Is It 1775 Again? - MC Asset Management Holdings

advertisement

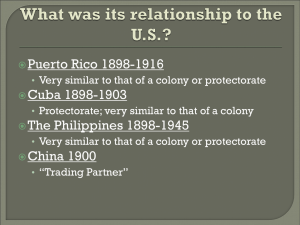

The Global Economic Reporter July 11, 2014 Is It 1775 Again? Scott B. MacDonald Head of Research (203) 487-6705 Scott.MacDonald@mcasset.com Heidi Constantine Senior Associate (203) 326-6893 Heidi.Constantine@mcasset.com MC Asset Management Holdings, LLC Executive Summary: In 1775, Lisbon was hit by a devastating earthquake, which was followed by a tsunami and city-wide fires in which some 100,000 people perished. The ripples of the Great Lisbon Earthquake were felt as far away as Ireland, Finland and North Africa. Fast-forward to July 2014, where global markets are now shaking from the problems of Portugal’s “Banco Espirito Santo,” the country’s second-largest bank. Although the concerns over the bank probably resemble more of a tremor than 1775’s earthquake, they point to the unwelcome fact that risk still exists despite the recent lowpoints in the VIX Index (10.32 on July 3rd), the rise of U.S equity markets to record highs and steady tightening of corporate bond spreads. The issue for Espirito Santo is that its parent company missed debt payments to “a few clients,” casting doubts over the bank’s creditworthiness. Although it does not appear that the bank will collapse, it is not a good thing for one of the country’s major financial institutions to have questions of this sort hanging over it, especially as they translate into questions over the value of credit lines to local businesses, both big and small. Anyone looking for an immediate ripple effect need only check the plummeting values of some of Portugal’s companies on stock exchanges, not to mention how ripples from Lisbon pulled European stock exchanges down on July 9th-10th. In the bond markets, it is peripheral sovereign debt and banks that took the hit. Take Espirito Santo’s problems, disappointing Chinese export data (for June 2014), an uptick in Israeli-Hamas hostilities and Puerto Rico’s debt woes into the picture, as well as a more sharply bifurcated debate over U.S Federal Reserve policy and inflation, and the world is not such a safe place for investors – at least not in the way bulls are calling it. What we are seeing now is a lot of tremors, which signal that tectonic plates are grinding away beneath the surface. There are more tremors to come and this mid-July scare should remind investors that there is risk associated with reaching for yield. Money can still be made in these markets, but the entwining of macroeconomics, geopolitics and specific company performance requires a more 360° view than earlier in the year. There are positive forces to keep markets moving – a flood of M&A activity, probably a solid earnings season and positive U.S. economic data. It is not 1775 again, but if you are in the wrong bonds, equities or real assets, it certainly can feel that way. The MC Asset Management Holdings, LLC Risk Monitor (Page 2) Bi-Weekly Risk Update (Page 3) The Fed Minutes – Finding Direction? (Page 4) Puerto Rico – Another Detroit? (Page 5) Economic Charts and Commentary (Page 7) USA Six Landmark Square Stamford, CT 06901 +1 (203) 487-6700 http://us.mcasset.com No part of this document may be reproduced in any manner without the permission of MC Asset Management Holdings, LLC (MC Asset Management). Although the statements of fact have been obtained from and are based upon sources MC Asset Management believes reliable, we do not guarantee their accuracy, and any such information may be incomplete. All opinions and estimates included in this report are subject to change without notice. This report is for informational purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security. MC Asset Management, its affiliates and their respective officers, directors, partners and employees, including persons involved in the preparation of this report, may from time to time maintain a long or short position in, or purchase or sell a position in, hold or act as market-makers or advisors or brokers in relation to the securities (or related securities, financial products, options, warrants, rights, or derivatives), of companies mentioned in this report or be represented on the board of such companies. Neither MC Asset Management nor any officer or employee of MC Asset Management or any affiliate thereof accepts any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this report or its contents. Forecasts, estimates and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. MC Asset Management Americas, Ltd., a wholly owned subsidiary of MC Asset Management Holdings, LLC, conducts securities activities in the United States. MC Asset Management Americas, Ltd., is a member of FINRA and SIPC. © 2014 MC Asset Management Americas, Ltd. MC Asset Management Holdings, LLC The Global Economic Reporter July 11, 2014 The MC Asset Management Holdings, LLC Risk Monitor Direction* Previous Ranking Factor 1. 