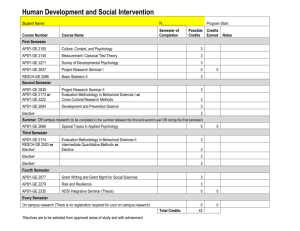

Finance Handbook - School of Business Administration

advertisement

FINANCE MAJOR ADVISING BOOKLET Name ______________________________________________________ My faculty advisor is __________________________________________ (Date) Catalog for major _____________________________________________ (Date) Catalog for general education ____________________________________ 2014 ABOUT SoBA SoBA MISSION STATEMENT The University of Montana's School of Business Administration (SoBA) is a collegial learning community dedicated to the teaching, exploration, and application of the knowledge and skills Page | 2 necessary to succeed in a competitive marketplace. SCHOOL OF BUSINESS ADMINSTRATION/ASSESSMENT AND ASSURANCE OF LEARNING As part of our assessment process and assurance-of-learning standards, the School of Business Administration has adopted five learning goals for our undergraduate students: Learning Goal 1 – SoBA graduates will possess fundamental business knowledge and integrated business knowledge. Learning Goal 2 – SoBA graduates will be effective communicators. Learning Goal 3 – SoBA graduates will possess problem solving skills. Learning Goal 4 – SoBA graduates will have an ethical awareness. Learning Goal 5 – SoBA graduates will be proficient users of technological skills. As a faculty we embrace the following SHARED CORE VALUES o Student-centered, participative, interactive, collegial learning environment o Teamwork within the School and responsive collaboration with stakeholders o Life-long learning and professional development o Excellence, with a focus on continuous improvement o Innovation and openness to risk o Maintenance of high-level professionalism o Integrity in all we do o Diverse perspectives o Sustainability, responsiveness and flexibility for an ever changing world ACCREDITATION The distinction of a quality undergraduate program is accreditation. The University of Montana School of Business Administration is proud to hold accreditation for its undergraduate and graduate programs by AACSB International - The Association to Advance Collegiate Schools of Business. This is the most rigorous accrediting body for business degree programs in the country. Programs in the School of Business Administration were first accredited by AACSB in 1949 making UM's School of Business Administration one of the first fifty schools to earn AACSB accreditation. Our MBA program has been accredited since 1982. Our undergraduate Accounting Program and our Master of Accountancy program received separate accreditation in 2001. AACSB accreditation promotes excellence and continuous improvement in business education. It represents the highest standards for achievement for business schools on worldwide basis. As an AACSB accredited member we are required to pass standards designed to ensure quality. FINANCE FACULTY Page | 3 Dr. Bruce Costa, Chair of Department of Accounting & Finance Associate Professor of Finance 243-6155, GBB 318 bruce.costa@business.umt.edu Dr. Costa received his B.S. in Industrial Engineering/Operations Research from The University of Massachusetts/Amherst and his Ph.D. in Finance from The Florida State University. Dr. Tony Crawford Associate Professor of Finance 243-2557, GBB 321 tony.crawford@business.umt.edu Dr. Crawford holds a BS degree in Industrial Management and Honors Economics from Purdue University (Indiana) and a Ph.D. in Finance from Penn State University. Dr. Crawford is a candidate for the Chartered Financial Analyst (CFA) designation having completed the level I examination. Dr. Keith Jakob Associate Professor of Finance Donald & Carol Jean Byrnes Professor of Finance 243-6159, GBB 317 keith.jakob@business.umt.edu Dr. Jakob studied at the University of Utah from 1987 to 2000. He received a B.S. in Chemistry, a Masters in Civil and Environmental Engineering, and a Ph.D. in Finance. Dr. Tim Manuel Rudyard B. Goode Professor of Finance 243-2511, GBB 305 tim.manuel@business.umt.edu Tim Manuel holds a Ph.D. in Business from the University of South Carolina and MBA and BS degrees from Virginia Tech. Finance at UM The finance curriculum is designed to equip students with a comprehensive foundation in financial management, financial markets, and investments. Students will gain experience in effective decision making, performing complex analyses, providing expert financial advice, and utilizing current technology tools and data sources. A finance degree can lead to exciting careers in Banking, Page | 4 Investment Banking, Financial Services, Financial Planning, Corporate Finance, Economics or International Finance. Useful information for finance students Information on Careers in Finance may be found at the following websites: http://www.business.umt.edu/career/ http://www.business.umt.edu/undergraduate/CareersinFinance.pdf http://www.careers-in-finance.com/ http://careers-in-business.com http://www.bls.gov/oco/cg/cgs027.htm Job search engines may be found at: http://jobsearch.monster.com/ http://www.efinancialcareers.com/ Salary and cost of living surveys may be found at the following websites: http://www.business.umt.edu/career/SalarySurveys.asp http://www.careers-in-business.com/ugsal.htm Information on internships may be found at the following website: http://www.business.umt.edu/CurrentStudents/internships/ The Finance Club The Finance Club is a student organization dedicated to promoting professional, educational and social development for both its members and the community. The Finance Club is open to students from all majors. We strive to provide real life working knowledge about the financial industry and the overall economy through guest speaker presentations by prominent, working professionals in the community. We possess a strong commitment to advancing the financial career opportunities for our members and offer various resources for students who are interested in careers in any financial discipline. CAREER PLANNING CHECKLISTS The following checklists are helpful guides for each year of your college career. Page | 5 Freshman - This is the year that you are discovering your interests, values, personality traits, and lifestyle preferences. As freshmen students should research possible majors and careers that interest you. Complete a personal SWOT Analysis (Strengths, Weaknesses, Opportunities, and Threats). Sophomore - During your sophomore year you want to start building your network, get some experience and continue researching careers. Do a Gap Analysis on pre-requisite classes for your specific SoBA major. See what you are missing and talk to advising about how to fill in the gaps. The SoBA Advising office is in GBB 335. Learn about majors; talk to friends and relatives about occupations and make tentative choices. Line-up an internship or career-related experience for the summer to "check out" potential career choices – you can also job shadow or volunteer during winter or spring break. Junior - Write a resume and cover letter and have it critiqued by a professional, continue to network and gain experience. Update your Career Services registration materials and Griz eRecruiting account at http://www.umt.edu/career/recruiting/ermain.htm. Participate in SoBA resume and cover letter critiques and mock interviews – continue to hone your resume and cover letter writing and interviewing skills. Participate in a videotaped mock interview at Career Services. Watch for bad habits that distract, receive critical feedback on your answers, etc. Call 406.243.2022 to schedule an appointment. Read about business ethics and understand the issues. Senior - This is when it all comes together. Continue to network, practice interviewing, buy a nice interview suit. Develop a job search schedule for senior year – allotting time each day for job search activities. Be proactive. Start early. Stay on track and up-to-date on job market, salary ranges, long range opportunities, and skills required. Learn job offer evaluation and negotiation strategies and skills. Check out http://www.business.umt.edu/career/Handouts.htm for tips on evaluating job offers. Research options: current employment trends and changes. Obtain three letters of recommendation. Take a position of leadership in a campus club or community organization. Contact the Center for Leadership Development to ask about leadership programs. Volunteer. Get involved, develop and hone new skills and meet potential networking contacts and employers. Page | 6 Complete a second internship. Add new skills and experience to your resume, job search documents, and portfolio. Join and become an active member in professional organizations related to your career. Attend SoBA Career Development workshops, employer panel discussions and recent alum presentations. You’ll find the complete schedule for each semester at www.business.umt.edu/career. ACADEMIC REQUIREMENTS The Department of Accounting and Finance seeks to instill high ethical standards in all students. Students are expected to be familiar with and to uphold the University of Montana Student Conduct Code available at http://life.umt.edu/vpsa/documents/StudentConductCode1.pdf. Academic misconduct is not tolerated. Freshman and Sophomore Years To do list: Complete the 11 lower-core courses required for any business major (see below) Earn grades of C or better in these 11 lower-core courses Take some general education classes Take some elective classes Apply for the finance major early in the semester before you plan to take 300-level business courses Begin attending Career Development activities in the SoBA