Training and Orientation of CMFRC Directors

advertisement

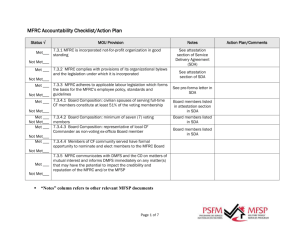

Section 7 NPF Accounting & Financial Reporting MFSP Training and Orientation Manual Updated 2012 Contents NPF Accounting Contacts: 3 Terminology 3 Finance Authority 4 Directors are given authority to expend / deposit funds relating to their location .................................................. 4 Section 5: Sources of Funding 12 DMFS MFSP Program Funding ................................................................................................................................. 12 Deadlines.................................................................................................................................................................. 12 The process for receiving DMFS funding is as follows: ............................................................................................ 13 DMFS Ineligible Expenses - Fiscal Year 2012-2013 Version 9 14 TRUST ACCOUNTS 18 SISIP Volunteer Recognition Funding ................................................................................................................... 18 NMR Site Specific ................................................................................................................................................. 18 Unit Funds ............................................................................................................................................................ 18 Fundraising ........................................................................................................................................................... 18 User Fees .............................................................................................................................................................. 18 Summary of Regulations Governing Petty Cash Funds 19 PETTY AND CASH FUND REGULATIONS GOVERNING USE GENERAL ....................................................................... 19 Procedure for dealing with financial transactions: 20 The process to be followed with each payment method: 21 Cash box payment .................................................................................................................................................... 21 Bank payment .......................................................................................................................................................... 21 Credit Card payment ................................................................................................................................................ 21 Request for Payment ............................................................................................................................................... 21 Travel Claims ............................................................................................................................................................ 21 Travel Claim Procedure 22 Banking information............................................................................................................................................. 27 Checklist ............................................................................................................................................................... 27 Daily Data Entry 29 All Coordinator Budget................................................................................................ Error! Bookmark not defined. MFRC ........................................................................................................................... Error! Bookmark not defined. Month End Procedures Contractor payments MFSP Training and Orientation Manual 30 31 Updated 2012 NPF Accounting Contacts: Peg Proctor NPF Accounting Manager Europe .............................. + 49 (0) 2451-48451511 George Hurshman Deputy NPF Accounting Manager Euro ............ +49 (0) 2451-48451515 Dorina Bucknall PSP Accounting Supervisor .................................... +49 (0) 2451-484-51512 Regina Little PSP Accounting - ......................................................... +49 (0) 2451-484-51514 Terminology Accrual: An entry that is set up to ensure that expenses are recorded in the appropriate period. An example would be to show the amount owing for an order that was received however the invoice has not yet been received. BIC: Bank Identification Code Committed Funds: A purchase that has not been paid for. I.e. postdated cheque. European Fund: A fund that has been established based on profits generated in Canadian Forces stores. Expenditure: The process of expending, an outlay Expense: An amount that has been spent. Examples of expenses include: personnel costs, bank charges, resources, contract fees, etc. Fiscal Year/Month: The accounting year/month. The accounting year is Apr 1 – Mar 30. This is in contrast to a calendar year of Jan 1 – Dec 31 General Ledger or GL: These are the accounts set up to record financial transactions Petty Cash: The combined total of all liquid (easily available) cash available to the Centre. In essence, it is a loan to the Centre. For example: Cash Box................... 50.00 € Bank Account ........... 