Master of Mathematical Finance

advertisement

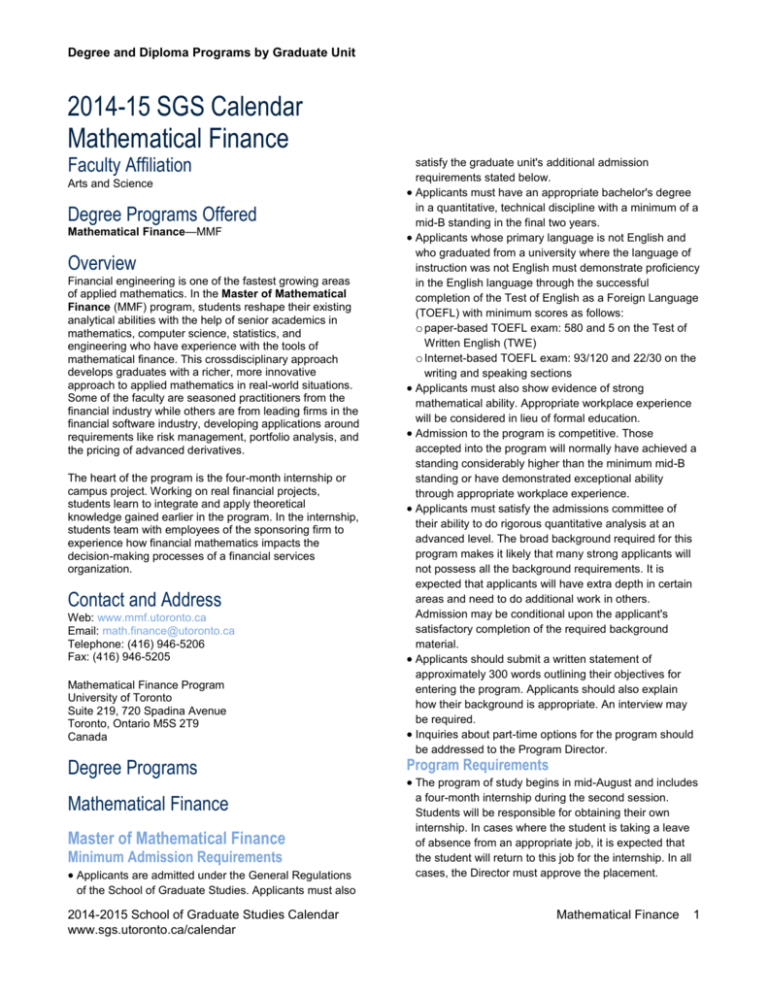

Degree and Diploma Programs by Graduate Unit 2014-15 SGS Calendar Mathematical Finance Faculty Affiliation Arts and Science Degree Programs Offered Mathematical Finance—MMF Overview Financial engineering is one of the fastest growing areas of applied mathematics. In the Master of Mathematical Finance (MMF) program, students reshape their existing analytical abilities with the help of senior academics in mathematics, computer science, statistics, and engineering who have experience with the tools of mathematical finance. This crossdisciplinary approach develops graduates with a richer, more innovative approach to applied mathematics in real-world situations. Some of the faculty are seasoned practitioners from the financial industry while others are from leading firms in the financial software industry, developing applications around requirements like risk management, portfolio analysis, and the pricing of advanced derivatives. The heart of the program is the four-month internship or campus project. Working on real financial projects, students learn to integrate and apply theoretical knowledge gained earlier in the program. In the internship, students team with employees of the sponsoring firm to experience how financial mathematics impacts the decision-making processes of a financial services organization. Contact and Address Web: www.mmf.utoronto.ca Email: math.finance@utoronto.ca Telephone: (416) 946-5206 Fax: (416) 946-5205 Mathematical Finance Program University of Toronto Suite 219, 720 Spadina Avenue Toronto, Ontario M5S 2T9 Canada Degree Programs Mathematical Finance Master of Mathematical Finance Minimum Admission Requirements Applicants are admitted under the General Regulations satisfy the graduate unit's additional admission requirements stated below. Applicants must have an appropriate bachelor's degree in a quantitative, technical discipline with a minimum of a mid-B standing in the final two years. Applicants whose primary language is not English and who graduated from a university where the language of instruction was not English must demonstrate proficiency in the English language through the successful completion of the Test of English as a Foreign Language (TOEFL) with minimum scores as follows: o paper-based TOEFL exam: 580 and 5 on the Test of Written English (TWE) o Internet-based TOEFL exam: 93/120 and 22/30 on the writing and speaking sections Applicants must also show evidence of strong mathematical ability. Appropriate workplace experience will be considered in lieu of formal education. Admission to the program is competitive. Those accepted into the program will normally have achieved a standing considerably higher than the minimum mid-B standing or have demonstrated exceptional ability through appropriate workplace experience. Applicants must satisfy the admissions committee of their ability to do rigorous quantitative analysis at an advanced level. The broad background required for this program makes it likely that many strong applicants will not possess all the background requirements. It is expected that applicants will have extra depth in certain areas and need to do additional work in others. Admission may be conditional upon the applicant's satisfactory completion