Word Document format - USS Hull Association

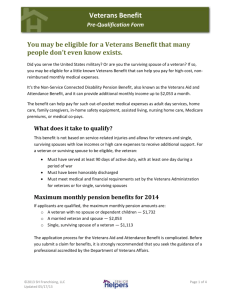

advertisement