Standard Operating Procedures (SOPs)

advertisement

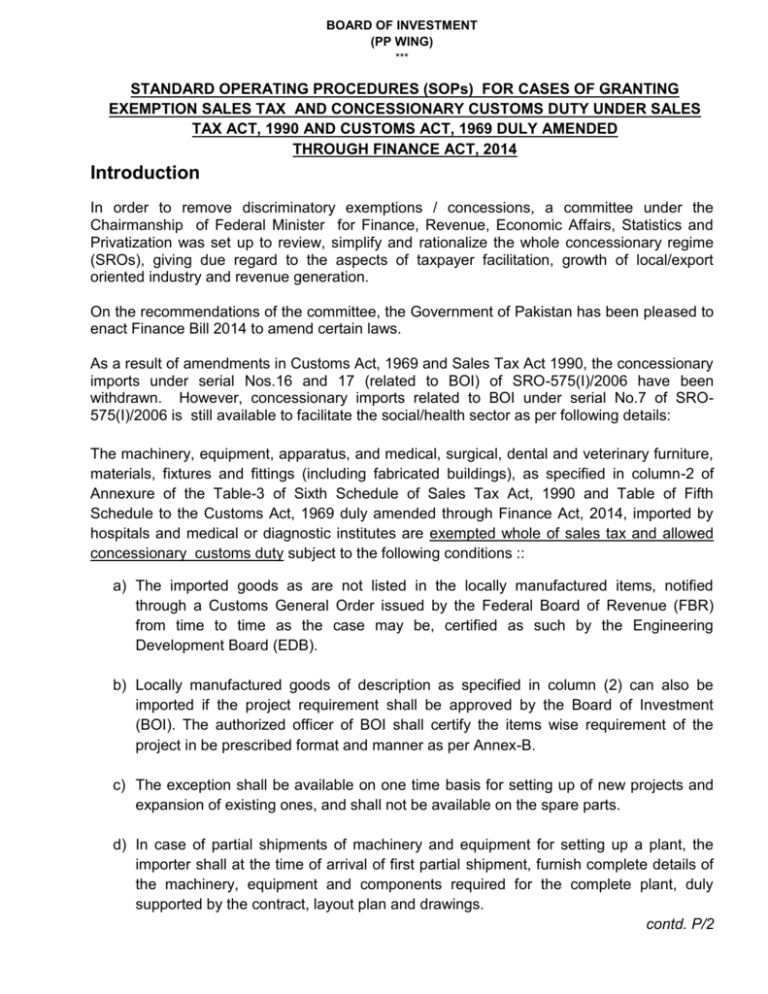

BOARD OF INVESTMENT (PP WING) *** STANDARD OPERATING PROCEDURES (SOPs) FOR CASES OF GRANTING EXEMPTION SALES TAX AND CONCESSIONARY CUSTOMS DUTY UNDER SALES TAX ACT, 1990 AND CUSTOMS ACT, 1969 DULY AMENDED THROUGH FINANCE ACT, 2014 Introduction In order to remove discriminatory exemptions / concessions, a committee under the Chairmanship of Federal Minister for Finance, Revenue, Economic Affairs, Statistics and Privatization was set up to review, simplify and rationalize the whole concessionary regime (SROs), giving due regard to the aspects of taxpayer facilitation, growth of local/export oriented industry and revenue generation. On the recommendations of the committee, the Government of Pakistan has been pleased to enact Finance Bill 2014 to amend certain laws. As a result of amendments in Customs Act, 1969 and Sales Tax Act 1990, the concessionary imports under serial Nos.16 and 17 (related to BOI) of SRO-575(I)/2006 have been withdrawn. However, concessionary imports related to BOI under serial No.7 of SRO575(I)/2006 is still available to facilitate the social/health sector as per following details: The machinery, equipment, apparatus, and medical, surgical, dental and veterinary furniture, materials, fixtures and fittings (including fabricated buildings), as specified in column-2 of Annexure of the Table-3 of Sixth Schedule of Sales Tax Act, 1990 and Table of Fifth Schedule to the Customs Act, 1969 duly amended through Finance Act, 2014, imported by hospitals and medical or diagnostic institutes are exempted whole of sales tax and allowed concessionary customs duty subject to the following conditions :: a) The imported goods as are not listed in the locally manufactured items, notified through a Customs General Order issued by the Federal Board of Revenue (FBR) from time to time as the case may be, certified as such by the Engineering Development Board (EDB). b) Locally manufactured goods of description as specified in column (2) can also be imported if the project requirement shall be approved by the Board of Investment (BOI). The authorized officer of BOI shall certify the items wise requirement of the project in be prescribed format and manner as per Annex-B. c) The exception shall be available on one time basis for setting up of new projects and expansion of existing ones, and shall not be available on the spare parts. d) In case of partial shipments of machinery and equipment for setting up a plant, the importer shall at the time of arrival of first partial shipment, furnish complete details of the machinery, equipment and components required for the complete plant, duly supported by the contract, layout plan and drawings. contd. P/2 -2- e) Only those importers shall be eligible to avail the aforesaid exemption whose cases are recommended and forwarded by BOI to FBR. f) The goods shall not be sold or not or otherwise disposed of without prior approval of the FBR and payment of custom-duties and taxes at statutory rates be leviable at the time of import. Breach of this condition shall construed as a criminal offence under the Customs Act, 1969 (IV of 1969): OBJECTIVE TO ADOPT STANDARD OPERATING PROCEDURES In order to facilitate the applying companies/importers the Standard Operating Procedures (SOPs) have been prepared to process the cases on ‘Fast Tract Basis’ for speedy disposal. The purpose is to have the required documents in one go and to have better understandings between the importers and Government agencies: STANDARD OPERATING PROCEDURES (SOPs) WHO IS ELIGIBLE? Hospitals and medical or diagnostic institutes etc. HOW TO APPLY? Hospitals and medical or diagnostic institutes shall apply to BOI at least fifteen (15) days prior to their shipment of imported goods. In case, where ‘Not Manufacturing Locally Status’ of the imported goods is required, the company shall simultaneously apply to EDB and BOI, to cut short the process. HOW TO APPLY? The importer shall apply to BOI along-with following information/documents (3 sets) at the address given below: i) Company/hospital Profile ii) Complete Project Profile in all respects, such as cost etc. iii) Details of Machinery, Equipment and Capital Goods along-with specification, catalogue, snaps etc. and other relevant information such as purpose of the said machinery, equipment in the project. …contd. P/3 - 3 - iv) Annex-A and Annex-B on the prescribed format and manner duly certified/signed and stamped by the Chief Executive Officer or next officer nominated