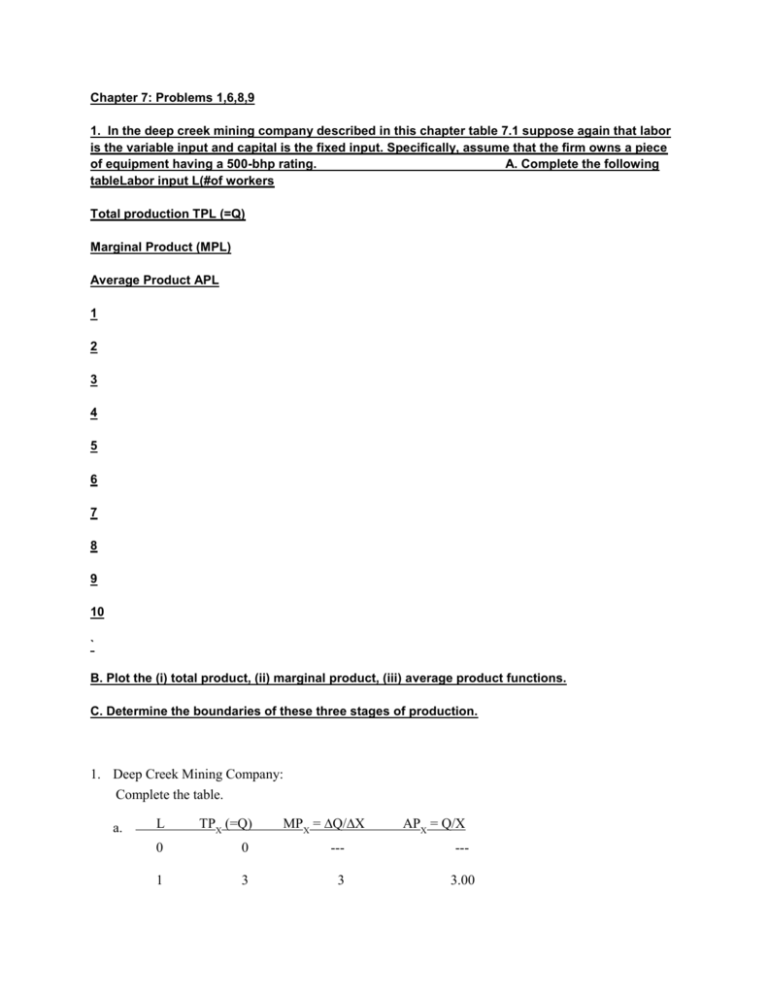

Chapter 7: Problems 1,6,8,9 1. In the deep creek mining company

advertisement

Chapter 7: Problems 1,6,8,9 1. In the deep creek mining company described in this chapter table 7.1 suppose again that labor is the variable input and capital is the fixed input. Specifically, assume that the firm owns a piece of equipment having a 500-bhp rating. A. Complete the following tableLabor input L(#of workers Total production TPL (=Q) Marginal Product (MPL) Average Product APL 1 2 3 4 5 6 7 8 9 10 ` B. Plot the (i) total product, (ii) marginal product, (iii) average product functions. C. Determine the boundaries of these three stages of production. 1. Deep Creek Mining Company: Complete the table. a. MPX = Q/X L TPX (=Q) APX = Q/X 0 0 --- --- 1 3 3 3.00 2 6 3 3.00 3 16 10 5.33 4 29 13 7.25 5 43 14 8.60 6 55 12 9.17 7 58 3 8.29 8 60 2 7.50 9 59 1 6.56 10 56 3 5.60 b. c. Stage I: Stage II: 06 APX increasing 6+ 8+ MPX 0 Stage III: 8+ MPX < 0 6. Consider the following short-Run production function (where input, ): A. Determine the marginal product B. Determine the average product function C. Find the value of L that maximizes Q D. Find the value of L at which the marginal product function takes on its maximum value E. Find the value of L at which the average product function takes on its maximum value. a. Q = 10L .5L2 MPL = 10 1.0L MRQ = Price = $10 MRPL = (10 1.0L)($10) = $100 $10L b. MFCL = $20 c. The optimal level of the variable input occurs where: MRPL = MFCL 100 10L = 20, so L* = 8 8. Based on the production function parameter estimates reported in Table 7.4: A. Which industry (or industries) appears to exhibit decreasing returns to scale? (Ignore the issue of statistical significance.) B. Which industry comes closest to exhibiting constant returns to scale? C. In which will a given percentage increase in capital result in the largest percentage increase in output? D. In what industry will a given percentage increase in production workers result in the largest percentage increase in output? 9. Consider the following Cobb- Douglas production function for the bus transportation system in a particular city: Q= ?L ^?1 F^?2 K^?3 Where L is the labor input in worker hours; F is the fuel input in gallons; K is the capital input in number of buses; Q is the output measured in millions of bus miles Suppose that the parameters (a,? 1, ?2, ?3) of this model were estimated using annual data for the past 25 years. The following results were obtained: ?= 0.0012;?; ?; ? A. Determine the (i) labor, (ii) fuel, and (iii) capital input production elasticities. B. Suppose that labor input (worker hours) is increased by 2 percent next year (other inputs held constant). Determine the approximate percentage change in output. C. Suppose the capital input (number of buses) is decreased by 3 percent next year (when certain older buses are taken out of service). Assuming that the other inputs are held constant, determine the approximate percentage change in output. D. What type of return to scale appears to characterize this bus transportation system? (Ignore the issue of statistical significance.) E. Discuss some of the methodological and measurement problems one might encounter in using time-series data to estimate the parameters of this model. a. (i). EL = 1 = .45; (ii). EF = 2 = .20; (iii). EB = 3 = .30. b. EL = %Q/%L = .45. If %L = .02, %Q = .45(.02) = .009, or .9%. c. EB = %Q/%B = .30. If %B = .03, %Q = .30(.03) = -.009 or -.9%. d. 1 + 2 + 3 = .45 + .20 + .30 = .95, this is Decreasing Returns to Scale, because the sum of the exponents is less than 1. e. Technical progress causes the production process to change over time. For example, wider roads and improved traffic control systems may result in increased output (i.e., bus miles) even though the number of buses (i.e., capital input) and drivers (i.e., labor input) remains constant. Likewise, the replacement of older buses with new models may increase output since the new buses may be faster and more maneuverable. Finally, as the experience level of the bus drivers increases over time, output may increase even though