Draft Handbook on Agricultural Cost of Production

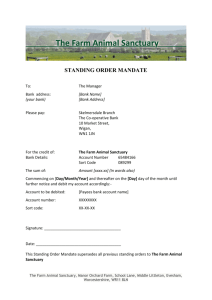

advertisement