of the required background material. Applicants should submit a written statement of approximately 300 words outlining their objectives for entering the program. Applicants should also explain how their background is appropriate. An interview may be required. Inquiries about part-time options for the program should be addressed to the Program Director. Program Requirements The program of study begins in mid-August and includes a four-month internship during the second session. Students will be responsible for obtaining their own internship. In cases where the student is taking a leave of absence from an appropriate job, it is expected that the student will return to this job for the internship. In all cases, the Director must approve the placement. of the School of Graduate Studies. Applicants must also 2014-2015 School of Graduate Studies Calendar www.sgs.utoronto.ca/calendar Mathematical Finance 1 Degree and Diploma Programs by Graduate Unit Students will proceed through the program as a group, MMF 1923H Financial Markets and Corporate Policy MMF 1926H Workshop in Mathematical Finance MMF 1927H Workshop in Mathematical Finance MMF 1928H Pricing Theory 1 MMF 1929H Asset Management MMF 1941H Stochastic Analysis 3 sessions full-time (typical registration sequence: F/W/S) MMF 1943Y0 Communication 3 years full-time MMF 2000H Risk Management Course List MMF 2011H Advanced Stochastic Processes Courses are offered in modules. A module will consist of a four-week unit with a minimum of three contact hours per week, or its equivalent. A large portion of the learning for the module will take place outside of class through carefully designed computer projects and group study. The courses have been packaged in units of one, two, three, four, or five modules, and the course weight will be equal to the number of modules; for example, a course with three modules will have a weight of three credit hours. Six modules will be considered the equivalent of one fullcourse equivalent in a standard format. The third digit of the four-digit course number determines the course weight. MMF 2012H Volatility Modelling and Forecasting MMF 2021H Numerical Methods for Finance MMF 2025H Risk Management Laboratory following a common course of study. The course of study will be fully integrated and computer-laboratory intensive. Course projects and assignments will be designed to integrate the material learned from a variety of the courses and to utilize it in a practical context. Excellent communication and presentation skills will be emphasized in both the oral and written components of the projects. Students must complete all courses listed below. Program Length Time Limit Course that may continue over a program. The course is graded when completed. 0 Third Digit Notation 1 = one-third of a half course 2 = two-thirds of a half course 3 = one half course 4 = two-thirds of a full course 5 = one full course MMF 1900Y Internship (Credit/No Credit) MMF 1910H Introduction to Financial Industry (Credit/ No Credit) MMF 1914H Information Technology (Credit/No Credit) MMF 1915H Introduction of Financial Products (Credit/ No Credit) MMF 1920H Investment and Finance MMF 1921H Operations Research MMF 1922H Statistics for Finance I 2014-2015 School of Graduate Studies Calendar www.sgs.utoronto.ca/calendar Mathematical Finance 2