1950.00 € Total Petty Cash ....... 2000.00 € NPF Accounting: This is the term used to identify the Non Public Fund Accounting office. This office downloads Petty Cash funds to the Centre and records the Centre’s revenue and expense transactions. They provide monthly financial statements that reflect the Centre’s transactions. MFSP Training and Orientation Manual Updated 2012 Quarter: A period of time. 1st quarter is April to June, 2nd quarter is July to September, 3rd quarter is October to December, and 4th quarter is January to March. Request for Payment: A form used to request payment from the NPF Accounting office. Revenue: Funds brought in. Examples of revenue include: DMFS funding, User fees, youth model funding, SISIP funding, Site Specific: NMR funding, These are public dollars. Trial Balance: A listing of general ledger accounts with their balances Trust Fund: An account that has been set up to hold funds for a specific purpose (examples include: SISIP funds, User Fees, Unit Funds Site Specific Funds, Fundraising, Youth Model staffing and other non-DMFS funds. Trust Funds are classified as revenue accounts. Accounts for which funds are being received (not to be mistaken for reimbursements). Balances in trust fund accounts are not carried forward. Unit Fund: A fund that has been established using European funds to be used to enhance the morale and welfare of the community. Year to Date or YTD: Accumulated totals for the year starting Apr 1 to current date. Finance Authority Directors are given authority to expend / deposit funds relating to their location Specimen signature form illustrating the signature of the director and Petty cash form acceptance form are to be completed at the time of turnover. These are to be signed and forwarded to the MFSP Manager. Also to be completed at time of handover is the application for a corporate credit card. MFSP Training and Orientation Manual Updated 2012 Signing Authority SPECIMAN SIGNATURE FORM UNIT / CMFRC / TRUST FUND._______________________________ SPECIFIC ACCOUNT_________________________________________ (IF APPLICABLE) ______________ ______________ ________________________ _________ S/N RANK NAME INT _____________________________ __________________________________________ SPECIMEN SIGNATURE FULL AUTHORITY/LIMITED AUTHORITY (IF LIMITED, TO WHAT LEVEL) _______________________________ _________________________________________ APPROVING AUTHORITY MFSP Training and Orientation Manual SIGNATURE Updated 2012 PETTY CASH I, ______, HEREBY ACKNOWLEDGE RECEIPT OF THE SUM OF __________EURO TO BE USED FOR THE PURPOSE OF Petty Cash. I UNDERSTAND THAT I MAY BE HELD PERSONALLY AND FINANCIALLY TO NPF FOR THIS AMOUNT. I ALSO ACKNOWLEDGE THAT I HAVE BEEN BREIFED ON HOW THE FUNDS MAY BE USED, AND I HAVE BEEN PROVIDED WITH A COPY OF THE SUMMARY OF REGULATIONS GOVERNING THE USE OF THESE FUNDS. DATE SIGNATURE OF AUTHORIZED HOLDER DATE AUTHORIZED BY MFSP Training and Orientation Manual Updated 2012 MFSP Training and Orientation Manual Updated 2012 MFSP Training and Orientation Manual Updated 2012 MFSP Training and Orientation Manual Updated 2012 MFSP Training and Orientation Manual Updated 2012 To: Commerzbank AG MSB Niederrhein CMIB Kunden Service 40300 Düsseldorf Order Credit Card Canadian Forces Personnel Support Agency (CFPSA) Account 02 877 077 00 Bankcode 390 800 05 Commerzbank AG Geilenkirchen-Teveren Correspondence address: Canadian Forces Personnel Support Agency (CFPSA) NPF Accounts SLOT 4000 POB 5053 NATO Airbase Geilenkirchen Teveren 52511 Geilenkirchen Please prepare the Credit Card agreement for: Product Limit (in thousand Euro) PIN Name Commerzbank Corporate Card Premium Commerzbank Corporate Card Basic with insurances without insurances Commerzbank Business Card Premium Commerzbank Business Card Basic € Yes No Prename Birthdate / Birthplace Private Address Street Postcode / Place Since Name on the Credit Card (max. 24 letters) Send the prepared agreement by telefax or email for underwriting on the second side at attention to: Peg Proctor telefax: 02451-48451520; mail: Proctor.Peg@cfpsa.com MFSP Training and Orientation Manual Updated 2012 Sources of Funding DMFS MFSP Program Funding Deadlines: DMFS Funding Application November 1 The CMFRC Director is responsible for managing service delivery funds, as well as demonstrating funding eligibility, the application process, CMFRC budgets and service level agreements. Under the direction of the Canadian National Military Representative, the Regional Accounting Office (Europe) provides accounting services for the MFSP, including administering the payroll of MFSP employees, allocating funds to CMFRCs for service delivery, and preparing financial reports. For detailed information about funding issues, refer to MFSP: Parameters for Practice. Service Delivery Agreement is the funding document used to: certify compliance with the Memorandum of Understanding or Service Level Agreement; budget resources, and commit to the delivery of services in accordance with MFSP: Parameters for Practice. Due end of February Service Delivery agreement is our authority to spend allocated funds. 