Cash Flow Management - Rappahannock Area of Narcotics

advertisement

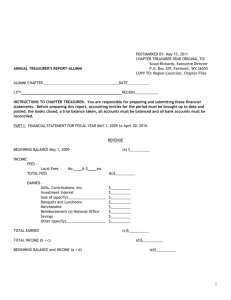

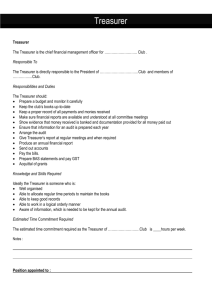

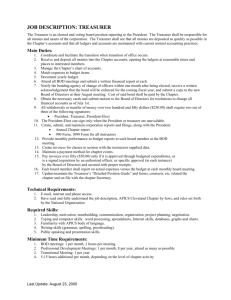

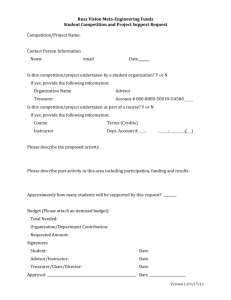

Auditing AdHoc Team Guidelines PURPOSE: The purpose of this document is to provide auditing criteria and guidance to the Rappahannock Area Service Committee of Narcotics Anonymous (RASCNA) Auditing AdHoc Team. These guidelines and concepts are based on pre-existing standardized accounting and auditing procedures. Therefore, this guidance should provide adequate written standardized auditing procedures that can be followed step-by-step during the auditing process. It is deemed feasible that an audit should occur on a quarterly basis of RASCNA financial and non-financial operational activities. Hopefully, this carefully thought out guidance can be reviewed and approved for dissemination and use by RASCNA Internal Auditing AdHoc team members. OBJECTIVE: The objective of this auditing team is to determine if management oversight is conducted to ensure RASCNA policies and procedures are followed. To determine if all financial safeguards and cash flow activities are made with appropriate signature authority, proper supporting documentation, and administrative record management in accordance with applicable By-Laws and Treasurer Handbook statutes and requirements. The auditing team will report any discovered areas of exception (error or theft) in the most efficient and timely manner by providing two levels of comprehensive functionality to meet RASCNA needs: To ensure compliance with proper internal control safeguards such as adherence to policies and procedures; segregation of duties, physical security, and proper authorizations and approvals. To minimize and identify immediately any compromise to the integrity of the financial accounting system. SCOPE: To perform a detailed evaluation and review (audit) of the monthly Balance Sheet, Bank Statement, Deposit Tickets, Check Register, and Receipt Ledger. The audit team will follow the audit trail through the duration of the total 1 reconciliation life cycle step-by-step. The life cycle consists of: 1) Cash Flow Management; 2) Matching; 3) Reconciliation; 4) Exception Resolution; 5) Reporting; 6) Archiving and 7) Compliance in Figure 1 below. Total Reconciliation Life Cycle Cash Flow Management Compliance Matching Archiving Reconciliation Expection Resolution Reporting Figure 1 Cash Flow Management The Area Chairperson is the one central appointed custodian over all Area cash flow. The Treasurer acts on behalf of the Area Chair. Therefore, it is the Treasurer duty to manage all financial transactions, account balances, electronic data, supporting documentations, and non-financial data such as various reports. The Treasurer Handbook provides guidance that will allow the trusted servant to execute the treasurer’s duties in total simplicity without compromising functionality. 2 The present Treasurer provides management for accounting systems that embody a very specific audit trail documenting all RASCNA transactions and balances. They are the General Ledger Accounts, Balance Sheet, Cash Receipt Ledger, Check Ledger, Deposit Ledger, and Bank Reconciliation Ledger. The audit teams should commence the audit by performing Matching of these various ledgers. Matching Matching should occur between the Bank Statement, the Bank Account, the Treasury Record Ledgers, and Treasurer Reports. Banks usually maintain a record of all checking account transactions. A summary of all transactions, called a statement of accounts, is mailed to the depositor, usually each month. Like any account with a customer or a creditor, the bank statement shows beginning balance, additions, deductions, and the balance at the end of the period. In the spirit of simplicity, the treasurer is referred to as the “depositor”. The depositor’s checks received by the bank during the period may accompany the bank statement, arranged in the order of payment. The paid checks are stamped “Paid”, together with the date of payment. Other entries that the bank has made in the depositor’s account may be described in debit or credit memorandums enclosed with the statement. You should note that a depositor’s checking account balance in the bank records is a liability with a credit balance. Debit memorandums issued by the bank on a depositor’s account therefore decrease the depositor’s balance. Likewise, credit memorandums increase the depositor’s balance. A bank issues a debit memorandum to charge (decrease) a depositor’s account for service charges or for deposited checks returned because of insufficient funds. Likewise, a bank issues a credit memorandum when it increases the depositor’s account for collecting a note receivable for the depositor, making a loan to the depositor, receiving a wire deposit, or adding interest to the depositor’s account. Bank Accounts are our primary tool used to control our cash flow. For example, our Area often requires that all cash receipts be initially deposited in a bank account. Likewise, RASCNA usually use checks to make all cash payments, except for very small reimbursable amounts. When such a system is used, 3 there is a double record of cash transactions—one by the Area Treasurer and the other by the bank. Matching a bank account and a RASCNA