2014 10-28-14 Tax Levy Presentationa

advertisement

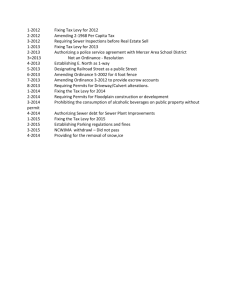

Woodland School District #50 2014 Tax Levy 10/28/2014 Levy Process - Timeline October 28, 2014 Board Meeting • Levy Certified for Publication as a Truth in Taxation Notice (required 20 days or more prior to Board action if the forecasted levy is greater than 5% of previous year) ▫ Truth in Taxation Notice Published 11/14/2014 (required 7 to 14 days prior to adoption) November 25, 2014 Board Meeting • Tax Levy Hearing followed by Levy Adoption ▫ Filing Deadline: By last Tuesday in December Levy estimate confirmed – April 2015 Tax Levy Estimate – For Truth in Taxation Legal Notice Based on the following variables… • CPI 1.5% Consumer Price Index - Confirmed 1/15/2014 • 2014 Equalized Assessed Value - Expecting a reduction of 1.4%. EAV of $1,426,478,606 ▫ Includes: New Construction $5.0 Plus TIF Retirement $8.8 PTELL - Property Tax Extension Levy Limitation • Limiting Rate Calculation – Determines base rate allowable under the tax cap Consumer Price Index 1.5% for 2014 Levy % Change December to December Equalized Assessed Value $1,426,478,606 Estimate for 2014 Levy $5.0 New Construction / $8.8 TIF Retirement Tax Rate allowable under the tax Cap – PTELL Property Tax Extension Levy Limitation District Tax Levy is Subject to Rate Maximums 2014 Truth in Taxation Notice Questions