1st Qtr Financial Statements (Apr – Jun) ................................................ end of Jul 2nd Qtr Financial Statements (Jul-Sep) .................................................. end of Oct 3rd Qtr Financial Statements (Oct-Dec) ................................................. end of Jan 4th Qtr (Jan-Mar) and Year End Financial Statements: .......................... end of Apr MFSP Training and Orientation Manual Updated 2012 The process for receiving DMFS funding is as follows: Online funding application is completed on ebusiness. A Director should request a new account on the following site: https://public.cfpsa.com/en/AboutUs/PSP/DMSF/fundingcentral/Pages/default.aspx Coordinate your request with the MFSP Manager. It is not a requirement for all staff to have one. Only those staff inputting data and the Director should have access to this site. Funding applications should be completed with enough time for it to be viewed by the MFSP Manager who will provide feedback and suggestions. A consolidated application is prepared and submitted to Ottawa Ottawa reviews the document and makes a decision of how much will be allocated to each Centre. Details of funding allocation is forwarded to Centres so that they are able to prepare the Service Delivery Agreement (SDA) Note: If the funding application process was followed and enough justification was provided for the level of funding requested, this should be a very easy process as the funding application numbers are automatically transferred to the SDA portion of the web site and so the only thing that needs to be done is to divide expected expenditures among the 4 quarters of the fiscal year. SDA details are consolidated for the Centres and submitted to Ottawa for approval. Once notification of approval is received, DMFS downloads the funds for CMFRC use. Note: The online funding application, SDA and quarterly reports are completed in Canadian currency. DMFS has agreed to a standard rate of exchange for reporting purposes. For the 20012/13 Fiscal year the rate is 1.45. Note: These funds are not downloaded to the CMFRC. NPF accounting receives and tracks the funds. The Centres are in effect being provided with something like a credit line. MFSP Training and Orientation Manual Updated 2012 For example: CMFRC is approved to spend 300 Euros in the category of Welcome and Community Orientation. The Centre can continue to spend, following the financial transaction recording process (as will be described later in this section) until they reach 300 Euros Unspent DMFS monies are clawed back, i.e. they do not carry forward into the next fiscal period. Note: No physical cash is provided to the Centre. NPF accounting holds all the funds. Justification of Funding It is necessary that we understand DMFS’s parameters. DMFS is a funder, and as such, is providing funds for Centres to meet the needs of their community within the confines of DMFS’s parameters. DMFS will not authorize funds being spent on things that are outside of their parameters, regardless of the need. DMFS Ineligible Expenses - Fiscal Year 2012-2013 Version 9 DMFS is committed to funding the Canadian/Military Family Resource Centres to meet the mandated objectives of the MFSP. Funding from DMFS provides C/MFRCs reasonable and adequate resources to effectively manage and coordinate the delivery of mandated services and to meet unique operations and maintenance requirements. However, there are some expenses that DMFS does not fund. Below you will find an updated list of ineligible expenses for the funding application. Ineligible Uses of DMFS Funds Organizational Infrastructure and Maintenance Items Renovations to physical property Vehicles, including the purchase, maintenance and ongoing regular expenses, (e.g. gas, oil, and car wash costs) related to vehicles Grounds upkeep Note: If a Centre was to initiate a gardening club as part of one of their programs, the purchase of plants, seeds, etc. would be considered programming costs not grounds upkeep. Heating, air conditioning, plumbing, and electricity Snow removal, salting and sanding Janitorial services All occupancy costs, including rental of off-base facilities for program overflow or outreach programming MFSP Training and Orientation Manual Updated 2012 Note: Rental for special events such as an annual general meeting or volunteer appreciation is not considered occupancy costs. Rental that is repetitive such as a youth centre location rental fee is considered occupancy costs. Health and safety equipment, including outdoor lighting, sprinkler systems, fire alarms, security systems, panic buttons, and accessibility