2 Changing Interest Rate Regime Commentary Fed Policy is front and center for investors in the months ahead as QE is set to end, inflationary pressures are expected to rise, and the debate (both with the FOMC and economist circles) intensifies as to when the central bank will raise rates. The closer the Fed moves to actual raising rates the more likely market uncertainty, despite the faith put in “forward guidance”. We are concerned that Fed policy could be a few steps behind upward inflationary moves and remained more focused on employment lags. China’s economy is a major concern for investors and economic policymakers. The world’s second-largest economy has substantial challenges, including bringing credit under control, a cooling property sector, dealing with a pipeline of corporate debt defaults and maintaining economic growth. We also have questions over the stability of the banking system. The shift to a more market-driven economy is in motion, which will not be without bumps along the way. For some analysts, this means a hard landing; for others, this translates into a challenging path that will have downturns, but will create an economy less dependent on top-down investment-led growth. We do not see a hard landing in 2014 but do not rule one out in 2015. According to the International Monetary Fund, economic growth in the Euro-area is forecast to reach only 1.2% in 2014 and 1.5% in 2015. The words “anemic” and “fragile” are sadly accurate pertaining to Europe’s recovery, leaving the region a potential, albeit declining risk factor. Extended low inflation only adds to economic concerns. July’s market tremors coming out of Portugal demonstrated this. 2. China’s Economic Challenges 3. 6 Europe’s Fragile Recovery 3 Middle East risk has returned with a vengeance when ISIS took Mosul, Iraq’s second-largest city, and continued to march south toward Baghdad. The risk represented by ISIS is that it could spark a Middle Eastern civil war between the country’s Sunni and Shia populations, disrupt Iraq’s ability to export oil and Political drag external forces into the conflict. ISIS’ plan to redraw the map of the Middle East by creating a Instability Sunni state out of Syria and the north and center of Iraq (to start with) is potentially a major geopolitical gamechanger. Israeli-Hamas tensions only add to the region’s volatility. 1 4. 4 5. Emerging Markets Drag Commodity-based economies are vulnerable to the potential of a sustained downturn in the Chinese economy. Growth has slowed in a number of countries and structural problems are hindering a return to a stronger economic expansion. An active period of elections ahead, including Brazil and Turkey, adds to the potential for volatility. 6. Ukraine’s Political Upheaval Ukraine’s new president is seeking to bring the country’s rebellious areas under control by military means. There has been a steady increase in deaths and fighting. We expect this to continue, a slowmoving and deadly game of escalation, falling short of outright conflict between Ukrainian and Russian forces. Washington’s Dysfunction The last several years have been marked by considerable dysfunctional political behavior in Washington D.C. in what resembles more of an extended freshman food fight. U.S. political parties have left many key matters on hold- immigration policy, renewing the Exim Bank’s mandate, a highway bill, and further efforts at fiscal reform. In the absence of adults in the Congress and White House economic policy had ended up by default at the Federal Reserve. Mid-term elections loom in November. Look for a more dysfunctional Washington in the months ahead. 5 7. 9 7 8 10 8. Japan’s Debt 9. Asian Geopolitical Risk 10. U.S. Inflation * Abenomics is seeking to generate enough economic growth to help the world’s third-largest economy to move out of deflation and into a position where it can stabilize and start to reduce its massive debt burden. We expect data will reflect ongoing forward momentum, but keeping the Japanese economy headed in the right direction is not an easy process. Considering the need to raise inflation, push up wages (still lagging) and reduce public sector debt, Abenomics has some challenging days ahead. Asia has a number of potential geopolitical flashpoints that could result in a major international crisis, including disputes over maritime boundaries (like the South China Sea and East China Sea), overlapping land claims and North-South Korean tensions. To this, we would add disputed elections in Indonesia and Thailand’s contested