Consider joining the Finance Club It is advisable to balance your schedule so that you do not find yourself in the position of having some of the more challenging courses all in the same semester. If you expect to have difficulties with any subject, take that subject early. This will allow you the most degrees of freedom. Be sure you have taken all UM placement exams and are following all prerequisites and corequisites listed in the catalog. One of the surest ways to get into academic trouble is to take courses without the needed preparation. Because of the requirement to earn a C or better in all eleven of these lower core courses, some students find the need to repeat a course to achieve the C grade (note: C- does NOT count as a C). Lower Core Courses Required for all Business Majors All students wishing to receive a UM Bachelor of Science Degree in any of our Business Majors must first complete the following Lower-Core courses with grades of C (2.0) or better: LOWER-CORE COURSES REQUIRED IN BUSINESS* Page | 7 WRIT 101 College Writing I COMX 111A Introduction to Public Speaking M 115 Probability & Linear Math STAT 216 Introduction to Statistics CSCI 172 Introduction to Computer Modeling BMIS 270 Management Information Systems ECNS 201S Principles of Microeconomics ECNS 202S Principles of Macroeconomics (Prerequisite ECNS 201S) ACTG 201 Principles of Financial Accounting (Co-requisite M 115) ACTG 202 Principles of Managerial Accounting (Prerequisite ACTG 201 and M 115) BMIS Business Law 257 * You must complete all prerequisites BEFORE taking the course (not with or after); You must complete all corequisites BEFORE or WHILE taking the course (not after). Suggested Program of Study Freshman and Sophomore years FRESHMAN (SEMESTER 1) FRESHMAN (SEMESTER 2) WRIT 101* College Writing 3 COMX 111 A Intro to Public Speaking 3 M 115** Probability & Linear Math 4 CSCI 172 Intro to Computer Modeling 3 ECNS 201S Principles of Microeconomics 3 ECNS 202S Principles of Macroeconomics 3 General Education Course 3 General Education Course 3 General Education Course 3 General Education Writing Course 3 Total 16 Total 15 * Availability of this course in the fall semester is based on the first letter of your last name. If you cannot take WRIT 101 your fall semester, take COMM 111A instead and take WRIT 101 in the spring of your Freshman year. ** Based on your ALEKS math placement score you may be required to take a math prerequisite first and then take M 115 in a subsequent semester. Finance majors should be confident in their math skills. SOPHOMORE (SEMESTER 3) ACTG 201 Principles of Financial Accounting STAT 216 Introduction to Statistics Elective – Non-business Elective – Non-business General Education Course Total 3 4 3 3 3 16 SOPHOMORE (SEMESTER 4) ACTG 202 Princ. of Managerial Acct BMIS 257 Business Law BMIS 270 Management Info Systems General Education Course Elective – Non-business or BFIN 228 Personal Financial Planning Total Apply for finance major Students must complete each of the lower core courses above withSENIOR a C (2.00)YEARS or better in order to take upperCOURSE ADVISING JUNIOR AND division courses in the School of Business Administration. A grade of C- is not acceptable. 3 3 3 3 3 15 Most of your finance courses will be taken in your junior and senior years. Important notes about these courses: Once you have completed the 11 lower core classes, achieved at least 60 credits, and applied for and been accepted in your finance major you can begin taking upper division business classes. These are in three groups: (1) upper core classes, (2) a capstone course and (3) courses required for your Page | 8 finance major. Finance majors must earn a C or better in BFIN 322 before taking any 400-level finance courses. You must earn a C- or better in the remaining upper-core courses. Upper Core Courses are listed below: Upper Core Courses Required for all Business Majors MINIMUM GRADE FOR UPPER-CORE COURSES REQUIRED IN BUSINESS: FINANCE MAJORS BFIN 322 Business Finance C BMGT 322 Operations Management C- BMGT 340 Management and Organizational Behavior C- BMKT 325 Marketing Principles C- Early in the semester in which you will complete the lower core with the proper grades and have at least 60 total college credits you should apply for admission to a finance major. After admission, students are able to register for upper-division 300- and 400-level business classes. However, you will be required to drop upper-division business classes if you fail to receive a C (not C-) or better in each lower-core class during the semester you applied for the finance major. The first semester in a business major, students begin taking the Upper-Core Courses required in business and should take at least two of the upper core requirements listed above, one of which