filed - CMS Energy Corporation

advertisement

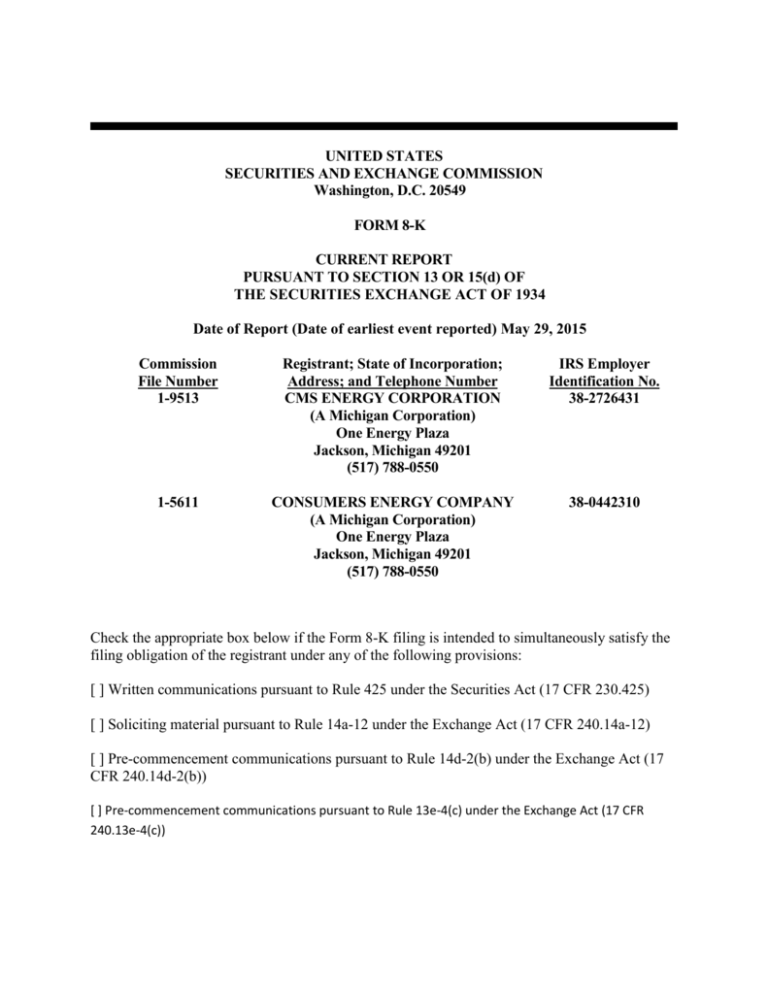

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported) May 29, 2015 Commission File Number 1-9513 Registrant; State of Incorporation; Address; and Telephone Number CMS ENERGY CORPORATION (A Michigan Corporation) One Energy Plaza Jackson, Michigan 49201 (517) 788-0550 IRS Employer Identification No. 38-2726431 1-5611 CONSUMERS ENERGY COMPANY (A Michigan Corporation) One Energy Plaza Jackson, Michigan 49201 (517) 788-0550 38-0442310 Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: [ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) [ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) [ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) [ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 7.01. Regulation FD Disclosure. On June 1-2, 2015, CMS Energy Corporation’s (“CMS Energy”) management will be meeting with investors. A copy of the CMS Energy handout to be used at these meetings is furnished as Exhibit 99.1 to this report. In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933. Investors and others should note that CMS Energy and Consumers Energy Company post important financial information using the investor relations section of the CMS Energy website, www.cmsenergy.com and Securities and Exchange Commission filings. Item 9.01. Financial Statements and Exhibits. (d) Exhibits. 99.1 CMS Energy handout dated June 1 & 2, 2015 SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized. CMS ENERGY CORPORATION Dated: May 29, 2015 By: /s/ Thomas J. Webb Thomas J. Webb Executive Vice President and Chief Financial Officer CONSUMERS ENERGY COMPANY Dated: May 29, 2015 By: /s/ Thomas J. Webb Thomas J. Webb Executive Vice President and Chief Financial Officer Exhibit Index 99.1 CMS Energy handout dated June 1 & 2, 2015 CMS Energy CMS Liste d NYSE Ameri can Gas As sociation May 18 RBC Global E nergy and P ower Confere nce June 1, & 19, 20 15 Ludington Pumped Storage Fourth Largest in the worl d Ray Compress or Station #1 LD C in gas storage Cr oss Winds® Energy Park #2 in ren ewable sales i n the Great Lakes area CMS Energy CMS Liste d NYSE Invest or Meetings June 1 & 2, 2 015 Ludi ngton P umped Storage Fourth Largest in the w orld Ray Compress or Station #1 LD C in gas storage Cros s Winds® Energy Park #2 in re newable sale s in the Great Lake s area This prese ntation is made as of the date hereof and contains “forward -looking stateme nts” as defi ned in Rule 3 b-6 of the Se curities E xchange Act of 193 4, Rule 175 of the Se curities Act of 193 3, and relevant legal de cisions. The forwar d-looking stateme nts are subject to risks a nd uncertainties. All forwa rd-looking stateme nts should be considered in the context of the risk and other fa ctors detaile d from time to ti me in CMS E nergy’s and Consumers Energy’s Securities and Excha nge Commission filing s. Forward-l ooking state ments s hould be rea d in conjunction with “FORWA RD-LOOKI NG STATEMENTS A ND INFORMATION” and “RISK FACT ORS” sections of CMS Energy’s and Cons umers Energy’s For m 10 -K for the year en ded De ce mber 31, 2014 and as updated in subseq uent 10 -Qs. CMS Energy’s a nd Cons umers Energy’s “FORWARD -LOOKING STATEME NTS AND INF ORMATI ON ” and “RISK FACT ORS ” se ctions are incorporated herei n by refere nce a nd di scuss important fa ctors that coul d cause CMS Energy’s and Consumers Energy’s res ults to di ffer materially from t hose a nticipated i n such state ments. CMS Energy and Consumers Energy undertake no