political situation. While, in the short-term, inflation in the U.S. is not a major worry, stronger-than-expected growth in the U.S. economy could change this. The Fed is geared for low inflation, but if pressures build in areas such as wages and food as well as housing, the dynamic could start to change in the second half of 2014. If so, Fed policy will have to be reassessed, something most likely to be played out in markets before any changes in Fed policy. means moving up as a risk, means moving down as a risk, means staying the same. 2 MC Asset Management Holdings, LLC The Global Economic Reporter July 11, 2014 Bi-Weekly Risk Update Portugal and All That A couple of weeks ago we sounded a cautious note, probably too cautious considering that U.S. stock markets headed into record territory and U.S. corporate bond spreads ground tighter. One reader of our newsletter wrote: “Thanks Dad. So far, precisely wrong strategy. As the great Chuck Prince said, ‘while the music is going you need to dance’ or whatever. Party!!!!!” At the time, it was precisely the message that most investors did not want to hear and most certainly did not follow. Our point was that risks had not gone away, they still are very much a part of the market landscape and are likely to have some impact on macroeconomic trends. We also said that risk was on and would probably play out that way for the short-term. We still stick to our key tenets concerning risks for 2014 – they remain largely manageable, we will end the year ahead in debt and equity markets and that – somewhere along the way – there will be a significant re-pricing. As for global economic growth, the pace will be a little lower than initially forecast by the World Bank, International Monetary Fund (IMF) and Organisation for Economic Co-operation and Development (OECD), but it will not be recessionary and 2015 appears set to be stronger. Equally important, trade will continue to be a major component of global economic growth despite the spread of geopolitical risks. As for risks – clear and present dangers exist – the trials and tribulations for Portugal’s Banco Espirito Santo in July served to be a proverbial shot across the bow of the ship. Three things can be taken from Portugal’s tremors: (1) Europe’s economic recovery remains anemic, especially in the southern European countries; (2) links between banking systems and sovereigns remain in place (and as such function as risk); and (3) much of the European banking system remains anchored on complex (and not necessarily transparent) relationships. Considering the still-anemic economic recovery, low inflation and heavy debt burden in many European countries, the ramp-up in sovereign debt prices was too quick and discounted any potential slippage. Public sector debt burdens in Belgium, Cyprus, Italy, Greece and Ireland remain above 100% of GDP, a heavy burden under any circumstances. Looking ahead, the Euro-zone remains vulnerable to shocks, whether financial, economic or geopolitical. Europe still has not safely reached the shore. The Portuguese tremors remind of us of this and were a key consideration in moving Europe’s anemic recovery up as a risk factor. Exhibit 1: The 100+ Club (General Gov’t Debt/GDP) 2010 2011 2012 2013 96.6% 99.2% 101.1% 101.5% Ireland 91.2% 104.1% 117.4% 123.7% Greece 148.3% 170.3% 157.2% 175.1% Italy 119.3% 120.7% 127.0% 132.6% Cyprus 61.3% 71.5% 86.6% 111.7% Belgium Source: Eurostat. We changed the name of another key risk factor from “U.S. fiscal consolidation” to “Washington’s dyfunctionalism.” While Washington’s politics have moved away from functioning like a wrecking play for financial markets and the general economy, the potential for returning to that role as a risk factor is mounting. The issue of fiscal reform has never really left policymaking circles and other issues – immigration reform and a plethora of infrastructure needs – remain undone. With elections looming in November and the possibility of a Republican takeover of the Senate, the American political landscape is going to get a little more challenging. Our main concern is that fiscal policy continues to be that awkward subject that the political class dances around, finding posturing and blaming the other side easier than turning to the hard work of finding a working compromise that includes tough long-term decisions. The fact is that debt in the United States is larger than in the past (making reducing fiscal deficits more important), while costs are likely to increase over the longer-term due to the larger fiscal outlays needed to match the expected obligations of a large, retiring Baby Boomer generation. Add to this the expansion of health care coverage under the Affordable Care Act. What