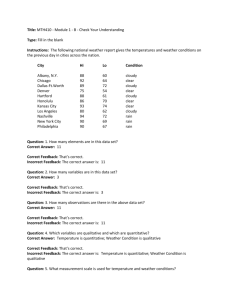

1) Aggregate demand will increase if: a) Savings rise Incorrect

advertisement

1) Aggregate demand will increase if: a) Savings rise Incorrect – savings are a withdrawal, so AD would fall b) Exports fall Incorrect – exports are an injection, so if exports fall, AD would fall c) Imports rise Incorrect – imports are a withdrawal, so AD would fall d) Investment rises Correct – investment is an injection, so if investment rises, AD will rise 2) Aggregate demand will fall if: a) Savings rise Correct – savings are a withdrawal, so AD would fall as the withdrawal is greater b) Interest rates fall Incorrect – if interest rates fall, spending is generally stimulated and AD would rise c) Investment rises Incorrect – investment is an injection, so if investment rises, AD will rise d) Imports fall Incorrect – if imports (a withdrawal) fall, spending is generally stimulated and AD would rise 3) If growth in AD is greater than the underlying trend rate of growth, this is likely to lead to: a) A fall in AS Incorrect – AS is either likely to remain unchanged, assuming the economy is at full employment, or it will rise to meet the rise in AD b) Inflationary pressure Correct – this is likely to create demand pull inflation c) A balance of payments surplus Incorrect – if AD increases, and national income is stimulated, the extra income will stimulate imports, and exports will be unaffected, hence the balance of payments would worsen, and not improve d) Rising unemployment Incorrect – if AD increases, and national income is stimulated, the extra income will stimulate consumer spending which, via a multiplier effect, will reduce unemployment, if anyone is unemployed, rather than increase it 4) A rise in investment is likely to cause: a) A movement along the AS curve Incorrect – it will shift AS to the right b) A rise in tax rates Incorrect – tax rates are not likely to be affected by a rise in investment c) A shift to the right in the AS curve, and a movement along the AD curve Incorrect – there will not be a movement along the AD curve d) A shift to the right in both the AD and AS curve Correct – both AD and AS will shift to the right, given that investment is a determinant of both AD and AS 5) Cost push inflation is most likely to occur if: a) Exchanges rates rise Incorrect – this would cause imported costs to fall, not rise b) Exchange rates fall Correct – lower exchange rates reduce the value of a currency and mean that imports are more expensive when converted into the local currency, hence costs of imports rise c) Income tax rates fall Incorrect – this might cause demand pull inflation, but not cost push inflation d) Interest rates fall Incorrect – this might cause demand pull inflation, but not cost push inflation 6) A shift to the left in the AD curve is most likely to be caused by falling: a) Imports Incorrect – if imports fall, spending is generally stimulated and AD would rise b) Exports Correct – if exports, an injection, fall then AD is likely to fall, ceteris paribus c) Tax rates Incorrect – if tax rates fall, spending is generally stimulated and AD would rise d) Savings Incorrect – if savings fall, spending is generally stimulated and AD would rise 7) If a small fall in investment leads to a larger fall in national income, there is a: a) Downward multiplier effect Correct – the multiplier effect shows how a small change in an injection or withdrawal can trigger a bigger final change in national income. So a fall in investment triggers a downward multiplier effect b) Rising savings ratio Incorrect – this cannot be established as true c) Downward accelerator effect Incorrect – the accelerator effect is the ‘other way round’ – i.e. shows the effect of a change in income on investment d) Upward multiplier effect Incorrect - the multiplier effect shows how a small change in an injection or withdrawal can trigger a bigger final change in national income. But a fall in investment would not trigger an ‘upward’ multiplier effect 8) The long run aggregate supply curve is affected by: a) Prices Incorrect – long run aggregate supply is not determined by changes in the price level b) Wages Incorrect – long run aggregate supply is not determined by changes in the wage level c) Exchange rates Incorrect – long run aggregate supply is not determined by changes in the exchange rate d) Technology Correct – improvements in technology increase the economy’s ability to produce 9) A rise in investment could be triggered by all of the following, except: a) Falling interest rates Incorrect - Investment is determined by a number of variables, including interest rates. A fall in interest rates reduces the benefit (increases the opportunity cost) of keeping funds in the bank, and increases the marginal productivity of capital, hence investment is more likely b) Rising incomes Incorrect - Investment is determined by a number of variables, including income. A rise in national income will make investment more likely, and will increase via an accelerator effect c) Falling business confidence Correct – falling business confidence will discourage investment, rather than encourage it d) Rising profits Incorrect - Investment is determined by a number of variables, including business profit. A rise in profits will make investment more likely 10) If real income per head rises in one country, the most likely result is: a) Rising imports Correct – imports are directly related to consumer spending which is related to income per head b) Falling investment Incorrect – investment is more likely to rise, not fall c) Rising exports Incorrect – exports are determined by overseas income, not