the number of drivers remains constant. Chapter 8: Problems 2,4,6 2. Howard Bowen is a large-scale cotton farmer. The land and machinery he owns has a current market value of $4M. Bowen owes his local bank $3M. Last year Bowen sold $5M worth of cotton. His variable operating costs were $4.5M; accounting depreciation was $40,000, although the actual decline in value of Bowen's machinery was $60,000 last year. Bowen paid himself a salary of $50,000, which is not considered part of his variable operating costs. Interest on his bank loan was $400,000. If Bowen worked for another farmer or a local manufacturer, his annual income would be about $30,000. Bowen can invest any funds that would be derived, if the farm were sold to earn 10% annually.(Ignore taxes) A. Compare Bowen's accounting profits. Howard Bowen’s cotton farm analysis appears below. a. Accounting profits: Revenues Less: Variable operating costs $5,000,000 4,500,000 Less: Depreciation 40,000 Less: Wages 50,000 Equals: Operating Income Less: Interest expense Accounting income before tax $410,000 400,000 +$10,000 b. Economic profits: Revenues Less: Variable operating costs $5,000,000 4,500,000 Less: Opportunity value of Bowen's income potential 30,000 Less: Economic depreciation 60,000 Equals: Economic profit before financial costs $410,000 Less: Interest expense 400,000 Less: Opportunity cost of net $1 million equity @10% 100,000 Equals: Economic profit, or (loss) ($90,000) If these calculations are representative of Bowen's regular performance, he would be better off financially by selling the farm and working for someone else. This analysis ignores many intangible factors that may affect Bowen's decision. 4. From your knowledge of the relationships among the various production functions, complete the following table: Q TC FC VC ATC AFC AVC MC 0 125 10 5 20 10.50 30 110 40 255 50 3 60 3 70 5 80 295 Complete the table. Bold figures reflect the given values. Q TC FC VC ATC AFC AVC 0 125 125 0 - - 10 175 125 50 17.50 20 210 125 85 30 235 125 40 255 125 MC - - 12.50 5.00 5.00 10.50 6.25 4.25 3.50 110 7.83 4.17 3.67 2.50 130 6.38 3.13 3.25 2.00 50 275 125 150 5.50 2.50 3.00 2.00 60 305 125 180 5.08 2.08 3.00 3.00 70 350 125 225 5.00 1.79 3.21 4.50 80 420 125 295 5.25 1.56 3.69 7.00 6. The Blair Company has three assembly plants located in California, Georgia and New Jersey. Currently the company purchases a major subassembly, which becomes part of the final product, from an outside firm. Blair has decided to manufacture the subassemblies within the company and must now consider whether to rent one centrally located facility, where all the subassemblies would be manufactured or to rent three separate facilities, each located near one of the assembly plants, where each facility would manufacture only the subassemblies needed for the nearby assembly plant. A single, centrally located facility, with a production capacity of 18,000 units per year, would have fixed costs of $900,000 per year, and variable costs of $250 per unit. Three separate, decentralized facilities, with production capacities of 8,000, 6,000 and 4,000 units per year, would have fixed costs of $475,000, $425,000 and $400,000, respectively. Variable costs per unit produced in any of these three, decentralized facilities equal $225 (per unit). The current production rates at the three assembly plants are 6,000, 4,500 and 3,000 units per year, respectively. A. Assuming that the current production rates are maintained at the three assembly plants, which alternative should management select? The Blair Company has multiple plant locations. a. One centralized plant in Missouri: TC = $900,000 + (6,000 + 4,500 + 3,000) $250 = $4,275,000 Three subassembly plants: TC = ($475,000 + $425,000 + $400,000) + (6000 + 4500 + 3000) $225 = $4,337,500 One centralized plant would be cheaper. b. One centralized plant at full capacity: TC = $900,000 + (18,000)$250 = $5,400,000 Three plants: TC = ($475,000 + $425,000 + $400,000) + (8,000 + 6,000 + 4,000)$225 = $5,350,000. Three plants should be built. c. It would be helpful to have a credible forecast of the future demand for subassemblies.