is worth watching in the months ahead and could function as a catalyst for another round of nasty politics in Washington is what happens to the Disability Trust Fund within the Social Security program, currently on track to run out of money by 2017 (according to the Congressional Budget Office, 2014). Wells Fargo Chief Economist John Silva observed (July 7, 2014): “Thus, without any action on the part of policymakers, the result will be an automatic reduction in disability payments, an unlikely political outcome. Thus, the need to put the Disability Insurance program on a sustainable path will force policymakers to act in the near future. The earlier the needed reforms are enacted, the lower the likelihood that abrupt changes in policy, that could lead to an economic shock, will be enacted.” While we fully concur with Silva’s view of the necessity to act to avoid 3 MC Asset Management Holdings, LLC economic shock, we have concerns that, unless a crisis is truly looming, Congress will be slow to act unless clear political gain is evident. Moreover, if the Senate falls to the Republicans, leaving President Obama as a lame duck, Washington could face a deadlock with little legislation passing. Policymakers should also fully understand that hoping for strong economic growth to bail out the U.S. fiscal situation is not going to be the solution (though it would help). The 1775 Lisbon earthquake left a lasting impression. Indeed, the French philosopher Voltaire used it in his Candide, to question the optimistic worldview of “all is for the best” (due to a benevolent deity) and instead proposed that “we must cultivate our garden” (i.e. take a more pragmatic approach in how we deal with the good and bad). As we hit mid-2014, the “all for the best” approach is likely to fade and it appears it is time to start cultivating our garden. The Fed Minutes– Finding Direction? The discussion over when the Federal Reserve moves to raise short-term interest rates is intensifying, with an increasing number of economists thinking that the U.S. central bank is more likely to move earlier in 2015 than wait until later in the year. What is likely to change the currently dovish Yellen Federal Reserve to a more hawkish stance is stronger economic growth and improvement in labor markets. Although unemployment is still high, it has dropped at a faster rate than expected and is likely to drop further over the next several months. At the same time, there could actually be some traction on the wage front. Despite what appears to be a changing macroeconomic landscape, the FOMC’s midJune meeting indicated that Fed officials were not worried by the evidence of an increase in inflation. This could become problematic as the U.S. economy moves into faster gear in the second half of the year. What to take from the mid-June FOMC meeting: Fed officials were not worried by either Q1’s GDP contraction or the evidence of an increase in inflation. They expect to terminate the monthly asset purchases with a final $15 billion reduction at October's FOMC meeting. The first rate hike’s timing is contingent on economic performance, with Fed officials currently expecting the first rate hike to occur around mid-2015. The Global Economic Reporter July 11, 2014 The committee discussed how to normalize monetary policy when appropriate. In the discussion on its exit strategy, the Fed looks more likely to continue to invest the proceeds of its maturing asset holdings until sometime after the first rate hike. As Capital Economics’ Paul Ashworth observed: “Asset sales were not even discussed in the minutes, which adds to the impression that, if sales even took place, it could be 2016 or 2017 before they begin.” The Fed balance sheet is currently around $4 trillion. The Fed also intends to use its fixed-rate reverse repo facility, with the rate on that facility set 20 bps below the rate payable on excess reserves. This will be done to tighten its control of the Fed Funds rate. While the FOMC tentatively points to a mid-2015 rate hike, there is a growing tilt to the chance it may be earlier. Capital Economics’ Ashworth stated: “We anticipate a slightly earlier rate hike, largely because we anticipate that wage growth will pick-up more quickly than the Fed expects in the second half of this year. Assuming that productivity growth remains very weak, that would add to the upward pressure on price inflation.” He is not alone: Janney Capital Market’s Chief Fixed Income Strategist, Guy LeBas, noted: “Inflation is a growing risk, and the core dovish view is that this can be ignored as long as lower wage earners don’t see inflation.” Bank of Tokyo-Mitsubishi UFJ’s New York economist Chris Rupkey in early July changed his outlook of a