Bar_Hava_2014

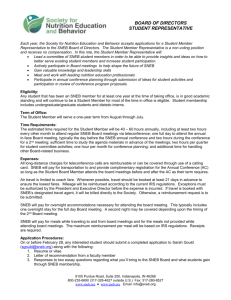

advertisement