should be BFIN 322. Additional courses should be determined in consultation with your finance faculty advisor. BMGT 322, BMGT 340 and BMKT 325 must be completed with grades of C- or better. Finance majors must complete BFIN 322 with a grade of C or better. Some Upper-Core Courses are prerequisites to courses in the business majors. For example, BFIN 322 is a prerequisite to all 400 level finance courses. All business majors must complete the following capstone courses during their senior year: CAPSTONE COURSEs (Co-Requisites) BMGT 486 Strategic Venture Management BGEN 499 Integrative Business Simulation In the capstone courses, students will utilize knowledge gained across the business curriculum. Students must have completed all Lower-Core and Upper-Core Courses and will have completed most business major courses by the time they take a Capstone Course. All course prerequisites and co-requisites are strictly enforced and you must earn a C- or better in the three non-finance upper core classes and a C in BFIN 322 BEFORE you take a capstone courses. In order to register for a Capstone Course, students must complete the following steps: 1) Complete and submit a graduation application to the Business School Advising Office at the beginning of your senior year (the semester prior to the one in which you plan to graduate). 2) After the graduation application is approved by the Business School Advising Office, pick it up and turn it into Business Services at Griz Central, with your $30 graduation fee. Page | 9 3) As soon as information is available about Capstone scheduling, let the Business School Advising Office know which sections you want and you will receive electronic overrides for the specific sections in order for you to register on CyberBear for your capstone course. Finance Major Requirements In addition to general education, lower core and upper core business requirements you must complete all five REQUIRED finance courses (see below), and nine credits from the list below. In each course you must achieve a grade of C- or better. Courses and normal offering times are given below: REQUIRED FINANCE COURSES*,+ Credits BFIN 420 Investments (FALL) 3 BFIN 424 Markets, Institutions & Fin Eng. (SPRING) 3 BFIN 429 Financial Management I (SPRING) 3 BFIN 439 Financial Management II (FALL) 3 BFIN 450 Banking (SPRING) 3 * Completion of BFIN 322 with a grade of C or better is required before taking any of these courses. BFIN 322 may not be taken or retaken concurrently with any of these courses. + The semesters listed are the normal times these classes are offered but course offerings may be different in any given year. Talk to your advisor about current year class scheduling. PLUS: STUDENTS MUST TAKE 9 CREDITS FROM THE FOLLOWING* BFIN 301 Financial Statement Analysis 3 BFIN 410 $50,000 Portfolio 3 BFIN 415 Real Estate Investment 3 BFIN 473 Multinational Finance 3 ACTG 305 Corporate Reporting I 3 ACTG 321 Accounting Info Systems 3 ACTG 410 Cost Management Accounting I 3 BFIN 498 Finance Internship (max 3 credits) 3 ECNS 301 Intermediate Microeconomics 3 ECNS 302 Intermediate Macroeconomics 3 ECNS 403 Econometrics * These 9 credits are selected in consultation with your faculty advisor. A signed track 3 sheet reflecting these courses is required. Important Items for Juniors & Seniors You must take BFIN 429, BFIN 439, BFIN 420, BFIN 450, BFIN 424 and 9 additional credits to complete the finance portion of your degree requirements. Many 300 and 400 level finance courses are only offered one term per year so you must plan ahead and do well in these courses to stay on track for graduation. Page | 10 You should meet with your faculty advisor in your junior year to discuss career options and how those might impact your future coursework and plans. Your advisor can help you choose the correct skills course and the two supplemental courses required to complete the finance degree. The advising office must have a sheet (attached at the end) signed by you and your advisor stating which skills course and supplemental courses you took or plan to take before you file for graduation. The advising office cannot sign this sheet; a finance faculty member must sign. It is strongly recommended you meet with your advisor when you declare your finance major. An advisor may refuse to sign the form if you have not consulted with them prior to completion of your supplemental coursework. It is highly recommended that you take BFIN 424 in the spring semester of your senior year. It is strongly recommended that you take no more than two finance courses per semester once you start the 400-level coursework, particularly if you work a significant number of hours while you are taking classes. The following is a suggested course plan for 300 and 400 level coursework. Courses