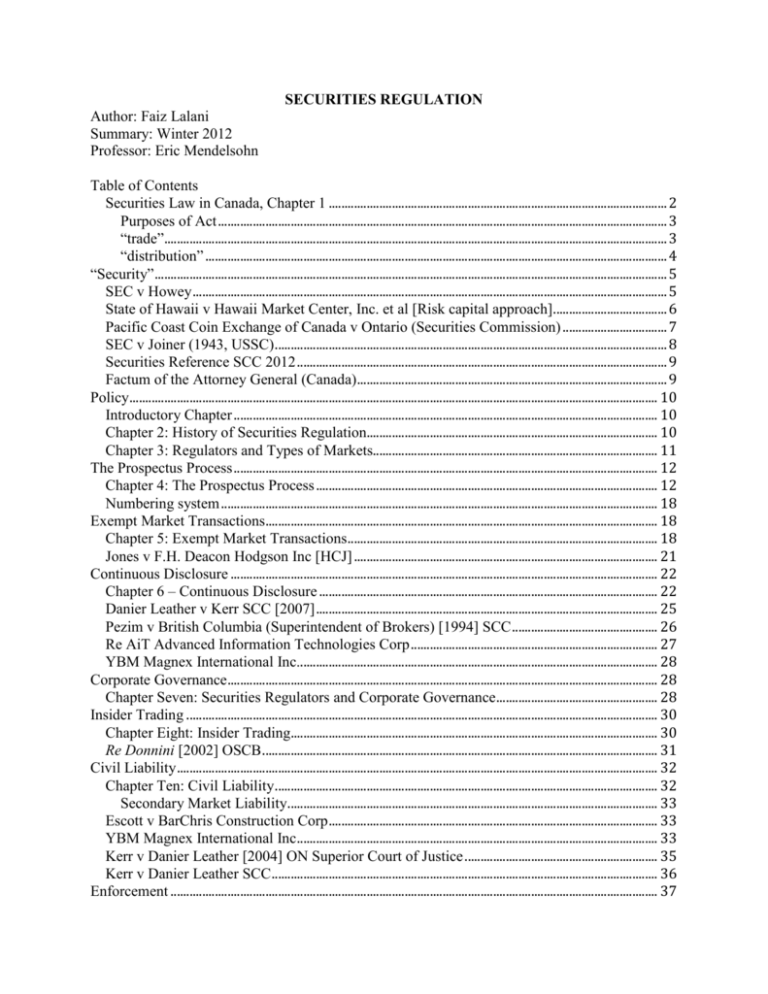

Security

advertisement