rate increase occurring in March 2015 rather than June. Even some central bankers believe in a quicker move on Fed rates. St. Louis Federal Reserve President and CEO James Bullard noted on June 9th, 2014: “The FOMC is much closer to its macroeconomic goals than it has been in the past five years. The Committee now faces a classic challenge concerning the appropriate pace of monetary policy normalization.” Bullard’s views are no doubt strengthened by his view that inflation is rising faster than expected. Those views are consistent with a St. Louis Fed paper that suggests much of the slack in the labor market is concentrated in the construction sector, which could be a structural factor (considering the absence of a housing boom like that which fueled the last bubble leading into the Great Recession). We expect that the discussion over inflation, wages and Fed action will intensify in the months ahead. Indeed, the summer months should be closely watched from the 4 MC Asset Management Holdings, LLC standpoint of prices (including food and energy), wage traction (if anything meaningful) and economic growth (how much of a bounce will there be from Q1’s -2.9%). Although we regard 6.1% unemployment as still high (not to mention underemployment over 10%), further employment gains are likely to trigger higher wages. As LeBas made the case (July 10, 2014), the Phillips Curve might rise again – lower unemployment triggers higher wages and then the price of everything rises due to greater demand. 2014 may retest the Phillips Curve’s validity, but it could also prove the New Neutral (low but stable top speeds of economic growth and central bank interest rates remaining stuck below their pre-crisis equilibrium) to be more short-lived than expected. All of this plays back to yields, which are likely to see a move from their current low range in the ten-year to something closer to 3.0% by year-end. As long as the rise in rates is gradual, this could help fixed income markets and not be too disruptive to equities. The Global Economic Reporter July 11, 2014 restructuring will not be far behind. A restructuring of debt is painful and time consuming, but something eventually needs to be done. Raising rates apparently is not an option as rates are already high. The new law, signed by Puerto Rico’s Governor, Alejandro García Padilla, enables the island’s utilities to negotiate repayments to bondholders for a period of several months. Exhibit 2: Annual GDP Growth (%) 2.0 1.0 0.0 -1.0 -2.0 -3.0 -4.0 -5.0 Puerto Rico – Another Detroit? The passage of a new law on June 28th allowing Puerto Rico’s state-owned public utilities the option to restructure debt outside of bankruptcy set off a firestorm for holders of Puerto Rican public debt. The reason this matters is that Puerto Rico’s debt is estimated at $73 billion and the high-yielding bonds are widely held by mutual funds. Indeed, it is estimated that Puerto Rican debt is held in 66% of U.S. municipal mutual funds. A substantial haircut or default in Puerto Rican bonds will have a sting for investors and municipal bond issuers. Between the Legislative Assembly’s passage of the enabling bill and the rapidly ensuing downgrading of Puerto Rican public sector debt, to some of the lowestratings available, this island territory quickly became compared to Argentina and Detroit with serious questions rising over both the ability and willingness of the government and its agencies to meet their obligations. The drama is most likely just starting as the validity of the new law is being challenged in the courts and investors are waiting for the agencies to miss a payment. The most likely candidate for a debt restructuring is the Puerto Rico Electric Power Authority (Prepa), which has $8.6 billion in debt. Prepa has two main credit lines, one with Citigroup for roughly $250 million (of which $146 million is due over the next two months) and a $550 million line with a syndicate of banks. The power company’s creditors sit in an awkward position – if they force the issue and demand prompt payment, Prepa’s 2009 2010 2011 2012 2013 Source: Statistical Institute of Puerto Rico. The governor’s view is that the legislation is meant to allow public companies to address their financial difficulties, an action that does not reflect the Commonwealth’s intention to restructure or stop payments on its general obligations. Sadly for Governor García Padilla, neither investors nor rating agencies shared that interpretation. Many of the former sold off their Puerto Rican bonds, pushing prices down, indicating that their perception was that the territory had made a fundamental departure from its commitment to bondholders. Simply stated, the new law eroded investor confidence. As