treasury records is an excellent safeguard to have in place because it provides a double check of records of all cash transactions. The audit team can then use the bank statement to compare and match cash transactions recorded in its accounting records to those recorded by the bank. The cash balance shown on the bank statement is usually different from the cash balance shown in the Area Treasurer’s accounting records. This difference may be the result of a delay by either party in recording transactions. For example, there is a time lag of one day or more between the date a check is written and the date that it is presented to the bank for payment. If the depositor mails deposits to the bank or uses the night depository, a time lag between the date of the deposit and the date that it is recorded by the bank is also probable. The bank may also debit or credit the depositor’s account for transactional fees about which the depositor will not be informed until later. Matching is useful in revealing differences that may be the result of errors made by the either the Treasurer or the Bank in recording transactions. For example, the Treasurer may incorrectly post to the cash ledger a check in the amount of $450 as $4,500. Likewise, a bank may incorrectly record the amount of a check deposit in the amount of $4,500 instead of the amount of $450. Without the Matching process, these errors may never be detected until one day Area receives a NSF fee from the bank. Reconciliation Bank Reconciliation is important because it provides effective control of cash inflows and outflows. There usually will be a difference balance between the treasurer’s cash balance and the bank’s balance. Therefore, the reasons for the difference between the cash balance on the bank statement and the cash balance in the accounting records should be determined by preparing the bank reconciliation. The bank reconciliation is a listing of the items and amounts that causes the cash balance reported in the bank statement to differ from the balance of the cash account in the ledger. 4 The bank reconciliation is usually divided into two sections (Step 1 and Step 2 below). First section begins with the cash balance according to the bank statement and ends with the adjusted balance. The second section begins with the cash balance according to the depositor’s records and ends with the adjusted balance. The two amounts designed as the adjusted balance must be equal. Included a step-by-step detailed listing of the procedures involved in Figure 2, which is an example of the bank reconciliation as shown below. Step 1. Balance per bank statement on Aug. 31, 2011 $ 3,490 Adjustments: 0 Deposits in transit + 1,450 Item #9 Outstanding checks – 3,221 Item #8 Bank errors Step 2. Item #1 0 Adjusted/corrected balance per bank $ 1,719 Balance per books on Aug. 31, 2011 Adjustments: $ 967 Item #7 Bank service charges NSF checks & fees – – 35 110 Item #2 Item #3 Check printing charges – 80 Item #4 Interest earned + 8 Item #5 Note Receivable collected by bank + 960 Errors in company's cash account + 9 Item #6 Item #10 Adjusted/corrected balance per books $ 1,719 Figure 2 These steps may be useful in finding the reconciling items and determining the adjusted balance of the monthly cash flows: 1. Compare each deposit listed on the bank statement with unrecorded deposits appearing in the preceding period’s reconciliation and with deposit receipts or other records of deposits. Add deposits not recorded by the bank to the balance according to the bank statement. 2. Compare paid checks with outstanding checks appearing on the preceding period’s reconciliation and with recorded checks. Deduct checks outstanding that have not been paid by the bank from the balance according to the bank statement. 5 3. Compare bank credit memorandums to entries in the journal. For example a bank would issue a credit memorandum for a note receivable and interest that it collected for a depositor. Add credit memorandums that have not been recorded to the balance according to the depositor’s records. 4. Compare bank debit memorandums to entries recording cash payments. For example, a bank normally issues debit memorandums for service charges and check printing charges. A bank also issues debit memorandums for not-sufficient-funds checks. A not-sufficient-funds (NSF) check is a customer’s check that was recorded and deposited but was not paid when it was presented to the customer’s bank for payment. NSF checks are normally charged back to the customer as an account receivable along with a $25.00 fee. Deduct debit memorandums that have not been recorded from the balance according to the depositor’s records. 