obligation to update any of the information pres ented herein to re flect fa cts, events or circumstance s after the date hereof. The presentation also includes non-GAAP mea sures when de scribi ng CMS Energy’s res ults of operations and fina ncial perfor mance. A reconciliation of each of these measure s to the most directly comparable GAAP measure is i ncluded i n the appe ndi x and poste d on our website at www.cmse nergy.com. CMS Energy provide s histori cal fina ncial results on both a rep orted (G enerally Acce pted Accounting Principle s) and adjusted (non-GAAP ) basi s and pr ovides forward -looking guidance on an a djuste d basis. Ma nage ment views adjusted earni ngs as a key meas ure of the company’s pre sent operating fina ncial perfor mance, unaffecte d by dis continued operations, ass et sales, impairme nts, regulatory items from prior years, or other items. Thes e items have the pote ntial to impa ct, favorably or unfavora bly, the company's reporte d earnings i n fut ure periods. Invest ors and others s hould note that CMS Energy and Consumers Energy post important fi nancial infor mation using the i nvestor relations s ection of t he CMS Energy website, www.cmsen ergy.com and Securities a nd Excha nge Commissi on filing s. .Best track record of consiste nt, high -end E PS growth? .Biggest O&M cost red uction track record? .Highe st capital investment growth? .N o nee d for block e quity (diluti on) over five years? .“World -clas s” regulation and e nergy law? Who Ha s the. . . . CMS Energy CMS Energy Consistent Gr owth . . . . . . . . even easier, with lots of upsides. Sustaina ble Future Gr owth Invest ment (bils) O&M Red uctio ns Sales Growth Energy P olicy Future Shines Bright $6. 4 (10 )% +1% $7.6 (7)% + ½ % Past Performa nce Next 5 Year s Improved Law (20 10-2014 ) (2 006 -2014 ) (20 10-2014 ) 2008 Law Ne xt 5 Years +7% /year +5% to + 7% / year _ _ _ _ _ a Adjusted E PS (non -GAAP) $ 3.50 Cons ervative Conservative Capa city Op! a Peers = 3% /year 200320 04200 5200 62007 2008 20092 0102 0112 01220 1320 14201 5201 62017 2018 20192 0202 02120 2220 23202 4. . . . creating an opportunity for the ne xt ten years. Amount (billions ) $1.8 CMS Peers _ _ _ _ _ a Base d on De ce mber 3 1, 2014 i nformation percent of market cap S ource: 10K ; actual a mount s through 20 14 s moothed for illustration I nvestme nt “Cat ch -up” . . . . > $1. 5 per year 14% 15% 1 6% 12% 20% 15% Cape x Cas h Flow (oper ) Consumers E nergy Peer Average Peer Performa nce a Cape x Up 4 5% . . . . . . . . driven by gas infrastructur e and reliability. 2015 -20 24 200 5-2 014 $1 0.7 bil $1 5.5 bil +4 5% Cape x U p 45% . . . . . . . . driven by gas infrastructure and reliability.Electric Mainte nance New Ge neration Environ. Smart Energy Ele ctric Reliability Electric Mai ntenance Gas I nfra structure E nviron. New Ge neration S mart Energy Electric Reliability Opportunity for Another 30% . . . . . . . . with no “big bets” over ten years! 2015 -202 4 2005 -20 14 $10. 7 bil $15. 5 bil +45% Opportunity for Another 30% . . . . . . . . with no “big bets” over ten years!+30% Electri c Maintena nce Ga s Infrastructure New Ge neration Environ. Smart Energy Ele ctric Reliability Electric Maintenance Gas I nfrastructure Environ. New G eneration S mart Energy Electric Reliability Opportunity $20 + bil OrganicGrowth+ 30%OpportunityElectric Mainte na nceGas I nfrastructure New GenerationEnviron.Smart EnergyEle ctric Relia bilityElectric Maintena nce Growing the Gas Busi ness . . . . . . . . e xpa nding one of the largest syste ms in the country. Amount (bils) $5 .6 Capital Inve stme nt $ +93% Pipeline Integrity Civic I mprove ment Ca pacity & D eliverability Compressi on & Other Infrastructure New Cust omers Gas service area Tra nsmi ssion line Compress or stations Storage fiel ds Inter connect s Gas Service Territory - 1. 