for the rating agencies, Puerto Rico and its agencies were promptly downgraded by Moody’s and Fitch. Moody’s warned that the law provided “a clear path to default” for public companies. As the agency stated: “By providing for defaults by certain issuers that the central government has long supported Puerto Rico’s new law marks the end of the commonwealth’s long history of taking actions needed to support its debt. It signals a depleted capacity for revenue increases and austerity measures and a new preference for shifting fiscal pressures to creditors, which, in our view, has implications for all of Puerto Rico’s debt, including that of the central government.” Moody’s also indicated that Cofina (Puerto Rico Sales Tax Financing Corporation) debt could be vulnerable if the Puerto Rican government “invokes its police powers” and impairs bondholder claims on sales-tax revenues. Moody’s cut its rating on 5 MC Asset Management Holdings, LLC The Global Economic Reporter July 11, 2014 Puerto Rico’s GOs to B2 from Ba2, and Cofina to Ba3 from Baa1. Significantly, the Moody’s action included the main government issuer Cofina, which has long been perceived as the premier credit in Puerto Rico due to lien on sales-tax receipts. This points to a rating agency view that the situation is close to a full sovereign restructuring. Standard & Poor’s took a little longer to act, but on July 9th it cut the rating on Prepa’s debt four notches from BB to B-. The rating agency apparently was waiting for the outcome of Prepa’s negotiations to renew a revolving credit facility. The effort was not successful, with only a temporary extension to the end of July being achieved. The rating agency noted of this: “We believe this increases the risk that the authority will attempt to restructure long-term debt, as a law passed in June allows.” Exhibit 3: Development Indicators School Enrollment, Primary (%) Live Expectancy at Birth (years) GNI per capita (Atlas method, current U.S.$) Improved water source, rural (% of population with access) Puerto Rico United States Dominican Republic 87% 98 103% 79 79 73 $18,080 $53,670 $5,620 94% 98% 98% prohibit government-owned corporations in Puerto Rico from filing under Chapter 9. The other trend to watch is the rumor that vulture funds are quietly buying Puerto Rican debt, which now trades at a considerable discount. If so, it would underscore that somebody believes that Puerto Rican debt is likely to return something in terms of value. Despite periodic efforts to reform Puerto Rico’s economy and spurts of growth, it has been difficult to maintain the momentum to make lasting changes. Puerto Rico still has a large informal economy, its public finances are fragile and it relies on foreign transfers. The island faces critical challenges, the resolving of which are likely to shape the local economy and society for decades to come. The debt level is simply beyond what the Puerto Rican economy can maintain- and probably pay back – at least the way the debt is currently structured – just like Detroit. The sad fact is that the last round of reforms was too late and not far-reaching enough. Unemployment is 13.8%, many of the young and talented are leaving and questions exist as to whether the authorities will be able to keep the lights on. Puerto Rico has no access to markets – the new law killed that. The end-game is likely to be a hair-cut for investors, a stint in non-investment grade ratings and an even longer period of economic contraction and stagnation. Even with a modicum of assistance from the U.S. government (in the form of “technical help”), Puerto Rico faces a challenging road ahead. Source: World Bank While Puerto Rico is being compared to Argentina and Detroit, the latter shares greater similarities in that both are small territorial units with limited resources and have no options to devalue the currency to boost exports, and have significant social concerns in terms of poverty levels. While Puerto Rico is more developed than other Caribbean nations, it is below U.S. standards. Detroit’s path to recovery has begun by declaring bankruptcy and negotiations with creditors of its $18 billion debt are resulting in haircuts on bonds, with investors sharing the pain. What next for Puerto Rico? In the short-term attention will obviously focus on what happens to Prepa’s credit facility at the end of July. We expect the headlines are likely to remain negative. Prepa did make its most recent payment (in early July), but prospects for future payments are questionable. Two other things to watch – Puerto Rico’s Resident Commissioner in Washington, D.C. announced that he was seeking to explore the option of changing federal legislation to eliminate the clause