requirements, (e.g. equipment required for wheelchair accessible buildings) Note: Equipment that is necessary for safety that is connected to programming is acceptable. This includes things like baby gates. Capital assets. DMFS defines a capital asset as having the following characteristics: A useful life of more than one year An acquisition cost of $200.00 or more Stand-alone, meaning that it is not incorporated into a building or structure, and is subject to depreciation (e.g. buildings, land, vehicles, swimming pools, and skate boarding parks) Vehicle insurance Note: An exception to this is in the UK where Coordinators are using their personal vehicles for MFSP programming use. The rider necessary on their personal insurance policy is eligible from DMFS The exception would be non-owned automobile coverage for employees and volunteers. The formal explanation of this is as follows: “Non-owned vehicle liability insurance for the protection of the corporation for liability emanating from vehicles owned or leased by employees and volunteers used for official company business.” Organizational Supplies, Resources and Furnishings Information technology and automatic data processing support on IT assets, maintenance of IT assets or purchase of specialized IT equipment, (e.g. palm pilots, blackberries, etc.) Note: An exception would be substantiated costs for web cams used for Emergency Intervention with Social Worker and/or Padre scheduled discussion Office furniture Postage, including bulk mail Repairs associated with equipment and resources used in Youth Centres or Daycares (e.g. pool tables, TVs and accessories, computer or video games, high-chairs, toys, and cribs) Photocopying Standard office equipment, (e.g. telephones, photocopiers, fax machines, etc.) The exception would be substantiated costs for cell phones and pagers used for Emergency Childcare Services and/or the management of risk in other DMFS mandated programs. Standard stationary and regular office supplies MFSP Training and Orientation Manual Updated 2012 The exception to this would be unique C/MFRC office supplies/letterhead, normally identified as needed to support a DMFS service category but not available through Base/Wing standard stationary and supply stock. Service Delivery Costs for the provision of ongoing, long-term, psychosocial counselling Fund-raising and profit making initiatives, (e.g. salaries of fund-raising consultants or professional fundraisers, thrift shops, catering services, restaurants, snack bars, and stores) Any service or activity that cannot be directly linked to an MFSP mandated service objective. This is critical to funding. Food and beverage Note: This does not apply if a facilitator is hired to conduct a course and they provide the food and/or beverage as part of their contract. Note: There is a border line provision for food and beverage if you delivery an all day training session for volunteers and/or AC members. The volunteers should not be out of pocket as a result of volunteering their time for the day (similar to child care). If the lunches can be provided within the prescribed rates, and the volunteers did not claim lunch, this would be considered acceptable. Site-specific services (e.g. medical clinics, daycare centres, family home daycares) Cost of transportation for C/MFRC program participants The exception would be emergencies or extreme situations determined as such by the C/MFRC. Note: This does not apply if the Centre was taking participants on the metro as part of a community orientation and/or getting familiar with metro activity. Costs for the provision of casual childcare The exception to this would be Casual childcare for SLT, (refer to MFSP: Parameters for Practice, DMFS SLT Policy, Annex E). Coordination of casual childcare is an eligible expense. Provision of casual childcare is ineligible and would be removed automatically from funding applications as ineligible. Costs of childcare for volunteers (including AC members) is eligible however. Those costs must be included in the M&A category of the application as line items in either the volunteers or the AC. For the community forum, if the CMFRC was providing on site casual care for the volunteers, and the numbers allowed, you could perhaps charge other community members a nominal fee for the convenience of having care on site as well Programs for children and youth that relate to achievement of objectives within the four service categories, which happen to be offered at a time adjacent to parent programs/briefings, etc are eligible for funding. MFSP Training and Orientation Manual Updated 2012 Other Profit accumulation for the purposes of establishing contingency funds Gifts This is a very sensitive area that Centres must be extremely cautious about. Examples: Welcome Package maps (not a gift - resource) Welcome Plant (gift) Box of chocolates to a spouse going through deployment (gift) Box of chocolates presented to a volunteer during volunteer appreciation evening (not a gift – recognition item) Welcome basket with 2 mugs and package of coffee (gift) Welcome basket with 2 mugs bearing MFSP logo and CMFRC contact info (not a gift - marketing and promotion item) In cases where it is unclear, check with MFSP Manager to verify if something would be considered a gift or not. Fines & penalties Any other costs that have been identified by the C/MFRC and deemed by its DMFS FOM to be ineligible based on the MOU/SLA and MFSP: Parameters for Practice MFSP Training and Orientation Manual Updated 2012 TRUST ACCOUNTS The details for the download and expenditure of funds in the following categories are recorded in Trust Funds SISIP Volunteer Recognition Funding The purpose of the fund is to provide financial support to offset the cost of offering volunteer recognition events. There is a very strict application and follow through process. A finite amount of money exists in this pot. The total for all Europe Centres is $4,000. Keep in mind that this is not a big chunk of funding for six Centres. NMR Site Specific A proposal is submitted to the MFSP Manager to request funds from this funding source. A finite amount of money exists for Europe. The proposals are reviewed and then the Centre receives notification of the amount. The funds are not actually received by the Centre until the summer months. Types of expenses that this funding is intended for: Camp supervisor’s for summer camp program. Unit Funds Funds received through the Unit (or sometimes referred to as the European Fund) Fundraising These are funds that are generated by each Centre. Depending on the agreement of the country, base and other factors, there are various levels of funding that can be generated. User Fees These are funds for which amounts are collected from users to pay for services and programs taken part in. MFSP Training and Orientation Manual Updated 2012 Summary of Regulations Governing Petty Cash Funds PETTY AND CASH FUND REGULATIONS GOVERNING USE GENERAL Petty cash funds are issued on the written authority of mess committees, base fund committees, the B Comd, B Admin O or CANEX RM. Petty cash funds shall not normally exceed $200 And shall not exceed the authorized limits of the secure facilities available. Where more than $200 is required the B Comd, B Admin O or CANEX RM must approve, in writing, the request for the fund. PURPOSE The funds are intended for expenditures of items when it is not practical to pay for them by cheque or through the invoicing procedures of the NPFAS. RESTRICTIONS Payments from a petty cash fund shall be limited to amounts not in excess of $200 in any single instance. Petty cash expenditures are for expense items only and payments for merchandise for resale or salaries are not to be made from these funds. In addition, they shall be subject to such further restrictions as may be imposed by the mess committees, base fund committees, B Comd, B Admin O, PSP Mgr or CANEX RM. RESPONSIBILITIES OF FUND HOLDER The petty cash fund holder shall: obtain a sales slip/voucher for each petty cash expenditure; seek reimbursement of the fund at least once each month by submitting a Recap of Petty Cash Expenditures signed by the appropriate approving authority and supported by the sales slips or vouchers; return the funds to the NPFAS when they are no longer required or when ordered to do so by the NPFAS or some other competent authority; ensure that no single expenditure exceeds $200; and ensure that the monies and/or vouchers totalling the amount of the fund are properly secured at all times. The petty cash fund holder shall not: lend, exchange or otherwise apply the funds for any purpose or in any manner not authorized by proper authority; cash personal cheques or other negotiable instruments; make any personal expenditures from the fund; and pay salaries or commission to a person or company. SECURITY A petty cash fund not in excess of $1,000 may be stored in an approved filing cabinet equipped with an approved padlock as per CFAO 202-2 and NDSP, chapter 8. MFSP Training and Orientation Manual Updated 2012 Petty Cash / Operating Cash REIMBURSEMENT 1. 2. 3. 4. Each Centre begins the fiscal period with what is referred to as a Petty Cash. The level of Petty Cash is based on the requirements for the Centre and is therefore not the same for every Centre. Each Centre is expected to maintain the level of their allocated Petty Cash and complete a Petty Cash reconciliation at minimum on a monthly basis. Centres can prepare more than one petty cash reconciliation during the month. This is important so that the Centre does not run out of funds. Centres scan and send by email their authorized petty cash reconciliations to THE MFSP Manager (CC MFSP Finance Assistant) with all supporting documents and keep the hard copy for their own filing. The MFSP Finance Assistant will forward completed and verified Petty Cash reconciliation to NPF Accounting. Procedure for dealing with financial transactions: There are five ways that a transaction can