Full Text (Final Version , 3mb)

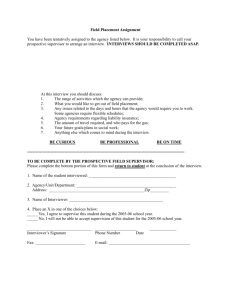

advertisement