7 million customers - 2 8,854 miles of distribution and trans mission - 3 09 Bcf gas st orage capa city Gas Infra structure . . . . . . . . inve sting $5.6 billion over the next 10 years. Main Re place ment s 800 miles $1 billi on Modernization 6 city gates, 7 regulation stations, 2 4 relief valves New Connections 10 0,000 cust omer s $550 million Repla ce Trans missi on Mains 275 miles WHAT’S I N WHAT’S N OT More Conversions 70,000 customers Compre ssion 35,0 00 hp $300 million . . . . emerging incrementally with replace ments not yet in plan! 7,50 010,0 00TodayJackson PlantRe place s Classi cSeven ROA Custo mers Return?Palisa des P PAExpires 202 2MCV PPAE xpires 2025Fut ure~800 M W 1,2 40 MW M W PPA 2,6 00 ca pacity ~30% ~8, 600 MW 540 MW 410 MW Shortfall Ow ned 6, 000 780 MW ~9, 400 MW 11,000 Owne d 8,82 0 PPA 580 Capa city Growth Over Ne xt Ten Year s Lower cust omer bills 2015 2 022 20 25 201 X Upside Ca pacity Opportunities . . . . Upside Ca pacity Opportunities . . . . ~3,00 0 MWN OT IN PLAN potential for Capacity & E nergy Price Increase s . . . . . . . . addi ng value to our “DIG ” plant. $0. 50$2. 00$4. 50$7. 50Ca pacity price ($ kW p er month) Was (mils ) Upside Sce narios (mils ) $55 $35 New Busi ness • Long-ter m Energy •250 M W at $4.00 per kW m (6/ 14) • 250 MW at $6 .02 per kW m (4/15 ) •Rece nt Capa city •Long-term > $ 3.30 • Near-ter m ˜ $4.50 Upside: Ca pacity and e nergy contracts layered in over time (CONE ) $15 ˜ $5 (Fore cast) (Prior ) Capa city Energy $65 $40 + $25 – $5 0 more $0.5 0 Sales Growth . . . . . . . . suggests upsi de to conservative plan. Annual Ele ctric Salesa 2008 -20 09Rece ssion2010 -20 13Re covery20 1420 15Future -5.0% -2.5% 5. 0% 8.7% 2.8% 3% 1% I ndustrial Total _ _ _ _ _ a Weather normaliz ed vs. prior year ½% 2% Conservative 2016 - 2019 E conomic Indicator s Grand Ra pids Michigan U.S Building Permits* +2 8% +6% +7% GD P 2010 2 013 15 1 1 8 Population 2 011 20 14 3 0 2 Unemployme nt (3 /15) 3 .9 5.6 5.5 *A nnualiz ed numbers thru Mar ch 20 15 Mich_Ma p. . . . continue s in Michigan. Ele ctric Gas Combination Betz MSU F RIB D urolast Roofing GM Ass embly Examples of New Busi ness Mi chigan D ens o North A merica •H ub for all thermal production in N. America •10 0 new jobs •$5 3.6 million invest ment •I nvestme nts thru 20 15 Announce ment Enbridge MACI Dart Brembo De nso WKW Post Magna -Cos ma Economic Growth . . . . Midwe st Job Creation -Mi chigan.g ov in U.S. Improved E conomy -Bl oomberg in U.S. Site Selection -Site Selection Magazi ne year Low Jobless Rate -Michigan.gov # Di castal Plasan Conti nental Dairy 1 # 2 # 7 13 O&M Cost Reductions . . . . . . . . provide more headroom for more capital investment. Dow n 10% $1.1 bil $0.9 bil 2 006 20 14 201 9 $1.0 bil •Coal to Ga s Switching (Zeeland) •Smarter Bene fit Plans • Productivity/Attrition •Coal to Gas Switching (Jacks on) •“Pole Top” Har dening • Productivity/Smart Energy Down 7% Inflation ˜2% Inflation ˜2% 200620 07200 8200 92010 2011 20122 013. . . . a ccelerate d; fundi ng investment and re ducing risk. 50% -25 Lines s moot hed for illustrative purposes O&M Trend vs Peers 20 14 Actual Pla n O&M Cost Savings Peers CMS 0 -10% ~ 2% per year -25% -7% O&M Cost Savings . . . . 