Tomorrow`s borrowers: What`s Labour going to do about personal

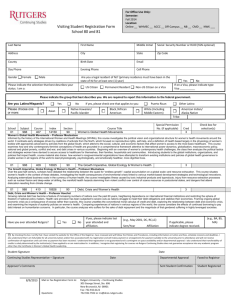

advertisement

Tomorrow's borrowers: What's Labour going to do about personal debt? (The Smith Institute and StepChange Debt Charity) September 23 2012, Hilton Surrey Room, 16:00 Speakers: Paul Hackett, director of The Smith Institute (chair) Stella Creasy MP (Walthamstow), shadow minister for Crime Prevention Lord Stevenson of Coddenham Lord Glasman of Stoke Newington, chair of StepChange Debt Charity People were encouraged to think responsibly about managing their own personal finances in the context of a national economic crisis at a panel debate chaired by The Smith Institute. The debate on personal debt was introduced by chair Paul Hackett, director of The Smith Institute, who discussed the political and social issues of personal debt in the midst of a recession. The challenge to invest with ‘good debt’ and clear the prevelance of ‘bad debt’ in people’s personal finance was picked up by Stella Creasy, shadow minister for Crime Prevention, who argued that debt had become an increasingly political issue. Lord Stevenson agreed that debt was “a good thing if used with knowledge” but contented with the saliency of personal debt as an election winner, saying that it was not the determining policy area that would win at the ballot box in 2015. Creasy was optimistic about the work that had already been done in the House of Lords but admitted that a shift in public attitudes towards personal debt would not come in the short term. “It’s an interesting challenge because in the three years I’ve been in parliament trying to work on these issues, it’s actually been in the House of Lords that I’ve made the most progress”, she said. “This is now the third year that The Smith Institute has very kindly asked me to talk about these issues- and every year we come, progress has been made. I think it’s worth saying that, but we still have a long way to go.” A culture of “have now, pay back later” had fuelled the growth of bad personal debt, said Lord Stevenson, who encouraged people who were hard pressed to return to times in which they saved only to create “enough money to be comfortable with”. One attendee accused pay-day loan companies of “praying on the most vulnerable” in their marketing and advertising campaigns. At a time when people’s personal debts are high, he said, high interest loans are often the only solution for people looking to pay back credit loans. The audience member raised concern over whether banning pay-day lenders would stem the wave of personal debt effectively, likening it the ban on tobacco advertising which saw little change in the habits of public consumers. All the panel agreed with an audience member who praised Justin Welby’s discourse surrounding credit unions as an “aspiration”. One attendee, a London Living Wage supporter and representative of the Community Engagement Fund and said there was a lack of diversity in the financial sector, a point picked up on by Lord Glasman of Stoke Newington who agreed that the consequences of the bailout were “being carried disproportionately”. He went on to say that it was important that the Labour party think about investing and growing alternative finance methods that could create both sustainable personal finance, and national economic growth through borrowing. Creasy attempted to pave the middle-ground between the two peers by offering an alternative solution: “I will triangulate between Lord Glasmans’ determination that revolution must come and Will’s pessimism that these are endemic problems”, she said. “First and foremost resolving the question of what impact debt has, not only on our present but on our future is a matter of political will.” Whilst there was optimism from the panel that a Labour government could deliver on a cut-down of pay day lenders, an increase in the support given to credit unions and cut personal debt, Creasy remarked about the public that “there is a growing sense of pessimism that any difference can be made”. “An interest rate cap or a cap on the cost of credit is not a solution- but it is absolutely a step in the right direction”, one audience member posited, to agreement from the room. “4000% interests rates are an obscenity”, he said. The shadow minister voiced her support for the strength of debate in the House of Lords but was keen to embrace more change in the Commons: “However difficult it may feel, one of the things that I have tried to do in the House of Commons ... is to give that sense that change can come”. The debate comes amidst what Creasy described as the contraction of individual’s wages amidst a rise in associated house and personal costs: “People’s wages have been squeezed just at the point that the cost of living has risen”, she said. Creasy moved on to comment on the international perspectives of debt and personal finance, saying that “people in places like Holland would be horrified at the amount of personal debt that we take on as a matter of course and without thinking”. In the UK, she emphasised, debt is part of the sustainability and development of many parts of the country: “It’s the sort of debt that has fuelled the growth in our communities - and shows that there are good and bad types of debt.” Overall, however the panel agreed with her sentiments that the high levels of debt in personal finance were still hard pushed when it came to paying off their loans: “Over 50% of people Britain thinking there is too much month at the end of their money”, she said. “It is about being a revolutionary”, said Creasy. “Having a recalibration so that we can invest in people”. “I don’t want to have the PPI equivalent of pay-day lending ... we’ve just got to keep the pressure up”. The shadow minister wound up the event by encouraging people to help stimulate a change in culture towards short term personal loans and suggested that a Labour government would “get people to invest in themselves”. Hacket as chair closed by saying “I still worry that we’re not deep enough in to this debate. “Just having more lending on the same rules is not going to get us to where we want to get to. “I think there are things we can do about trading, opportunities and industrial strategies that will help us to a better place.”