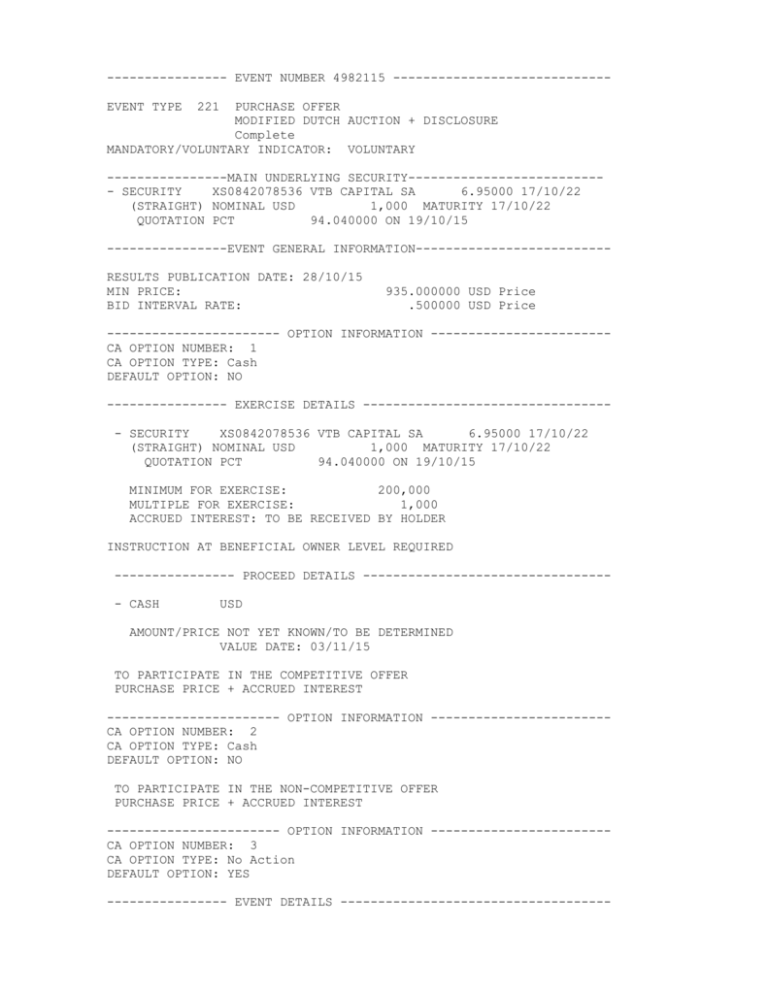

EVENT NUMBER 4982115 ----------------------------

advertisement

---------------- EVENT NUMBER 4982115 ----------------------------EVENT TYPE 221 PURCHASE OFFER MODIFIED DUTCH AUCTION + DISCLOSURE Complete MANDATORY/VOLUNTARY INDICATOR: VOLUNTARY ----------------MAIN UNDERLYING SECURITY-------------------------- SECURITY XS0842078536 VTB CAPITAL SA 6.95000 17/10/22 (STRAIGHT) NOMINAL USD 1,000 MATURITY 17/10/22 QUOTATION PCT 94.040000 ON 19/10/15 ----------------EVENT GENERAL INFORMATION-------------------------RESULTS PUBLICATION DATE: 28/10/15 MIN PRICE: BID INTERVAL RATE: 935.000000 USD Price .500000 USD Price ----------------------- OPTION INFORMATION -----------------------CA OPTION NUMBER: 1 CA OPTION TYPE: Cash DEFAULT OPTION: NO ---------------- EXERCISE DETAILS --------------------------------- SECURITY XS0842078536 VTB CAPITAL SA 6.95000 17/10/22 (STRAIGHT) NOMINAL USD 1,000 MATURITY 17/10/22 QUOTATION PCT 94.040000 ON 19/10/15 MINIMUM FOR EXERCISE: 200,000 MULTIPLE FOR EXERCISE: 1,000 ACCRUED INTEREST: TO BE RECEIVED BY HOLDER INSTRUCTION AT BENEFICIAL OWNER LEVEL REQUIRED ---------------- PROCEED DETAILS --------------------------------- CASH USD AMOUNT/PRICE NOT YET KNOWN/TO BE DETERMINED VALUE DATE: 03/11/15 TO PARTICIPATE IN THE COMPETITIVE OFFER PURCHASE PRICE + ACCRUED INTEREST ----------------------- OPTION INFORMATION -----------------------CA OPTION NUMBER: 2 CA OPTION TYPE: Cash DEFAULT OPTION: NO TO PARTICIPATE IN THE NON-COMPETITIVE OFFER PURCHASE PRICE + ACCRUED INTEREST ----------------------- OPTION INFORMATION -----------------------CA OPTION NUMBER: 3 CA OPTION TYPE: No Action DEFAULT OPTION: YES ---------------- EVENT DETAILS ------------------------------------ INFORMATION SOURCE: TENDER AGENT: LUCID ISSUER SERVICES LIMITED LEROY HOUSE 436 ESSEX ROAD LONDON N1 3QP UNITED KINGDOM TELEPHONE: +44 207 704 0880 ATTENTION: DAVID SHILSON EMAIL: VTB(AT)LUCID-IS.COM GENERAL INFORMATION --------------------THE PURPOSE OF THE OFFERS IS TO ENABLE THE OFFEROR TO ACQUIRE CERTAIN OF ITS OUTSTANDING EUROBONDS AT THEIR CURRENT MARKET PRICES, WHICH IS REFLECTIVE OF THE OFFEROR'S LIQUIDITY POSITION AND CONSISTENT WITH ITS ONGOING LIABILITY MANAGEMENT OBJECTIVES. 1. TENDER AND CONSENT: NON APPLICABLE. 