domestic income d) Falling aggregate demand Incorrect – AD is likely to rise, not fall 11) A fall in national income is most likely to cause: a) An improving budget surplus Incorrect – revenue will fall and spending will rise, so the budget position will worsen b) A rising inflation rate Incorrect – rising inflation is more likely to be associated with an increase in national income c) Worsening of the balance of payments Incorrect – imports are likely to fall. So the balance of payments should improve d) Rising unemployment rate Correct – a fall in national income could trigger an increase in demand deficient (or ‘Keynesian’) unemployment 12) If AD falls and there is a negative output gap, it is most likely that there will be a rise in: a) Unemployment Correct – a negative output gap means that the economy already has spare capacity and unemployment. If AD falls further the most likely result is unemployment. b) Imports Incorrect – as imports will probably fall c) Investment Incorrect – as investment will probably fall as business confidence falls d) Business confidence Incorrect – a rise in business confidence would not follow a fall in AD! 13) The accelerator effect relates to: a) Changes in investment causing changes in income Incorrect – this is the multiplier effect, not accelerator effect! b) Changes in government spending leading to falling unemployment Incorrect – this is the multiplier effect, not accelerator effect! c) Changes in supply side policy Incorrect – supply side policy would not directly trigger an accelerator effect d) Changes in income causing changes in investment Correct – the accelerator effect indicates that a small increase in national income can trigger a larger increase in investment 14) A falling savings ratio is most likely to be caused by falling: a) Consumer confidence Incorrect – falling confidence would encourage more saving, not less b) Imports Incorrect – falling imports would increase AD (C + I + G + (X – M)), ceteris paribus, and stimulate spending in the next time period, rather than encourage saving c) Interest rates Correct – falling interest rates will discourage saving and encourage spending d) Exports Incorrect – falling exports are more a sign of changes in overseas income, spending and saving 15) If AD is £500b, C is £400b, I is £50b, G is £40b and X is £50b, M must be: a) + £40b Incorrect - AD (C + I + G + (X – M))! b) - £40b Correct - AD (C + I + G + (X – M)), so 500 = 400 + 50 + 40 + (50 - M?), therefore: M? = 500 – 540, which = - 40 c) + £60b Incorrect - AD (C + I + G + (X – M))! d) - £80b Incorrect - AD (C + I + G + (X – M))! 16) Fiscal policy is associated with: a) Changing interest rates Incorrect – this is monetary policy b) Changes in government borrowing Correct – government borrowing is required to cover a fiscal deficit, where G > T c) Reducing the money supply Incorrect – this is monetary policy d) Lowering exchange rates Incorrect – this is monetary policy 17) An example of supply-side policy is the reduction of: a) Marginal tax rates Correct – one key element of supply-side policy is to provide incentives through the tax and benefits system. Reducing marginal tax rates, i.e. the extra tax paid on extra income, will, in theory, encourage people to work (though critics argue the effect is very small) b) Interest rates Incorrect – this is monetary policy c) The money supply Incorrect – this is monetary policy d) The exchange rate Incorrect – this is monetary policy 18) Structural unemployment could be worsened by: a) A fall in tax rates Incorrect – a fall in tax rates is likely to stimulate spending and certainly not increase any type of unemployment b) Immobility of labour Correct- immobility of labour will contribute to inflexibility of the labour market in the face of structural changes c) A rise in the money supply Incorrect – a rise in the money supply is likely to stimulate spending and certainly not increase structural unemployment in the short run d) Improved labour productivity Incorrect – an improvement in labour productivity will create and not destroy jobs 19) The Phillips curve directly shows the relationship between: a) Inflation and economic growth Incorrect – what are shown on the axes? b) Unemployment and the balance of payments Incorrect – what are shown on the axes? c) Interest rates and tax rates Incorrect – what are shown on the axes? d) Inflation and unemployment rates Correct – the simple Phillips curve shows how rates of unemployment and inflation are inversely related, where changes in the level of unemployment, through the effect of fiscal or monetary expansion on the labour market, affect wages and inflation. The Phillips curve indicates that policies to reduce unemployment may be in conflict with policies to reduce inflation. 20) If the economy is at full employment, the most likely effect of an increase in the money supply is: a) A fall in exports Incorrect – exports are largely determined by overseas income in the short run, not by changes in the money supply b) A rise in unemployment Incorrect – a rise in unemployment is not likely to follow an increase in the money supply c) A rise in imports Correct – a rise in the money supply will stimulate spending, either because of the increased availability of money and credit, or because of a fall in interest rates, or both. Hence imports are likely to rise d) A fall in investment Incorrect – a rise in the money supply will stimulate spending, either because of the increased availability of money and credit, or because of a fall in interest rates, or both. Hence investment is likely to rise as firms invest in new equipment and plant to produce more goods.