be paid for by a Centre 1. The amount of the bill is taken from a cash box a) This option reduces your petty cash amount and needs to be reflected in a request for replenishment 2. A payment is made through the Centre’s bank account a) This option reduces your petty cash amount and needs to be reflected in a request for replenishment b) This option should be used only when there is a real urgency to paying the amount owing 3. A payment is made through a corporate credit card a) This option reduces your petty cash as credit card payments are automatically deducted from bank accounts b) Not all Centres have corporate credit cards a) A Request for Payment is completed and sent to NPF Accounting for processing b) This option does not reduce your allocated Petty Cash 4. Claims a) Mileage claim b) One day travel claim c) Overnight claim from ClaimXpert d) General expense claim MFSP Training and Orientation Manual Updated 2012 The process to be followed with each payment method: Cash box payment The cash is taken from the cash box to pay for the item purchased The receipt is put into the cash box with a clear, legible notation of what the purchase is for and which account it is to be posted to (each Centre has a unique chart of accounts) These entries are included in the monthly end Petty cash reconciliation Director authorize all but their own expenses Reconciliation should be made every day but submitted with month end paperwork. Bank payment Details of items purchased and account to be posted information is to be documented on the invoice/receipt On-line payment At the bank Reconciliation is made at the end of the month paperwork Credit Card payment Details of items purchased and account to be posted information is to be documented on the invoice/receipt. Receipts should be collected in a file to allow for a cross check of the items charged on the credit card bill Credit card bills are automatically paid by NPF Accounting and do not affect your bank balance or your Petty Cash. Reconciliation is made with end month paperwork Credit cards cannot be authorized by the card holder, all Directors credit cards are to approved by MFSP Manager Request for Payment A request made to NPF to make a payment on behalf of the center Payment is made directly from NPF and therefore does not affect your bank account or Petty cash. Travel Claims Claim for mileage or on day trip when reimbursing the person with cash box it becomes part of your Petty cash. Mileage claim (km * 0.62/rate of that day.= amount to pay) Day trip rate of that day with site www. http://www.tbs-sct.gc.ca/pubs_pol/hrpubs/TBM_113/d_e.asp (Meal) http://www.njc-cnm.gc.ca/directive/travel-voyage/td-dv-a2-eng.php (Mileage) MFSP Training and Orientation Manual Updated 2012 Procedure for Expenses Fill out the requisition form, or With a stamp on the receipt or Receipt on a blank pager and stamp beside it. 1. 2. 3. 4. Fill out: Request # (number comes from your Expense Ledger) Amount Account # Description of the expense Event Director signature accepting this expense Input on Expense Ledger Input on All Coordinator Budget Input on Daily Cash Input on Petty Cash in the Expense section Refund of Activity Attach the White copy to this form 1. 2. 3. 4. Request # from Expense Ledger Account # Activity The person you receive the money back signs Director sign to approve Input on Expense Ledger Input on All Coordinator Budget Input on Daily Cash Input on Petty Cash in the Expense section MFSP Training and Orientation Manual Updated 2012 Request for Payment Asking NPF to pay for this Invoice Fill out the form: Request # Issue Payment to: Bank info: Description Account # Amount Person doing the demand signs Director sign for approval of the expense 1. 2. 3. 4. Input on Expense Ledger Input on All Coordinator Budget Make a copy for your file Send to NPF for payment Yellow slip Revenue money coming in. 1. 2. 3. 4. 5. Input on MFRC Input on Daily Cash Input on Deposit Input on Petty Cash in the Revenue section Keep in envelop until Month end paperwork Credit Card Reconciliation 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Receive credit card statement Get all your receipt Compare them to your statement Input on Credit Card Reconciliation Fill out Form Director sign Scan & send to MFSP Manager for signature Keep on your file Input in All coordinator Budget FSP Finance will send it to NPF for reconciliation MFSP Training and Orientation Manual Updated 2012 Cash Registry Count Cash whenever you want morning or end of the day, but every day there is finance activity. Your Daily cash sheet will tell you if you balance or not. At the end of each Month attach all paperwork signed scan and send to NPF. 1. 2. 3. 4. 5. 6. 