normally offered only in the fall or spring semester but not both are marked with **. Supplemental courses must be selected from the list above and are marked with*. These courses must be selected in consultation with, and approved by, your finance faculty advisor. SEMESTER 5 FALL Junior Year BFIN 322 Business Finance Supplemental Course* BMGT 340 Mgmt. & Org. Behavior BMKT 325 Marketing Principles Elective – Non-business, Gen Ed if needed 3 3 3 3 3 SEMESTER 6 SPRING Junior Year BFIN 429** Fin Mgmt I BFIN 450 Banking BMGT 322 Operations Management Supplemental Course* Elective; Gen Ed if needed 3 3 3 3 3 Total 15 Total 15 SEMESTER 7 FALL Senior Year BFIN 439** Fin Mgmt II BFIN 420** Investments Supplemental Course* Elective – (Should be non-business if needed for hours) General Education Course if needed, consider internship Apply for spring graduation (October deadline for filing) Total SEMESTER 8 SPRING Senior Year 3 BFIN 424** Markets & Institutions 3 Elective 3 Elective 3 Elective – (Should be non-business if needed for hours) 3 3 3 3 3 BMGT 486 Strategic Venture Management 3 BGEN 499 15 Total Integrative Business Simulation 1 16 Additional Advising Tips: Finance majors should never depend upon a particular course being offered during the summer or winter sessions. Summer offerings are determined early in the spring prior to summer session but before registration for fall semester. At this point, students can determine if a particular class will be offered during summer or winter sessions. Page | 11 Each student should meet in person with his or her assigned faculty advisor starting in the junior year. You can either see your advisor during regular office hours or make an appointment. Unless you are a 4Bear student you will still get your advising number at the group advising sessions. You should consider completing a finance internship if you have room in your business electives. Many firms use part-time spring internships and/or full-time summer internships as the primary means of hiring for full-time positions (offering next year’s full-time positions to interns at the end of their internships). See Kathleen Tarkalson (Phone: 243-6771; Office: GBB 328) for information about setting up internships for credit. Faculty members are required to hold office hours to meet students one-on-one. If you have any difficulties in a class you should see your instructor as soon as possible. Do not try to solve the problem on your own. If you are proactive you are far more likely to succeed. It is strongly recommended that when you become a second semester junior you ensure that you will meet the various requirements by the time you complete your final semester by counting up the hours in the various categories using your transcript and your planned course outline for your remaining semesters. Catalog Rules that you must follow: The catalogue dictates a number of rules that you must follow in order to graduate. These rules cannot be waived, so it is important that you pay attention to them as you plan your coursework. Every year a few students must delay their graduation because they fail to follow these rules. 1. All lower core courses must be completed with a grade of C or better (not C-). 2. All upper core courses must be completed with a grade of C- or better except that finance majors must complete BFIN 322 with a grade of C or better. 3. You must earn a C- or better in any course used to meet general education course requirements. 4. You must earn at least 120 credits to graduate. 5. Of the 120 credits, 60 must be non-business (ECNS may be counted as non-business). HHP activity courses cannot be counted in the 60 non-business courses. 6. If you earn two business majors, you will exceed 120 credits. You must earn 150 credits to earn two degrees in business, for example, a degree in Finance and a degree in Accounting. 7. All courses counted towards the major or general education requirements must be taken for a letter grade. 8. A maximum of 6 internship credits can count toward your degree (as electives). 9. All business majors are required to take experiential courses. Because BFIN 420, BFIN 439 and the capstone course are designated as “experiential,” finance majors will automatically meet the experiential requirement. Page | 12 a. Students who initially enroll at UM as freshmen or transfer students with 60 or fewer credits must take three experiential courses. b. Students who initially enroll at UM with 60.1 through 90 semester transfer credits must take two experiential courses. c. Students who initially enroll at UM with more than 90 semester transfer credits are required to take only one experiential course. 