201 8 ~6% per year Inflation 2 015 FAST START! -17% 2013 -7% -6% -7% •Attrition $ - 35 $ - 75 • Productivity (Coal Ga s) - 35 - 5 0 •“P ole Top” Hardening - 30 - 30 •S mart Meters - 5 - 25 •Eli minate Waste (UA’s ) - 15 - 20 •M ortality Tables & Dis count Rates +5 0 + 50 •Service U pgrades + 10 + 50 Net Savings $ - 60 $ - 1 00 Percent Savings - 6% - 1 0% 2014 & 201 5 2014 2 018 (mils ) (mils) . . . . AND provides s ustaina ble, pre mium growth for INVESTORS. 2014 Adj usted E PS (non -GAAP) G uida nce January Mar ch 31 June 30 Septe mber 3 0 Dece mber $1.77 + 7% 2015 “Reinvestment” Hel ps Customers . . . . 17 ¢ Weather 1 4¢ Natural Offsets (1 ) Cost & Other 4 Total 17¢ I ncreas e fore stry Accele rat e “DIG” Outage to 201 5 .$8 mil cost in 2015 ; $10 mil bene fit in 201 6 .Capa city increas e 38 MW . . . . competitive for resi dential and i mprovi ng for industrial customers. -201 32014 2015 2016I ndustrial Rates (1 2)% (14 )% (19 )% (1 3)% Nati onal Avg % Better Worse Rates Rates & Fuel Rates & D esign -2013 20142 0152 01626% 21% 13% Midwe st Avg % 7% Better Worse BetterRates & F uel Rates & Design 3% (5)% P olicy or market might el imi nate gap Plus Electric Customer Pri ces . . . . Outstandi ng Improving fa st Customer Satisfa ction . . . . Ele ctric 1st Quartile 2nd Quartile 4th Quartile 2010 2012 2 014 20 16 Re sidential3r d Quartile . . . . continues to i mprove rapi dly. Gas 1st Quartile 2nd Quartile 4th Quartile 3rd Quartile 2010 2012 2 014 20 16 Prese nt Rank Pre sent Ra nk Resi dential Busine ss Re sidential Business #6 #3 #2 #9 . . . is good for Michigan customers and investors . Governor Snyder’s Leaders hip On Energy. . . . How We Could G et There Gover nor Snyder’ s Four Pillars Gas Ren ewablesSubsidie s-1 5% waste Res our ce planning Ena blers Fair Choice Adapta bility •IRP proces s to deter mine gen eration mi x Reliability •Ensur e adequate s upply Affor dability •Red uce wa ste by 15% Environme ntally protective •Consi der environme nt in energy de cisions Michigan Energy Law Update . . . . •Historical test year •12 -18 months regulatory lag •N o cap on ROA •10% re newables by 2015 •E nergy effi cien cy standar ds •File-a nd -impleme nt •10% ROA ca p Adaptability Reliability Affordability Environmental pr otection Be fore 20 08 TODAY 2015 I mprove me nts . . . . builds on 200 8 Law! Update Prese nt: 10% ca p w/o s ubsi dy Governor Snyder > 10% ca p SB0 247 H B4298 S B023 5 Full Regulation . . . . provide stability. John Qua ckenbush (R), Chairman T erm Ends: July 2, 20 17 Greg W hite (I ) Term E nds: July 2, 2 015 Sally Talberg (I ) Term Ends: July 2, 20 19 Commissi on P owering Michigan’s Comeba ck Governor Rick Snyder Energy Committee Chairs Senat or Mike Nofs House Rep. Aric N esbitt Consist ent Leader ship! Experien ced Policy Makers . . . . . . . next 10 years eve n brighter than last 10 year record! Supported By .UPSIDES create headr oom .PART NERS in progress . PASSION to i mprove for customers AND owners .SE LF -FU NDED! Our Growth Engi ne Billion $15.5 M ore “upsi de” $5 bil NOT yet in Pla n! (201 5-2 024 Ca pe x) 5% - 7% EPS growth (Inve stment, Sales, Cost, & DIG ) (Customers, Regulators, & P olicy Makers) (Value, Reliability, & Environme nt) W hy Invest in CMS Energy? _ _ _ _ _ a Adjusted EPS (non-GAAP) Appendi x . . . to be in a good carbon position. Carbon Tonnage Reduction (Preli minary) 13 15171 9212 3252 005 Ba seline Million Tons of CO2 Consumers Energy 2014 20 30 202 0 2025 2 029 Cl ean Pow er Plan Proj ected e mis sion level “I mplie d” E PA Target Cons umers Appear s . . . . Generation Strategy: New Supply Sources . . . . 