FAQ for Training Volunteers: NYC/NYS Divestment

advertisement

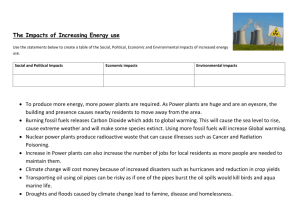

FAQ for Training Volunteers: NYC/NYS Divestment 1. What does the petitions say? Calls for Comptroller Stringer to divest from the top 200 fossil fuels companies (oil, gas and coal). We also have a petition calling on the State Comptroller, DiNapoli to do the same with the State pension funds. 2. Why Divest, what good will it do? Fossil fuels are causing global warming, doesn’t make sense for NYC/NYS to spend billions responding to climate change and then invest our money in making the problem bigger. We can reinvest a lot of money in solutions, renewable energy. We can break the power of the fossil fuel industry over our political system by stigmatizing the industry and making support for them socially unacceptable. Already have 5 X more fossil fuels in reserves than we can burn, so is risk of a carbon bubble. 3. Why not just invest in good kinds of energy, why divest? We advocate using the funds to invest in renewable energy and other investments for a green economy. Divesting is the way to free up more money for this, and make a bold statement signaling an end to the destructive fossil fuel industry. 4. What is a Fossil Fuel? Oil, Gas and Coal. Including the natural gas that comes from fracking. Fossil Fuels are getting more dangerous and more expensive to extract all the time. 5. Why not engage with the companies, and ask them to change to renewable energy? Why not Shareholder engagement? Shareholder engagement can be effective in many situations. But not for the types of companies we are talking about here, where their business plan is to extract and hold onto more oil, gas and coal. They already have 5 times as much as they can burn without causing total catastrophe and they have stated their plan to keep extracting. 6. What about fiduciary responsibility? We can’t risk losing money. Studies show that you can actually make just as good a return on your investments by leaving off the top 200 Fossil Fuel companies. Pension funds have a fiduciary responsibility not to take too many long term risks. Many think the only way to make profit is to invest in Oil, but the truth is that fossil fuels may be a big risk since the energy economy is transitioning. There are new ways all the time to invest in fossil free funds. There are a lot of other costs to these investments, besides immediate returns, like spending billions to prepare and respond to the climate crisis. 7. How much money is in fossil fuels? How much money is in the pension funds? NYC pension funds has about 127 billion dollars New York State has about 160 billion. About 5% of any pension fund is in fossil fuels, which includes oil, gas and coal. If we change the way NY pension funds do business, we can change the investment industry by creating new fossil free investment products. 8. What could will it do to divest, those companies will just get money elsewhere? This may be true, but it can also signal what a risk these companies are and start bigger trends to move money towards other investments. But divestment is really about taking away the social license of these companies. Like tobacco. In the same way, it shouldn’t be okay for people to be funding fossil fuel companies or supporting policies that keep expanding the fossil fuel industry. 9. Has anyone already divested? This movement started a couple years ago, by students! Over 400 schools have divestment campaigns, and 13 have already divested. Also some foundations, individuals, and religious institutions. Many city governments, like mayors and councils, have committed to pursuing divestment in their cities - but so far no pension boards have agreed. We hope to make New York City the first!