5. List any errors discovered during the preceding steps. For example, if an amount has been recorded incorrectly by the depositor, the amount of the error should be added to or deducted from the cash balance according to the depositor’s records. Similarly, errors by the bank should be added to or deducted from the cash balance according to the bank statement. Exception Resolutions An exception resolution is the process to be taken should the audit reveal mistakes, mathematical errors, or the occurrence of fraud or theft. There will be ZERO tolerate of theft of “7th Tradition” basket monies. The primary goal of transactional matching and balance reconciliations is to minimize the number of exceptions and to identify immediately any risk of compromise to Area cash flow. Unfortunately exceptions happen. The exception resolution method will provide speed and ease for resolving mistakes or errors and assist in minimizing and addressing inherent areas of risk to cash flow integrity and management in the most effective and timely manner. Should the audit discover evidences to support possible theft or fraudulent actives of any kind, the perpetrator will be 6 prosecuted by the Law to the fullest extent possible. The Area Chairperson is appointed as the sole custodian over all RASCNA cash flow (inflows and outflows). The Chair receives ALL monies from GSR and committee members and then passes the monies to the Vice-Chair or the Treasurer. With this specific intake process in place, the Chair as a United States American citizen has the right to press charges in his or her name for any crimes committed against their person. This would alleviate any involvement or mention of the Narcotics Anonymous Fellowship throughout the duration of the entire legal process. Reporting and Archiving The Treasurer trusted servant thoroughly understands the accounting and bookkeeping of the financial system’s functionality. The treasurer is the initial and central financial data collection point who is responsible for collecting, summarizing, and reporting data of all cash flow transaction on a monthly basis. In light of this it is imperative that a monthly report from the Treasurer’s viewpoint, be written, verbally presented, and then archived in a safe and accessible location. Each monthly report is considered as non-financial information. The auditing team should confirm that the financial data in the report is accurate and true. Due to the high cost involved with outsourcing a team of auditors, developing and utilizing an “internal” auditing team is a valuable solution in providing RASCNA’s auditing functionality needs. Area’s Internal Audit AdHoc team shall consist of at least four (4) members. One of these four team members shall be knowledgeable of standardize accounting and auditing procedures. Either the RASCNA Administrative Chair or Vice Chair shall be a member. Also, there shall be at least two members of the Fellowship with at least six (6) months or more uninterrupted clean-time. Each internal quarterly audit shall be performed using a quick and non-biased approach. This team shall be responsible for performing, documenting, and producing a written report. 7 Compliance The compliance portion the audit examination is one of the most important elements of the audit observation, review, and evaluation process because it ensures compliance with the RASCNA policies which ensure good financial governance. 1 2 3 4 5 6 7 8 COMPLIANCE AUDIT Treasurer meets minimum four (4) years clean-time requirement. Treasurer meets two (2) years Area-level experience requirement. Treasurer's provided services are within the two (2) year term requirement. There is a Vice-Treasurer "in training". The Chair is the one central appointed custodian of the all Area funds. (The Treasure only acts on behalf of the Area Chair.) Each of the Group Service Representative (GSR) and Committee member donations and monies are given directly to the Chair (or Vice-Chair only in the Chair's absence) not to the Treasurer. Chair (or Vice-Chair) then gives collected monies directly to the Treasurer who acts on behalf of the Chair. There are three (3) co-signers on the Area’s bank account. 9 Treasurer presents a report along with supporting documentation, such as receipts and disbursements, at each Area meeting. 10 The Treasury Report is reviewed and approved at each monthly meeting by the Area GSRs. 11 All monies are deposited into the Area’s bank account within five (5) business days. 12 All check expenditures and payments have three Trusted Servants signatures. 13 All available Area funds have been disbursed as directed in accordance with Area motions and policy guidelines. 14 There are written receipts for all monies received on behalf of the Area. 15 16 17 Weekly budget review meeting is facilitated in October of each year. An Annual Budget was submitted at November’s Area meeting A Quarterly Audit has been performed this quarter. 18 Audit AdHoc Committee presented a written Quarterly Report to Area. Figure 3 8 YES NO The audit team should question members of the Areas Administrative body to answer the 18 questions listed in Figure 3 above. Determination of compliance will be noted with a “Yes” answer and determination on noncompliance with will be noted with a “NO”. All noncompliance should be reported and recommendations made by the audit team using the “Exception Resolution” method mentioned earlier in this document. Summary and Conclusion This document has provided auditing criteria and guidance to fulfill RASCNA internal auditing needs. These guidelines and concepts are based on pre-existing standardized accounting and auditing procedures. This simple and explicit guidance has been reviews and found to be adequate as written standardized auditing procedures to be used during the Area internal auditing process. It has been determined that an audit should occur on a quarterly basis of RASCNA financial and non-financial operational activities. Thus, this guidance is being disseminated for use by RASCNA Internal Auditing AdHoc team members. 9