051 01520 25CoalNuclear. . . . combine d cycle gas is t he most attractive new sour ce of supply. Leveliz ed cost of new build (¢ /kWh) Gas pri ce= $3. 00 $4. 50 $6.0 0 W/ tax credit W /o tax credit W/ e missi on control s Today $3. 00 per watt 5¢ 6¢ 7¢ 6¢ 9¢ 10¢ 12¢ 22¢ 8¢ Ba ck -up 11¢ Back -up 6¢ Wind Combined Cy cle Gas Pla nt Residential Solar 15¢ Future $ 2.00 per watt? Consumers E nergy Sources 5¢ 7¢ 5 .5¢ New Build Zeela nd Cr oss Winds . 6¢ Big 5 Palisa des Capital Expenditure s 2015 -20 1920 20-20242 015 -202 42015 2016 20172 0182 019SubtotalSubtotalTotal (mils )(mils )(mils )(mils)(mils)(mils )(mils )(mils )New Ge neration (incl udes Ren ewables ) 70$ 2 24$ 52 $ 64$ 1 34$ 54 4$ 612 $ 1,156 $ Environmental2 54 98 1 36 153 2 12 853 139 99 2 Gas Infrastructure237 216 200 159 1 38 950 1 ,454 2, 404 Smart Energy130 177 164 43 2 2 536 - 536 Ele ctric Relia bility & Distribution196 1 98 208 2 62 255 1,119 1, 575 2, 694 Mainte nance (Ele ctric & Gas)714 70 0 650 77 4 786 3, 624 4,0 94 7,7 18 Total1,6 01$ 1,6 13$ 1, 410$ 1, 455$ 1, 547$ 7 ,626$ 7,874 $ 15,50 0$ Electri c1,088 $ 1,11 6$ 9 11$ 983$ 1,073 $ 5,171 $ 4,704 $ 9,87 5$ Gas5 13 497 499 47 2 474 2,4 55 3,1 70 5,62 5 Total1,60 1$ 1,6 13$ 1,4 10$ 1,4 55$ 1, 547$ 7, 626$ 7, 874$ 1 5,500 Capacity Diversity . . . . Coal 34% Ga s 32% Pumped Storage 11% Renewa bles 9% Oil 6% N uclear 8% Coal 24% Ga s 37% P umped Storage 12% Renewa bles 10% P urchases 3% Oil 6% Nuclear 8% . . . . evolving to clea ner generation while be coming more cost competitive. Coal 41% Ga s 31% P umped Storage 11% Renewa bles 3% Oil 6% Nuclear 8% 2005 2017 2 014 Operating Ca sh Flow Growth . . . . (0.5 )0.0 0.51. 01.52. 02.52 0142 01520 1620 17201 8201 9Amount (bils) $ Cash flow before dividen d a Non-GAAP NOLs & Credits $ 0.7 $0. 7 $0.5 $ 0.4 $0. 3 $0.2 up $ ½ billion or 3 0% over five years! $2.2 I nterest, working ca pital and taxe s $1.8 $ 2.4 $1. 68 Pct of Market Cap (a s of De c. 201 4) Cap Inv OCF CMS Peer s 14 12 1 6% 15% Up $0.5 Billion $2. 0 $2.1 $ 1.9 Gross operating cas h flow up $0. 1 billion per year 2015 Cas h Flow Fore cast (non -GAAP) CMS Energy Parent Ca sh at year end 2 01495 $ Sour cesCons umers Energy divide nd and tax shari ng355$ E nterprises 20 Sour ces3 75$ U sesI nterest and pre ferre d dividen d(1 30)$ Overhea d and Fe deral tax pay ments (10 ) Equity infusion(150 ) Pen sion contribution0 Uses a (340 )$ Ca sh fl ow35$ Fina ncing a nd Divide ndNew is sues 150$ Retireme nts - D RP, conti nuous eq uity45 Net short-ter m fina ncing & other20 Common dividen d(320 ) Financi ng(1 05)$ Cas h at year end 201 525$ Bank Facility ($55 0) available52 7$ Cons umer s Energy _ _ _ _ _ a Include s other _ _ _ _ _ b Include s cost of re moval and capital leases Cash at year end 2 0147 1$ Sour ces Operating (depre ciation & amortization $ 675)1,940 $ Other w orking capital(135 )Sour ces1, 805$ U sesI nterest and preferre d dividen d(2 35)$ Capital e xpe nditures b(1, 585 ) Dividend a nd tax sharing $ (150 ) fr om CMS(3 55) P ensi on contri bution0 Uses (2, 175 )$ Cas h flow (37 0)$ Fina nci ngEquity150 $ New iss ues2 50 Retire ments (50 ) Net s hort-ter m fina nci ng & ot her(2 6) Financing3 24$ Ca sh at year end 2 01525 $ Bank Facility ($ 650 ) available595$ A R Facility ($250 ) available25 0$ Amount(mils) Credit Ratings . . . . . . . . s how continuous improvement. •Consi stent Performa nce • Les s Risk •Customer Focus • Constructive Regulation • Good Energy Poli cy Re flects Pre sent Prior 2 002 Scale S &P M oody’s S &P (Dec. ‘ 14) M oody’s (Mar. ‘1 5) A+ A1 A A2 A- A3 BBB+ Baa1 BBB Baa2 BBB- Baa3 BB+ Ba1 BBB Baa 2 BBB - Baa3 BB+ Ba 1 BB Ba2 BB- Ba3 B+ B1 B B2 B- B3 Outlook Stable Stable Consumers Se cure d CMS Unsecured 2015 Sensitivities . . . . _ _ _ _ _ a Re flect 2 015 sale s fore cast; weather a djuste d 2015 I mpa ct Status Sensitivity EPS OCF Sales a •Electric (38, 093 G Wh) • Gas (302.6 Bcf) + 1% + 5 + $ 0.05 + 0. 