by the CEO. v) Bill of Lading. vi) Commercial Invoice vii) Undertaking that the imported machinery, equipment shall be used for the intended project only. The same items shall not be sold out or used in any other project or by third party/company. viii) A statement regarding total value of imported machinery, equipment and Sales Tax applicable before exemption and relief amount after exemption. FACILITATION SERVICES BY BOI The BOI will examine the request in the light of the provision available in the Finance Act, 2014 and views/comments of EDB, if required. BOI will certify that the item(s) mentioned in the Annex-A/B item(s) is/are bonafide requirement of the project of the company. The request along-with all necessary documents will be forwarded to Federal Board of Revenue (FBR) for their consideration at their end. ADDRESS/CONTACT PERSON QAZI ASIF MAHBOOB Desk Officer (Policy & Planning) Board of Investment (BOI), Room No.103, First Floor, Old USAID Building, Ataturk Avenue, G-5/1, Islamabad Tele: (92-51) 9224749, Fax: (92-51) 9244557 ------------------------- Annex-I DETAILS OF MACHINERY EQUIPMENT, APPARATUS ETC. IN RESPECT OF SERIAL NO.2 OF TABLE-3 OF ANNEXURE OF FINANCE ACT, 2014 Following machinery, equipment, apparatus, and medical, surgical, dental and veterinary furniture, materials, fixture and fittings imported by hospitals and medical or diagnostic institutes:A. Medical equipment 1) 2) 3) 4) 5) Dentist Chairs Medical surgical dental or veterinary furniture Operating Table. Operating Lights. Emergency operating lights. 6) Hospital beds with mechanical fittings 7) Gymnasium equipments 8) Cooling Cabinet. 9) Refrigerated Liquid Bath. 10) Contrast Media Injection (for use in Angiography & MRI etc). 11) Breathing Bags. 12) Automatic Blood cell Counter 13) Automatic Cell Separator for Preparation of platelets. B. Cardiology/ Cardiac Surgery Equipment 1) Cannulas. 2) Manifolds. 3) Intra venous Cannula i.v. catheter. C. Disposable Medical Devices 1) Self disabling safety sterile syringes. 2) Insulin syringes. 3) Burettes D. Other Related Equipments 1) Fire extinguisher. 2) Fixture & fittings for hospitals Annex-A (9) (10) (11) (12) (13) CRN / Macn No.. Collectorate Quantity Imported UOM (8) Name of Regulatory Authority (3) Goods imported (Collectorate of Import) Quantity (7) WHT Specs (6) Sales Tax Rate (applicable) (5) Customs Duty rate (applicable) (4) Description HS Code Header Information NTN of Importer Regulatory Authority No. (1) (2) Details of Input goods (to be filled by the Chief Executive of the importing company) (14) Date of CRN/ Mach. No. (15) CERTIFICATE. It is certified that the description and quantity mentioned above are commensurate with the project requirement and that the same are not manufactured locally. It is further certified that the above items shall not be used for any other purpose. Signature of Chief Executive, or the person next in hierarchy duly authorized by the Chief Executive Name : _____________________________________________________________ N.I.C. No. _____________________________________________________________ NOTE: In case of clearance through Pakistan Customs Computerized System, the above information shall be furnished on line against a specific user I.D. and password obtained under section 155D of the Customs Act, 1969 (IV of 1969). Explanation: Chief Executive means.1. Owner of the firm, in case of sole proprietorship; or 2. Partner of firm having major share, in case of partnership firm; or 3. Chief Executive Officer or the Managing Director in case of limited company or multinational organization; or 4. Principal Officer in case of a foreign company Annex-B (8) (9) (10) Quantity Imported UOM (7) Goods imported (Collectorate of Import) Quantity (6) WHT Specs (5) Sales Tax Rate (applicable) (4) Customs Duty rate (applicable) (3) Description HS Code Header Information NTN of Importer Approval No.. (1) (2) Details of Input goods (to be filled by the authorized officer of the Regulatory Authority) (11) Collect orate CRN/ Mach No. (12) (13) Date of CRN/ Mach No. (14) CERTIFICATE. Before certify the above-authorized officer of the Regulatory Authority shall ensure that the goods are genuine and bonafide requirement of the project and that the same are not manufactured locally. Signature __________________ Designation ________________ NOTE: In case of clearance through Pakistan Customs Computerized System, the above information shall be furnished on line against a specific user I.D. and password obtained under section 155D of the Customs Act, 1969 (IV of 1969).