Members brief - Fire services property levy update, Mar 2013 (Word

advertisement

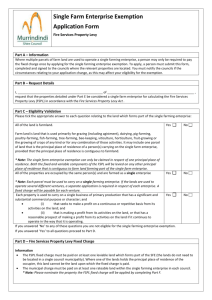

FIRE SERVICES PROPERTY LEVY UPDATE Introduction This members’ brief provides an overview of the status of the implementation of the Fire Services Property Levy Act 2012 (the FSPL Act), which mandates a fire services property levy (FSPL) to be collected by local government from 1 July 2013. The purpose of the brief is to update councils on the operation of the levy as well as the status of the negotiations that have been occurring between the MAV, Revenue Management Association (RMA) and the Victorian Government on the reimbursement of collection costs. Summary From 1 July 2013 a fire services property levy will appear as a separate charge on council rates notices for the first time. All Victorian councils are required to collect this levy on behalf of the Victorian Government, and must pass the full amount collected to the State Revenue Office. A recommendation of the 2009 Bushfires Royal Commission, the FSPL is replacing a previous fire levy that was paid through property insurance premiums (such as building and contents insurance). The FSPL will help to fund the cost of the Metropolitan Fire and Emergency Services Board (MFB) and the Country Fire Authority (CFA). To ensure everyone contributes, the Victorian Government has determined that all property owners will pay the levy - even properties that are eligible for a council rates exemption. Separate levy rates will apply in MFB and CFA areas: o For residential properties (including vacant residential land) the levy will be a $100 fixed charge plus a variable rate set by the Government and calculated as a percentage of the capital improved value (CIV) of the property. o For non-residential properties, the fixed charge will be $200 plus a variable rate set by the Government and calculated as a percentage of the capital improved value (CIV) of the property. o Each property classification (residential, commercial, industrial, primary production, public benefit and vacant land (non-residential)) will have its own variable rate, set by the Victorian Government no later than 31 May each year. The levy will be paid in the same manner as council rates – quarterly from September 2013, or annually each February (if your council offers this option). The Fire Services Levy Monitor has been appointed to monitor insurers’ progress in genuinely passing on the effects of the change to insurance policy holders. The Monitor’s office will enforce consumer protection laws, can provide advice to policy holders, and will receive and investigate complaints about the insurance-based levy. Background The Victorian Bushfire Royal Commission considered fire services funding and recommended that the Victorian Government abolish the insurance-based funding and implement a propertybased funding model. The Victorian Government accepted the recommendation and released a Fire Services Levy Options Paper that sought comments from the community and interested groups on the design of the levy. This paper stated that Victorian councils were the Government’s preferred collection agency rather than the State Revenue Office (SRO), which already operates to collect State tax. The MAV and many councils argued against local government collecting the levy on the basis that (a) it is best practice that any level of government that spends a tax also collects that tax, and (b) that the SRO already levies a property-based tax (land tax) and therefore had the suitable infrastructure in place to collect the levy. These arguments were rejected by the Victorian Government and it legislated to require councils to collect the levy. The Fire Services Property Levy Act 2012 provides that councils are required to collect the levy from all leviable properties. Who will pay the new levy? Leviable properties include all rateable properties and a majority of current non-rateable properties. Exempt properties include properties owned by the Victorian Government as part of its core business, Commonwealth land as well as some infrastructure, including council roads and bridges. Non-core government organisations, such as water corporations, will be required to pay the levy on their property. Council property will be leviable, although the FSPL Act provides for some council-owned public recreational property (such as community parks and football ovals) to pay only the fixed charge component of the levy. There are also exemptions for some of the sector’s infrastructure such as roads and bridges. The new levy effectively attempts to ensure any person or organisation that would have contributed to the FSL through insurance premiums would continue to pay under the new model. It also aims to improve the fairness of contributions by capturing those who previously didn’t contribute funding to our fire services through a failure to insure their property. The CFA and MFB will continue to be funded separately under the new FSPL. How does the payment work? The Act provides for a levy based on the capital improved value (CIV) of properties. The Act also specifies that a fixed fee is payable for residential properties ($100) and all other property types ($200), indexed annually. In addition to the fixed charge, variable charges will apply to properties. Each leviable property will be categorised for the purpose of the FSPL based on its Australian Valuation Property Classification Code (AVPCC), which is a formal classification allocated by qualified valuers. The property classifications allowable under the Act are: residential (including vacant residential land), commercial, industrial, primary production, public benefit, and vacant (excluding residential land). The Act provides a level of discretion about the application of differential rates, including that the Minister can: establish different rates for the CFA and MFB areas specify different levy rates for the above property classifications; and provide a maximum levy amount, including for individual property classifications. The Act also provides for a single fixed charge to be applied where: land is held as a single farm enterprise; land is held across a municipal boundary; or land held which is contiguous and either occupied by the same persons or unoccupied The Treasurer