07 + $ 20 + 30 Ga s price s (N YMEX ) + 50¢ 0 55 ROE (authorized ) •Electri c (10. 3%) •Ga s (1 0.3%) + 1 0 bps + 2 0 + 0.01 + 0.01 + 5 + 4 I nterest Rates Ca pital Investment O&M Cost +100 bps +$100 mil + 2% < 0.01 + 0.0 1 0.04 0 + 10 20 – + . . . . re flect strong risk mitigation. – + – + – + (mils ) – + . . . . “autos ” only 5% of gros s margin. • Heml ock Se miconductor •G eneral Motor s •Ne xteer Automotive Cor poration •Gerda u MacSt eel •De nso I nternational • Packaging Corporation of America •Meijer •State of Mi chigan •Spectrum Health •AT &T Perce ntage of electric gr oss margi n is 2.4% Top Ten Customers $2.3 Billi on 201 4 Electric Gross Margin Other 4% Industrial 8% Commer cial 33% Re sidenti al 50% (201 4 Ranke d by Deliveries) Aut o 5% Electric Customer Base Diversifi ed . . . . 2016 201 5 2014 File d $88 M 7/ 01 . . . . pri marily for customer improvement with large O&M offsets . ELECT RI C GAS Our View Our View Filed $16 3 M 12/0 5 Securitization Sur charge E nds $ 80 M 201 6 2015 2 014 Jacks on Plant in rate ba se Invest ment re covery and cost red uctions New Rate Design A ) B) C) Se ttled $45 M Final Order New Rate Design Jack son Pla nt Classi c 7 De commis sione d Self -implement B) C) A) Settled $45 million 10 .3% ROE A) B) . 201 5 Gas And Electric Rate Case s . . . . GAAP Reconciliation 200320 04200 5200 62007 2008 20092 0102 0112 01220 1320 14Re ported ear nings (loss ) per s hare - GAAP ($0. 30)$0.64 ($0 .44)($0 .41 )($ 1.02 )$1.2 0$0.9 1$1.2 8$1.5 8$1.4 2$1.6 6$1.7 4After-ta x items :Electric a nd gas utility0.21 (0.3 9)- - (0.07 )0.0 50.33 0.03 - 0.17 - - E nterprises 0.740. 620.0 4(0 .02)1.25 (0.0 2)0. 09(0.0 3)(0.11 )(0. 01)*0.03 Corporate interest and other0. 16(0.03 )0.04 0.27 (0.3 2)(0.02 )0.0 1*(0.01 )***Dis continue d operations (income) los s(0.16 )0.02 (0.0 7)(0.03 )0. 40(* )(0.08 )0.0 8(0. 01)(0. 03)* (* )Asset impairme nt charge s, net- - 1.82 0.760 .60 - - - - - - - Cumulative accounting cha nges0. 160.0 1- - - - - - - - - - Adjus ted earnings per share, includi ng MTM - non-GAAP$ 0.81$ 0.87$ 1.39$ 0.57$ 0.84$ 1.21 (a)$ 1.26$ 1.36$ 1.45$ 1.55$ 1.66$ 1.77Mark-t o-market impa cts0.0 3(0 .43)0.51Adj usted ear nings per share, e xcl uding MTM - non-GAAPNA$0. 90$0. 96$1. 08NANA NANANANANA NA*Le ss than $ 500 thousand or $0. 01 per s hare.(a ) $1.25 e xcludi ng discontinued E xeter oper ations and accounting changes relate d to convertible de bt and restricte d stock. CMS ENE RGY CORPORATIONEarnings Per Share By Year GAAP Reconciliation(Unaudited) Interest/Ca pitalTaxOt her Financi ngOther Working Lease Py mtsSecuritizationCommonnon-GAAPSharing Pay ments Capitaland OtherDe bt PymtsDivide nds GAAPA mountOperatingas Operatingas Inve stingas Financingas Fina ncinga s FinancingAmountDe scripti onCa sh at year end 20 1471 $ -$ -$ -$ -$ -$ -$ 71 $ Cash at year end 2 014Source sOperating (de p & a mort $6 75)1,940 $ Other working capital(1 35) Net cas h provide d byS our ces1 ,805$ 150$ (235 )$ 44 $ 23$ 7 4$ -$ 1,861$ operating a ctivitiesUsesI nterest and preferre d dividen ds (235 )$ Ca pital expe nditure s a(1,5 85) Dividends/tax s haring t o CMS (355 ) Pe ns ion