in the U.S. Bankruptcy Code that appears to 6 MC Asset Management Holdings, LLC The Global Economic Reporter July 11, 2014 Economic Charts and Commentary Table 1. Economic Snapshot GDP – 2014E (%) U.S. China Japan Germany UK France Canada Italy 2.2 7.2 1.2 2.0 3.0 0.8 2.3 0.2 Industrial Production (Latest) 4.3% May 8.8% May 0.8% May 1.2% May 2.2% May -2.0% Apr 3.9% Apr 1.5% Apr CPI (Latest) Unemployment Rate Foreign Exchange Reserves (U.S. $bn)** 2.1% May 2.3% June 3.7% May 1.0% June 1.5% May 0.7% May 2.3% May 0.3% June 6.1% June 4.1% Q1 3.5% May 6.7% June 6.6% Mar 10.1% May 7.0% May 12.6% May 152 3,300 1,190 256 134 190 68 187 Sources: U.S. Department of the Treasury, U.S. Department of Commerce, Federal Reserve Board, Bureau of Labor Statistics, Banca d’Italia, Istat, People’s Bank of China, Asian Development Bank, European Central Bank, Bank of England, EuroStat, Ireland Central Statistics Office, Bank of Canada, Bank of Japan, Japan Ministry of Finance, Banque de France, International Monetary Fund, World Bank, Organization for Economic Co-Operation and Development, Deutsche Bundesbank, Statistisches Bundesamt (Germany). China on the Mind: China remains a factor for international markets. That is a fact that cannot be denied, as reflected by the negative reaction that accompanied China’s June export numbers, which rose 7.2% year-onyear, up marginally from May’s 7.2%. Export growth was disappointing as most economists expected a weak base for comparison to push it into double digit territory (the Bloomberg median was 10.4%). Import growth was stronger month-on-month, up from -1.6% in May to +5.5% in June. Consequently, export growth remains stronger than import growth, which continues to be affected by the slowdown in the property sector. This also meant that although the trade surplus declined from $35.9 billion in May to $31.6 billion last month, it remains large. Significantly, the trade surplus for Q2 was the third largest on record. What next for Chinese trade? In July we expect headline export and import growth are likely to decline again, but the general direction in trade is constructive. We concur with Julian Evans-Pritchard, Capital Economics’ China economist, who notes: “More broadly though, improving conditions in developed markets mean that we expect the export growth to remain healthy going forward, despite today's disappointing data. In contrast, we expect import growth to drop further, given our view that cooling investment growth will weigh on commodity imports over the next couple of years. As a result, China is likely to continue to post large trade surpluses.” The bottom line is that China’s economy will remain under pressure as it undergoes important structural changes, but on the trade front – as long as advanced economies continue to grow – Asia’s largest economy will be able to maintain healthy trade surpluses. Portugal on Fire, Spain Turns the Corner: In 2014 the Portuguese economy is still struggling, fiscal deficits function as a drag on economic growth and debt remains high. Additionally the problems with Espirito Santo point to renewed worries over the safety and soundness of the Portuguese banking system. The OECD notes: “The unemployment rate is expected to continue to slowly decline throughout the forecasting horizon. An economic slack is and will remain sizeable, inflation is set to remain very low, with a risk of deflation, which would make debt reduction more difficult.” While Portugal will struggle to grow in 2014, Spain’s prospects are relatively better. In late June, the International Monetary Fund released its Article IV report of the Iberian country’s economy, declaring “Spain has turned the corner. Growth has resumed, labor market trends are improving, the current account is in surplus, banks are healthier, and sovereign yields are at record lows.” The IMF does admit that unemployment is unacceptably high (24.9% for 2014), incomes have fallen, and deleveraging is weighting on growth. In contrast to Portugal, the real GDP growth is expected to be 1.2% in 2014, 1.6% in 2015 and 1.7% in 2016. Exports are expected to rise and keep a pace above 5% from 2014-2017. While unemployment gradually trends down. Although Spain still has major vulnerabilities, its economy benefits from its larger size and greater diversification. Portugal looks like a potential candidate for slippage back into crisis mode. 7 MC Asset Management Holdings, LLC The Global Economic Reporter July 11, 2014 Table 2. Real GDP for Selected Countries (%) Real GDP 2009 2010 2011 2012 2013E 2014F 2015F Global U.S. Canada -0.6 -3.1 -2.8 5.2 2.4 3.2 3.9 1.8 2.6 3.1 2.2 1.7 3.1 1.9 1.7 3.3 2.2 2.2 3.7 2.8 2.4 Japan UK Switzerland Sweden -5.5 -4.0 -1.9 -5.0 4.6 1.8 3.0 