2. CONDITIONS AND RESTRICTIONS: CERTAIN RESTRICTIONS APPLY FOR THE FOLLOWING COUNTRIES: UNITED STATES, UNITED KINGDOM, FRANCE, BELGIUM, ITALY AND RUSSIA THESE RESTRICTIONS APPLY TO BENEFICIAL OWNERS. COMPLETION OF THE OFFERS IS CONDITIONAL UPON THE SATISFACTION (OR, IF APPLICABLE, WAIVER) OF THE TRANSACTION CONDITIONS REFER TO THE OFFER DOCUMENTATION FOR THE COMPLETE CONDITIONS AND RESTRICTIONS OF THIS OFFER. TIMETABLE ----------- PRICING DATE: 28/10/2015 ENTITLEMENT ------------1. PURCHASE PRICE: THE PURCHASE PRICE IS BASED ON A BIDDING PROCESS (A 'MODIFIED DUTCH AUCTION'). TO INSTRUCT FOR THE COMPETITIVE OFFER, YOU NEED TO INCLUDE A BID PRICE IN YOUR INSTRUCTION, GREATER THAN THE MINIMUM PRICE. - MINIMUM PRICE: USD 935 PER USD 1,000 THE BID PRICE NEEDS TO BE IN INCREMENTS OF USD 0.50 PER USD 1,000. A BID PRICE THAT IS NOT IN ACCORDANCE WITH THE SET INCREMENT WILL BE ROUNDED UP TO THE NEAREST INCREMENT WITHIN THE BID RANGE. NOTE THAT FOR THE COMPETITIVE OPTION THE LOWEST BID PRICE POSSIBLE IS THUS: USD 935.50 PER USD 1,000 NO BID PRICE IS NEEDED WHEN YOU INSTRUCT FOR THE NON- COMPETITIVE OFFER 2. ACCRUED AND UNPAID INTEREST: ACCRUED AND UNPAID INTEREST WILL BE PAID UP TO, BUT NOT INCLUDING, THE SETTLEMENT DATE 3. MINIMUM AGGREGATE ACCEPTANCE AMOUNT: THE OFFER IS NOT CONDITIONAL ON A MINIMUM AGGREGATE AMOUNT OF SECURITIES BEING TENDERED. 4. TENDER CAP: UP TO USD 750,000,000 IN AGGREGATE PRINCIPAL AMOUNT ACROSS ALL ISSUES OF MDA NOTES. 5. PRORATION: IF THE TENDER CAP IS EXCEEDED, INSTRUCTIONS TO TENDER WILL BE SCALED BY A FACTOR EQUAL TO: (A) THE RELEVANT ISSUE ACCEPTANCE AMOUNT FOR THE MDA NOTES LESS THE AGGREGATE PRINCIPAL AMOUNT OF THE RELEVANT ISSUE OF THE MDA NOTES THAT HAVE BEEN TENDERED AND ACCEPTED FOR PURCHASE AND ARE NOT SUBJECT TO ACCEPTANCE ON A PRO RATA BASIS (IF ANY), DIVIDED BY (B) THE AGGREGATE PRINCIPAL AMOUNT OF THE RELEVANT ISSUE OF THE MDA NOTES THAT HAVE BEEN VALIDLY TENDERED FOR PURCHASE PURSUANT TO THE OFFERS AND ARE SUBJECT TO ACCEPTANCE ON A PRO RATA BASIS (SUBJECT TO ANY ADJUSTMENT FOLLOWING ROUNDING OF TENDERS) EACH TENDER OF NOTES THAT IS SCALED IN THIS MANNER WILL BE ROUNDED DOWN TO THE NEAREST USD 1,000 OR CHF 5,000, AS APPLICABLE, IN THE PRINCIPAL AMOUNT OF NOTES, PROVIDED THAT NO TENDER INSTRUCTION WILL BE ACCEPTED IN THIS MANNER WHERE THE ACCEPTANCE OF PRO-RATED NOTES WOULD RESULT IN A NOTEHOLDER (I) TRANSFERRING NOTES TO THE OFFEROR IN AN AGGREGATE PRINCIPAL AMOUNT LESS THAN THE APPLICABLE MINIMUM DENOMINATION OR (II) HOLDING A RESIDUAL AMOUNT OF VALIDLY TENDERED NOTES TOTALLING LESS THAN THE APPLICABLE MINIMUM DENOMINATION. 6. POOLFACTOR: NOT APPLICABLE ==================END OF NOTICE===================