Contribution- - Net cas h us ed inU ses (2,17 5)$ (150 )$ 2 35$ (44)$ -$ -$ 505 $ (1, 629 )$ investing a ctivitiesCash flow fr omCash flow(370 )$ -$ -$ -$ 23$ 74$ 50 5$ 232 $ operating a ndinvesting a ctivitiesFinanci ngEquity150 $ New Is sues 250 Retireme nts(5 0) Net s hort-ter m fi nancing & other(26) - - N et cash used inFinancing3 24$ -$ -$ -$ (23)$ (7 4)$ (505 )$ (278 )$ fi nancing activitiesNet change in cash(46 )$ -$ -$ -$ -$ -$ -$ (46)$ Net change in cashCash at year en d 2015 25$ -$ -$ -$ -$ -$ -$ 25 $ Cas h at year end 2015a I ncl udes cost of re moval and capital leasesDes criptionConsumers E nergy2015 Fore caste d Cash Flow GAAP Re conciliation (in millions ) (unaudite d)Recla ssifi cations From Sources a nd U ses to Stateme nt of Cash Flow sPrese ntation Sour ces and Us esCons olidated Stateme nts of Cas h Flows Non Equitynon -GAAP Uses GAAPAmountas OperatingOt herAmountDe scriptionCa sh at year end 20 1495 $ -$ (95 )$ -$ Cash at year en d 2014S ourcesCons umer s Energy dividen ds/ta x sharing 355$ E nterprises 20 Net ca sh pr ovided bySource s375$ (19 0)$ 1 27$ 31 2$ operating activitiesUses Interest and pre ferred dividen ds(130 )$ Overhead and Federa l tax pay ments (10 ) Equity infusi ons (15 0) Pe nsion Contribution- N et cash use d inUse s (a )(3 40)$ 190$ (32 )$ (182 )$ investing a ctivitiesCash flow fr omCash flow35 $ -$ 9 5$ 130 $ operating a ndinvesti ng activitiesFinanci ng and dividendsNew Is sues 150$ Retireme nts- E quity programs (D RP, continuous equity)45 Net s hort-ter m fina nci ng & ot her20 - - Common divide nd(320 ) Net ca sh us ed inFina ncing (10 5)$ -$ -$ (10 5)$ fina ncing a ctivitiesNet cha nge in ca sh(70)$ -$ 9 5$ 25$ Net cha nge in ca shCash at year end 2 0152 5$ -$ -$ 25 $ Cas h at year end 201 5(a ) Incl ude s other DescriptionCMS Energy Parent201 5 Forecaste d Cas h Flow GAAP Re conciliation (in millions ) (unaudited )Re classi fications From S ource s and Uses to Statement of Cas h FlowsPres entation Sources a nd U sesCons olidated Stat ements of Cas h Flows OtherCons umer sEquityCons umersCMS Pare ntConsoli datedCommon Dividen dInfusi ons toConsolidate d Statements of Cash Flows Descri ptionA mountAmountEntitiesa s Financi ngConsumersA mountDes criptionCas h at year end 201 471$ -$ 13 6$ -$ -$ 20 7$ Cas h at year end 20 14Net ca sh pr ovided by1 ,861$ 312$ 12$ (505 )$ -$ 1,68 0$ Net cash pr ovided byoperating a ctivitiesoperating activitiesNet ca sh used in(1,6 29) (182 ) (333 ) - 15 0 (1, 994) Net cas h use d ininvesti ng activitiesinvesting activitiesCas h flow from232 $ 130 $ (32 1)$ (505 )$ 1 50$ (314 )$ Cas h flow fromoperating andoperating andinvesting a ctivitiesinvesting activitiesNet ca sh used in(27 8)$ (105 )$ 27 7$ 505 $ (1 50)$ 249$ Net cas h provide d byfi nanci ng activitiesfina nci ng activitiesNet cha nge in cash(46 )$ 25$ (44 )$ -$ -$ (65 )$ Net change i n cas hCas h at year end 201 525$ 2 5$ 92$ -$ -$ 142 $ Cash at year en d 2015 Consolidate d CMS Energy2015 Fore casted Consoli dation of Cons umer s Energy and CMS Energy Parent St ateme nts of Cash Flow (in millions ) (unaudited )Eliminations/ Re classifi cations/Cons olidation to Arrive at the Consoli dated Stateme nt of Ca sh Stateme nts of Cas h Flows 201420 15201 6201 72018 2019 Consumers Operating Income + De preciation & A mortization1,813 $ 1,940 $ 1,955 $ 2,08 1$ 2,19 4$ 2,3 58$ Enter prises Proj ect Ca sh Flows2 0 20 28 5 0 52 55 Gr oss Operating Ca sh Flow1, 833$ 1, 960$ 1, 983$ 2 ,131$ 2,246 $ 2,413 $ (38 6) (280 ) (5 83) (63 1) (646 ) (7 13) Net cash pr ovided by operating