and preliminary result of the CBA were also presented, as well as training of the participants in the use of the LDC Portal for accessing information about ISM. Discussions: LDC Portal – Participants recognized the portal as a valuable tool for the dissemination of the trade related information and other ISMs related to Uganda. They suggested that the LDC Portal be publicized more and especially the Uganda page kept up to date so as to maximize its benefit as a research tool for stakeholders. It was noted that the mandate of DESA under this project was neither to conduct a detailed study of the products nor to provide solutions for every product; rather to study the use of ISMs. For Market Access, the aim of the project and of workshop is to show that there are opportunities other than the traditional markets so that that later, these new duty free quota free opportunities can be explored, products fitting for that market developed and the opportunity taken advantage of. Some examples of emerging markets include Turkey and Russia; to implement this, there is need for Uganda to collaborate with other development partners. The EIF advisor noted that inclusion of the EIF should be made not as EIF Tier II but simply as the EIF because the Tier II are not permanent project and expire in a short duration, while EIF focal point is a permanent employee of the Ministry of Trade who can guarantee the sustainability. Relating to the TBT enquiry point, it was noted that TBT notifications sent to stakeholders are received; the challenge therefore is in acquiring the comments to the measures notified. UNBS still lacks capacity to reach a wider base of producers and exporters and to mobilize for the comments to be addressed in the WTO. ISM enquiry point / contact points – participants agreed with the recommendation to address functionalization of the enquiry points and focal points for SPS and DFQF not often used by exporters. The gaps in their operation and functionality should be sought out and addressed. An example was given that the first notification to SPS committee in 1999 was done by Tanzania on behalf of Uganda. The SPS Enquiry point / contact point was reported to be ill equipped and none-functional and should be strengthened. Tool kit and e-Ping – participants were in agreements with the recommendation for the tool kit and e-Ping, they also had additional suggestions: Participants suggested a creation of a communication strategy which would create an institutional linkage and buy-in from all the stakeholders. In other words it would incorporate all the national stakeholders and use the existing national structures to get to grass roots; ownership by the national structures ensures that the project is sustainable. The District Commercial Officers should be trained in the use of the tool and e-Ping in order that the information is translated to non-technical language and disseminated to the local producers at the district levels using posters and radio. All 25 EIF Tier II DCOs are equipped with notice boxes in their respective offices that they can use as a means of communication. It was also agreed that the easiest way of communicating is by phone and laptop and the relevant stakeholder in the private sector have internet access. Furthermore the private sector is more likely to use this too as long as the they know of its existence and value to their work, therefore promotion and raising awareness of the tool is key to ensure it works amongst the private sector. The idea of a live chat was also considered a good addition to the toolkit. It is also critical to ensure validity of the information; and that the tool works so that users can trust it as a reliable source of information. For example, the EU rapid alert works efficiently and therefore many exporters use it. Participants were also concerned about how the success of the toolkit would be measured. Suggestions were made for a survey after a period of 12 months from the launch of tool kit and tracking the number of visits to the pages. Workshop participants: 1. Elizabeth Tamale –Ministry of Trade, Industry and Cooperatives 2. Cyprian Batala –Ministry of Trade, Industry and Cooperatives 5. Henry Nyakajo – EIF Advisor EIF - NIU 6. Alex Mukuluma – EIF – TRACE II project 7. Lwere John Bosco – Uganda National Export Promotions Board 8. George Opio – Uganda National Bureau of Standards 9. Dr Charles Mukama – Ministry of Agriculture Animal Industry and Fisheries 10. Mr. Othieno Odoi – National Planning Authority 11. Mr. Lawerence Othieno – Ministry of East Africa Community Affairs 12. Moses Ogwal – Private Sector Foundation Uganda 7. Preparation of follow up actions (30 May) The Team of consultants and DESA also met with a selected number of the steering committee members to conclude on the validation of the mission findings and discuss the next steps of the project implementation. Discussion: A sketchy road map was drawn by DESA; it is expected that the final report with recommendations should be ready by the end of June, copies will be sent to the Ministry of Trade focal point to disseminate to the stakeholders and relevant stakeholders in July. UNDESA will then come up with an implementation strategy which possibly includes organization of workshops with Uganda and the other three countries in which the project is also being implemented, development partners and international organizations. Follow up activities would be implemented in the second half of 2014 and 2015.. Jacquiline Pimer (National Consultant) pimerj@live.com Annex A: Survey Part A Respondents List of Respondents – Survey Part A 1. Kailash Natami - UGACOF Ltd (Coffee and Cocoa) 2. George Sekitoleko – Uganda Tea Association (UTA) (Tea) 3. Purity Mbae-Musyoka – Uganda Tea Development Agency (UTDA) (Tea) 4. Ms Matovu Katiti Ovia Lily - Uganda Fish Processors & Exporters Association (UFPEA) (Fish) 5. William M. Tibyasa – Uganda Fish Processors and Exporters Association (UFPEA) (Fish) 6. Philip Borel De Bitche - Greenfields Uganda Limited (Fish) 7. Kamuturaki Seremos – Uganda Fisheries and Fish Conservation Association (Fish) 8. Charity Namuwoza – National Organic Agricultural Movement of Uganda (NOGAMU) (Cocoa Beans and Vanilla) 9. Mr Aga Sekalala Jr – Uganda Vanilla Growers Association (UVAN) (Vanilla) 10. Winnie Nambalele - Esco Uganda Limited (Cocoa and Vanilla) 11. Mr. David Lule - Horticultural Exporters Association of Uganda (HORTEXA) (Horticulture) 12. Juliet Musoke - Uganda Flowers Exporters Association (UFEA) (Flowers and cuttings) 13. Ms. Esther Nekambi - Uganda Flowers Exporters Association (UFEA) (Flowers and cuttings) 14. Lamech Wesonga - Uganda Manufacturers Association (UMA) (Semi-processed Hides and Skins and Leather) 15. Mwebe Emmanuel Zoya - Uganda Leather and Allied Industries Association (Semi-processed Hides and Skins and Leather) 16. Regina Corry - Uganda Telecom Limited (UTL) (Telecommunication services) 17. Rogers Karebi - Uganda Business Process Outsourcing Association and Dail-A Services (ICT enables services)