10. In addition to specific course grade requirements your GPA must meet each of the following three tests in order to graduate: a. Overall GPA must be at least 2.0 b. GPA in business courses must be at least 2.0 c. GPA in major courses must be at least 2.0 11. You must earn 39 upper division credits at UM (upper division residency requirement). 12. You must earn 30 of your last 45 credits at UM (end of degree residency requirement). Department of Accounting and Finance General Policies 1. The University of Montana School of Business Administration is a high quality AACSB accredited institution that produces highly trained graduates. The Department of Accounting & Finance has authority to determine if any transferred courses can count towards the finance major. Once study at UM-Missoula begins, it is the expectation of the Department that the eight courses counted for the finance major will be taken from UM-Missoula. In rare circumstances, the department chair along with the course instructor will consider pre-approval for transfer of a course that is extremely close in content and taken in the same delivery format from a highly regarded program with demonstrated rigor. The Department does not look favorably on such requests made solely to replace a UM-Missoula grade already earned. Students transferring to UM from other campuses will have their courses evaluated on an individual basis by the department chair and course instructor. 2. Department faculty members will not normally sign drop slips after the University’s official midterm drop date unless the student can produce documentation of meeting one of the approved circumstances per the UM catalog. 3. The Department strictly enforces finance and School of Business Administration prerequisites. Prerequisites are normally checked early in each semester. If a student does not meet course prerequisites, he or she is required to drop the course; otherwise the student will receive a failing grade for the course and may forfeit all fees and tuition paid. 4. It is the student’s responsibility to plan their schedule, including the possibility that not all classes may be available every semester. To avoid the possibility of a delay in graduation, students should regularly consult with their faculty advisor about the departmental plans for course offerings. Page | 13 5. A career in finance is a professional career. Students are expected to act professionally in all of their courses and in their contact with faculty members. Faculty members of the department are dedicated to helping all students achieve their professional career goals. To accomplish this, it is essential that students respect each other’s right to pursue their education in the most beneficial atmosphere possible. 6. Students must use an approved calculator on examinations: HB 10BII and TI BAII+. The instructor must approve the use of any other calculator. 7. Department faculty members maintain an open-door policy. Students are encouraged to visit faculty during their office hours or to seek appointments to discuss any academic or career questions. 8. Rules and requirements may change from year to year and it is the student’s responsibility to attend all advising sessions to keep abreast of any changes. Notes and Questions for Advisors Page | 14 Finance Major Catalogues 09/10 and later** Student Name: ___________________________ Date: _________________ ** Some course numbers were changed effective Fall 2009. Required Courses (all 400-level finance courses require a C or better in BFIN 322) Course Recommended semester/year BFIN 420 – Investments Fall Junior or Senior year BFIN 424 – Markets, Institutions & Fin. Eng. Spring Senior year BFIN 429 – Financial Mgmt I Spring Junior year BFIN 439 – Financial Mgmt II Fall Junior or Senior year BFIN 450 – Banking Spring Junior or Senior year Three (3) Supplemental Courses (see current catalogue for prerequisites) In addition to the above required courses, finance students must take three (3) additional upper division courses preapproved and signed-off in consultation with their advisor and incorporated into their program of study. A recommended group of courses is provided below: Recommended Courses BFIN 301 – Financial Statement Analysis BFIN 410 – $50,000 Portfolio BFIN 415 – Real Estate Investment & Analysis BFIN 473 – Multinational Finance & FDI ACTG 321 – Accounting Information Systems ACTG 305 – Corporate Reporting I ACTG 410 – Cost/Management Acct I ECNS 301 – Intermediate Microeconomics ECNS 302 – Intermediate Macroeconomics ECNS 403 – Intro to Econometrics BFIN 498 – Finance Internship (3 credit max) Course 1:____________________________ Course 2:____________________________ Course 3:____________________________ ___________________________________ Finance Advisors Signature ____________________________________ Student Signature Selected Salaries in Finance from 2009 Robert Hall Salary Guide Page | 15