activities1,44 7$ 1,68 0$ 1,4 00$ 1,5 00$ 1,6 00$ 1, 700$ CMS EnergyRe conciliation of Gr oss Operating Cas h Flow to GAAP Operating Activities(unaudited)(mils)Other operating activities including taxe s, interest pay ments a nd working ca pital June 2015 OU R MODE L; OUR PLAN I NVESTOR I NFORMATION CMS Energy Corporation Phil M cAndrews 517 78 8146 4 Investor Relations De partme nt Travis Upha us 517 76831 14 One Energy Plaza, Jacks on, MI 49201 www. cmsenergy. com CUST OME RS INVESTORS 1 2. . . . AND provi des sustainable, premi um growth for INVEST ORS.20 14Adjusted EPS (non-GAAP)G uidanceJanuaryMarch 31 June 30 Septe mber 30 December$1.7 7 +7%20 15“Reinvest ment ” Helps Cust omer s . . . . 17¢W eather 14¢ Natural Offs ets (1 )Cost & Other 4Total 17 ¢Increase forestryAccelerate “DIG ” Outage to 2015. $8 mil cost in 2 015; $ 10 mil be nefit in 2 016.Ca pacity increase 38 M WCustomer Satisfacti on . . . . Electri c1stQuartile2nd Quartile4t hQuartile2010 20 12 201 4 2016 3rdQuartile. . . . continue s to improve rapidly. Gas 1stQuartile2ndQuartile4thQuartile3r dQuartile2010 20 12 201 4 2016 Prese ntRankPre sentRa nkRe sidential Business Reside ntialBusiness #6#3# 214#9 • High-end E PS (and dividen d) growth - 12 year track record - Repeata ble •Ca pex -- 1 00% organi c (no “big bets”) •Self-funded -- N o block eq uity dilution! (5 years!) •Worl d-class cost per for mance •Solid sale s growth (under promise/ over deliver) • World -cla ss regulation a nd law OUTPE RFORMED FOR A DE CADE: NE XT DECADE EVEN BRI GHTER Adjusted EPS Gr oss OCF Dividen d CapEx CMS O&M Cost Electric Sales (Ind. /Total ) Energy Policy 10% 1 1 16% 15 21% • Energy efficie ncy standards •File and impl eme nt •10% renewa bles by 20 15 •10% ROA ca p •Adapta bility •Reliability •Affor dability •Environmentally prote ctive 2015 U pdate 2 008 Law 200920 10201 1201 22013 2014 20152 0162 0172 01820 1920 08 - 2 009 Reces sion2010 - 201 3 Re covery2014 2015 2016 - 2019 F utureOCF+$10 0 mil $1 bil cape x = +1% sale s = $20 mil OCF = 5 ¢ EPS Self -funde d (No block eq uity dilution) 20¢ 36 ¢ 50¢ 66¢ 84¢ 96¢ $1.02 $ 1.08 $ 1.15 $0 .81 $0. 90 $0. 96 $1.0 8 $0.8 4 $1.21 $1 .26 $1. 36 $1. 45 $1.5 5 $1.6 6 2003 20042 0052 00620 0720 08200 9201 02011 2012 20132 0142 015Future + $0.6 $ 1.8 $2. 4 Base Rates < 2% 20 05 - 2 014 $1 0.7 B 2015 - 2024 $15.5 B Opportunity $16.5 + B +30% +45% D own 1 0% Down 7% -5% -2.5% 5% 1% 3% 1% 2% ½% $1.1 $ 0.9 $1. 3 > 2% < 2% $1. 77 Conservative Opportunity •Ge neration ca pacity •Gas conversion • Grid moder nization N o “Big Bets ” Gas Infrastructure Ele ctric Reliabil ity Smart Energy Environme ntal New Gen eration Ele ctric Maintena nce 2 006 20 14 201 9 -2 0100102 02013 2014 20152 016 -30 -20 -100 10203 0201 3201 42015 2016 Resi dential Bills Industrial Rate s National Avg Midwest Avg EPS+10¢ (bils ) (bil s) % of Mkt Cap % % Peers • New ca pacity •Gas combine d cy cle -- $700 million • Ren ewables -- $ 1 billion • New Energy Efficie ncy •I nce ntive/ rate base •De coupling •Eliminate ROA s ubsi dy = $150 million $2 0 + B U pside Peers up 42% Actual Pla n Upsides NOT in Plan +5% - + 7% Int’l Sale $1.0 2. 8% 8.7% 7% /year + $0. 5 This pla ce mat contains “forward -looking stateme nts”; please re fer to our SE C filings for infor mation regardi ng the risks and uncertainties that could ca use our results to differ materially. It also contains non -GAAP meas ures. Reconciliations to most dire ctly comparable GAAP meas ures are found in the a ccompanying ha ndout or on our web site at www.cms energy.com a a a N on -GAAP