7. Petty Cash with all receipt Daily Cash Cash Count Deposit Register All Yellow slip Bank Statement Bank Reconciliation Mileage Claim Mileage Keep track and depending on the Center but you can processed them every month or quarterly Member as to fill out; Date Purpose xxKm * 0.62 = $xx / rate of that day= €xx xxKm *0.62 = $xx / rate of that day= €xx * rate of that day = £xx Get pay by petty cash or send it with claim Make your own Invoice Staffs sometimes have to add a receipt. Repaid your staff make sure they do sign for that money they received. MFSP Training and Orientation Manual Updated 2012 Travel Claim Procedure Each person raises their “Pre-Travel” claim (through TravelXpert) prior to travel. Print it, Sign it, Scan and send to MFSP Finance Assistant. MFSP Manager will sign it. You will receive a signed copy to have in your possession on the time of travel. We will keep the approved Pre-Travel form in our office, to match up with the finalization of the travel claim. Once Pre-Travel authority is received, travel bookings can be made in according with CMFRC procedures Upon return from trip: CMFRC traveler will complete the attached Staff Worksheet, scan copies of all supporting documentation and send them to MFSP Finance Assistant. The claim will then be finalize by Finance Assistant and reviewed and approved by MFSP Manager. Finance assistant will then input the claim in TravelXpert. Finance assistant will send you an email to print the claim sign it and scan and send it back. MFSP Manager will make the finalize signature and MFSP Finance Assistant will then scan and send to NPF for payment (with supporting receipts including electronic ticket, if relevant) Approx. 2 weeks after the claim is sent for payment; the claim will be open and “Send to NAPO” which moves it from incomplete to complete claims. Staff is responsible for notify if payment is not received in their bank within those two weeks. Claims that are same day travel can be processed/reimbursed locally. (This can be reimbursed on a Minor Travel Expense Claim- MTEC, vice an NPF Travel Claim) Claims that take place over a day, must be processed through NPF accounting In the event of an amount paid by corporate credit card, the explanation of why no reimbursement is necessary is included, but no amounts or receipts are attached to the claim. Reimbursement of the credit card expense is accomplished through the NPF with the Credit Card Reconciliation paperwork done at the end of each month. NPF reimburses the Centre for expenses paid out or processes the claim and deposits to the employees account Amounts are to be showed in the above currency. Exchange conversions are done using the rate of the day. If looking rates up, here are the site addresses http://www.tbs-sct.gc.ca/pubs_pol/hrpubs/TBM_113/d_e.asp (Meal) http://www.njc-cnm.gc.ca/directive/travel-voyage/td-dv-a2-eng.php (Mileage) IMPORTANT: ALL TRAVEL MUST BE APPROVED ON TRAVEL CLAIM FORM PRIOR TO COMMENCEMENT OF TRAVEL. THIS IS FOR INSURANCE AND SAFETY PURPOSES. AND CARRY THEIR PRE-APPROVAL DOCUMENT WITH THEM. MFSP Training and Orientation Manual Updated 2012 HOW TO FILL OUT TRAVEL EXPENSE CLAIM Surname/Given Name: Enter your last name first, then your first name Is to proceed FROM: Where did you travel from (initial location) Destination TO: Where did you travel to (furthest point) Inclusive dates of travel (from/to) First day of travel to last day of travel For the purpose of: State the overall purpose of the travel Certification: Director to sign for staff, MFSP Manager to sign for Directors Method of Travel & Details of Transportation Issued RAIL = by train Rental = by rental car/vehicle Bus = by bus PMC = private motor vehicle PMC License Plate No = enter your license plate number Please note if you are traveling with someone else. Travel Expenses & Other Expenses Note: All stop-over need to be detail Dep: Location of departure (city) Date: Date of departure Time: Time of departure Arr: Location of arrival Date: Date of arrival Time: Time of arrival Ensure you do include airline stopovers. Departure and arrival times are critical. B/F: Breakfast claim amount (see allowable claims for the location where you had breakfast) Note: Many Europe hotels provide B/F as part of their fees. For this reason, some locations do not state an allowable claim for breakfast. If you incurred an expense, a receipt is require, Lunch: Lunch claim amount (see allowable claims for the location of where you had lunch) Dinner: Dinner claim amount (see allowable claims for the location of where you had dinner) Incidentals: Incidentals claim amount (amount will be the location you wake up that day) Lodgings: where you stayed (Private or commercial) Travel Method: State method of travel Note: If claiming mileage, include km x rate in detail section. Format example: 142 km x 0.62 Cdn = 88.04 Cdn / 1.55 = 56.80 Eur Details: Provide details of travel Total: Total the line items across. MFSP Training and Orientation Manual Updated 2012 Other Expenses: This section is also used for travel, lodgings and other expenses such as parking. The above section is for travel days, while this section is for full days. Note: Please note expenses paid by other means such as corporate credit. The purpose of this is to confirm that