must announce the rates for the FSPL by no later than 31 May 2013. Council collection responsibilities Under the Act, councils are responsible for collecting the FSPL revenue and must pay all levy amounts and levy interest received to the SRO. The Valuer General is responsible for undertaking the valuations of non-rateable leviable properties. The Valuer-General wrote to all councils offering a payment to undertake the identification of these properties and a further payment to complete the valuation. It is understood that most councils accepted the offer of payment for the completion of both tasks. Councils will be advised of the levy rates by the Treasurer in line with the FSPL Act. Councils will then be required to upload these levy rates into their rates databases and add the new charge to the rates notice. Under the FSPL Act, councils must offer four payment instalments and may offer a single instalment, in line with their own rates payment practices. Councils will be required to provide the Victorian Government with a transfer of funds in four instalments 28 days after the rates instalments are due. Councils are only responsible for the payment of funds received – they will not face the risk of non-payment of the FSPL by property owners. In the event that payments are incomplete, the revenue must be pro-rated to rates and the property levy. Councils have the same powers under the Local Government Act 1989 to collect unpaid FSPL revenue. Council funding The Victorian Government recently announced a funding package of $53 million over four years for FSPL implementation and administration. We are holding discussions with the Government about how much of the funding will be available to cover councils’ collection and administration costs, and we understand the $53 million also includes funding for the operation of the Fire Services Levy Monitor and funding for the Valuer-General for the valuation of non-rateable properties for the first time so they can be levied, and for future biennial valuation cycles.. We also understand that funding has been provided for the State Revenue Office to provide resources and conduct customer service training for council staff prior to 1 July, and for a statewide public information campaign to commence in June to inform property owners about the change from an insurance-based system to a property-based levy. The MAV will provide advice to councils about the portion of funding that is likely to be received by councils when the information becomes available. The new FSPL will result in councils incurring additional administration costs. The MAV and the RMA have worked cooperatively with the Victorian Government to attempt to identify the costs borne by councils to ensure the sector is not financially disadvantaged by the requirement to collect the FSPL. A Fire Services Levy Working Group was established comprising senior finance managers and officers by the MAV to help guide this process. The MAV successfully argued in favour of a centralised IT systems change project that will ensure that all councils’ rating systems have the capability of calculating the FSLP, applying concessions and reporting to the SRO. The MAV has subsequently conducted a process to deliver these IT system changes, with payment to be made by the Victorian Government. The project is on track to be delivered by 31 May and the IT vendors will commence implementation of the system changes with pilot councils in the next fortnight. It is anticipated that the pilot councils’ systems would be implemented by late April and the roll-out to the balance of the councils will commence shortly after this date. The MAV has also undertaken a comprehensive analysis of council costs, initially as part of the submission writing process on the options paper, and subsequently through its negotiations with the Victorian Government. This work was informed by the MAV’s FSL Working Group. These analyses suggest that the major component of costs that will be incurred by councils comprise of system changes, valuation costs and customer service costs. There will be additional costs associated with project management, printing, and posting notices to non-rateable, leviable properties. Any council that pays merchant fees to collect revenue will also experience additional costs. Despite the efforts of councils, the MAV and the RMA to accurately estimate the costs of collection, there is considerable uncertainty, particularly the level of customer service costs arising. In the opinion of the MAV, these costs will depend, in part, on the effectiveness of the information campaign undertaken by the Victorian Government. As such, the MAV strongly advises councils to record all expenditure on the implementation and continued administration of the FSPL to inform negotiations for appropriate funding. Informing Victorians of the change An information campaign is planned to coincide with the commencement of the new levy to inform Victorians of the change, As part of this campaign, the Victorian Government would like to include a flyer in councils’ first rates notices for the 2013-14 financial year. Fire Services Monitor The Victorian Government has also established the position of the Fire Services Levy Monitor. Allan Fells AO is the Monitor and he has powers under the Fire Services Levy Monitor Act 2012 (the FSLM Act) to: provide information and guidance on fire services levy reform, particularly the abolition of the insurance-based levy; monitor compliance of insurance companies against the prohibition on price exploitation under the FSLM Act; and monitor compliance on the prohibition on false, misleading or deceptive conduct under the FSLM Act. The Monitor has the power to collect and analyse data from the insurance companies to ensure that the full benefits of the reform are passed on to consumers. Complaints about the conduct of insurance companies should be passed onto the Fire Services Levy Monitor. The Fire Services Levy Monitor hotline is available on 1300 300 635 The Fire Services Monitor Act 2012 will be repealed on 31 December 2014. FURTHER INFORMATION Website link: www.dtf.vic.gov.au/firelevy http://www.firelevymonitor.vic.gov.au/home/the+levy/faqs/ MAV contact person: Owen Harvey-Beavis Phone Number: 9667 5584 Email: oharvey-beavis@mav.asn.au