6.6 -0.6 1.0 1.8 2.9 1.4 0.3 1.0 1.0 1.7 1.7 1.7 0.9 1.7 2.7 1.8 2.3 1.0 2.3 1.9 2.3 Euro Area Germany France Greece -4.4 -5.1 -3.1 -3.1 2.0 4.0 1.7 -4.9 1.4 3.1 1.7 -7.1 -0.6 0.9 0.0 -6.4 -0.4 0.4 0.0 -4.2 1.0 1.6 0.8 0.0 1.4 1.4 1.5 2.5 Ireland Spain Italy Portugal -6.4 -3.7 -5.5 -2.9 -1.1 -0.3 1.7 1.9 2.2 0.4 0.4 -1.3 0.2 -1.5 -2.5 -3.2 0.6 -1.3 -1.8 -1.8 1.8 1.2 0.4 0.5 2.5 1.6 1.0 1.5 Angola Argentina Brazil Chile 2.4 0.9 -0.3 -0.9 3.4 9.2 7.5 5.7 3.9 8.9 2.7 5.8 5.2 1.9 1.0 5.6 5.6 3.5 2.3 4.4 6.3 2.8 2.3 4.5 6.4 2.8 2.8 4.5 China Colombia Egypt Ghana India Indonesia Iran Kenya Mexico Mongolia Nigeria Peru 9.2 1.7 4.7 4.0 5.0 4.6 4.0 2.7 -6.0 -1.3 7.0 0.9 10.4 4.0 5.1 8.0 11.2 6.2 5.9 5.8 5.3 6.4 8.0 8.8 9.3 6.6 1.8 15.0 7.7 6.5 3.0 4.4 3.9 17.5 7.4 6.9 7.8 4.0 2.2 7.9 4.0 6.2 -1.9 4.6 3.9 12.3 6.6 6.3 7.7 3.7 1.8 7.9 5.6 5.6 -1.5 5.9 2.9 11.8 6.2 5.4 7.2 4.2 2.8 6.1 5.4 5.3 1.3 6.2 3.0 11.7 7.4 5.7 7.0 4.5 4.0 5.5 6.4 5.8 2.0 6.3 3.5 5.8 6.9 5.8 Philippines Russia Saudi Arabia Singapore South Africa South Korea Thailand Turkey Ukraine Venezuela 1.1 -7.8 1.8 -0.8 -1.5 0.3 -2.3 -4.8 -14.8 -3.2 7.6 4.5 7.4 14.8 3.1 6.3 7.8 9.2 4.1 -1.5 3.6 4.3 8.6 5.2 3.5 3.7 0.1 8.8 5.2 4.2 6.8 3.4 5.8 1.3 2.5 2.0 6.5 2.2 0.2 5.6 6.8 1.5 3.8 3.5 1.8 2.8 3.1 3.8 0.4 1.0 6.0 0.5 4.4 3.4 2.8 3.7 5.2 3.5 1.5 1.7 5.5 1.5 4.2 3.6 3.3 3.8 5.0 4.3 1.5 2.2 Sources: MC Asset Management Holdings, LLC Research and International Monetary Fund. 8 MC Asset Management Holdings, LLC The Global Economic Reporter July 11, 2014 Table 3. Inflation for Selected Countries (%) 2009 2010 2011 2012 2013E 2014F 2015F U.S. -0.3 1.6 3.1 2.1 1.4 2.0 2.5 China -0.7 3.3 5.4 2.7 2.7 3.0 3.0 Japan -1.3 -0.7 -0.3 0.0 0.0 2.9 1.9 Germany 0.2 1.2 2.5 2.1 1.6 1.8 1.8 France 0.1 1.5 2.3 2.2 1.0 1.5 1.5 UK 2.1 3.3 4.5 2.8 2.7 2.3 2.0 Italy 0.8 1.6 2.9 3.3 1.6 1.3 1.2 Euro area 0.3 1.6 2.7 2.5 1.5 1.5 1.4 Brazil 4.9 5.0 6.6 5.4 6.3 5.8 5.3 India 10.9 12.0 8.4 10.4 10.9 8.9 7.5 Russia 11.7 6.9 8.4 5.1 6.7 5.7 5.4 Turkey 6.3 8.7 6.5 8.9 7.7 6.5 6.0 Sources: MC Asset Management Holdings, LLC Research and International Monetary Fund, April 2014. Table 4. Budget Balance (Fiscal Indicators as a % of GDP) 2009 2010 2011 2012 2013E 2014F 2015F U.S. -12.9 -10.8 -9.7 -8.3 -5.8 -4.6 -3.9 Japan -10.4 -9.3 -9.9 -10.1 -9.5 -6.8 -6.0 Germany -3.1 -4.2 -0.8 0.1 -0.4 -0.1 0.0 France -7.6 -7.1 -5.3 -4.9 -4.0 -3.5 -2.8 UK -11.3 -10.0 -7.8 -7.9 -6.1 -5.8 -4.9 Ireland -13.8 -30.5 -13.1 -7.6 -7.6 -5.0 -3.0 Italy -5.4 -4.3 -3.7 -2.9 -3.2 -2.1 -1.8 Portugal -10.2 -9.9 -4.4 -6.4 -5.5 -4.0 -2.5 Spain -11.2 -9.7 -9.6 -10.8 -6.7 -5.8 -5.0 Greece -15.6 -10.8 -9.6 -6.3 -4.1 -3.3 -2.1 Brazil -3.1 -2.7 -2.5 -2.7 -3.0 -3.2 -3.5 China -0.7 -3.1 -1.5 -1.3 -2.2 -2.5 -2.1 India -10.0 -9.8 -8.4 -8.0 -8.5 -8.5 -8.5 Russia -6.3 -3.4 -1.5 0.4 -0.7 -0.8 -1.0 Turkey -6.0 -3.0 -0.7 -1.6 -2.3 -2.3 -2.5 Sources: International Monetary Fund, April 2014. 9 MC Asset Management Holdings, LLC The Global Economic Reporter July 11, 2014 Table 5. Gross General Government Debt (% of GDP) Belgium Canada France Germany Greece Ireland Italy Japan Korea Netherlands Portugal Spain Advanced Economies UK U.S. Emerging Markets Brazil China India Russia South Africa Turkey 2008 2009 2010 2011 2012E 2013F 2014F 89.2 71.3 68.2 66.8 112.9 44.2 106.1 191.8 30.1 58.5 71.7 40.2 80.4 51.9 73.3 33.5 63.5 17.0 74.5 7.9 27.8 40.0 95.7 83.7 79.2 74.5 129.7 64.4 116.4 210.2 33.8 60.8 83.7 54.0 93.7 67.1 86.3 36.0 66.8 17.7 72.5 11.0 31.3 46.1 95.6 94.0 82.4 82.4 148.3 91.2 119.3 216.0 33.4 63.4 94.0 61.7 100.3 78.5 95.2 40.3 65.0 33.5 67.0 11.0 35.8 42.3 97.8 108.4 85.8 80.4 170.3 104.1 120.8 230.3 34.2 65.7 108.4 70.4 104.4 84.3 99.4 37.8 64.7 28.7 66.4 11.7 39.6 39.1 99.8 123.8 90.2 81.9 156.9 117.4 127.0 238.0 35.0 71.3 123.8 85.9 108.7 88.8 102.7 36.5 68.0 26.1 66.7 12.5 42.3 36.2 100.9 123.6 93.5 80.4 175.7 123.3 132.3 243.5 35.7 74.4 123.6 93.7 108.5 92.1 106.0 35.5 68.3 22.9 67.2 14.1 43.0 36.0 101.2 125.3 94.8 78.1 174.0 121.0 133.1 242.3 35.3 75.6 125.3 99.1 109.2 95.3 107.3 34.1 69.0 20.9 68.1 14.6 44.7 34.9 Sources: MC Asset Management Holdings, LLC Research and International Monetary Fund. Table 6. Unemployment (%) Belgium Brazil Canada China France Germany Greece Ireland Italy Japan Netherlands Portugal Russia South Africa Spain Turkey United Kingdom United States 2014 2015 2016 2017 9.1 5.6 7.0 4.1 11.0 5.2 26.3 11.2 12.4 3.9 7.3 15.7 6.2 24.7 24.9 10.2 6.9 6.4 8.9 5.8 6.9 4.1 10.7 5.2 24.4 10.5 11.9 3.9 7.1 15.1 6.2 24.7 23.8 10.6 6.6 6.2 8.8 6.0 6.8 4.1 10.3 5.2 21.4 10.1 11.1 3.9 6.6 14.5 6.0 24.4 22.6 10.6 6.3 6.1 8.6 6.0 6.7 4.1 10.0 5.2 19.1 9.6 10.3 3.9 6.2 14.0 6.0 24.0 21.4 10.6 6.1 5.8 Sources: MC Asset Management Holdings, LLC Research and International Monetary Fund. 10