there are no missing receipts. Claimant Signature: Sign your claim Approval: Director for staff, MFSP Manager for Director Exchange Rates: Enter exchange rates used (per DMFS agreed upon rate). Watch your calculations. Note: Banking information needs to be included on all claims. NPF does not look up details. The claim will not be processed. Banking information Details required by NPF Accounting: Inside Germany: BLZ & account number Outside Germany: Name of the bank, SWIFT code and the IBAN (should be on your bank statement) Canadian: Bank name, bank full mailing address, bank transit number (BTN) three digit code – five digit code (transient number), and the account number. Information/details are available on a blank cheque. Sending a void cheque will work for NPF. Note: If a staff member requests payment to a Canadian account they will be liable for the service charges there will service at Europe and Canada end, this is highly discouraged. Checklist Pre-approved claim signed Stated all departure and arrival timings (account for all days including personal) Stated if payments were made by business credit card or other means Attach all receipt and e-tickets Stated if any meal were provided GL / Account number And finally all you’re banking information. Date – from – time – to – time – transportation (receipt) – Accommodations (receipt) MFSP Training and Orientation Manual Updated 2012 MFSP Training and Orientation Manual Updated 2012 Daily Data Entry Expense Reimbursements Fill out Payment Requisition Record requisition in the Expense Ledger Enter in the All Coordinator Budget under the appropriate tab Enter in the Daily Cash Reconciliation Enter in the Petty Cash Make note of amount in the Total Expenditures/Cash request for reimbursement from prior month(on the Petty Cash report) and enter this amount on the Bank reconciliation Send the expense reconciliation to Director for signature Scan and send expense reconciliation to NPF at month end; and Original receipts is maintained for Finance records and 1 copy goes to the appropriate Coordinators. Receipts Deposit Voucher Remove yellow copies from the receipt book at the front desk Enter in the Daily Cash Reconciliation Enter in the MFRC Budget Enter in the Deposit register by event Enter in Petty Cash report under User Fees Make note of amount in the Total Expenditures/Cash request for reimbursement from prior month(on the Petty Cash report) and enter this amount on the Bank reconciliation Ensure receipts are in numerical order and send to NPF at month end MFSP Training and Orientation Manual Updated 2012 Month End Procedures Verify amount with the last month reports on Master spreadsheet from MFRC budget. There are 3 days after the last day of the month to process month end to scan and send to NPF Ensure there is no more than 750 Euro cash on hand for month end (This is an NPF rule) Bank deposit is required for month end do this at least 2 banking days prior to pulling a bank statement or it will not show on statement. Fill out Deposit Slip card with Konto/ (account) Name Directors name and enter euro amount. Ensure all expense requisitions and receipts for User Fees have been posted Ensure Cash is balanced Scan and Send the following to NPF Accounts: All expense requisitions with receipts (maintain original copies for Finance and 1 photocopy for the Coordinators) Receipts for User Fees (yellow slip) Bank reconciliation report Petty Cash report (verify entries against requisitions before sending to NPF) Deposit Record Copy of Bank statement Post funds received (from Deposit Record) to the All Coordinator Budget Enter all requisitions and Direct Payment requests to the MFRC budget Ensure Payroll reports have been entered to the MFRC budget After NPF has processed month end and sent out statements verify against requisitions and All Coordinator Budget ( master) File requisitions and give copies to Coordinators Direct Payment do go through NPF just send paperwork directly. Master Card payment proceeds like Direct Payment. Paper is sign by Director and then fax to MFSP Management and then scan and sent to NPF for reconciliation. LDR enter amount to All Coordinator Budget and keep track to part time salaries on the USB key. Quarterly ask for the Mileage sheet from the coordinators. MFSP Training and Orientation Manual Updated 2012 Get mileage rates at the Treasure Board site http://www.tbs-sct.gc.ca/pubs_pol/hrpubs/tbm_113/menu-travel-voyage-eng.asp Take mileage multiply with the rate Find the exchange rate for that day Add total for km and total for amount Do up a requisition of expense. And process as a receipt Pay the members for their mileage and have them sign the register. With Deposit spreadsheet enter amount into All Coordinator Budget as dX (month). Contractor payments: Payments for all contracts should be processed on a separate Request for Payment. An original copy of the contract must be attached to the Request for Payment. MFSP Training and Orientation Manual Updated 2012