Governmental Ethics Ordinance Chapter 2

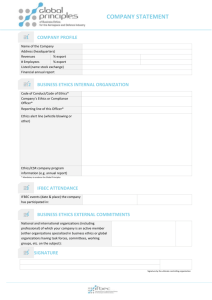

advertisement